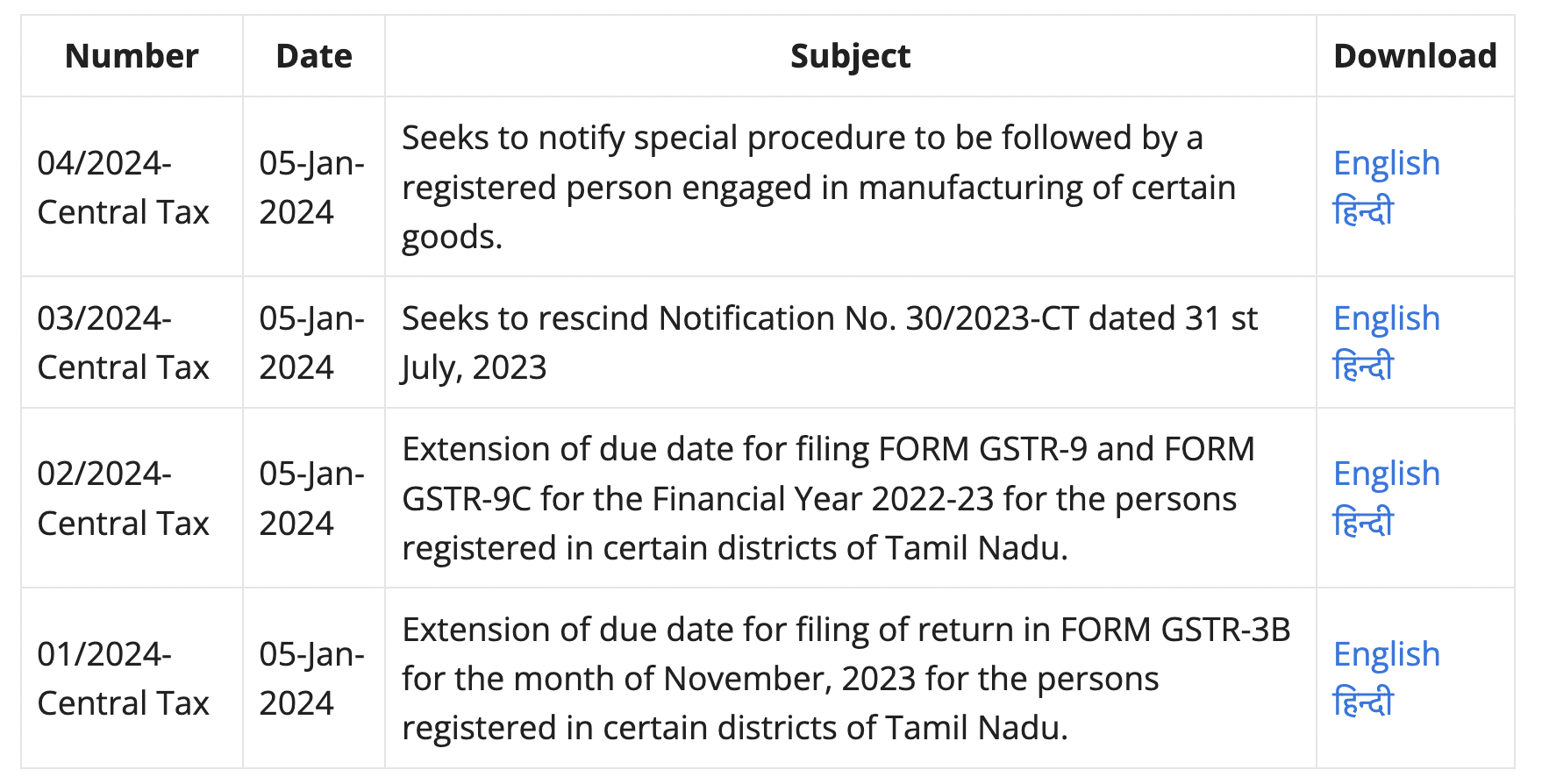

| Number | Date | Subject | Download |

|---|---|---|---|

| 04/2024-Central Tax | 05-Jan-2024 | Seeks to notify special procedure to be followed by a registered person engaged in manufacturing of certain goods. | English हिन्दी |

| 03/2024-Central Tax | 05-Jan-2024 | Seeks to rescind Notification No. 30/2023-CT dated 31 st July, 2023 | English हिन्दी |

| 02/2024-Central Tax | 05-Jan-2024 | Extension of due date for filing FORM GSTR-9 and FORM GSTR-9C for the Financial Year 2022-23 for the persons registered in certain districts of Tamil Nadu. | English हिन्दी |

| 01/2024-Central Tax | 05-Jan-2024 | Extension of due date for filing of return in FORM GSTR-3B for the month of November, 2023 for the persons registered in certain districts of Tamil Nadu. | English हिन्दी |

Let’s Read in Brief:

Notification No.1/2024: New Notification related to Date Extension of GSTR-3B

Extension of due date for filing of return in FORM GSTR-3B for the month of November, 2023 for the persons registered in certain districts of Tamil Nadu.

hereby extends the due date for furnishing the return in FORM GSTR-3B for the month of November, 2023 till the 10th day of January, 2024, for the registered persons whose principal place of business is in the districts of Tirunelveli, Tenkasi, Kanyakumari, Thoothukudi and Virudhunagar in the state of Tamil Nadu and are required to furnish return under sub- section (1) of section 39 read with clause (i) of sub-rule (1) of rule 61 of the Central Goods and Services Tax Rules, 2017.

Notification No.2/2024: New Notification related to Date Extension of GSTR -9/9C

Extension of due date for filing FORM GSTR-9 and FORM GSTR-9C for the Financial Year 2022-23 for the persons registered in certain districts of Tamil Nadu.

Notwithstanding anything contained in sub-rule (1), for the financial year 2022-2023, the said annual return shall be furnished on or before the 10th day of January, 2024 for the registered persons whose principal place of business is in the districts of Chennai, Tiruvallur, Chengalpattu, Kancheepuram, Tirunelveli, Tenkasi, Kanyakumari, Thoothukudi and Virudhunagar in the state of Tamil Nadu.”;

Notwithstanding anything contained in sub-rule (3), for the financial year 2022-2023, the said self-certified reconciliation statement shall be furnished along with the said annual return on or before the 10th day of January, 2024 for the registered persons whose principal place of business is in the districts of Chennai, Tiruvallur, Chengalpattu, Kancheepuram, Tirunelveli, Tenkasi, Kanyakumari, Thoothukudi and Virudhunagar in the state of Tamil Nadu.

Notification No.3/2024: It Rescinds the earlier notification related to Special Returns under GST for Manufacturers of certain Goods like Tobacoo, Pan Masala etc.

In exercise of the powers conferred by section148 of the Central Goods and Services Tax Act, 2017 (12 of 2017) (hereinafter referred to as the said Act),the Central Government, on the recommendations of the Council, hereby rescinds the notification of the Government of India in the Ministry of Finance, Department of Revenue, Number 30/2023-CT, dated the 31st July, 2023 published vide number S.O. 3424(E), dated the 31st July, 2023, except as respects things done or omitted to be done before such rescission.

2. This notification shall come into force from 1st day of January, 2024

Notification No.4/2024: New Notification related to Special Returns under GST for Manufacturers of certain Goods like Tobacoo, Pan Masala etc.

New Special Returns for Manufacturers of Certain Goods will be effective from 1 April 2024 and will be available on GST portal.

Click to Read Detailed Article on Special Returns under GST: https://taxupdates.cagurujiclasses.com/date-extended-for-new-special-returns-procedure-under-gst-for-a-registered-person-engaged-in-manufacturing-of-certain-goods/

Visit www.cagurujiclasses.com for practical courses