Congratulations on obtaining your GST registration! Whether you’re running an offline business, an online venture, a new startup, or an established enterprise, GST compliance is mandatory after getting GST number, because in case of non-compliance there may be heavy penalties and consequences

1. Display GST Registration Details

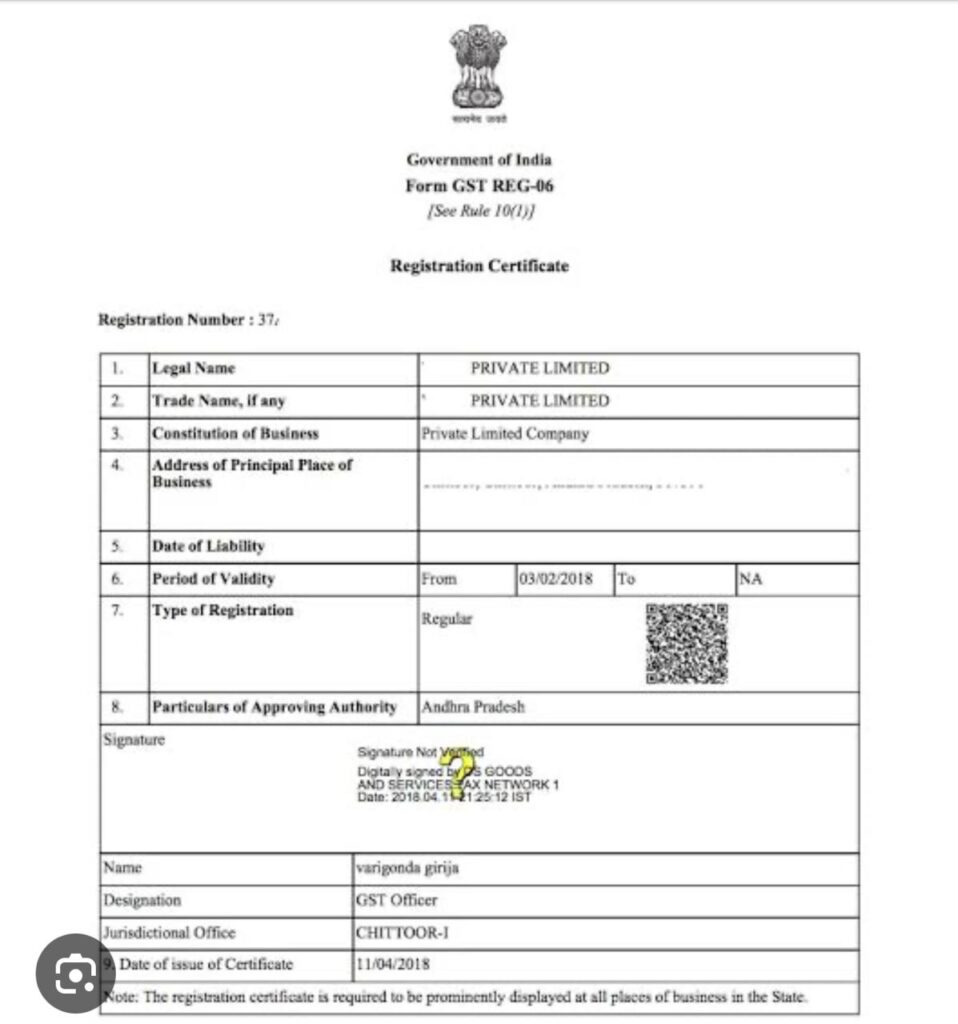

- Display Certificate: Ensure the GST Registration certificate is displayed prominently at your principal place of business and other business locations.

- Show GSTIN: Display your GST Identification Number (GSTIN) on the name-board at the entrance of your registered office or factory.

2. Determine Place of Supply

- Intra-state vs. Inter-state: Identify whether your transactions are within the state (intra-state) or between states (inter-state) to decide if you should charge CGST & SGST or IGST and accordingly choose HSN and SAC codes

3. Issue GST-Compliant Invoices

- Compliant Invoicing: Start issuing GST-compliant invoices immediately to allow buyers to claim input tax credits.

- Revise Pre-GST Invoices: Revise invoices issued before GST registration to comply with GST rules.

- Mandatory Fields: Include key fields such as serial number, GSTIN, date of issue, description, quantity, value, tax rate, HSN code, place of supply, and supplier’s signature.

4. Charge and Collect GST

- Apply Correct Rates: Charge GST on all taxable supplies at the specified rates (5%, 12%, 18%, or 28%).

- Deposit GST: Deposit collected GST with the government through filing GSTR-3B.

- Avoid Penalties: Ensure GST is charged and collected correctly to avoid penalties.

5. File ITC-01 for Input Tax Credit

- Claim ITC: File Form ITC-01 within 30 days to claim input tax credit on stock purchased for manufacturing.

- Include All Stock: Claim ITC on raw materials, consumables, and finished goods lying in stock.

6. Avail Input Tax Credit on Purchases

- Monthly Claims: Claim ITC on purchases made after GST registration in your monthly GSTR-3B return.

- Reconciliation: Regularly check and reconcile ITC claims with GSTR-2B to ensure accuracy.

7. Maintain Proper Accounts and Records

- Record Keeping: Maintain detailed records of transactions, including production, supply, stock, ITC availed, and tax paid.

- Digital Records: Use electronic modes like ERP applications or cloud-based software to maintain records.

8. File GST Returns

- Timely Filing: File the appropriate GST returns within stipulated due dates to avoid interest and penalties.

- Normal Taxpayers: File GSTR-1 (sales details) and GSTR-3B (summary of sales and ITC).

- Composition Dealers: File GSTR-4 quarterly.

- Special Returns: File additional returns like GSTR-6 for input service distributors if applicable.

9. Understand Reverse Charge Mechanism

- Reverse Charge: For certain transactions, the recipient must pay GST directly to the government.

- Notified Goods and Services: Be aware of goods and services notified for reverse charge by CBIC.

10. Other Compliance Tips

- Supplier Invoices: Ensure suppliers upload your invoices in their GSTR-1 to avoid losing ITC.

- Correct Invoicing: Issue the correct type of invoice for your sales and apply the correct GST rates.

- Document Maintenance: Maintain copies of debit notes, credit notes, receipts, payment vouchers, and stock records.

- Educate Employees: Train employees on GST compliance and workplace ethics.

- Regular Checks: Regularly check GSTR-2B for invoice uploads by your suppliers.

- Timely Responses: Respond promptly to any departmental notices.

Conclusion

Compliance with GST after registration involves several critical steps. Proper documentation, timely filing of returns, and adherence to GST rules will help you avoid penalties and ensure smooth business operations. For expert assistance, consider consulting professional GST practitioners or tax consultants.

Visit www.cagurujiclasses.com for practical courses