Specified Financial Transactions (SFTs) have emerged as a pivotal tool in the arsenal of tax authorities for enhancing transparency, combating tax evasion, and promoting compliance. Rule 114E of the Income Tax Rules, 1962, lays down the framework for reporting these transactions, mandating various entities to furnish statements of financial transactions to the Income Tax Department. Let’s delve into the intricacies of Rule 114E and understand its implications.

Understanding Rule 114E: Rule 114E stipulates the manner and scope of reporting financial transactions under Section 285BA of the Income Tax Act, 1961. It outlines the types of transactions, threshold limits, reporting entities, and the timeline for submission of statements.

Key Provisions of Rule 114E:

- Scope of Transactions: Rule 114E covers a wide spectrum of financial dealings, including cash deposits, withdrawals, investments, purchases, sales, and more.

- Threshold Limits: Different threshold limits are specified for various transactions, beyond which reporting becomes mandatory. These limits vary depending on the nature of the transaction and the class of reporting person.

- Cash Transactions:

- Payment made in cash for the purchase of bank drafts, pay orders, or banker’s cheques of an amount aggregating to ten lakh rupees or more in a financial year.

- Cash deposits or withdrawals aggregating to fifty lakh rupees or more in a financial year in one or more current accounts of a person.

- Other Financial Transactions:

- Cash deposits aggregating to ten lakh rupees or more in a financial year in one or more accounts (other than a current account and time deposit) of a person.

- One or more time deposits of a person aggregating to ten lakh rupees or more in a financial year.

- Payments made by any person of an amount aggregating to one lakh rupees or more in cash, or ten lakh rupees or more by any other mode, against bills raised in respect of one or more credit cards issued to that person in a financial year.

- Investment Transactions:

- Receipt from any person of an amount aggregating to ten lakh rupees or more in a financial year for acquiring bonds, debentures, or shares issued by a company or institution.

- Property Transactions:

- Purchase or sale by any person of immovable property for an amount of thirty lakh rupees or more or valued by the stamp valuation authority at thirty lakh rupees or more.

- Other Transactions:

- Receipt of cash payment exceeding two lakh rupees for the sale of goods or services by any person liable for audit under section 44AB of the Act.

- Cash Transactions:

- Reporting Entities: Various entities such as banks, financial institutions, companies, mutual funds, and other specified persons are obligated to furnish statements of financial transactions to the tax authorities.

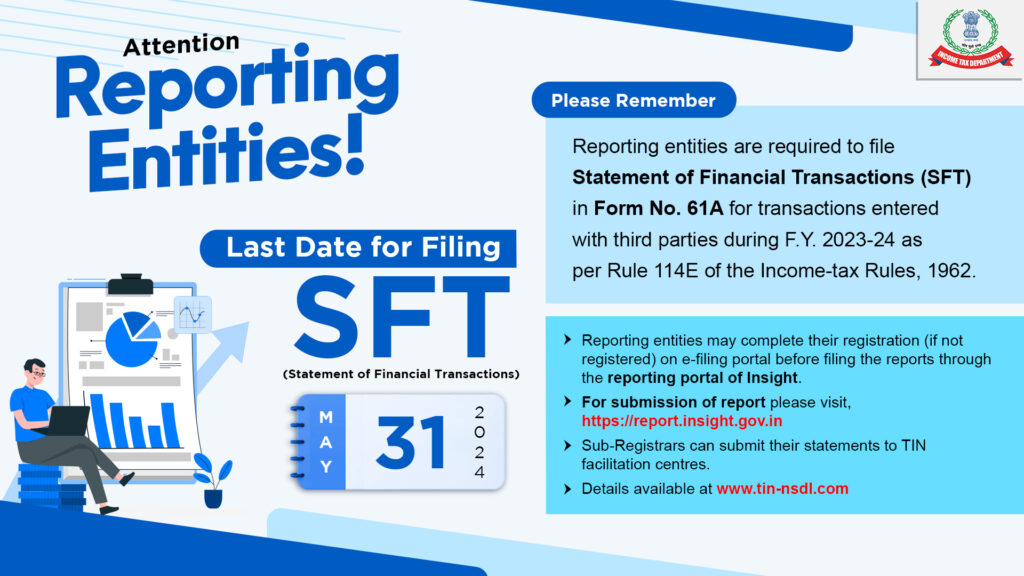

- Form 61A: The statement of financial transactions is to be furnished in Form No. 61A, electronically, through the Income Tax Department’s online portal.

- Verification: The statement must be verified in the manner indicated in Form 61A, ensuring authenticity and accuracy of the information provided.

- Timeline: Statements of financial transactions are required to be furnished on or before the 31st of May, immediately following the financial year in which the transactions are registered or recorded.

Recently Income Tax Department Tweeted for Reminder of SFT transactions:

Kind Attention SFT filers!

The last date for filing the Statement of Financial Transactions (SFT) for F.Y. 2023-24 is May 31st, 2024.

SFT is required to be filed in Form No. 61A for transactions entered with third parties. Do ensure timely submission of your SFT!

Delay in filing SFT may entail penalty upto ₹1000 for each day of default. Non-filing or filing inaccurate statement may also lead to levy of penalty. Please file your SFT within the due date.

Visit www.cagurujiclasses.com for practical courses