📢 Kind Attention, Taxpayers!

The Income Tax Department has now enabled the online filing of ITR-2 for Assessment Year 2025-26 on the official e-filing portal.

If you fall under the category of taxpayers who need to file ITR-2, you can now file your return online with pre-filled data, making the process smoother and faster.

🔍 Who Should File ITR-2?

You should file ITR-2 if you are:

✅ An individual or HUF (Hindu Undivided Family)

✅ Not earning income from business or profession

✅ Earning income from any of the following sources:

- Salary / Pension

- House Property (more than one house)

- Capital Gains (Shares, Mutual Funds, Real Estate, etc.)

- Other Sources (like interest income, dividend, etc.)

- Foreign Income or Foreign Assets

- Agricultural income over ₹5,000

🆕 What’s New?

✅ Pre-filled Data Enabled – Your personal details, salary income (from Form 16), TDS, bank details, capital gains (from AIS/TIS), etc., will now be auto-filled, saving time and reducing manual errors.

✅ E-Filing Option Active – You can now complete, verify, and submit your ITR-2 entirely online without downloading Excel/Java utilities.

📅 Important Deadlines

🗓️ Due Date for Filing ITR (Non-Audit Cases):

31st July 2025

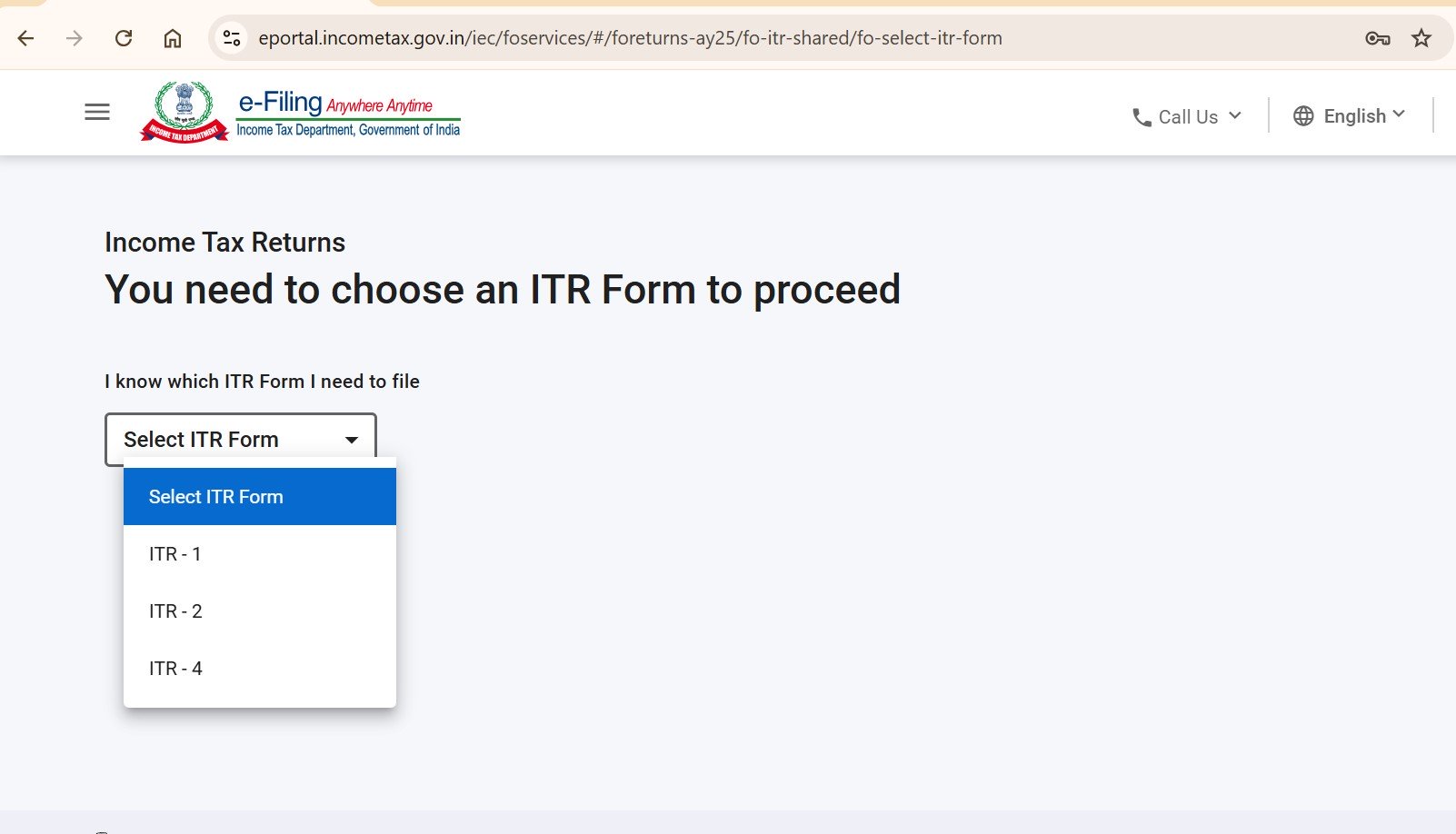

📍 How to File ITR-2 Online?

- Visit the official Income Tax e-filing portal

- Log in with your PAN and password

- Go to “e-File” > “Income Tax Return” > Select AY 2025–26 & ITR-2

- Proceed with pre-filled details, review each section

- Validate, e-verify and submit

📝 Pro Tip from CA Guruji

If you have capital gains from stocks or mutual funds, prepare your computation sheet in advance, especially if you’ve sold any asset after 23rd July 2024, as tax implications may vary.

⚠️ Don’t Delay!

Filing your ITR early ensures faster refunds and fewer chances of errors. Use the new pre-filled ITR-2 form to your advantage today.

🔁 Share this update with your family and clients who need to file ITR-2 this year.

For a step-by-step guide on ITR-2 filing, watch my detailed video on CA Guruji YouTube channel.

Visit www.cagurujiclasses.com for practical courses