Many times Taxpayers received notices in the name of Income Tax Department. After Receiving it they do not check its validity and authenticity, while many times that notice may not be from Income Tax Department and they may be get into the trap of other person.

Ensuring the authenticity of notices issued by the Income Tax Department is necessary for taxpayers to safeguard their interests and comply with legal requirements. With the proliferation of digital communication, verifying the legitimacy of these notices has become increasingly important, especially amidst concerns about fraudulent activities and phishing attempts. Therefore, having reliable methods to authenticate such notices is essential for individuals and businesses alike.

Follow the steps as given in this article to know the validity and authenticity of Notice

The Authenticate Notice / Order issued by ITD service is available to both registered and unregistered users of the e-Filing portal as a pre-login service to verify the authenticity of a Notice, Order, Summons, Letter or any correspondence issued by Income Tax Authorities.

Prerequisites to Avail This Service

Step-by-Step Guide

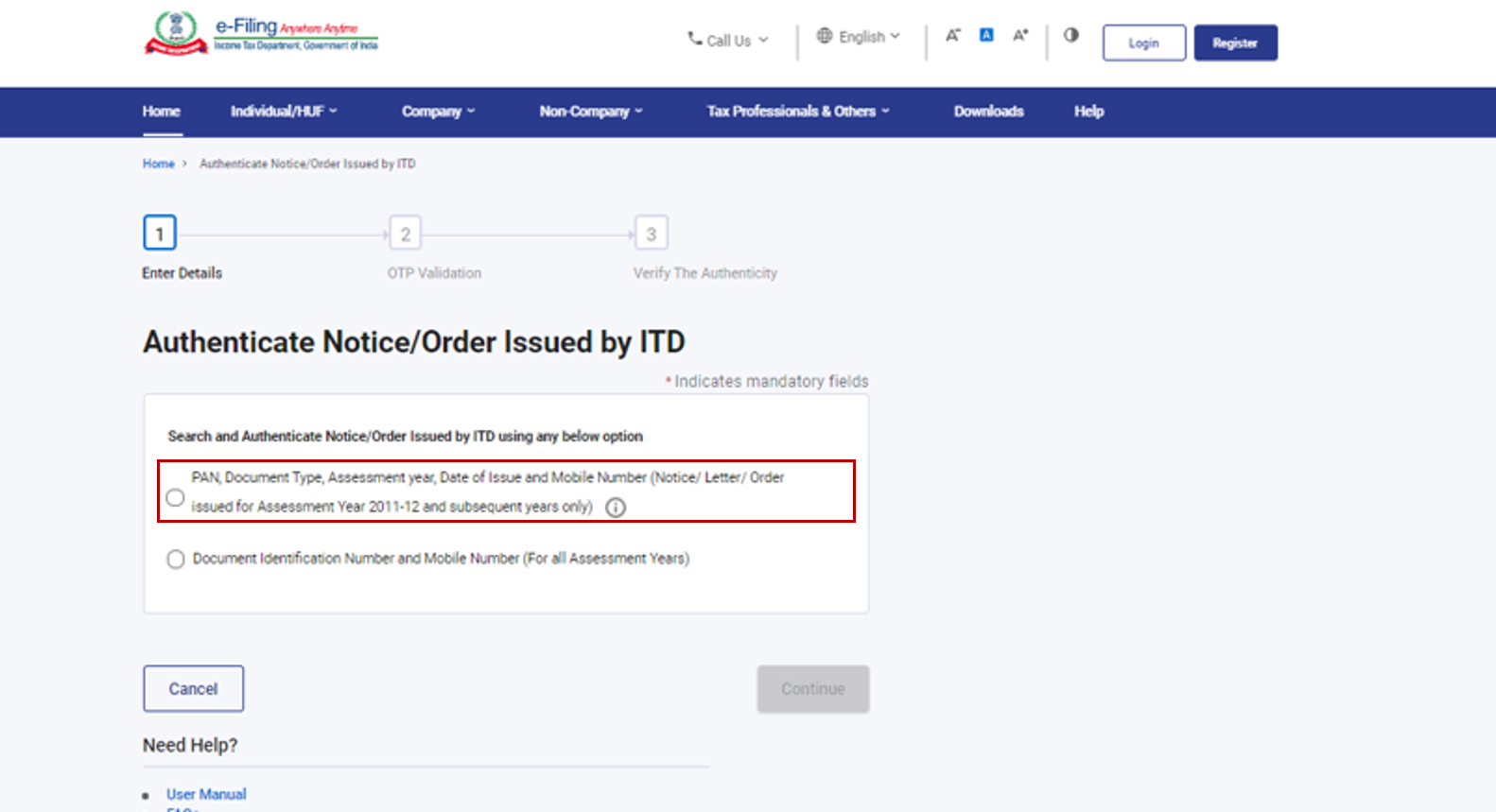

Go to the e-Filing portal homepage and Click Authenticate Notice / Order issued by ITD

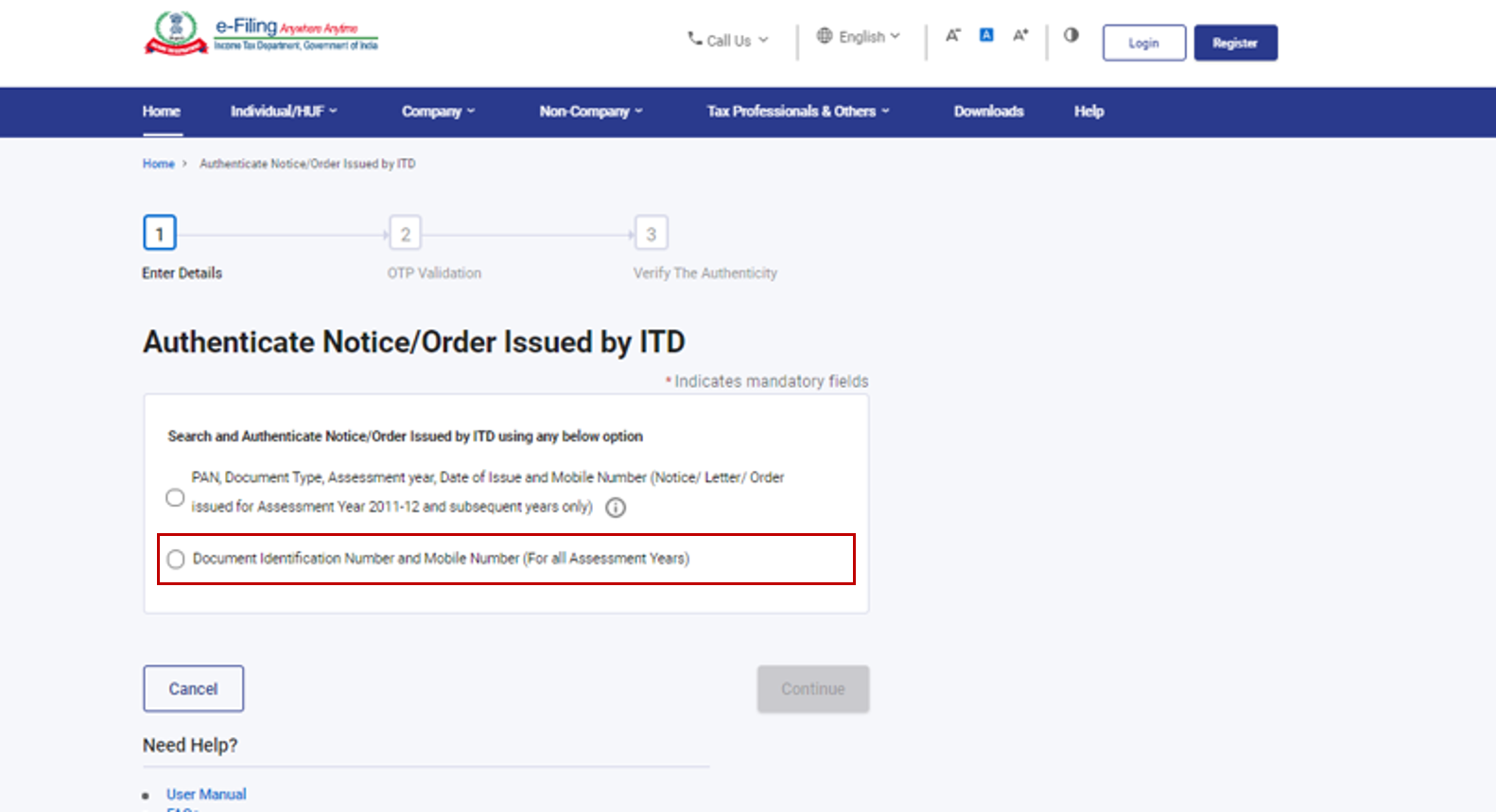

Select either of the following options to authenticate the notice / order –

| PAN, Document type, Assessment Year, Date of Issue and Mobile Number | Refer to Section 3.1 |

| Document Identification Number and Mobile Number | Refer to Section 3.2 |

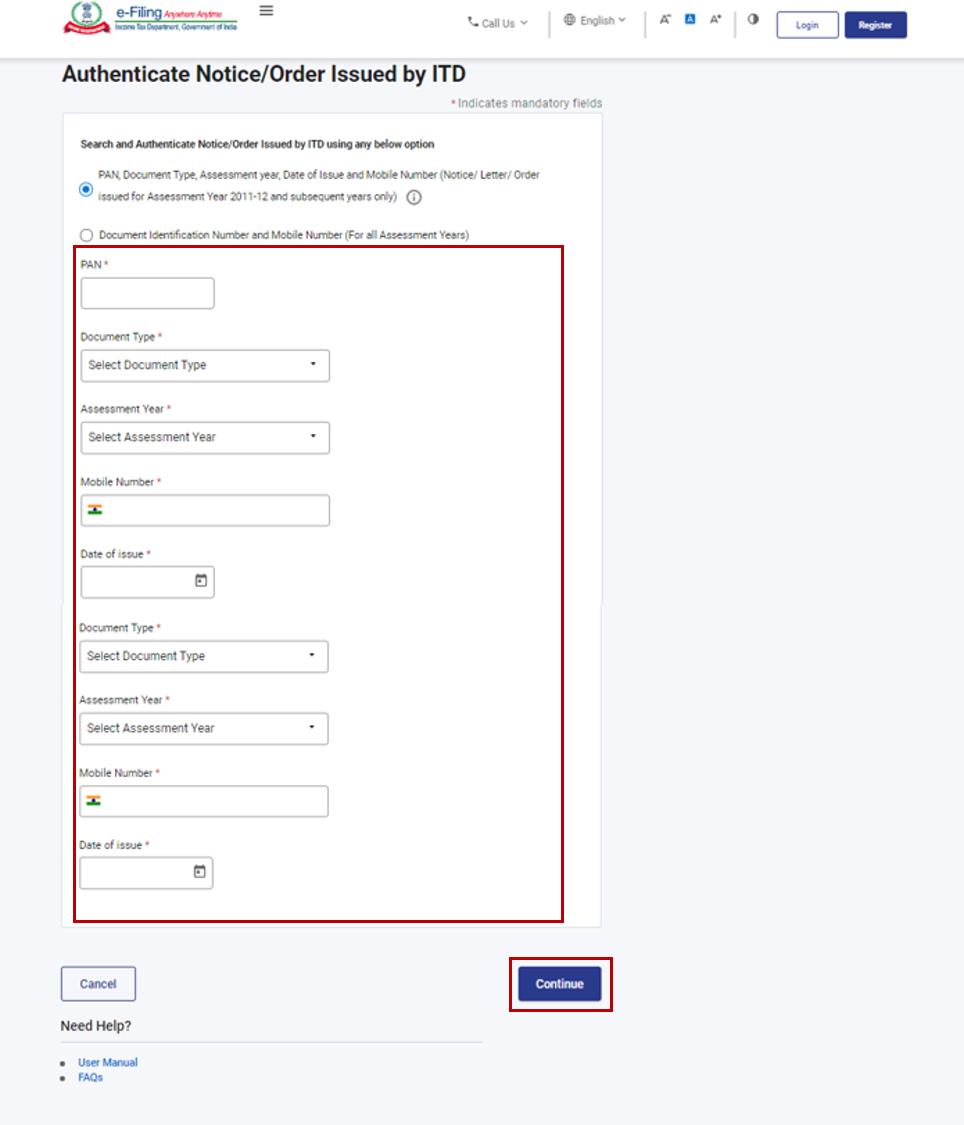

3.1 If you select the option – PAN, Document Type, Date of Issue and Mobile Number

Step 1: Select PAN, Document type, Assessment Year, Date of Issue and Mobile Number.

Step 2: Enter PAN, select Document Type and Assessment Year, enter Mobile Number and Date of Issuance and click Continue.

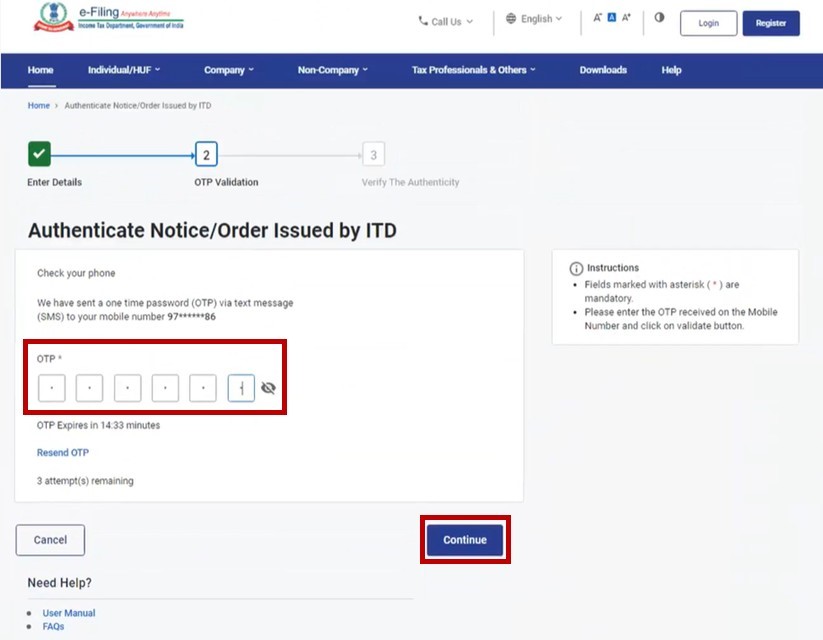

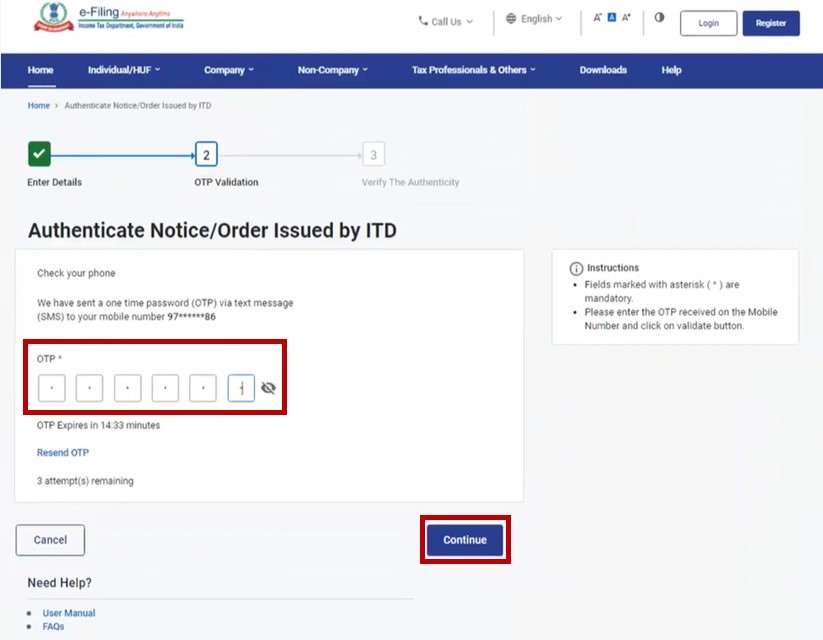

Step 3: Enter the 6-digit OTP received on the mobile number entered by you in Step 2 and click Continue.

Note:

- OTP will be valid for 15 minutes only.

- You have 3 attempts to enter the correct OTP.

- The OTP expiry countdown timer on screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generated and sent.

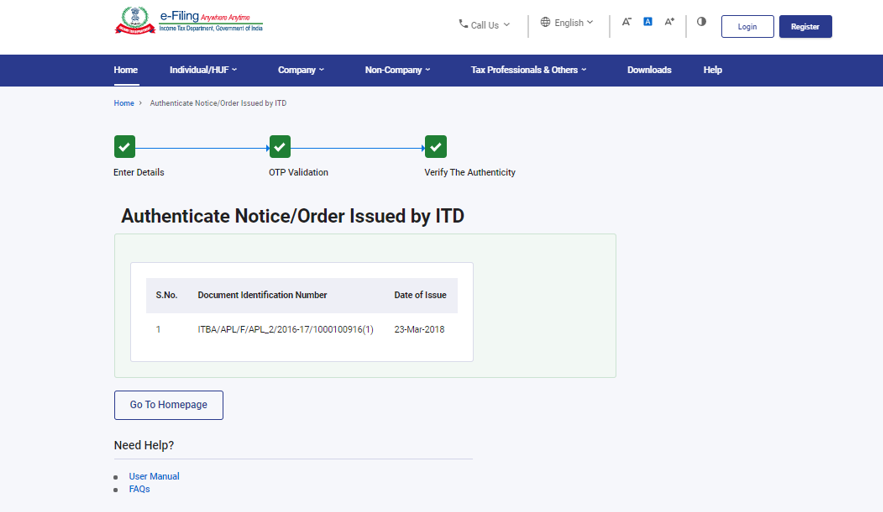

Once the OTP is validated, the document number of the notice issued along with the date of issue of the notice will be displayed.

Note: In case no notice was issued by ITD, it will display a message – No record found for the given criteria.

3.2: If you select the option – Document Identification Number and Mobile Number

Step 1: Select Document Identification Number and Mobile Number.

Step 2: Enter Document Identification Number and Mobile Number and click Continue.

Step 3: Enter the 6-digit OTP received on the mobile number entered by you in Step 2 and click Continue.

Note:

- OTP will be valid for 15 minutes only.

- You have 3 attempts to enter the correct OTP.

- The OTP expiry countdown timer on screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generated and sent.

Once the OTP is validated, a success message will be displayed.

Note: In case no notice was issued by ITD, it will display a message – No record found for the given Document Number.

Source Income Tax Portal

In conclusion, while receiving notices from the Income Tax Department can be daunting, verifying their authenticity is crucial for maintaining compliance and protecting against potential fraud. By following the steps outlined above and remaining vigilant, taxpayers can confidently respond to legitimate notices and mitigate risks associated with fraudulent communications. Remember, when in doubt, seeking guidance from authorized channels or professional advisors can provide invaluable support in navigating the complexities of tax-related correspondence.

Visit www.cagurujiclasses.com for practical courses