(Updated with GTA GST Rate Change w.e.f. 22.09.2025)**

Meaning of GTA

A Goods Transport Agency (GTA) is a person who transports goods by road and issues a consignment note.

Transporters who do not issue a consignment note are not treated as GTA and their services remain exempt from GST.

Therefore, Individual Truck/Tempo operators who do not issue any consignment note may not be covered within the term GTA.

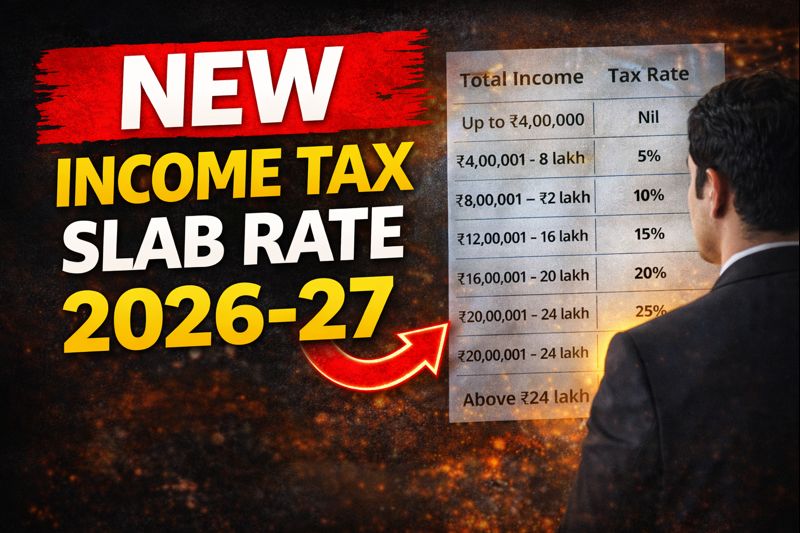

Taxability Structure for GTA (Updated as of 22.09.2025)

| Category | GST Rate | ITC Eligibility | Who Pays Tax |

|---|---|---|---|

| RCM (Reverse Charge Mechanism) | 5% | ITC available to recipient | Recipient |

| FCM (Forward Charge Mechanism) | 18%* | Full ITC available | GTA |

| FCM (Optional Concessional Rate) | 5% | No ITC to GTA | GTA |

*Before 22.09.2025 it was 12% with ITC

Important Note

- GTA must exercise an annual option to choose Forward Charge (18%) by filing Annexure V on GST Portal and in case he wants to withdraw then file Annexure VI OR continue taxable under RCM (5%). Once chosen, the option applies for the full financial year.

- GTA have to Declare on Invoice in case he opted for forward charge

- Declaration on Invoice issued by GTA : If GTA opts for forward charge, he has to make a declaration on invoice as per Annexure III of NN 13/2017. This provision is inserted vide Notification No. 5/2022-Central Tax (Rate), dated 13-7-2022, w.e.f. 18-07-2022.

- Declaration: I/we have taken registration under the CGST Act, 2017 and have exercised the option to pay tax on services of GTA in relation to transport of goods supplied by us from the Financial Year ____under forward charge and have not reverted to reverse charge mechanism.

Who is Liable to Pay GST under RCM?

RCM applies when freight is paid by any of the following recipients:

- Factory

- Society

- Cooperative Society

- Body Corporate

- Registered Person under GST

- Partnership Firm / AOP

- Casual Taxable Person

If freight is paid by an unregistered person, GTA must apply 18% under FCM if opted, otherwise service remains exempt (as per GTA rules for unregistered recipients).

Non-applicability of RCM Provisions

RCM provisions shall not apply to services provided by a GTA, by way of transport of goods in a goods carriage by road to-

(a) A Department / establishment of the Central Government / State Government/ Union territory; or

(b) local authority; or

(c) Governmental agencies,

which has taken registration under the CGST Act only for the purpose of deducting tax under section 51 and not for making a taxable supply of goods or services.

Note – It is important to note here that this service is exempted from GST vide entry 21B of NN 12/2017 (extract below). Hence, there will be no tax liability in this case.

Exemptions for GTA

The following remains exempt:

- Transport of agricultural produce

- Milk, food grains, salt

- Organic manure

- Newspapers

- Relief / disaster materials

- Defence goods for Government

- Services provided by a goods transport agency to an unregistered person, including an unregistered casual taxable person

Place of Supply for GTA

- For registered recipient → Location of recipient

- For unregistered recipient → Location where goods are handed over for transport

Visit www.cagurujiclasses.com for practical courses