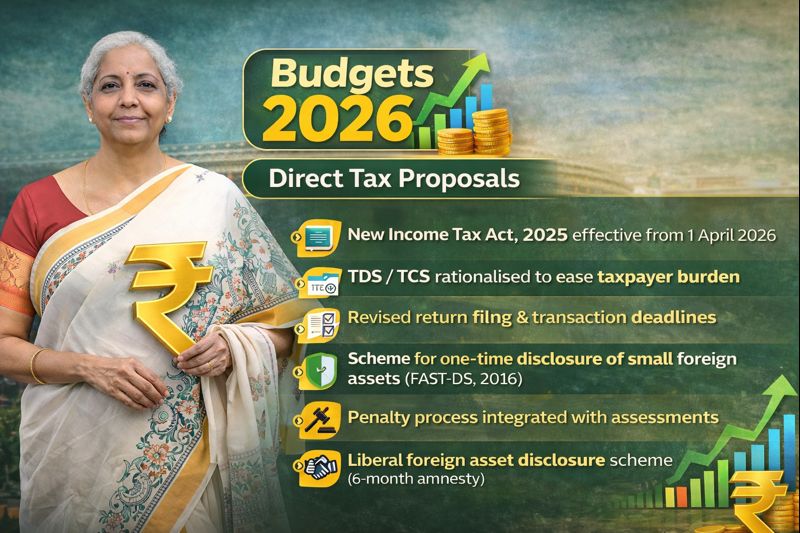

The Central Board of Direct Taxes (CBDT) has released the Draft Income-Tax Rules, 2026 to support the implementation of the Income-Tax Act, 2025, which will take effect from 1 April 2026. As part of these draft rules, the requirements for quoting and using a Permanent Account Number (PAN) in various financial transactions have been revised significantly.

These proposed changes aim to simplify compliance for routine financial activities while strengthening the reporting of high-value or lifestyle-related transactions.

🧠 Why PAN Requirements Are Being Revised

Under the existing system (Income-Tax Rules, 1962), PAN had to be quoted in a range of transactions — sometimes at low thresholds — which often led to high compliance burden for ordinary taxpayers. The draft rules seek to address this by:

✔ Raising monetary thresholds for PAN quoting

✔ Eliminating PAN requirements for smaller routine transactions

✔ Focusing reporting requirements on large and recordable transactions

✔ Aligning with the automated tax-data ecosystem under the new Act

These changes are part of the broader simplification under the Income-Tax Act, 2025 and are intended to take effect from 1 April 2026 once the rules are finalised and notified (likely by early March 2026).

📊 Key PAN Quoting Requirement Changes

✅ 1) Cash Deposits & Withdrawals

Current Rule:

- PAN required for cash deposits over ₹50,000 in a single day with a banking or cooperative bank.

Proposed New Rule:

- PAN will be required only when total cash deposits or withdrawals in a financial year aggregate ₹10 lakh or more across one or more bank accounts.

👉 This significantly reduces paperwork for small cash transactions and day-to-day banking.

✅ 2) Motor Vehicle Purchases

Current Rule:

- PAN must be quoted for all motor vehicle purchases (four-wheelers) regardless of price; generally not required for two-wheelers.

Proposed New Rule:

- PAN will be mandatory only if the vehicle purchase value exceeds ₹5 lakh (inclusive of cars and two-wheelers).

👉 This eases compliance for low-value vehicles.

✅ 3) Property Transactions

Current Rule:

- PAN required for purchase, sale, gift, or joint development agreement of immovable property with value above ₹10 lakh.

Proposed New Rule:

- Threshold raised to ₹20 lakh.

👉 Only transactions above this limit will require PAN quoting, reducing paperwork for smaller property deals.

✅ 4) Hotel, Event & Lifestyle Payments

Current Rule:

- PAN is required if hotel or restaurant bills exceed ₹50,000 (or payments at banquet halls, event management services above threshold).

Proposed New Rule:

- PAN requirement raised to ₹1 lakh for payments to hotels, restaurants, banquet halls, convention centres, or events.

👉 This reduces PAN quoting for many routine lifestyle payments.

✅ 5) Insurance Accounts

Current Rule:

- PAN becomes mandatory if the annual premium exceeds ₹50,000 in a financial year.

Proposed New Rule:

- PAN will be mandatory for any account-based relationship with an insurance company, regardless of premium amount.

👉 This expands the scope of PAN reporting in life and general insurance.

⭐ What Stays Mandatory

The draft rules continue to require PAN for high-value and certain tax-critical transactions, such as:

- Filing income tax returns

- Large investments

- Corporate compliance

- Certain statutory reporting obligations

These obligations are not being relaxed and continue to uphold the role of PAN as a key identifier in the tax ecosystem.

📌 What Is the Timeline?

The Draft Income-Tax Rules, 2026 — including the PAN requirement changes — were released for public consultationuntil 22 February 2026. The government is expected to finalise and notify the rules before 1 April 2026, when the new Income Tax Act, 2025 comes into effect.

This transition period allows stakeholders — taxpayers, professionals, businesses — to review the changes, suggest feedback, and prepare for implementation.

🧾 Why These Changes Matter

🌟 Lower Compliance Burden

Many routine transactions will no longer require PAN quoting, reducing paperwork for common citizens — especially in cash banking and lifestyle spending.

📈 Focus on Meaningful Reporting

Higher thresholds ensure that PAN reporting is tied to significant financial activities, improving the relevance of information collected by the tax system.

💼 Ease of Doing Business

Simplifying PAN requirements lowers friction for taxpayers and reduces unnecessary compliance steps for everyday financial activities.

📌 Important Reminder

These changes are currently draft proposals and have not yet been formally notified as law. They are subject to stakeholder feedback and final approval before being published officially and enforced.

Visit www.cagurujiclasses.com for practical courses