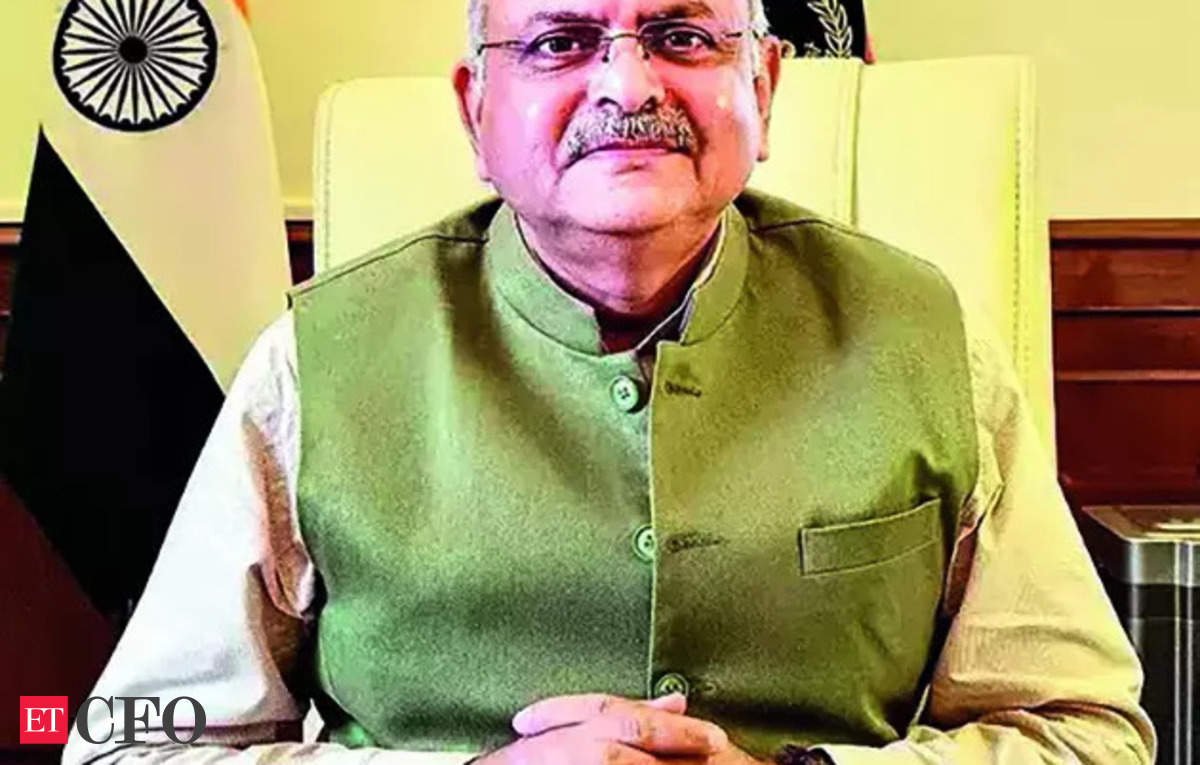

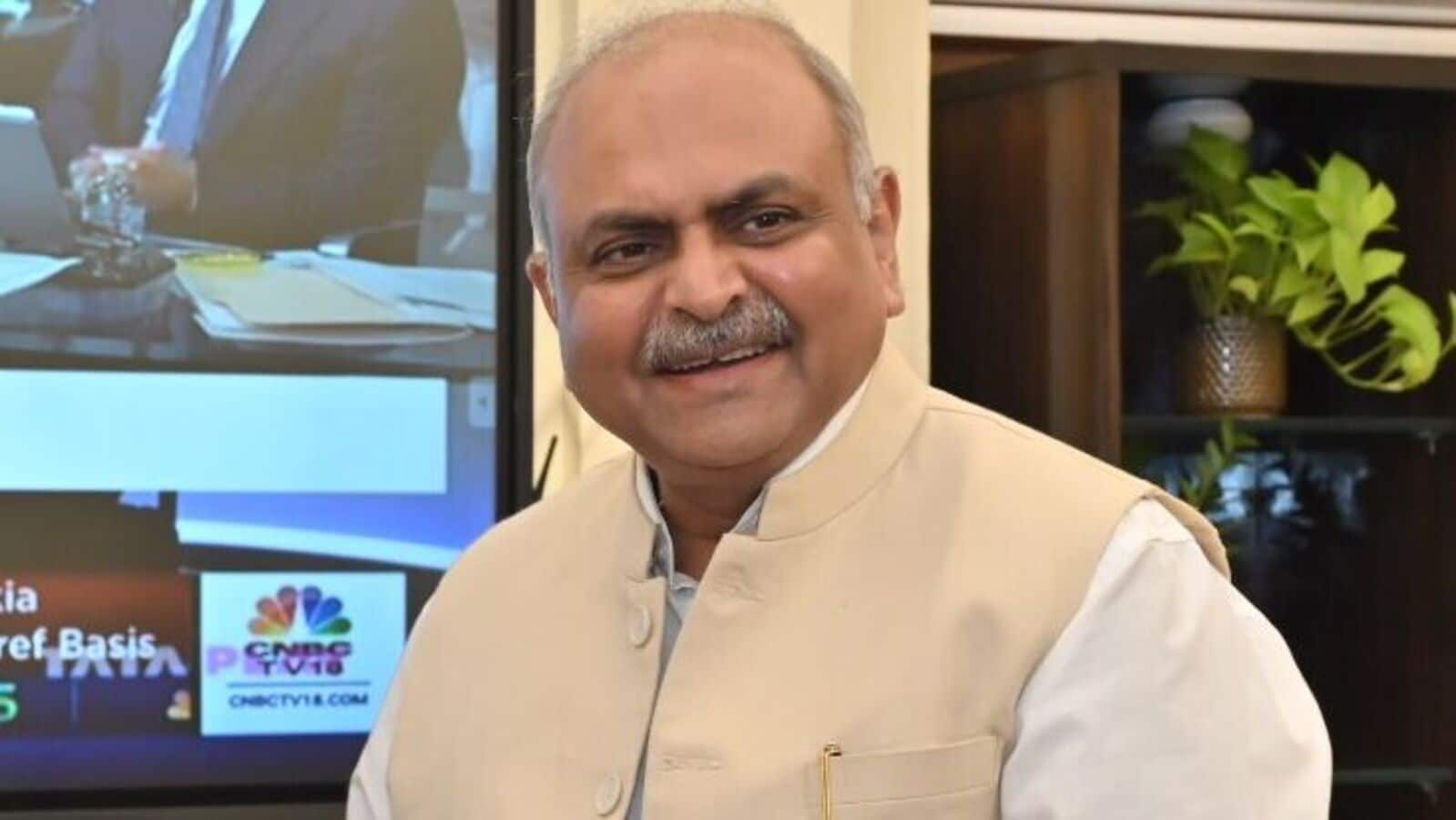

Cryptocurrencies are a serious threat to global financial stability, especially for emerging market economies, Reserve Bank of India (RBI) Governor Shaktikanta Das said at the Business Standard BFSI Insight Summit 2023 in Mumbai on Tuesday.

In a fireside chat with Business Standard’s consulting editor Tamal Bandyopadhyay, Das explained that cryptocurrencies have to be dealt with properly.

“Incidentally, the International Monetary Fund (IMF)–Financial Stability Board (FSB) synthesis paper says very clearly that, based on country-specific requirements, especially for emerging markets and developing economies, countries may impose additional restrictions with regard to cryptocurrencies. The risks are well recognised by the IMF-FSB synthesis paper, and the BIS (Bank of International Settlements) paper on cryptocurrencies. Everybody understands and agrees that there are serious risks,” Das said.

He was referring to the IMF-FSB synthesis paper, published in September, that presents guidelines for countries and a possible roadmap for crypto regulations.

Additionally, he expressed his concerns about regulating the use of cryptocurrencies and questioned the major tenets surrounding crypto terminology.

“How will you regulate it (crypto)? Whom will you regulate and regulate what? Before you think of regulating it, let us first understand, what is this? What is this cryptocurrency? Is it a product, a financial product, an asset? If it is an asset, what is underlying that it is not a tangible thing? What is the underlying definition of cryptocurrency? Till now, I am yet to see a credible definition of what cryptocurrency is,” he said.

Moreover, Das questioned the purpose of cryptocurrencies that the Central Bank Digital Currency (CBDC) is incapable of serving.

“I am yet to come across any sort of critical explanation of what is the larger purpose that cryptocurrencies serve. What is it that cryptocurrencies will do for international transactions or domestic transactions, whatever you call it, in the digital mode, which the CBDC cannot do?,” he said.

CBDC is a digital form of currency notes issued by a central bank.

The RBI broadly defines eRe as the legal tender issued by a central bank in digital form. It is similar to sovereign paper currency but takes a different form, is exchangeable at par with the existing currency, and is accepted as a medium of payment, a legal tender, and a safe store of value.

Das asked if governments and central banks across the world were comfortable with the existence of private currency with respect to fiat currency issued by a country’s central bank.

“It (cryptocurrency) is a kind of a new currency system that is developing. Are governments and central banks across the world comfortable with private currency, vis-a-vis a fiat currency or a currency issued by a central bank on behalf of the sovereign,” he said.

In October, G20 finance ministers and central bank governors (FMCBG) adopted the roadmap on crypto assets proposed in the IMF-FSB synthesis paper, calling for its swift and coordinated implementation.

“The leadership of the G20 (summit) has welcomed the IMF-FSB synthesis paper. It is a good beginning to understand what are the risks and possibly how to deal with them,” Das said.

He expressed that while he understood the concerns of crypto businesses, the regulator looks at the situation from the perspective of macro-economic stability.

“I can understand their concern. I don’t hold a grudge against them. They are entitled to their views. But we have to look at it from the overall perspective of macroeconomic stability,” he said.

He noted that the regulator was not trying to stifle innovation and suggested that innovation in the public interest must be supported.

“We are not trying to stifle innovation. Innovation, which is in public good and in public interest, must be supported and promoted. It should serve a public purpose,” he said.

Visit www.cagurujiclasses.com for practical courses