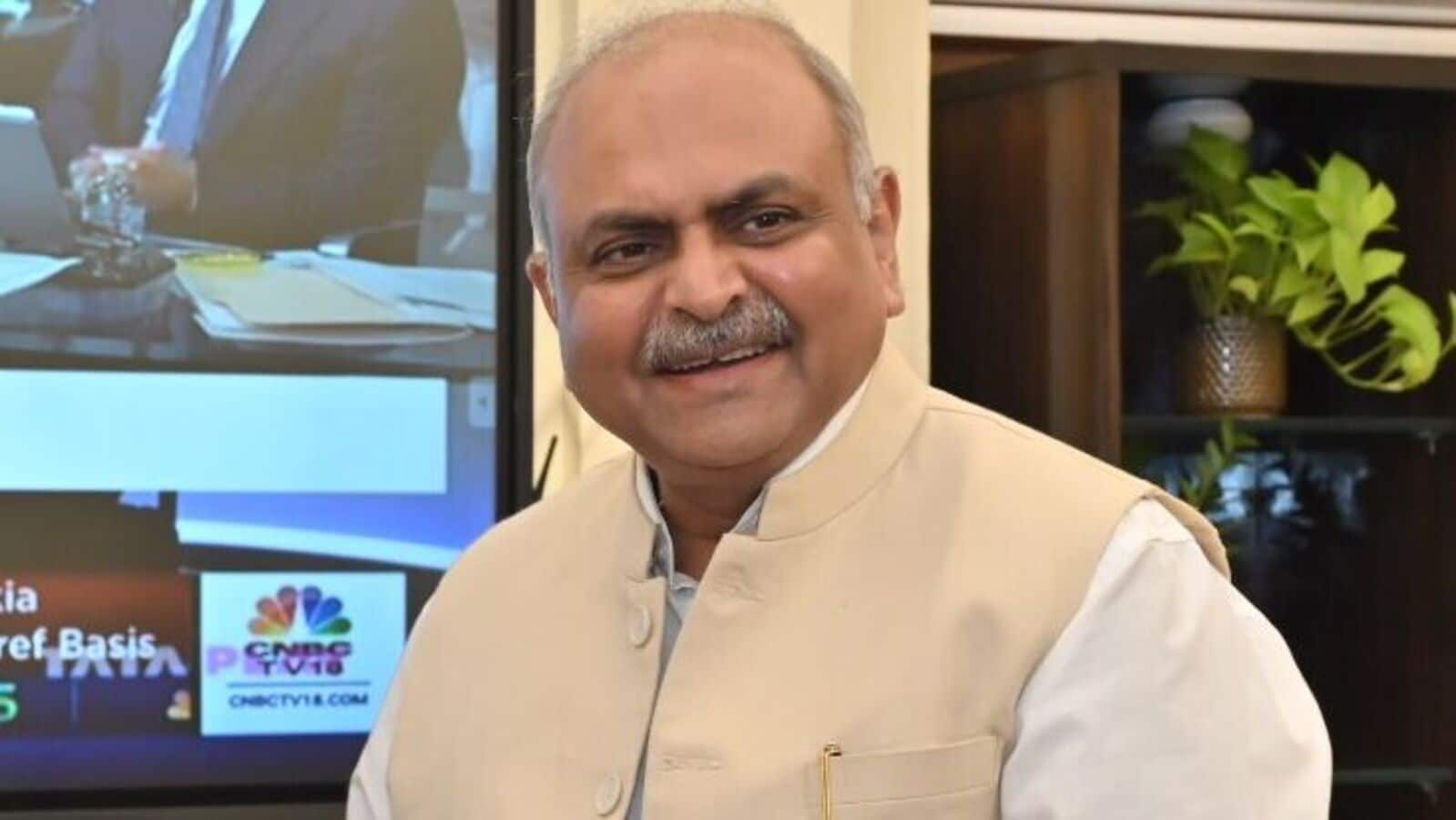

The days of intrusive tax scrutiny and compliance enforcement are over and tax administration will be based purely on trust and greater reliance on data mining, Central Board of Direct Taxes chairperson Ravi Agrawal said in a post budget interview to Mint. Agarwal said that under the revamped new personal income tax regime, those with ₹24 lakh annual income will benefit a tax reduction of ₹1.1 lakh, while, the benefit will be of ₹35,000 for those with ₹15 lakh income and of ₹70,000 for those with ₹18 lakh annual income.

That is due to the restructuring of the slabs. Agarwal said that with the government laying emphasis on a trust based tax system, the appeal to tax payers is that they should pay the correct amount of tax. Edited excerpts:

Are you confident of meeting the target of personal income tax revenue collection outpacing nominal GDP growth in FY26 in spite of the massive tax relief offered?

Overall direct tax collection is projected to grow 12.7% in FY26 to ₹25.2 trillion. With 10.1% nominal GDP growth projected for FY26, non-corporate tax (mainly personal income tax) buoyancy requires to be about 1.47, as against a 2.08 buoyancy that we had earlier estimated for FY25. A tax buoyancy of 1.47 is a doable figure and the taxpayer response to information being shared with them for voluntary compliance is encouraging.

For example, as per the concept of updating tax returns introduced a few years ago, more than 90 lakh people have filed updated returns in the last three years. That is over and above the revised returns that they may have filed. Updated returns mean that after one year, and after the time of filing a belated return or revised return is over, people have filed updated returns based on the information with them, or with the department, and have paid a tax of more than ₹8,500 crore. That concept has been further expanded this year to give four years to update returns, from two years previously. So even in the third year after filing tax returns in the first place, if some information comes up and the taxpayers want to come clean, then the person has an opportunity to file updated returns.

In response to the emails to taxpayers and our outreach programme, 90,000 people who had otherwise claimed deductions on their income incorrectly, came forward, revised their returns and paid about ₹1,000 crore in tax. A very encouraging sign. We sent notices or communication to about 20,000 people in the context of foreign assets. Out of that, about 12,000 have already filed and corrected their returns and paid tax on that.

While we sent communications to 20,000 people, in 15,000 cases where the communication had not gone, but since it had come in the media, taking a cue from that exercise, 15,000 people on their own filed updated returns. Encouraging or facilitating the taxpayer to comply is the new mantra. Gone are those days of enforcement, intrusive scrutiny and all those things. And that’s what the finance minister has said—”trust first.” That is, the person will comply on her own. There is no need for a very hard nudge or intrusive scrutinizing.

Now we would appeal that we pay right taxes, correct taxes that are due. We are already flagging information to the taxpayers. We have got an encouraging response.

What is the extent of tax relief for individuals at different income levels on account of the income tax slab rejig?

If we talk about those with income of ₹8 lakh, the overall benefit because of the restructuring is of ₹30,000 when you compare it with the existing tax rate. That is, the person’s tax obligation under the current structure is ₹30,000. In the revised structure, it has become zero. Therefore, the total benefit that she gets is ₹30,000. In the case of those with ₹12 lakh income, the obligation under the existing structure was ₹80,000. Now that has been reduced to zero, and therefore the benefit is ₹80,000.

For ₹15 lakh, the tax obligation as per the rate-slab structure prior to the revision was ₹1.4 lakh. Now that has been reduced to ₹1.05 lakh, so the benefit is ₹35,000. For those with income of ₹18 lakh, that is, income of ₹1.5 lakh a month, the tax obligation was ₹2.3 lakh. Now it is ₹1.6 lakh and therefore the benefit is ₹70,000. For ₹24 lakh, as per existing rates the tax obligation was ₹4.1 lakh. Now it is ₹3 lakh, so the benefit is ₹1.1 lakh.

Can we say that with the rebate for those with income up to ₹12 lakh, and the income tax slab restructuring, the socioeconomic profile of actual taxpayers has shifted to higher income earners?

Yes, one can say that.

Visit www.cagurujiclasses.com for practical courses