In India, the sale of property is subject to tax implications, including the requirement of Tax Deducted at Source (TDS) under certain circumstances. Section 194-IA of the Income Tax Act, 1961, pertains to the deduction of TDS on the sale of immovable property. Let’s delve into the details of TDS on the sale of property under Section 194-IA, its applicability, rates, and the process involved.

Let’s understand the law first

Provisions of Section 194-IA:

(1) Any person, being a transferee, responsible for paying (other than the person referred to in section 194LA) to a resident transferor any sum by way of consideration for transfer of any immovable property (other than agricultural land), shall, at the time of credit of such sum to the account of the transferor or at the time of payment of such sum in cash or by issue of a cheque or draft or by any other mode, whichever is earlier, deduct an amount equal to 1% of such sum as income-tax thereon.

(2) No deduction under sub-section (1) shall be made where the consideration for the transfer of an immovable property and the stamp duty value of such property, both, is less than 50 Lakh rupees.

(3) The provisions of section 203A shall not apply to a person required to deduct tax in accordance with the provisions of this section.

Explanation — For the purposes of this section,—

(a) “agricultural land” means agricultural land in India, not being a land situate in any area referred to in items (a) and (b) of sub-clause (iii) of clause (14) of section 2;

(aa) “consideration for transfer of any immovable property” shall include all charges of the nature of club membership fee, car parking fee, electricity or water facility fee, maintenance fee, advance fee or any other charges of similar nature, which are incidental to transfer of the immovable property;’

(b) “immovable property” means any land (other than agricultural land) or any building or part of a building.

2 Scope of section 194-IA:

Section 194-IA, provides that any person, being a transferee, responsible for paying (other than the person referred to in section 194LA) to a resident transferor any sum by way of consideration for transfer of any immovable property (other than agricultural land) shall deduct an amount equal to 1% of such sum as income-tax at the time of credit of such sum to the account of the transferor or at the time of payment of such sum in cash or by issue of cheque or draft or by any other mode, whichever is earlier.

No deduction shall be made the consideration for the transfer of an immovable property and the stamp duty value of such property, both, is less than 50 lakh rupees.

3 What payment is covered by section 194-IA:

Any sum paid by way of consideration for transfer of any immovable property (other than agricultural land) is covered under section 194-IA, provided the consideration for transfer of an immovable property is not less than Rs. 50 lakhs.

3.1 Agricultural Land: Agricultural land means agricultural lands in India, not being a land situated in any area referred to in section 2(14)(iii)(a)/(b).

A land shall not be treated as Agriculture Land, if:

a) It is situated within jurisdiction of Municipality or Cantonment Board which has a population of not less than 10,000; or

b) It is situated in any area within below given distance measured aerially:

| Population of the Municipality | Distance from Municipal limit or Cantonment Board |

| More than 10,000 but does not exceed 1,00,000 | Within 2 kms. |

| More than 1,00,000 but does not exceed 10,00,000 | Within 6 kms. |

| Exceeding 10,00,000 | Within 8 kms. |

3.2 Immovable Property: Immovable property means any land (other than agricultural land) or any building or part of building.

4 Who is the payer:

The payer is any person, being a transferee, responsible for paying (other than the person referred to in section 194-IA) to a resident transferor any sum by way of consideration for transfer of any immovable property (other than agricultural land).

5 Who is the payee:

The payee is resident transferor of any immovable property (other than agricultural land).

6 Conditions to be satisfied for applicability of section 194-IA:

For applicability of section 194-IA following conditions need to be satisfied:

• The payer must be any person referred to in Para 4 above.

• The payee must be a resident transferor of an immovable property (other than agricultural land).

• The payment must be by way of consideration for transfer of any immovable property (other than agricultural land).

• The quantum of payment, or stamp duty value of property, must be Rs. 50 lakhs or more.

7 Time of deduction of tax:

Tax shall be deducted at the time of credit of such sum to the account of the transferor or at the time of payment of such sum in cash or by issue of a cheque or draft or by any other mode, whichever is earlier.

8 Rate of TDS:

Tax shall be deducted at the rate of 1%.

9 Effect of non-furnishing of PAN on rate of tax:

Section 206AA, as inserted with effect from 1-4-2010, provides as under:

• Every person whose receipts are subject to deduction of tax at source (i.e., the deductee) shall furnish his PAN to the deductor.

• If such person does not furnish PAN to the deductor, the deductor will deduct tax at source at higher of the following rates:

(a) the rate prescribed in the Act;

(b) at the rate in force, i.e., the rate mentioned in the Finance Act; or

(c) at the rate of 20 per cent.

• Where the PAN provided to the deductor is invalid or does not belong to the deductee, it shall be deemed that the deductee has not furnished his PAN to the deductor and above provisions shall apply accordingly.

10 Tax Deduction and Collection Account Number (TAN):

Provisions pertaining to Tax Deduction and Collection Account Number, i.e., section 203A, shall not apply to a person deducting tax at source under Section 194-IA.

11 Deposit of tax to the credit of the Central Government:

Any sum deducted under section 194-IA shall be paid to the credit of the Central Government within a period of thirty days from the end of the month in which the deduction is made and shall be accompanied by a challan-cum-statement in Form No. 26QB.

The sum so deducted shall be deposited to the credit of the Central Government by remitting it electronically to the Reserve Bank of India or the State Bank of India or to any authorised bank.

12 Certificate for tax deducted at source:

Every person responsible for deduction of tax under section 194-IA shall furnish the certificate of deduction of tax at source in Form No. 16B to the payee within fifteen days from the due date for furnishing the Challan-cum-statement in Form No. 26QB under Rule 31A after generating and downloading the same from the web portal specified by the Director General of Income-tax (System) or the person authorised by him.

13 Furnishing of statements by tax deductor to department:

Every person responsible for deduction of tax under section 194-IA shall furnish to the Director General of Income-tax (System) or the person authorised by him a challan-cum-statement in Form No. 26QB electronically within 30 days from the end of the month in which the deduction is made. CPC-TDS has also enabled the online functionality for correction in Form No. 26QB.

In Case of TDS on property Provisions of law are very clear. let’s understand more

FAQ

1. What is TDS on property?

The Finance Bill 2013 has proposed that purchaser of an immovable property (other than rural agricultural land) worth Rs 50 lakh or more is required to pay withholding tax at the rate of 1% from the consideration payable to a resident transferor

2. Who is responsible to deduct the TDS on sale of Property?

According to rules in respect of tax deducted at source, buyer of the property would have to deduct the TDS and deposit the same in Government treasury.

3. I am Buyer, do I required to procure TAN to report the TDS on sale of Property?

Buyer or Purchaser of the property is not required to procure Tax Deduction Account Number (TAN). The Buyer is required quote his or her PAN and sellers PAN.

4. What are the forms to be used for filing annual/quarterly TDS/TCS returns?

PAN of the seller is mandatory. The same may be acquired from the Seller before effecting the transaction.

5. How can I use this facility to pay TDS on sale of Property?

The Buyer of the property (deductor of tax) has to furnish information regarding the transaction online on the TIN website. After successfully providing details of transaction deductor can:

- Either make the payment online (through e-tax payment option) immediately;

- Or make the payment subsequently through e-tax payment option (net-banking account) or by visiting any of the authorized Bank branches. However, such bank branches will make e-payment without digitization of any challan. The bank will get the challan details from the online form filled on www.tin-nsdl.com

6. If I encounter any error on NSDL site while entering the online form details what should I do?

If any problem is encountered at the NSDL website while entering details in the online form then contact the TIN Call Center at 020 – 27218080 or write to us at (Please indicate the subject of the mail as Online Payment of Direct Tax).

7. What is Form 26QB?

The online form available on the TIN website for furnishing information regarding TDS on property is termed as

Form 26QB.

8. I have filled Form 26QB and made the payment online, but I forgot to save the Acknowledgment No. generated at TIN website. From where can I get the Acknowledgment No.?

a) Acknowledgment number for the Form 26QB furnished is available in the Form 26AS (Annual Tax Statement) of the Deductor (i.e. Purchaser/ Buyer of property). The same can be viewed from the TRACES website (www.tdscpc.gov.in) or

b)Taxpayer can also click the option ‘View Acknowledgment’ hosted on the TIN website. Taxpayer needs to enter PAN of the Buyer and Seller, Total Payment and Assessment Year (as mentioned at the time of filing the Form 26QB) to retrieve the Acknowledgment Number.

9. What is Form 16B?

Form 16B is the TDS certificate to be issued by the deductor (Buyer of property) to the deductee (Seller of property) in respect of the taxes deducted and deposited into the Government Account.

10. From where will I get the Form 16B?

Form 16B will be available for download from the website of Centralized Processing Cell of TDS (CPC-TDS) www.tdscpc.gov.in

11. I am a buyer, whether I should deduct TDS on Property from the amount exceeding the property value of 50 Lakhs or on For example, If amount of property sold is 70 Lakhs, would TDS be calculated at 20 Lakhs or on 70 Lakhs?

TDS is to be deducted on the amount paid/credited to the seller. In the above e.g. the deduction will be on total amount i.e. on 70 Lakhs.

12. Can I make Cash/ Cheque payments for the TDS at Banks?

Buyer may approach any of the authorized Bank Branch to facilitate in making e-payment.

13. I am a Buyer and I have filled Form 26QB before TDS payment and I have selected the option e-payment at subsequent date then how the payment made thereafter within the permissible period would be matched in the 26QB?

E-payment of taxes at subsequent date will be linked to the FORM 26QB based on Acknowledgement number generated at the time of filing of Form 26QB.

14. How will transactions of joint parties (more than one buyer/seller) be filed in Form 26QB?

Online statement cum challan Form/ Form 26QB is to be filled in by each buyer for unique buyer-seller combination for respective share. E.g. in case of one buyer and two sellers, two forms have to be filled in and for two buyers and two seller, four forms have to be filled in for respective property shares.

15. I am a buyer of the property, do I require to obtain TAN to deduct TDS on sale of property?Buyer or Purchaser of the property is not required to procure Tax Deduction Account Number (TAN). All that is required is the buyer’s and sellers PAN to report the TDS.

16. What if I don’t have the seller’s PAN for deducting TDS?

Having the PAN of the seller is mandatory for TDS deduction. It is advisable to obtain the seller’s PAN before the transaction is completed.

17. How are transactions involving joint parties filed in Form 26QB?

Each buyer needs to fill the Form 26QB challan separately for every unique buyer-seller combination based on their respective share. For instance, in a scenario with one buyer and two sellers, two forms need to be filled. Similarly, if there are two buyers and two sellers, four forms are required.

18. As a buyer, should I deduct TDS only on the amount exceeding Rs. 50 lakh or on the entire property value?

TDS needs to be deducted on the entire amount paid or credited to the seller when it exceeds Rs. 50 lakh. For example, if the property is bought for Rs. 70 lakh, TDS should be deducted on the entire amount of Rs. 70 lakh, not just the Rs. 20 lakh exceeding the threshold.

19. How can I report TDS on the sale of property without a TAN?

Neither the buyer nor the seller needs to procure a TAN for TDS payment on the purchase of immovable property. However, it is mandatory for the buyer to quote their PAN and the seller’s PAN while deducting TDS.

20. What if I don’t have the PAN of the seller(s)?

The seller(s)’s PAN is essential for TDS deduction and filing Form 26QB. The buyer should obtain the PAN from the seller(s) before completing the transaction.

How to file Form 26QB

Steps to pay TDS (Form26QB) and to obtain Form 16B

The steps to pay TDS through challan 26QB and to obtain Form 16B (for the seller) are as follows:

e-Payment through Challan 26QB (Online)

Step-1: Log in to your account on the Income Tax e-filing portal. Select e-File > click on e-Pay Tax from the dropdown as shown below

Step-2: Click on ‘+ New Payment’

Step-3: Click on the proceed button on the tab ‘26QB- TDS on Property’ as highlighted below

Note: In the next few steps, you will have to add the following details:

- Add Buyer’s Details

- Add Seller’s Details

- Add Property Transferred Details

- Add Payment Details

Step-4: Add Buyer’s Details

All your details will be auto-filled, but you can also change them if needed. After entering the details, click on ‘Continue’

Step 5: Add Seller’s Details

Add all the details of the Seller like their PAN, address

Step 6: Add Property Details

Add all the property details like type, address and also the sale details like date of agreement, value etc. The tax amount will be calculated automatically. Once done, click on ‘continue’

Step 7: Add Payment Details

Select the payment mode and proceed to complete the payment. Once the payment is done, a challan will be generated.

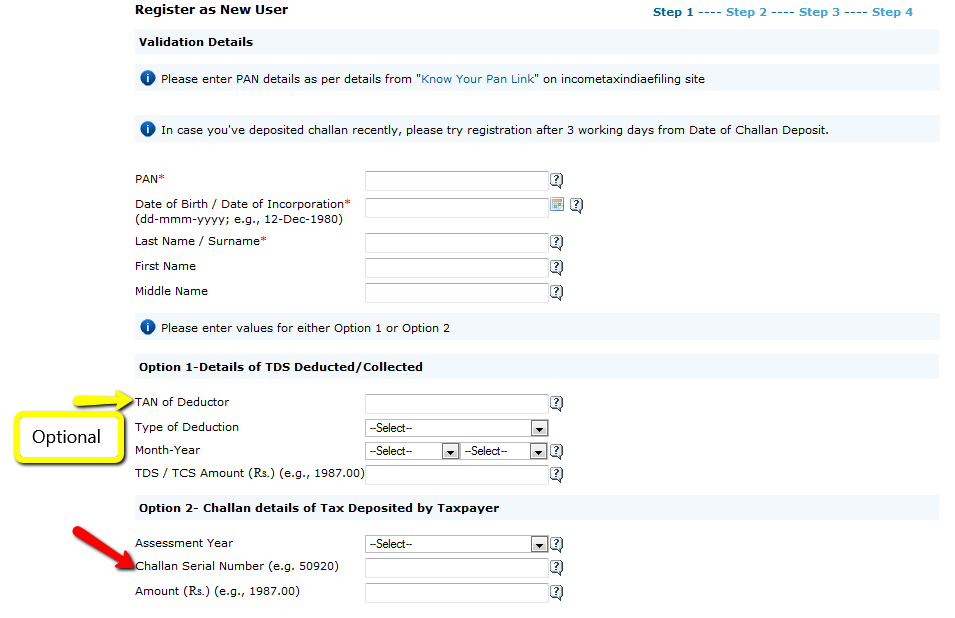

Step 8: Register in TRACES

- If you are a first-time user, register on TRACES as a Tax Payer with your PAN Card Number and the Challan number registered during payment.

- Once you register, you will be able to obtain approved Form 16B (TDS certificate) and you can issue this Form to the Seller.

- Check your Form 26AS seven days after payment. You will see that your payment is reflected under “Details of Tax Deducted at Source on Sale of Immovable Property u/s 194(IA) [For Buyer of Property]”.

- Part F gives you details such as TDS certificate number (which TRACES generates), name and PAN of deductee, transaction date and amount, acknowledgement number (which is the same as the one on your Form 26QB), date of deposit and TDS deposited.

Step 9:

Download your Form 16B

- After your payment in Form 26AS has been reflected, log in to TRACES. Go to the Download tab at the tab and click on “Form-16B (for the buyer)”.

- To finish this process, fill PAN of the seller and acknowledgement number details pertaining to the property transaction and click on “Proceed”.

- Verify all the details once and click on “Submit a request”.

- After a few hours, your request will be processed. Click on the Downloads tab and select Requested Downloads from the drop-down menu.

- You should be able to see that the status of your Form 16B download request is ‘available‘.

- If the status says ‘submitted‘ wait for a few hours more before repeating the last step.

- Download the ‘.zip file’. The password to open the ‘.zip file’ is the date of birth of the deductor (the format is DDMMYYYY). Your form will be available inside the .zip file as a pdf. Print this out.

Notice for Non-Filing of Form 26QB

The income tax department regularly receives information about property transactions through the Annual Information Return (AIR) from registrar/sub-registrar offices. Transactions exceeding Rs. 50 lakh are closely monitored, and if the buyer fails to deduct 1% TDS or doesn’t file Form 26QB within the stipulated time, the IT department issues a notice to the buyer.

Sample Notice Received by the Taxpayer

Subject: CPC (TDS) Follow-up: 26QB Statement Not Yet Filed for Property Purchase FY 2013-14 Communication Date: 05/04/2016

Dear Buyer of Immovable Property (PAN XXXXX1234X),

According to information from the Annual Information Return (AIR) through the Registrar/Sub-registrar, you’ve engaged in a property transaction exceeding Rs. 50 lakhs during FY 2022-23. However, you haven’t filed TDS Statement in Form 26QB yet. Please pay attention to the following regarding Form 26QB filing and issuance of TDS certificates in Form 16B downloaded from TRACES.

Mandatory Filing of Form 26QB

As per the Finance Act of 2013, TDS is applicable on immovable property transfers where consideration exceeds Rs. 50 lakhs. Section 194 IA of the Income Tax Act, 1961, along with Rules 30, 31, and 31A, stipulates:

- From June 1, 2013, the purchaser must deduct 1% tax during payment of sale consideration.

- The deducted tax should be paid to the Government Account through e-tax payment or authorized banks.

- The deducted sum must be paid to the Central Government within seven days from the deduction month’s end.

- Both seller’s and purchaser’s PAN must be furnished in Form 26QB online at www.incometax.gov.in

Issuance of TDS Certificates in Form 16B

Buyers must issue TDS certificates downloaded from TRACES. These certificates hold validity for TDS reconciliation analysis and correction through “TDS Reconciliation Analysis and Correction Enabling System” at www.tdscpc.gov.in.

Implications of Non/Late Filing of TDS Statements

For Buyer of Property

Failure to file Form 26QB incurs a fee under section 234E. The buyer pays Rs. 200 per day as long as the failure continues. Penalties for late deduction, payment, and interest may also apply.

For Seller of Property

Non/late filing of Form 26QB prevents the seller from claiming TDS credit.

Penalties Applicable on Non-Filing of Form 26QB

Interest Calculation

- Not deducting TDS: 1% per month from the intended deduction date until actual deduction.

- Not depositing TDS with the government: 1.5% per month from TDS deduction date to payment date.

Late Filing Fee Calculation

- Late filing fee under section 234E: Rs. 200 per day until Form 26QB submission.

Penalty Calculation

- Penalty under section 271H: Assessing Officer may levy a penalty ranging from Rs. 10,000 to Rs. 1 lakh for untimely submission of the required statement.

Join our Course on TDS on Property for Detailed knowledge