CBDT notifies Rule for determination of value of perquisite in respect of residential accommodation provided by employer

The Finance Act, 2023 brought in an amendment for the purposes of calculation of “perquisite” with regard to the value of rent-free or concessional accommodation provided to an employee, by his employer.

Accordingly, CBDT has modified Rule 3 of the Income-tax Rules, 1961 to provide for the same, effective from 1 September 2023

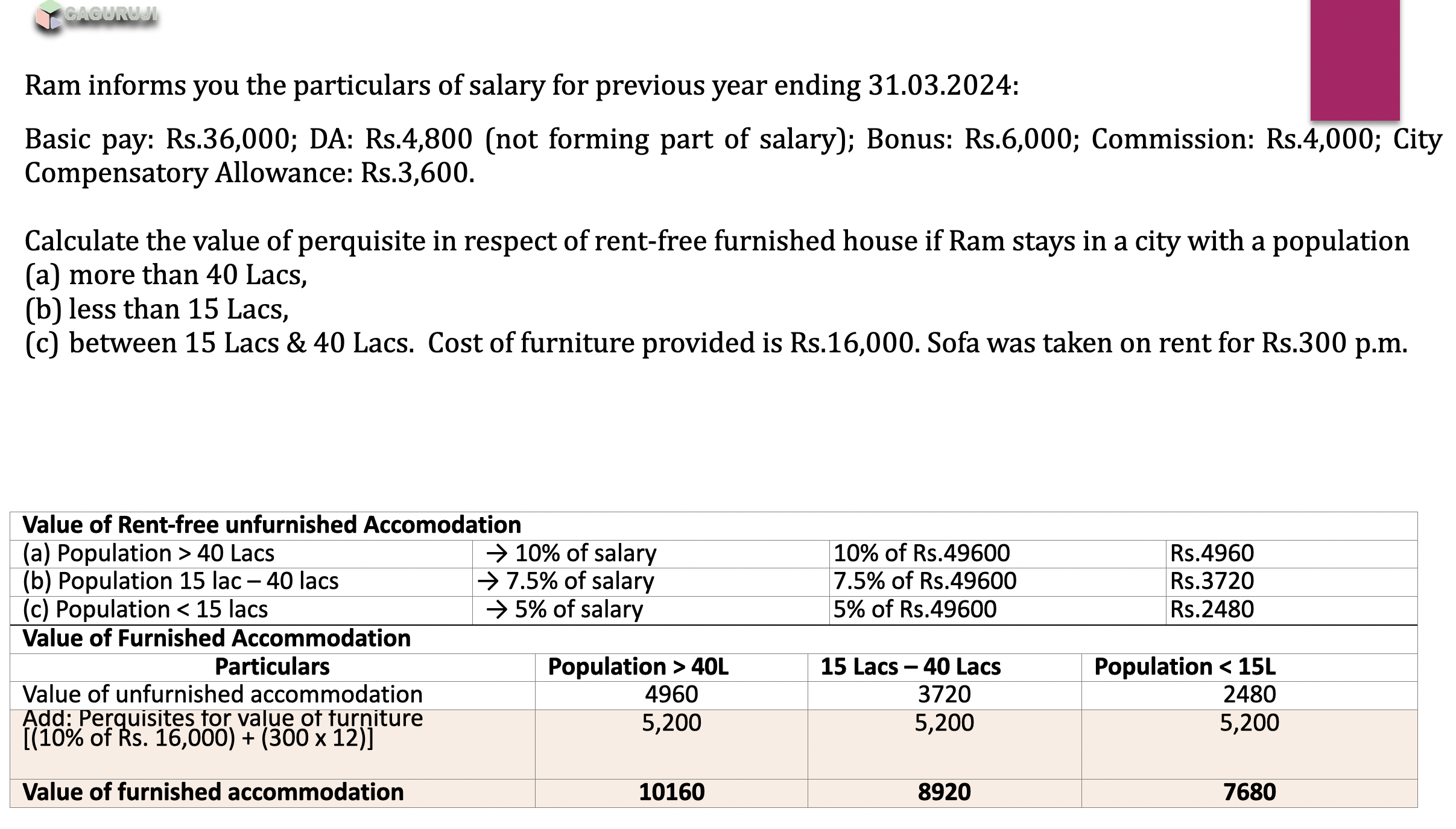

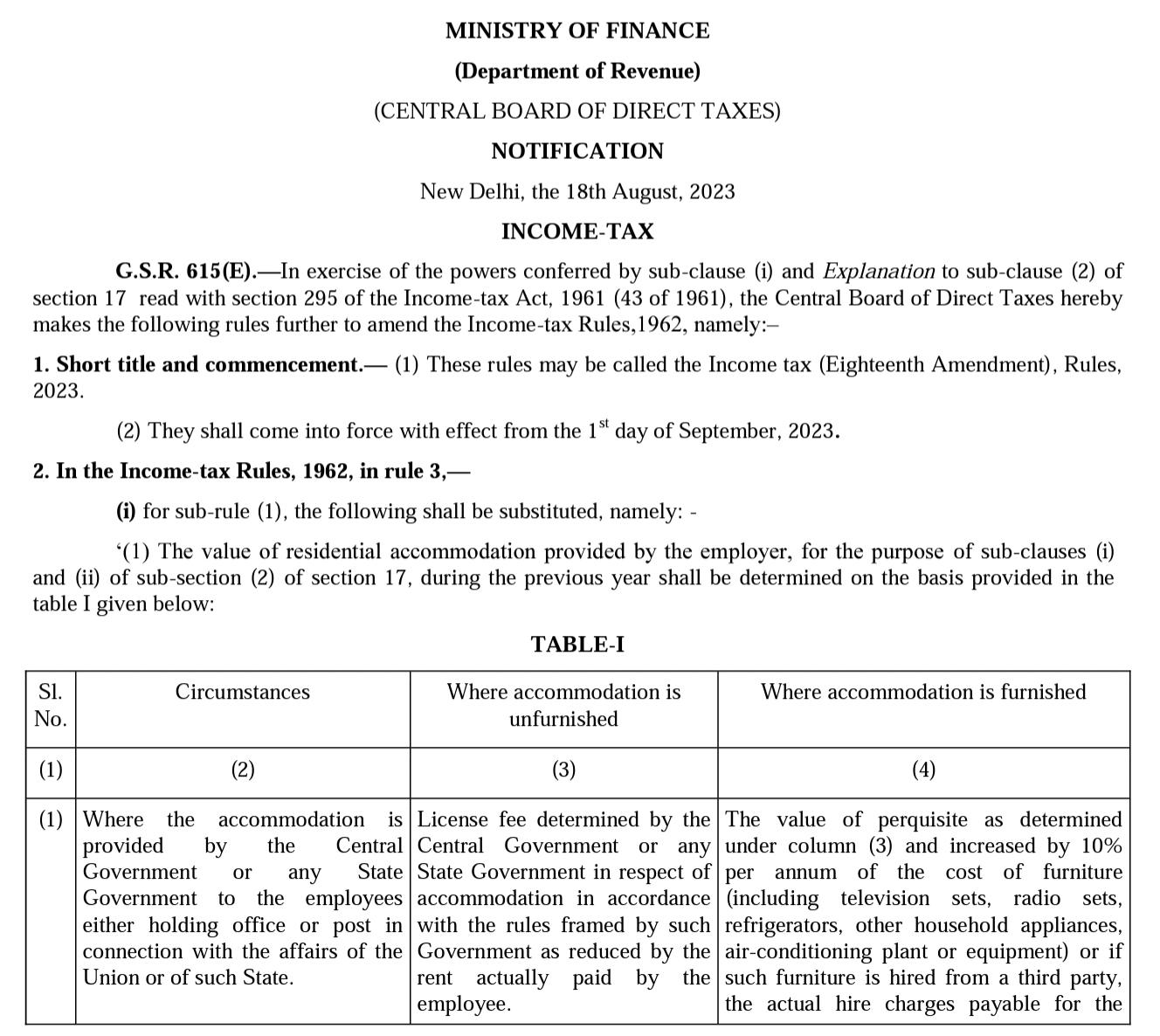

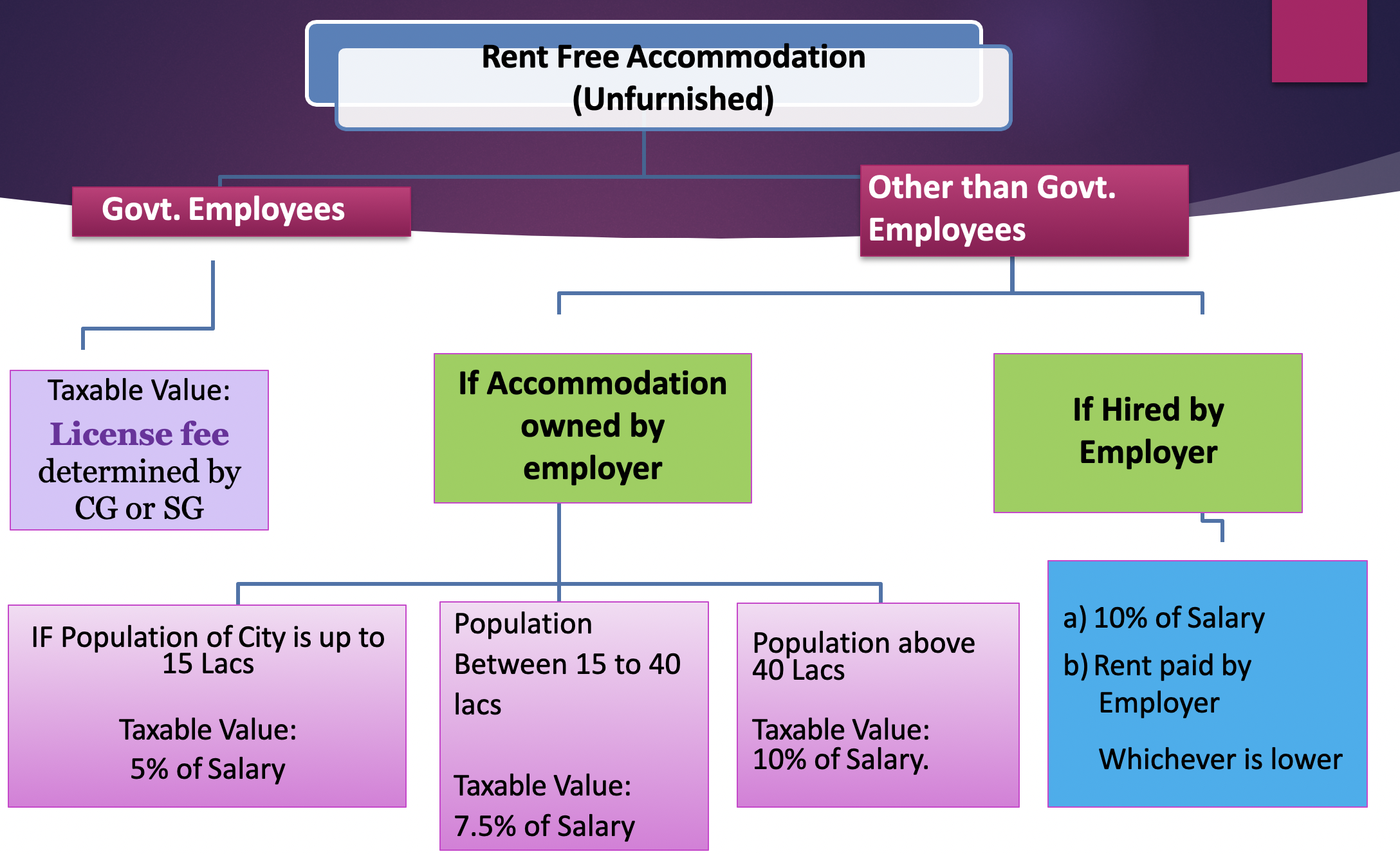

The categorisation and the limits of cities and population have now been based on the 2011 census as against the 2001 census earlier. The revised limits of population are 40 lakh in place of 25 lakh and 15 lakh in place of 10 lakh. The earlier perquisite rates of 15%, 10% and 7.5% of the salary have now been reduced to 10%, 7.5% and 5% of the salary respectively in the amended Rule.

This is summarised as under:

| Previous Categorisation and Rates | New Categorisation and Rates | ||

| Population | Perquisite Rate | Population | Perquisite Rate |

| More than 25 lakh | 15% | More than 40 lakh | 10% |

| Between 10 lakh and 25 lakh | 10% | Between 15 lakh and 40 lakh | 7.5% |

| Less than 10 lakh | 7.5% | Less than 15 lakh | 5% |

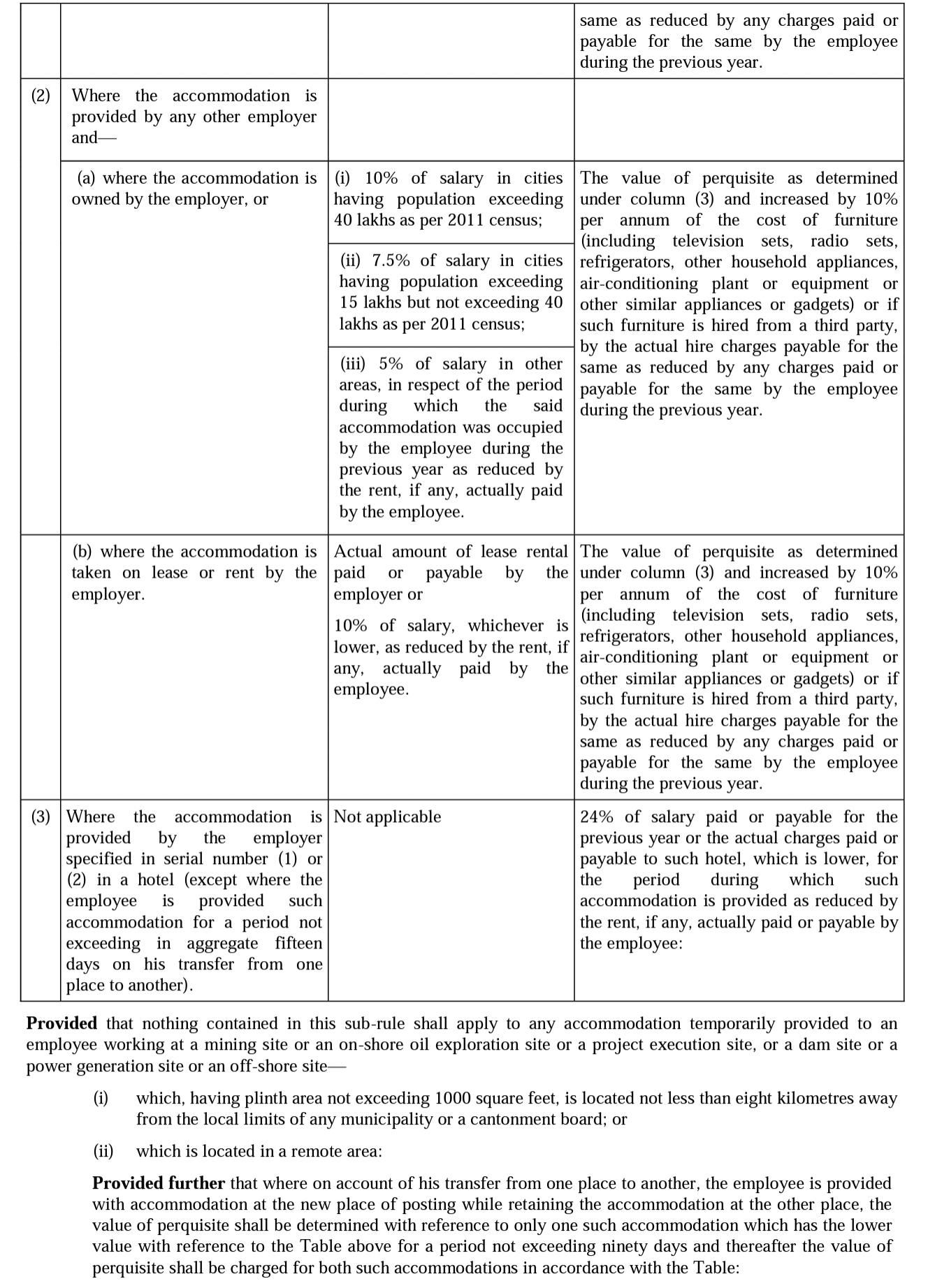

The Rule has also been further rationalised so as to compute a fair tax implication of the same accommodation being occupied by an employee for more than one previous year.

Notification No. 65/2023 dated 18th August, 2023 has been published :

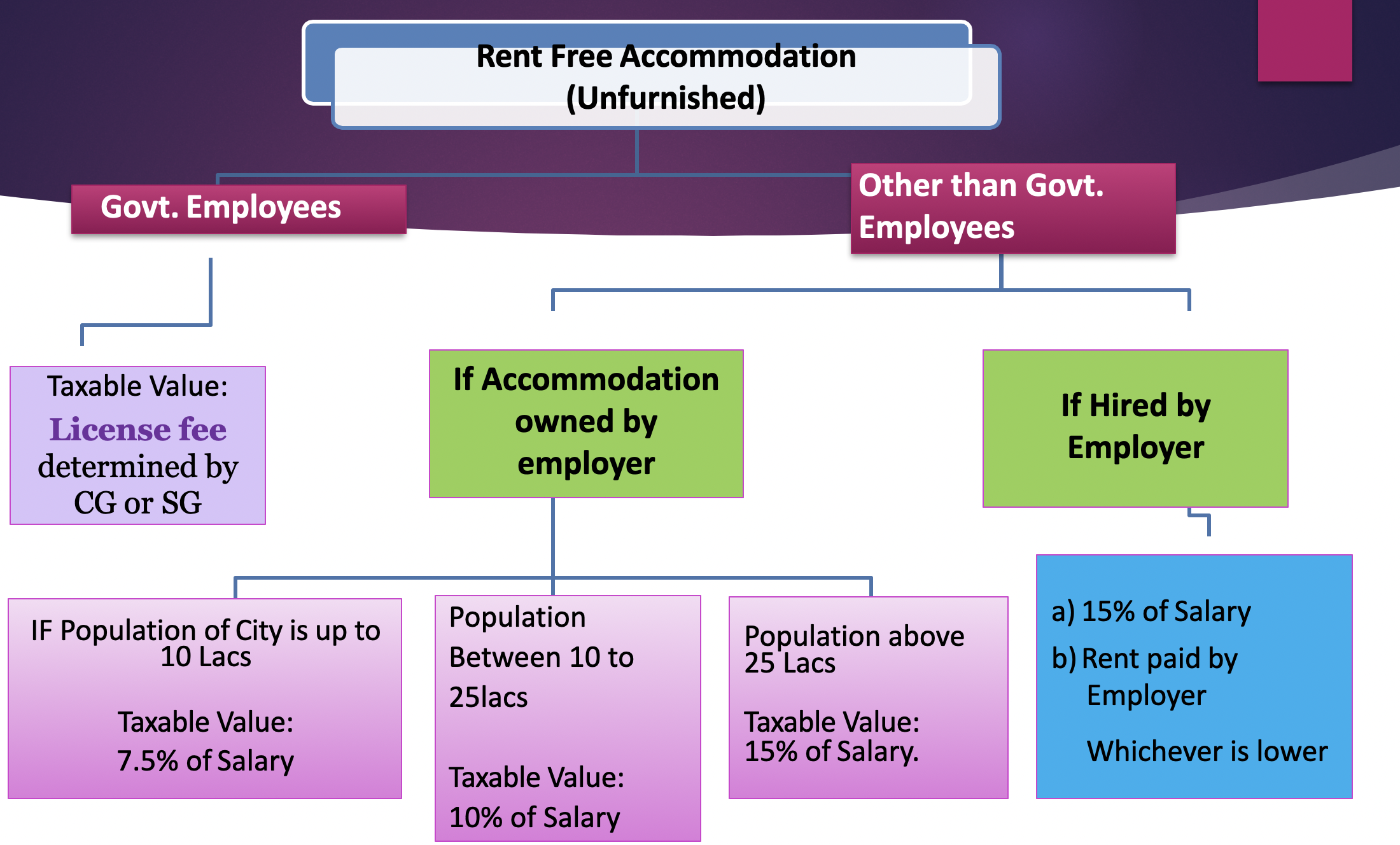

See Earlier Limits in Table form:

See Changes w.e.f 1st September 2023

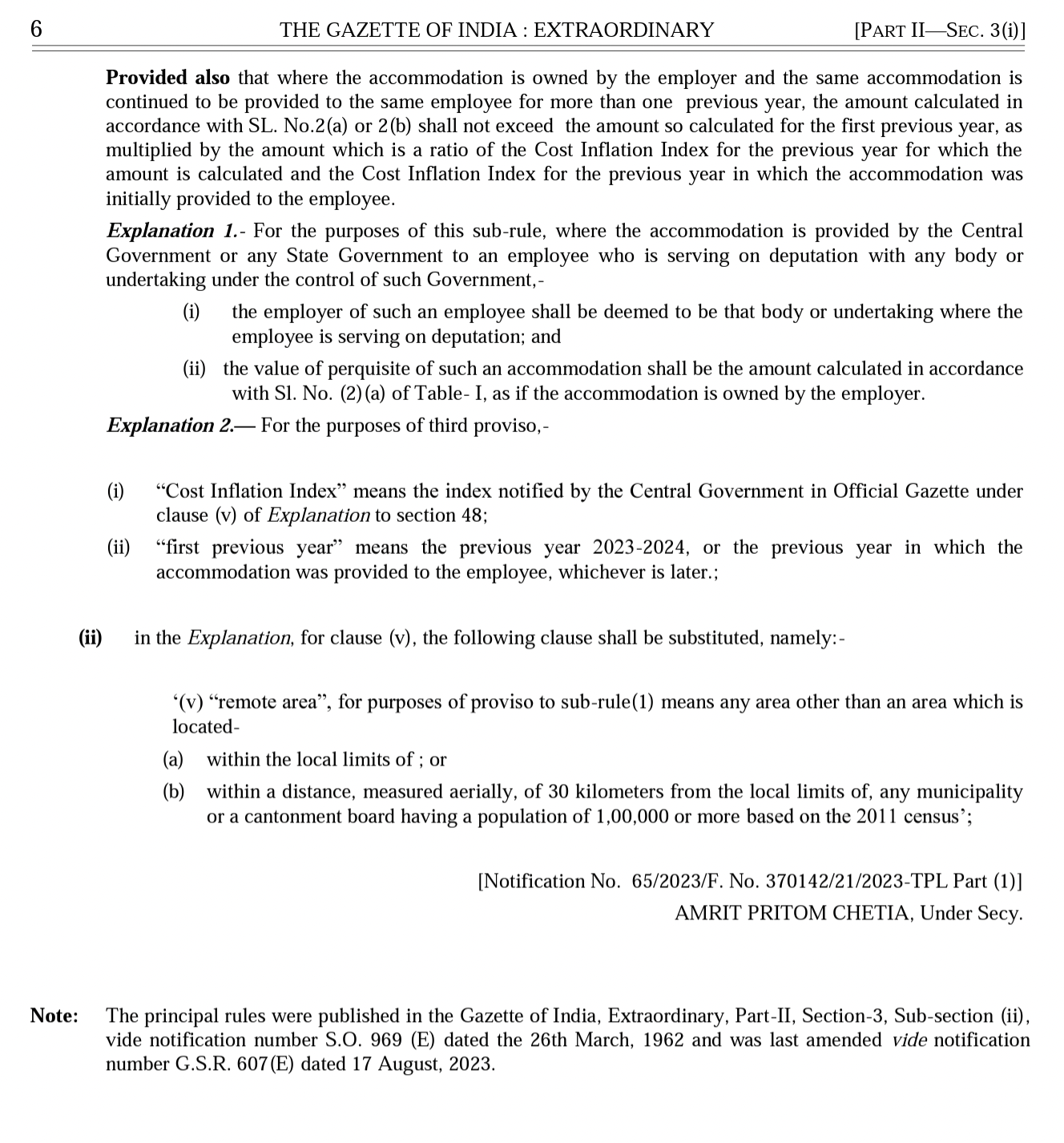

Meaning of Salary for Rent free accommodation

Incudes:

- Basic Salary

- D.A. (in terms)

- Any Commission, Bonus , fee

- Taxable part of all Allowances

- Any other monetary benefit from one or more employer

Doesn’t Include:

- Taxable portion of PF

- Taxable portion of Perquisites u/s 17(2)

- Benefits received at the time of retirement like gratuity, pension etc.

- Arrear of salary or advance salary

Example: