📌 What Are Capital Gains?

Capital gains refer to the profit earned on the sale of a capital asset like shares, mutual funds, real estate, gold, or bonds. It is the difference between the sale price and the purchase cost of the asset. This gain is taxed based on:

- The type of asset

- The holding period (short-term vs. long-term)

- The date of sale (especially relevant from 23 July 2024 onward)

1. Short-Term vs. Long-Term Capital Gains

| Asset Type | Holding Period (Before Sale) | Capital Gain Type |

|---|---|---|

| Equity shares & equity mutual funds | ≤ 12 months | Short-Term Capital Gain (STCG) |

| Real estate (land/building) | ≤ 24 months | Short-Term Capital Gain |

| Other assets (gold, debt funds, bonds) | ≤ 36 months | Short-Term Capital Gain |

| (More than the above periods respectively) | — | Long-Term Capital Gain (LTCG) |

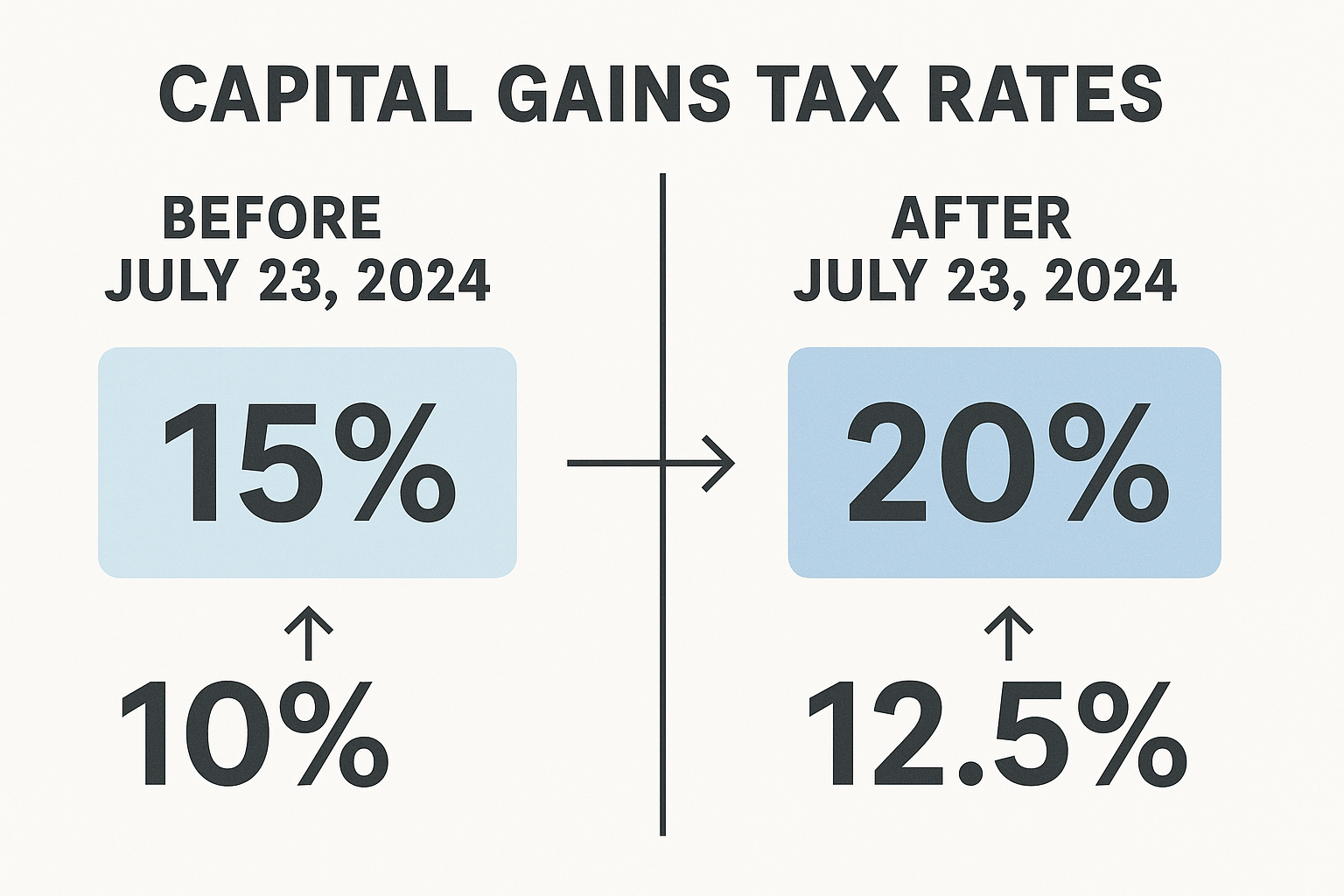

2. Capital Gains Tax Rates: Major Changes from 23 July 2024

🪙 Equity Shares & Equity Mutual Funds (with STT)

- Short-Term Capital Gain (≤ 12 months)

- Before 23 July 2024: 15%

- From 23 July 2024: 20%

- Long-Term Capital Gain (> 12 months)

- Before 23 July 2024: 10% (on gains exceeding ₹1 lakh, no indexation allowed)

- From 23 July 2024:

- Flat 12.5% tax (no indexation allowed)

- Exemption limit increased to ₹1.25 lakh

🏠 Real Estate (Land or Building)

- Short-Term Capital Gain (≤ 24 months)

- Taxed as per individual’s income tax slab rates

- Long-Term Capital Gain (> 24 months)

- Before 23 July 2024: 20% with indexation benefit

- From 23 July 2024:

- Flat 12.5% without indexation

- However, Parliament has allowed taxpayer’s choice:

- Either opt for 12.5% flat tax without indexation, or

- Continue with 20% tax with indexation

3. Other Capital Assets (Gold, Debt Mutual Funds, Bonds, GDRs, FCCBs)

- Short-Term Capital Gain: Taxed at applicable slab rates

- Long-Term Capital Gain (after 24 months):

- Generally taxed at 20% with indexation

- Certain bonds now qualify for 12.5% without indexation, aligning with new unified LTCG regime

4. Key Objectives of the July 2024 Reform

- Simplification: The aim is to simplify the tax system by offering a flat LTCG rate of 12.5% across asset classes

- Encourage Long-Term Holding: Higher STCG and lower LTCG rates incentivize investors to stay invested longer

- Public Feedback Response: Due to concerns on indexation removal (especially for real estate and gold), the government allowed the option to choose between 12.5% (no indexation) and 20% (with indexation)

5. Summary Table: Updated Capital Gains Tax Rates (Post 23 July 2024)

| Asset Type | STCG Rate | LTCG Rate | Notes |

|---|---|---|---|

| Equity & Equity Mutual Funds | 20% | 12.5% (No indexation) | ₹1.25 lakh exemption |

| Real Estate | As per slab rate | 12.5% or 20% (with indexation) | Choice available |

| Gold, Debt Funds, Bonds | As per slab rate | 20% with indexation or 12.5% for some bonds | Depending on holding period |

How to Show Capital gain ITR-2, Live filing:

📊 Capital Gains Tax Comparison – Before & After 23 July 2024

| Type of Asset | Tax on STCG (Before & After) | Tax on LTCG – Before 23 July 2024 | Tax on LTCG – After 23 July 2024 |

|---|---|---|---|

| Listed Equity Shares (STT Paid) | Before 23 July 2024 – 15% After 23 July 2024 – 20% | 10% on gains above ₹1 lakh | 12.5% on gains above ₹1.25 lakh |

| Unlisted Equity Shares | Normal tax rate | 20% with indexation | 12.5% without indexation |

| Listed Preference Shares | Normal tax rate | 20% with indexation or 10% without indexation | 12.5% without indexation |

| Unlisted Preference Shares | Normal tax rate | 20% with indexation | 12.5% without indexation |

| Equity Mutual Funds (STT Paid) | Before 23 July 2024 – 15% After 23 July 2024 – 20% | 10% on gains above ₹1 lakh | 12.5% on gains above ₹1.25 lakh |

| Equity Mutual Funds (STT not Paid) | Normal tax rate | 20% with indexation | 12.5% without indexation |

| Sovereign Gold Bonds (Listed) | Normal tax rate | 10% without indexation | 12.5% without indexation |

| Any Other Bond (Listed) | Normal tax rate | 20% with indexation | 12.5% without indexation |

| Specified Mutual Funds (Debt Funds) | Normal tax rate | 20% with indexation or 10% without indexation | 12.5% without indexation |

| Other Mutual Funds (Gold/Overseas/FOFs) | Normal tax rate | 20% with indexation | 12.5% without indexation |

| Units of AIF (Non-listed shares) | Normal tax rate | 20% with indexation | 12.5% without indexation |

How to separate Capital Gain before and after 23 July 2024

Income from Lottery, Gambling, Betting, Card Games, Online Gaming

| Income Type | Tax Rate | TDS Applicable | Remarks |

|---|---|---|---|

| Lottery, Gambling, etc. | 30% | TDS @ 30% u/s 194B | No deductions or expenses allowed |

| Horse Racing | 30% | TDS @ 30% u/s 194BB | |

| Online Gaming (w.e.f. 1 Apr 2023) | 30% | TDS on net winnings u/s 194BA | Applies on withdrawal or year-end |

🚫 No deduction under Chapter VI-A, no rebate u/s 87A applicable on these incomes.

📊 Tax Provisions on VDAs

📌 What is a Virtual Digital Asset (VDA)?

As per Section 2(47A) of the Income Tax Act, VDAs include:

- Cryptocurrencies (like Bitcoin, Ethereum, etc.)

- Non-Fungible Tokens (NFTs)

- Any other digital asset as notified by the government

📊 Tax Rules on VDA:

| Particulars | Tax Treatment |

|---|---|

| Tax Rate | 30% flat on gains (Section 115BBH) |

| Surcharge & Cess | Applicable as per income slab |

| No Deduction | No deduction allowed except cost of acquisition |

| Loss Set-off | VDA losses cannot be set off against any other income |

| Loss Carry Forward | Not allowed |

| Gift of VDA | Taxable in hands of recipient under Section 56(2)(x) if value > ₹50,000 |

| TDS | 1% TDS under Section 194S if total payment > ₹10,000 (₹50,000 for specified persons) in a financial year |

| Transaction Type | TDS applies whether in cash or in kind (crypto-to-crypto also) |

All Tax Rates

Visit www.cagurujiclasses.com for practical courses

no indexation benefit in Gold :

Physical gold follows the same tax rules as digital gold. If you sell physical gold within two years of buying it, the gains will be regarded as STCG and taxed as per your applicable income tax slab rate.

If you sell it after holding it for more than two years, it will be considered a long-term capital asset. In this case, you will have to pay a flat 12.5% tax on the gains. However, no indexation benefit is allowed.