Indian casino operator Delta Corp said on Friday it has received a notice from the government to pay tax of 111.4 billion Indian rupees ($1.34 billion) along with interest and penalty for the period July 2017 to March 2022.

The tax notice comes at a time when the company, valued at over $566 million, is already facing heat over the recent move in July by the country’s Goods and Services Tax (GST) Council to impose a 28% indirect tax on the money collected by gaming companies from customers.

The GST amount claimed is based on the gross bet value of all games played at the casinos during the relevant period, Delta said, adding that a show cause notice will be issued to the company if it failed to pay.

“Demand of GST on gross bet value, rather than gross gaming revenue, has been an industry issue and various representations have already been made to the government at an industry level in relation to this issue,” the company added.

Delta said that it will pursue all legal remedies to challenge such tax demand and related legal proceedings.

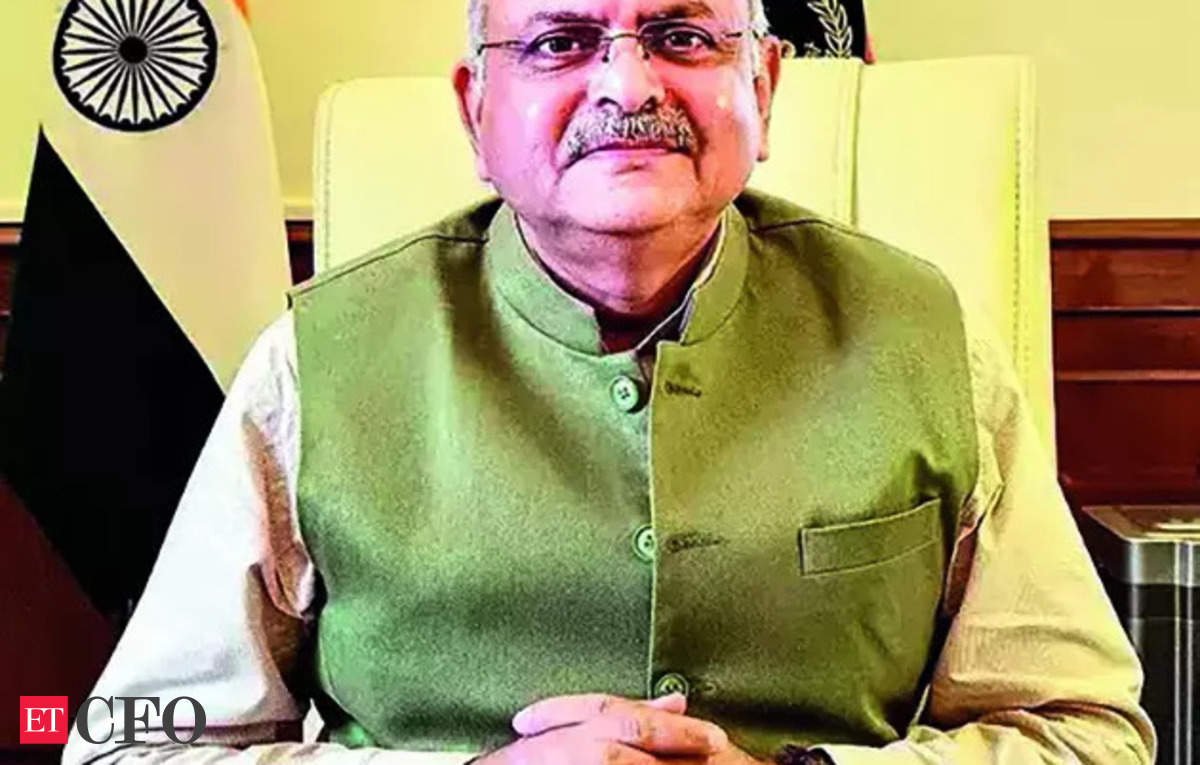

While global investors have urged Indian Prime Minister Narendra Modi to review the 28% gaming tax, citing an adverse impact to prospective investments of about $4 billion, the country’s revenue secretary had clearly said there was no need to rethink the tax.

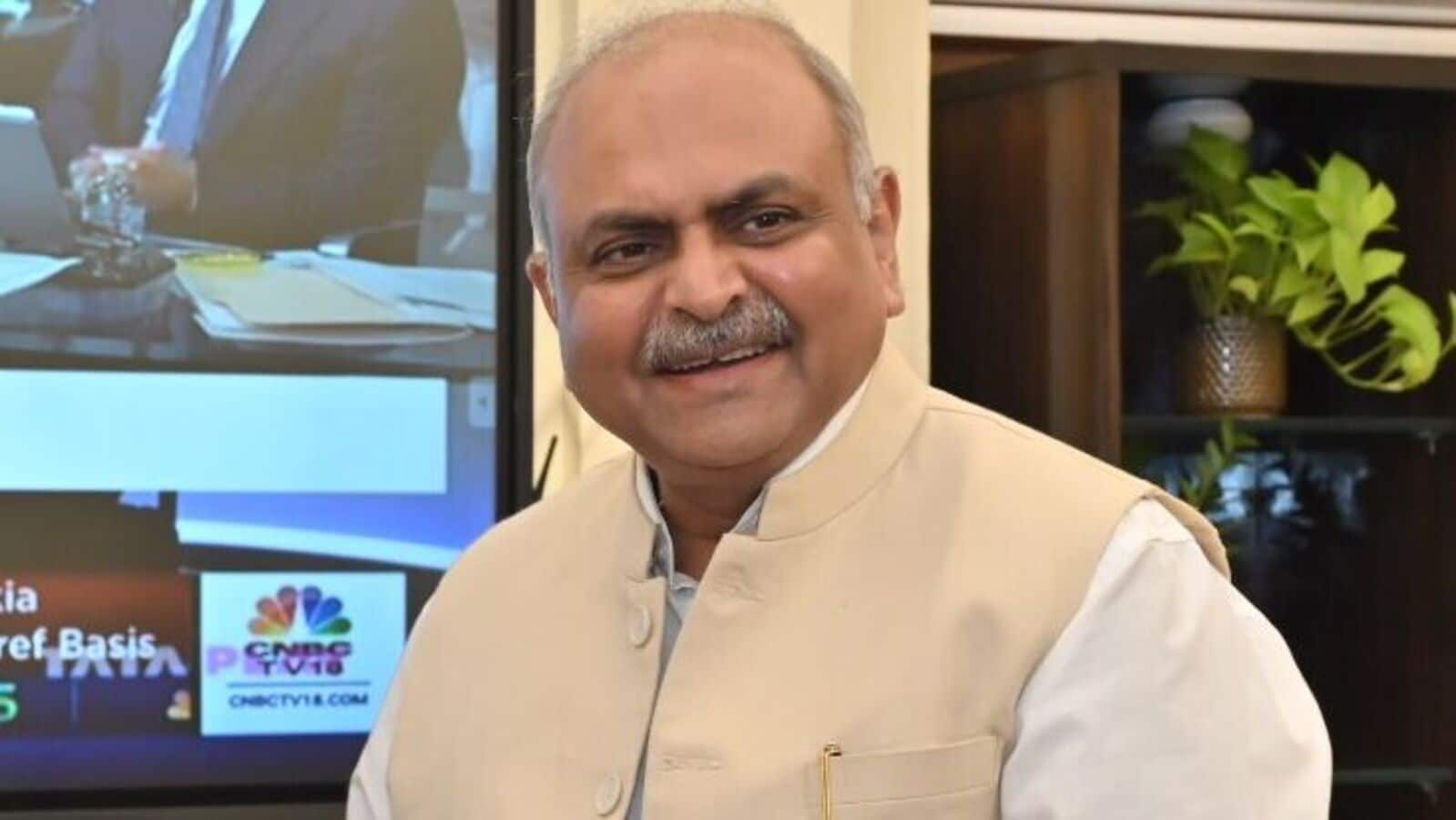

On the other hand, gaming companies have started feeling the impact of the new 28% GST tax and gaming app Mobile Premier League last month said it would lay off 350 employees to “survive” the tax.

Delta Corp shares have lost about 29% since the government proposed the new 28% GST in July.