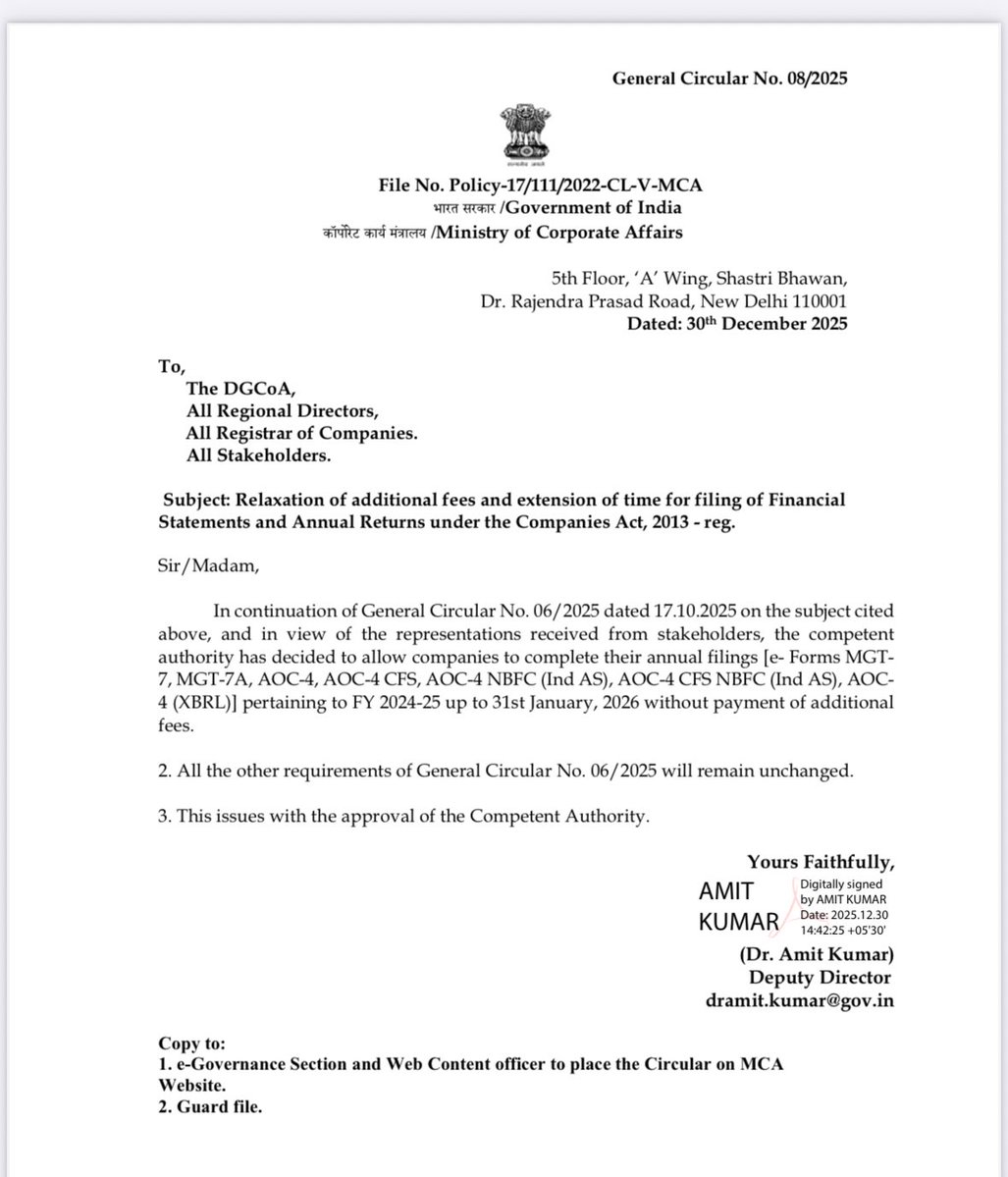

MCA Annual Filing Extended Without Additional Fees

(General Circular No. 08/2025 dated 30 December 2025)

The Ministry of Corporate Affairs (MCA) has issued General Circular No. 08/2025 dated 30 December 2025, granting a major relief to companies by extending the time limit for filing Annual Returns and Financial Statements for FY 2024-25 without payment of additional fees.

This extension is extremely important for companies, directors, professionals (CA/CS/CMA) and other stakeholders who were unable to complete annual filings within the normal due dates.

1. Background of the Circular

Earlier, MCA had issued General Circular No. 06/2025 dated 17 October 2025, allowing relaxation in additional fees for certain annual filings. Based on further representations received from stakeholders and considering practical difficulties, MCA has now extended the relaxation period further through Circular No. 08/2025.

This decision has been taken with the approval of the Competent Authority.

2. New Extended Due Date (Key Relief)

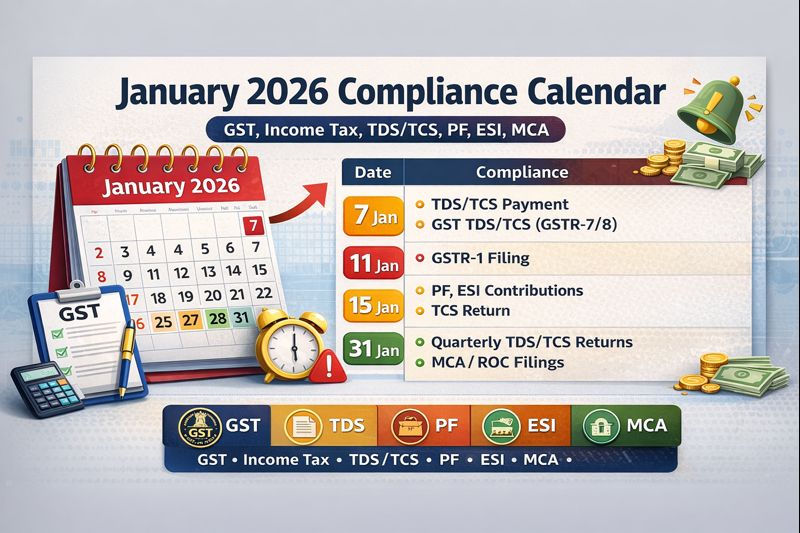

✅ New last date: 31st January 2026

Companies can now complete their annual filings for FY 2024-25 up to 31 January 2026 without paying any additional (late) fees.

This extension applies only for waiver of additional fees. Normal filing fees, if applicable, will still be payable.

3. Forms Covered Under the Extension

The relaxation applies to the following e-forms related to Annual Return and Financial Statements:

📄 Annual Return Forms

- MGT-7

- MGT-7A (for OPC & AOC-4 linked entities)

📊 Financial Statement Forms

- AOC-4

- AOC-4 XBRL

- AOC-4 CFS

- AOC-4 CFS NBFC (Ind AS)

- AOC-4 NBFC (Ind AS)

All these forms pertain to Financial Year 2024-25.

4. What Does “Without Additional Fees” Mean?

- No late fee / additional fee will be charged if the above forms are filed on or before 31 January 2026.

- If these forms are filed after 31 January 2026, normal additional fees and penalties under the Companies Act, 2013 will apply.

This is a one-time compliance relief window and should be used carefully.

5. Important Clarifications

- 📌 Only the time limit is extended – all other provisions, disclosures, certifications and requirements remain unchanged.

- 📌 The circular does not provide immunity from penalties for other non-compliances under the Companies Act.

- 📌 The relaxation applies only for FY 2024-25 filings, not for earlier years.

6. Who Will Benefit the Most?

This extension is especially beneficial for:

- Companies that missed original due dates due to audit delays

- Companies facing technical or portal-related issues

- Start-ups, SMEs and NBFCs

- Professionals handling bulk MCA compliance work in December

- Companies planning to avoid heavy additional fees running into lakhs

7. Practical Action Points for Companies & Professionals

✔ Review pending MGT-7 / MGT-7A / AOC-4 series filings for FY 2024-25

✔ Complete board approvals and finalisation of accounts immediately

✔ Do not wait till the last day – portal congestion is common in January

✔ Ensure accuracy, as incorrect filings may still attract notices later

✔ Keep proof of timely filing before 31 January 2026

31st January 2026 is now the final opportunity to complete MCA Annual Filings for FY 2024-25 without additional fees.

Missing this date will result in heavy late fees and possible penal consequences for the company and its officers.

This MCA relaxation should be treated as a golden compliance window, not as an excuse for further delay.

Visit www.cagurujiclasses.com for practical courses