After delivering significant relief to the middle class on personal income tax and customs tariff rationalisation, the Centre is likely to make a renewed push for revamping the goods and services tax (GST) structure to make it simpler to implement and comply with, officials said.

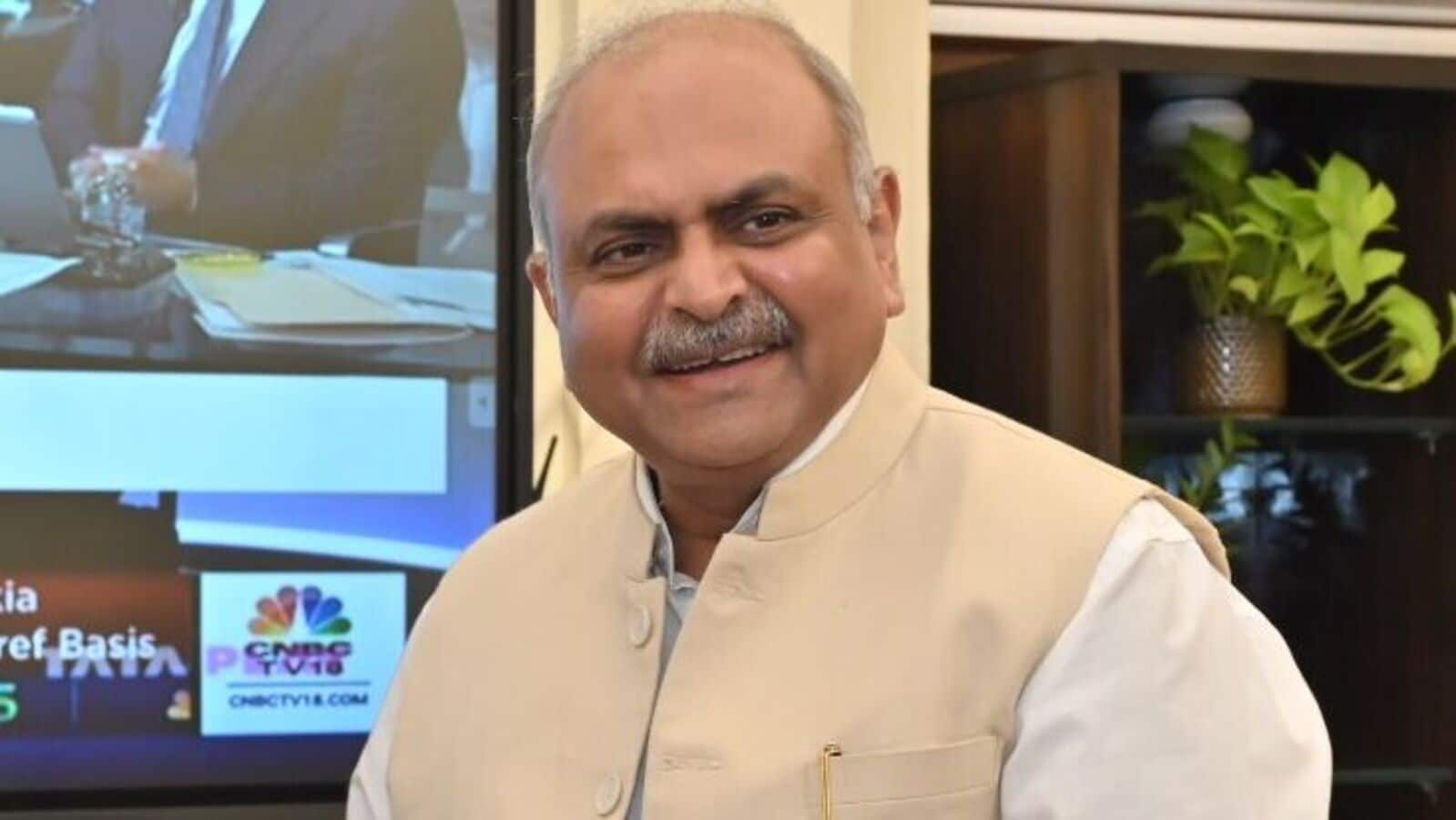

The focus will be on revamping the slabs to ensure that the exercise is meaningful, they said.

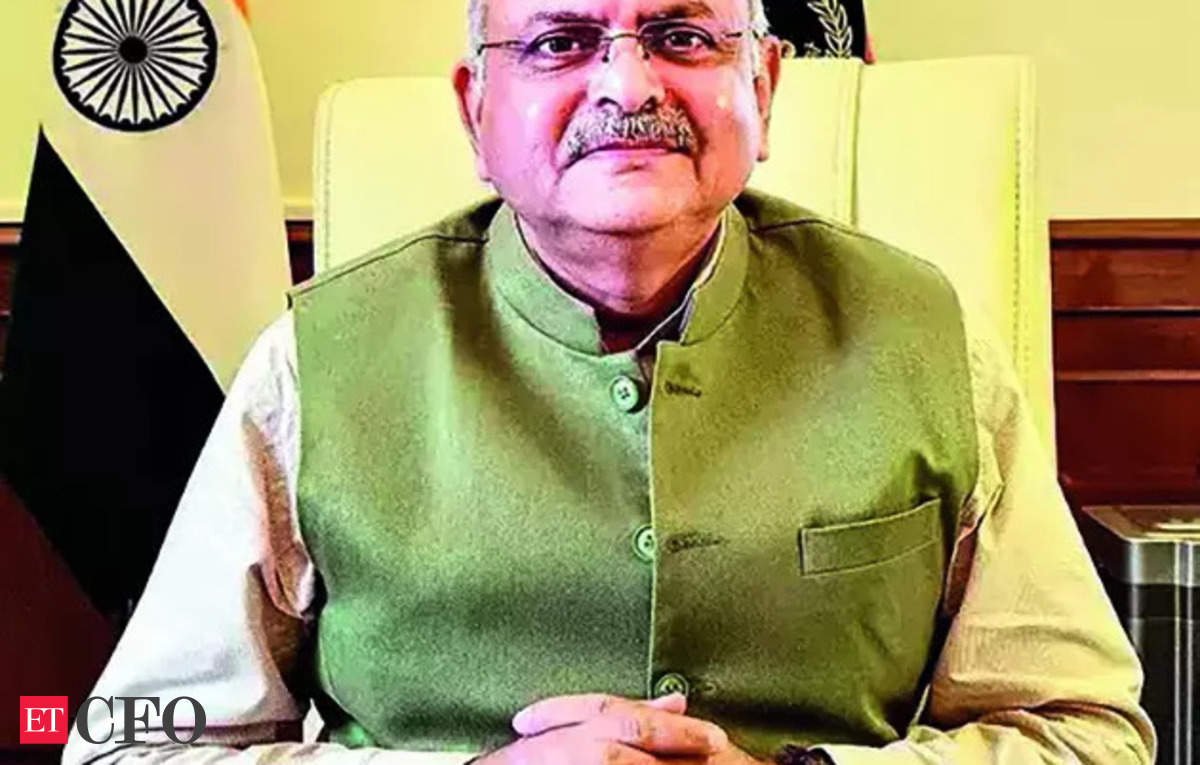

The Centre is likely to take up the issue of simplification and rationalisation with the group of ministers (GoM) mandated to examine the rates, a person familiar with the deliberations said.

The person said the focus within the GoM so far has been on moving goods from one slab to another but for an impactful simplification the current structure will have to be rationalised.

The GST Council, the apex decision-making body for the indirect tax, had set up the GoM on rate rationalisation in September 2021. The GoM is yet to submit its final report though it has held several meetings.

Some of the proposals being examined by the GoM include doing away with dual rates for products such pens and sunglasses with price thresholds. Experts have pointed out that this makes GST complex and adds to difficulties in compliance. The GST has a four-slab structure-5%, 12%, 18%, and 28%. Additionally, there are special rates for some goods such as precious metals. Some sin goods also attract a cess.

Currently, the 5% slab has about 21% of all the items under GST. The 12% tax is levied on 19% of items; the 18% slab on 44% of items; and the highest 28% on 3% of items.

The GST revenue-neutral rate (RNR) has fallen to about 11.6% because of several exemptions and reductions. The RNR was at about 15.5% when GST was rolled out in July 2017.

Experts have generally favoured a three-rate structure to make it simpler to more effective.

Visit www.cagurujiclasses.com for practical courses