On November 5, 2024, the Ministry of Finance, Department of Revenue, Central Board of Indirect Taxes & Customs (CBIC), issued a new set of instructions regarding the conduct of personal hearings under various Acts, including the CGST Act, 2017, IGST Act, 2017, Customs Act, 1962, Central Excise Act, 1944, and Chapter V of the Finance Act, 1994. These guidelines aim to streamline the procedures for adjudicating authorities and provide clarity on how personal hearings should be conducted, particularly in the context of virtual and physical hearings.

Background and Context

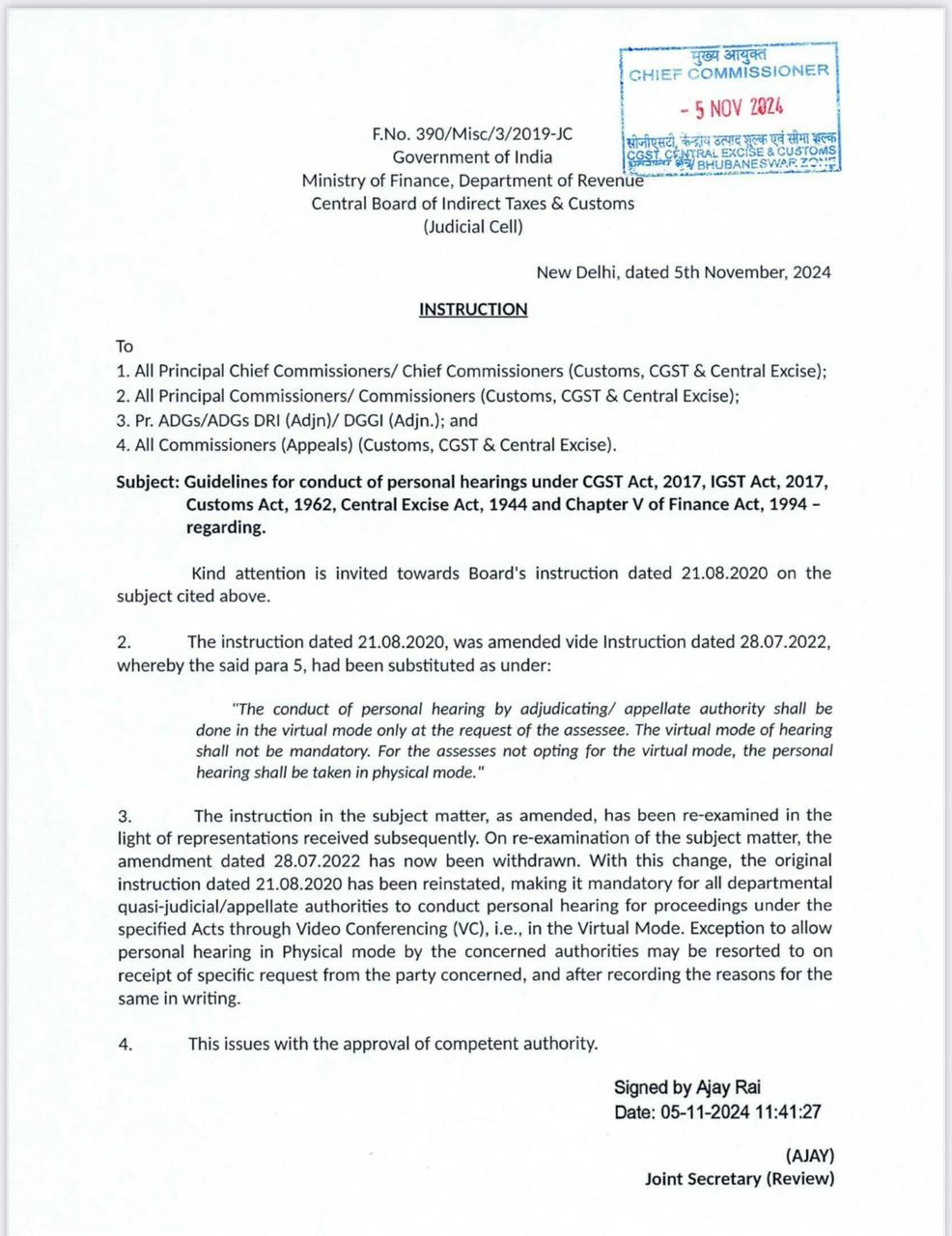

- The CBIC had issued an earlier instruction on August 21, 2020, mandating that personal hearings in quasi-judicial and appellate proceedings be conducted via video conferencing (VC) to ensure convenience and efficiency.

- Subsequently, on July 28, 2022, this directive was amended to allow personal hearings in physical mode, making virtual hearings optional and only conducted at the request of the assessee.

Reinstatement of Virtual Hearings

- The latest instruction from November 5, 2024, revisits the policy and withdraws the amendment made on July 28, 2022. Consequently, the original instruction dated August 21, 2020, has been reinstated.

- Mandatory Virtual Hearings: All departmental adjudicating and appellate authorities are now required to conduct personal hearings through Video Conferencing (VC) as the default mode. This is applicable to proceedings under the CGST Act, IGST Act, Customs Act, Central Excise Act, and related laws.

- Exception for Physical Hearings: If an assessee explicitly requests a personal hearing in physical mode, the concerned authority may consider and grant the request. However, this is contingent upon receiving the request in writing and recording the reasons for granting the physical hearing.

Objective of the Reinstatement

- The CBIC’s decision to revert to mandatory virtual hearings aims to standardize and modernize the hearing process, ensuring faster and more efficient resolution of cases. Virtual hearings also facilitate convenience for taxpayers and authorities, minimizing logistical challenges associated with physical appearances.

Approval and Implementation

- This revised instruction has been issued with the approval of the competent authority and is effective immediately. Taxpayers and stakeholders must take note of the updated procedure and make necessary arrangements to comply.

Implications for Stakeholders

- Taxpayers and Representatives: Those involved in GST, customs, and excise cases should be prepared to attend personal hearings through Video Conferencing as the standard practice. It is crucial to ensure that all technical arrangements, such as reliable internet connections and appropriate digital devices, are in place.

- Option for Physical Hearing: While the default mode is virtual, taxpayers still retain the option to request a physical hearing. Such requests must be justified and submitted in writing to the concerned authority.

- Administrative Efficiency: The emphasis on virtual hearings is expected to reduce the backlog of cases and improve the efficiency of the dispute resolution process. It also aligns with the government’s broader digital transformation initiatives.

The CBIC’s latest instruction marks a significant shift in the approach to conducting personal hearings under various indirect tax laws. By reinstating the mandate for virtual hearings, the department seeks to enhance transparency and ease of doing business for taxpayers. However, the flexibility to opt for physical hearings ensures that taxpayers’ needs are also accommodated. Stakeholders must stay informed of these changes and adapt accordingly to ensure compliance and smooth proceedings.

Visit www.cagurujiclasses.com for practical courses