The Finance Act 2023 has amended the provisions of Section 115BAC w.e.f AY 2024-25, making the new tax regime the default for individuals, HUFs, AOPs (not being cooperative societies), BOIs, and Artificial Juridical Persons. However, taxpayers have the option to opt out of the new regime and choose the old regime. The old regime allows for various deductions and exemptions, while the new regime offers lower tax rates without most deductions and exemptions.

Form 5th July 2024 a major change is made in the ITR utility which change the method to avail Rebate allowed under New Tax Regime due to interpretation in language of law so it is very important to know all the slab rates carefully, watch below video also where change in Rebate is explained in detail:

Choosing the Tax Regime

- Non-business cases: The option to choose the regime can be exercised every year directly in the ITR filed on or before the due date specified under section 139(1).

- Business and profession cases: Taxpayers must furnish Form 10-IEA on or before the due date under section 139(1) for filing the return of income to switch regimes. This option can only be changed once in a lifetime for these taxpayers.

Income Tax Rates for Individuals (Tax on Normal Income)

Surcharge, Marginal Relief, and Health & Education Cess

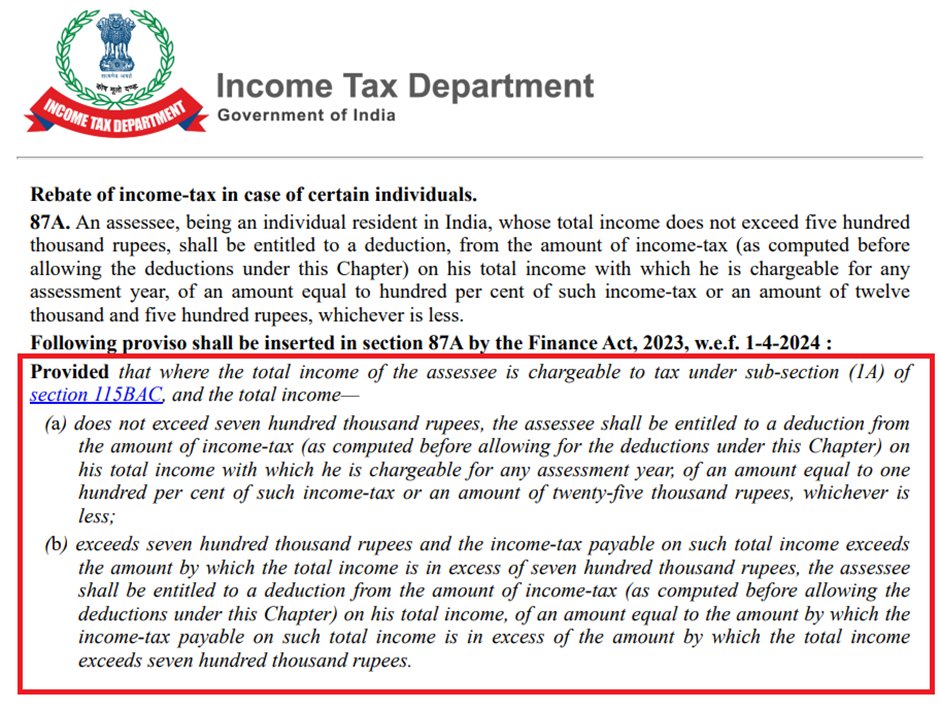

Rebate under Section 87A:

| Old Tax Regime | New Tax Regime |

|---|---|

| Tax rebate up to ₹12,500 | Tax rebate up to ₹25,000 |

| if total income does not | if total income does not |

| exceed ₹5,00,000 | exceed ₹7,00,000 |

Also under New Regime Marginal Relief is available for income above Rs.700000 Click here to read in detail

Marginal Relief under Section 87A For New Tax Regime

As per Section 87A, the tax rebate only applies if the total taxable income is less than the prescribed limit. Even though the prescribed limit has been increased under the new tax regime for FY 2023-24 and AY 2024-25, a slight increase in income from Rs. 7,00,000 will not automatically remove your tax rebate relief due to marginal relief.

The marginal relief for income tax rebate is a new amendment to Section 87A applicable only to the new tax regime. Instead of paying the full tax amount if your income is more significant than Rs. 7,00,000, you can pay only a small amount for the excess income. The tax payable will not exceed the income of more than Rs. 7,00,000. So, the tax you must pay will be less than the difference between your total taxable income and Rs. 7,00,000.

It can be easily explained with the following example:

Consider that Mr. X’s salary is Rs. 7,70,000 in FY 2023-24, and they have opted for a new tax regime. The standard deduction of Rs. 50,000 will apply, and consider that no other deductions are applicable. So, the total taxable income will be Rs. 7,20,000. This income is Rs. 20,000, more than the prescribed limit of Rs. 7,00,000.

When tax is computed per the new tax regime, the total tax amount is Rs. 27,000. So, does Mr. X have to pay Rs. 27,000 just because their income is slightly more than Rs. 7,00,000? Here is how marginal relief will reduce the total payable tax.

As per the new amendment, Mr. X can get marginal relief as they don’t have to pay taxes greater than the excess income. So, they can get a marginal relief of Rs. 7,000 (27,000 – 20,0000). As a result, their total payable tax comes down to 20,000 (27,000 – 7,000).

The marginal relief amount will break even at a taxable income of Rs. 7,77,778, after which there will be no rebate. So, you can get marginal relief if your income is greater than Rs. 7,00,000 and less than Rs. 7,77,779.

If Mr. X’s total taxable income is Rs. 8,00,000 for FY 2023-24 as per the new tax regime, their tax liability based on the new income tax slabs is Rs. 35,000. Marginal relief will not apply here as the payable tax is less than the income over Rs. 7,00,000. So, Mr. X has to pay the full tax amount of Rs. 35,000, and an income tax rebate is not applicable.

Government notified major interpretation change in Rebate u/s 87A in Income Tax utility form 5 July 2024 under New Tax Regime that allowing Rebate of Rs.25000 Under New Regime for Normal Income only not for special Tax Rate income, kindly read the language of law below:

Health and Education Cess

- Rate: 4% of Income Tax + Surcharge

Surcharge Rates

| Total Income (₹) | Old Tax Regime | New Tax Regime |

|---|---|---|

| Up to 50,00,000 | Nil | Nil |

| 50,00,001 to 1,00,00,000 | 10% | 10% |

| 1,00,00,001 to 2,00,00,000 | 15% | 15% |

| 2,00,00,001 to 5,00,00,000 | 25% | 25% |

| Above 5,00,00,000 | 37% | 25% |

Note: The enhanced surcharge of 25% & 37% is not levied on income chargeable to tax under sections 111A, 112, 112A, and Dividend Income. Hence, the maximum rate of surcharge on tax payable on such incomes shall be 15%, except when the income is taxable under sections 115A, 115AB, 115AC, 115ACA, and 115E.

Marginal Relief for Surcharge

Marginal relief is a relief from surcharge, provided in cases where the surcharge payable exceeds the additional income that makes the person liable for surcharge.

| Net Income Range (₹) | Marginal Relief Explanation |

|---|---|

| Exceeds 50,00,000 but does not exceed 1,00,00,000 | Amount payable as income tax and surcharge shall not exceed the total amount payable as income tax on total income of ₹50 Lakh by more than the amount of income that exceeds ₹50 Lakh |

| Exceeds 1,00,00,000 but does not exceed 2,00,00,000 | Amount payable as income tax and surcharge shall not exceed the total amount payable as income-tax on total income of ₹1 Crore by more than the amount of income that exceeds ₹1 Crore |

| Exceeds 2,00,00,000 but does not exceed 5,00,00,000 | Amount payable as income tax and surcharge shall not exceed the total amount payable as income-tax on total income of ₹2 Crore by more than the amount of income that exceeds ₹2 Crore |

| Exceeds 5,00,00,000 | Amount payable as income tax and surcharge shall not exceed the total amount payable as income-tax on total income of ₹5 Crore by more than the amount of income that exceeds ₹5 Crore |

Special Tax Rates on Different Types of Income

Here is a detailed table covering the special tax rates applicable to different types of income, including those from share markets, virtual digital assets (VDA), lottery, betting, gambling, online gaming, etc., as per the Income Tax Act, 1961.

Tax on Income from Share Market

| Category | Section | Tax Rate | Exempt Income | Chapter VIA Deductions | Rebate u/s 87A | Unexhausted Basic Exemption Limit | Special Rate Details |

|---|---|---|---|---|---|---|---|

| Long-Term Capital Gain (LTCG) | 112A | 10% | Up to ₹100,000 | Not Available | Not Available | Available | Gains exceeding ₹100,000 |

| Long-Term Capital Gain (LTCG) | 112 | 20% | Nil | Not Available | Available in old regime only | Available | 10% without indexation for listed securities or zero-coupon bonds, 20% with indexation |

| Short-Term Capital Gain (STCG) | 111A | 15% | Nil | Not Available | Available in old regime only | Available | STT paid on transactions |

| Short-Term Capital Gain (STCG) | Slab Rate | Slab Rate | Nil | Available | Available | Available | STT not paid |

| Transaction in Forex in IFSC | – | 10% (LTCG) / 15% (STCG) | Nil | – | – | – | |

| Special Rate for Non-Residents | – | 10% (unlisted securities) | Nil | – | – | – |

Tax on Income from Other Sources

| Category | Section | Tax Rate | Exempt Income | Chapter VIA Deductions | Rebate u/s 87A | Unexhausted Basic Exemption Limit |

|---|---|---|---|---|---|---|

| Lottery, Betting, Gambling | – | 30% | Nil | Not Available | Available in old regime only | Not Available |

| Online Gaming | – | 30% | Nil | Not Available | Available in old regime only | Not Available |

| Virtual Digital Assets (VDA) | – | 30% | Nil | Not Available | Not Available | Not Available |

Detailed Understanding of Capital Gains Tax

Long-Term Capital Gains (LTCG)

Section 112A (Cases Where STT Paid):

- Tax Rate: 10% on gains exceeding ₹100,000.

- Exempt Income: Gains up to ₹100,000 are exempt.

- Deductions: Chapter VIA deductions are not available.

- Rebate: Rebate u/s 87A is not available.

- Unexhausted Basic Exemption Limit: Available.

Section 112 (Cases where STT Not Paid):

- Tax Rate: 20% with indexation benefits.

- Special Rate: For listed securities (other than units) or zero-coupon bonds, 10% without indexation and 20% with indexation.

- Deductions: Chapter VIA deductions are not available.

- Rebate: Rebate u/s 87A is available.

- Unexhausted Basic Exemption Limit: Available.

Short-Term Capital Gains (STCG)

Section 111A (Cases Where STT Paid):

- Tax Rate: 15%.

- Exempt Income: No exemption.

- Deductions: Chapter VIA deductions are not available.

- Rebate: Rebate u/s 87A is available.

- Unexhausted Basic Exemption Limit: Available.

Non-Specified Sections (Where STT Not Paid):

- Tax Rate: Taxed at applicable slab rates.

- Exempt Income: No exemption.

- Deductions: Chapter VIA deductions are available.

- Rebate: Rebate u/s 87A is available.

- Basic Exemption Limit: Available.

Treatment of Losses

- Short-Term Capital Loss (STCL):

- Can be set off against both STCG and LTCG.

- If not fully set off in the same year, it can be carried forward for 8 assessment years.

- To carry forward losses, the taxpayer must file the income tax return before the due date.

- Long-Term Capital Loss (LTCL):

- Can be set off only against LTCG.

- If not fully set off in the same year, it can be carried forward for 8 assessment years.

- Similar to STCL, LTCL must be reported in the income tax return filed before the due date.

Capital gains tax rates for assets other than share market income (e.g., real estate, gold, debt mutual funds) are governed by Sections 112 and 112A of the Income Tax Act, 1961. These rates vary based on the type of asset and the holding period. Here is a detailed breakdown:

Long-Term Capital Gains (LTCG) on Assets Other Than Share Market

| Type of Asset | Section | Holding Period | Tax Rate | Indexation Benefits | Deductions (Chapter VIA) | Rebate u/s 87A | Exemptions |

|---|---|---|---|---|---|---|---|

| Real Estate (Immovable Property) | 112 | More than 24 months | 20% | Available | Not Available | Available in old regime only | Unexhausted basic exemption limit |

| Debt-Oriented Mutual Funds | 112 | More than 36 months | 20% | Available | Not Available | Available in old regime only | Unexhausted basic exemption limit |

| Unlisted Shares | 112 | More than 24 months | 20% | Available | Not Available | Available in old regime only | Unexhausted basic exemption limit |

| Gold and Other Precious Metals | 112 | More than 36 months | 20% | Available | Not Available | Available in old regime only | Unexhausted basic exemption limit |

| Other Long-Term Capital Assets | 112 | More than 36 months | 20% | Available | Not Available | Available in old regime only | Unexhausted basic exemption limit |

Short-Term Capital Gains (STCG) on Assets Other Than Share Market

| Type of Asset | Section | Holding Period | Tax Rate | Indexation Benefits | Deductions (Chapter VIA) | Rebate u/s 87A | Exemptions |

|---|---|---|---|---|---|---|---|

| Real Estate (Immovable Property) | Slab Rate | 24 months or less | Slab Rate | Not Available | Available | Available | Unexhausted basic exemption limit |

| Debt-Oriented Mutual Funds | Slab Rate | 36 months or less | Slab Rate | Not Available | Available | Available | Unexhausted basic exemption limit |

| Unlisted Shares | Slab Rate | 24 months or less | Slab Rate | Not Available | Available | Available | Unexhausted basic exemption limit |

| Gold and Other Precious Metals | Slab Rate | 36 months or less | Slab Rate | Not Available | Available | Available | Unexhausted basic exemption limit |

| Other Short-Term Capital Assets | Slab Rate | 36 months or less | Slab Rate | Not Available | Available | Available | Unexhausted basic exemption limit |

Detailed Explanation of Terms and Provisions

Long-Term Capital Gains (LTCG)

- Tax Rate: The long-term capital gains tax rate is generally 20% with indexation benefits.

- Indexation Benefits: This allows for adjustment of the purchase price with the inflation index, reducing the taxable amount.

- Deductions: Chapter VIA deductions are not available on LTCG.

- Rebate: Rebate u/s 87A is available if the total income is below ₹5,00,000.

- Exemptions: Unexhausted basic exemption limit can be adjusted against LTCG.

Short-Term Capital Gains (STCG)

- Tax Rate: Short-term capital gains are taxed at the applicable slab rates for the individual.

- Indexation Benefits: Not available for STCG.

- Deductions: Chapter VIA deductions are available on STCG.

- Rebate: Rebate u/s 87A is available if the total income is below ₹5,00,000.

- Exemptions: Unexhausted basic exemption limit can be adjusted against STCG.

Example Calculations

Long-Term Capital Gain on Real Estate

- Purchase Details: Property bought for ₹50,00,000 in FY 2015-16.

- Sale Details: Property sold for ₹80,00,000 in FY 2020-21.

- Holding Period: More than 24 months (Long-Term).

Calculation:

- Indexed Purchase Price: ₹50,00,000 * (CII for 2020-21 / CII for 2015-16)

- Indexed Purchase Price: ₹50,00,000 * (301 / 254) = ₹59,25,197

- LTCG: ₹80,00,000 – ₹59,25,197 = ₹20,74,803

- Tax Payable: ₹20,74,803 * 20% = ₹4,14,960.60

Short-Term Capital Gain on Debt Mutual Funds

- Purchase Details: Units bought for ₹2,00,000 in FY 2019-20.

- Sale Details: Units sold for ₹2,50,000 in FY 2020-21.

- Holding Period: Less than 36 months (Short-Term).

Calculation:

- STCG: ₹2,50,000 – ₹2,00,000 = ₹50,000

- Tax Payable: ₹50,000 (Taxed at applicable slab rate)

Visit www.cagurujiclasses.com for practical courses

In India, middle income Senior citizens are facing very severe adversities, as their pension income & interest income on their life time savings(Generally deposited as FD in banks etc, are being eaten up by income tax structure (framed by policy makers & planners) , at par with routine employees, and GST on each and everything & also by the severe inflation. They are paying on an average more than 20% of their pension +interest income as Income tax and on an average 20% as GST on each and everything & apart from this severe inflation is biting them day by day, but system’s expectation is only to collect income tax any how from such Senior citizens mercilessly.

I purchased flat in june 1987 in Chandigarh and sold in june 2023. Purchase price was 125000 and selling price 45,00,000. Spent 5,00,000 on home improvement and 2,51,000 on repayment of instalments upto 2011. Pl guide what is my capital tax.

Excellent update

Long. Term. Capital. Loss. On. Shares. Sold. In. Off. Market. Is. Adjustable. With. Ltcg. Profit. By. On. Market. Sale. Please. Reply. My. Whatsup. 9518088076.