If we talk about Personal Income Tax changes announced in Budget 2024 the only change was made in the New Tax Regime, Standard Deduction under New regime, Family pension under New Regime and section 80CCD (2) under New Regime which is discussed here.

Also after budget 2024 which was presented on 23 July 2024, many taxpayers are confused about ITR to be filled till 31st July 2024 that which tax rate to be taken for ITR of FY 2023-24, for them answer is these changes of Budget are applicable from next financial year 2024-25 only, file your ITRs of FY 2023-24 as per slabs rate before the Budget 2024.

These are applicable for FY 2024-25 & AY 2025-26

There are 2 Tax regimes : Old Tax Regime vs New Tax Regime

Choosing the Tax Regime

- Non-business cases: The option to choose the regime can be exercised every year directly in the ITR filed on or before the due date specified under section 139(1).

- Business and profession cases: Taxpayers must furnish Form 10-IEA on or before the due date under section 139(1) for filing the return of income to switch regimes. This option can only be changed once in a lifetime for these taxpayers.

New Tax Regime:

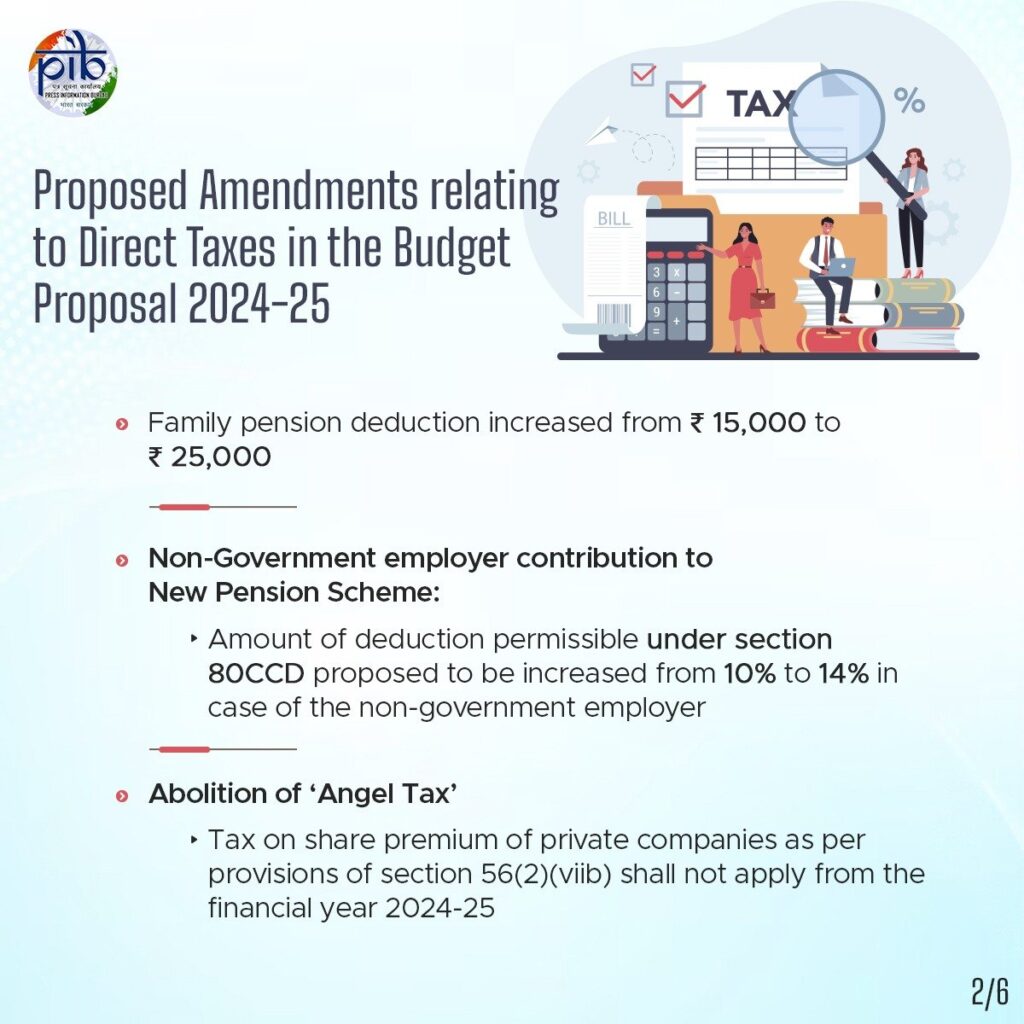

The standard deduction for salaried employees is increased from ₹50,000/- to ₹75,000/-.

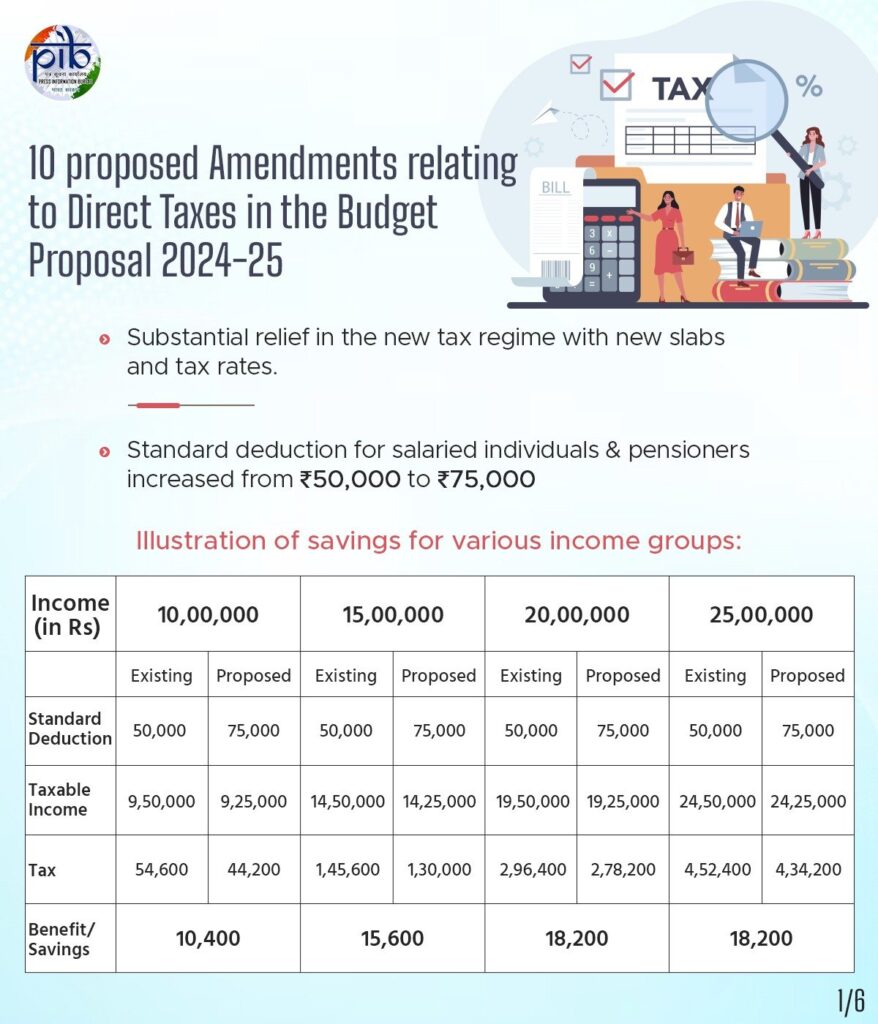

Similarly, deduction on family pension for pensioners is proposed to be enhanced from ₹ 15,000/- to ₹25,000/-

Section 80CCD(2): Increase the amount of deduction allowed to an employer in respect of his contribution to a pension scheme referred to in section 80CCD, from the extent of 10% to the extent of 14% of the salary of the employee. Further, a nongovernment employee in the new tax regime shall be allowed deduction of an amount not exceeding 14% of the employee’s salary in place of 10%.

Other Deductions or exemptions (Like Agniveer corpus fund, Travelling allowance of physically disabled etc.) which were earlier allowed in new tax regime are continue to be allowed as it is.

Slab Rate:

| Income Range (₹) | Tax Rate |

|---|---|

| 0 – 3,00,000 | No tax |

| 3,00,001 – 7,00,000 | 5% |

| 7,00,001 – 10,00,000 | 10% |

| 10,00,001 – 1200000 | 15% |

| 1200000 – 1500000 | 20% |

| 150000 and Above | 30% |

As a result of these changes, a salaried employee in the new tax regime stands to save up to ₹ 17,500/- in income tax. you can see how you can save 17500 under new regime.

Old Tax Regime (No Change):

All Deductions and Exemptions allowed.

Individuals below 60 years

| Income Range (₹) | Tax Rate |

|---|---|

| 0 – 2,50,000 | No tax |

| 2,50,001 – 5,00,000 | 5% |

| 5,00,001 – 10,00,000 | 20% |

| Above 10,00,000 | 30% |

Senior Citizens (60-80 years)

| Income Range (₹) | Tax Rate |

|---|---|

| 0 – 3,00,000 | No tax |

| 3,00,001 – 5,00,000 | 5% |

| 5,00,001 – 10,00,000 | 20% |

| Above 10,00,000 | 30% |

Super Senior Citizens (80+ years)

| Income Range (₹) | Tax Rate |

|---|---|

| 0 – 5,00,000 | No tax |

| 5,00,001 – 10,00,000 | 20% |

| Above 10,00,000 | 30% |

Surcharge, Marginal Relief, and Health & Education Cess

Rebate under Section 87A:

| Old Tax Regime | New Tax Regime |

|---|---|

| Tax rebate up to ₹12,500 | Tax rebate up to ₹25,000 |

| if total income does not | if total income does not |

| exceed ₹5,00,000 | exceed ₹7,00,000 |

Also under New Regime Marginal Relief is available for income above Rs.700000 Click here to read in detail

Marginal Relief under Section 87A For New Tax Regime

As per Section 87A, the tax rebate only applies if the total taxable income is less than the prescribed limit. Even though the prescribed limit has been increased under the new tax regime for FY 2023-24 and AY 2024-25, a slight increase in income from Rs. 7,00,000 will not automatically remove your tax rebate relief due to marginal relief.

The marginal relief for income tax rebate is a new amendment to Section 87A applicable only to the new tax regime. Instead of paying the full tax amount if your income is more significant than Rs. 7,00,000, you can pay only a small amount for the excess income. The tax payable will not exceed the income of more than Rs. 7,00,000. So, the tax you must pay will be less than the difference between your total taxable income and Rs. 7,00,000.

It can be easily explained with the following example:

Consider that Mr. X’s salary is Rs. 7,70,000 in FY 2023-24, and they have opted for a new tax regime. The standard deduction of Rs. 50,000 will apply, and consider that no other deductions are applicable. So, the total taxable income will be Rs. 7,20,000. This income is Rs. 20,000, more than the prescribed limit of Rs. 7,00,000.

When tax is computed per the new tax regime, the total tax amount is Rs. 27,000. So, does Mr. X have to pay Rs. 27,000 just because their income is slightly more than Rs. 7,00,000? Here is how marginal relief will reduce the total payable tax.

As per the new amendment, Mr. X can get marginal relief as they don’t have to pay taxes greater than the excess income. So, they can get a marginal relief of Rs. 7,000 (27,000 – 20,0000). As a result, their total payable tax comes down to 20,000 (27,000 – 7,000).

The marginal relief amount will break even at a taxable income of Rs. 7,77,778, after which there will be no rebate. So, you can get marginal relief if your income is greater than Rs. 7,00,000 and less than Rs. 7,77,779.

If Mr. X’s total taxable income is Rs. 8,00,000 for FY 2023-24 as per the new tax regime, their tax liability based on the new income tax slabs is Rs. 35,000. Marginal relief will not apply here as the payable tax is less than the income over Rs. 7,00,000

Health and Education Cess

- Rate: 4% of Income Tax + Surcharge

Surcharge Rates

| Total Income (₹) | Old Tax Regime | New Tax Regime |

|---|---|---|

| Up to 50,00,000 | Nil | Nil |

| 50,00,001 to 1,00,00,000 | 10% | 10% |

| 1,00,00,001 to 2,00,00,000 | 15% | 15% |

| 2,00,00,001 to 5,00,00,000 | 25% | 25% |

| Above 5,00,00,000 | 37% | 25% |

Note: The enhanced surcharge of 25% & 37% is not levied on income chargeable to tax under sections 111A, 112, 112A, and Dividend Income. Hence, the maximum rate of surcharge on tax payable on such incomes shall be 15%, except when the income is taxable under sections 115A, 115AB, 115AC, 115ACA, and 115E.

Marginal Relief for Surcharge

Marginal relief is a relief from surcharge, provided in cases where the surcharge payable exceeds the additional income that makes the person liable for surcharge.

| Net Income Range (₹) | Marginal Relief Explanation |

|---|---|

| Exceeds 50,00,000 but does not exceed 1,00,00,000 | Amount payable as income tax and surcharge shall not exceed the total amount payable as income tax on total income of ₹50 Lakh by more than the amount of income that exceeds ₹50 Lakh |

| Exceeds 1,00,00,000 but does not exceed 2,00,00,000 | Amount payable as income tax and surcharge shall not exceed the total amount payable as income-tax on total income of ₹1 Crore by more than the amount of income that exceeds ₹1 Crore |

| Exceeds 2,00,00,000 but does not exceed 5,00,00,000 | Amount payable as income tax and surcharge shall not exceed the total amount payable as income-tax on total income of ₹2 Crore by more than the amount of income that exceeds ₹2 Crore |

| Exceeds 5,00,00,000 | Amount payable as income tax and surcharge shall not exceed the total amount payable as income-tax on total income of ₹5 Crore by more than the amount of income that exceeds ₹5 Crore |

Also there are changes in Capital Gain Tax Rates which are explained in below video:

Visit www.cagurujiclasses.com for practical courses

Reabte u/s 87A 25000 new regime FY 2023-24 but income will upto 7 lakhs

Rebate u/s 87A 25000 new regime FY 2024-25 and what will be income for claim the Rebate u/s 87 A

Tax on 750000

Upto 300000 nil

300000 to 700000 5% 20000

700000 to 750000 10% 5000

=25000

if Rebate 87A Available upto 7.5 lakhs Income ?

25000 hogi

My total income from pension is around 685000/ and other income including Interst in deposits Say on saving Bank account is 15000 and fixed deposited around 105000. Total 805000/ Am I eligible for standard deductions of 75000. If yes please furnish details of the calculation

In the budget it is not clear..