As on 11 September 2023, 2 important changes are announced for E-invoice

- 2 Factor Authentication

- New Time limit for reporting of Invoices on the IRP portal

1. 2 Factor Authentication

2-Factor Authentication for all taxpayers with AATO above Rs 20 Cr is mandatory from 1st November 2023.

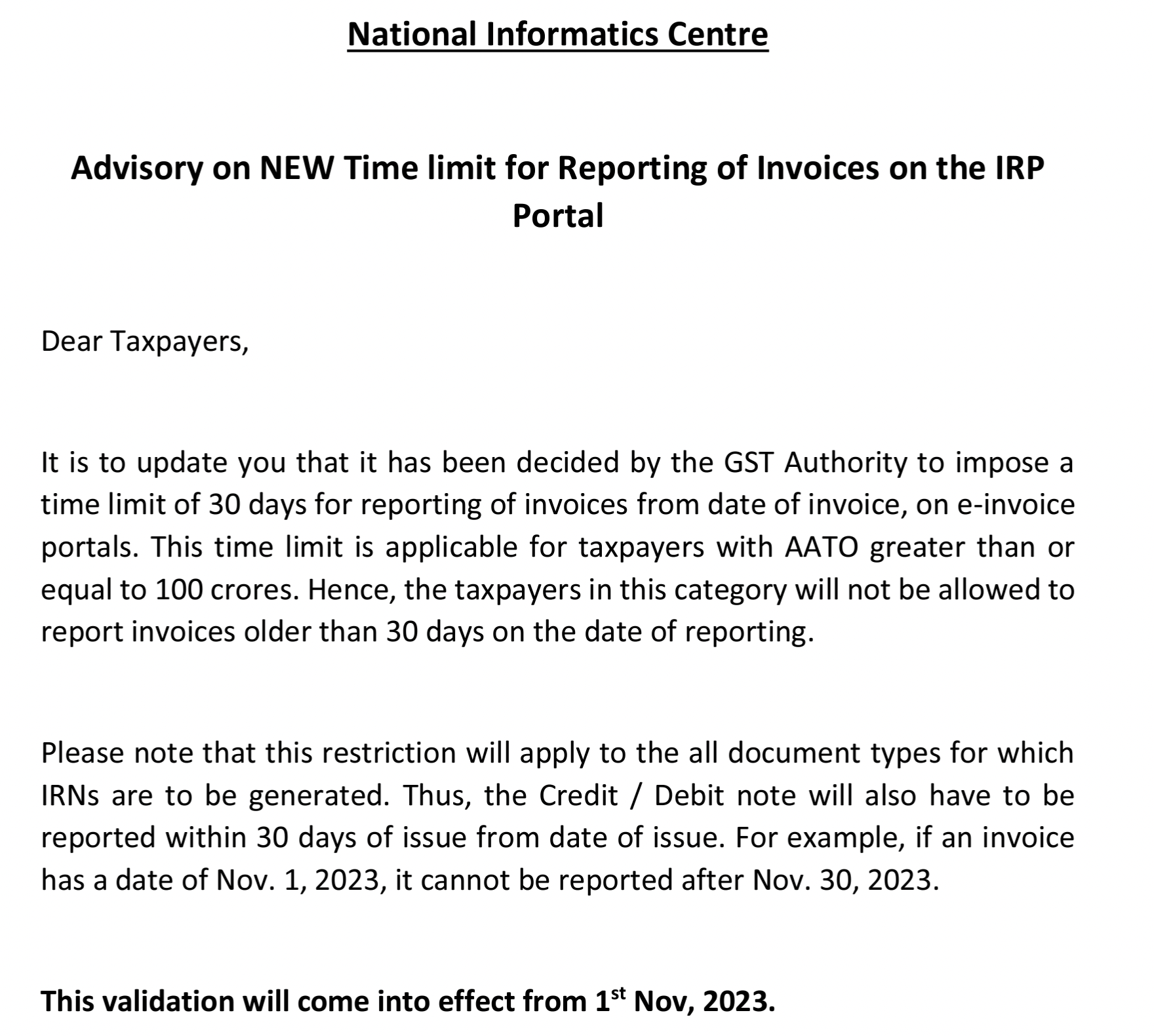

2. New Time limit for reporting of Invoices on the IRP portal

Dear Taxpayers,

It is to update you that it has been decided by the GST Authority to impose a time limit of 30 days for reporting of invoices from date of invoice, on e-invoice portals. This time limit is applicable for taxpayers with AATO greater than or equal to 100 crores. Hence, the taxpayers in this category will not be allowed to report invoices older than 30 days on the date of reporting.

Please note that this restriction will apply to the all document types for which IRNs are to be generated. Thus, the Credit / Debit note will also have to be reported within 30 days of issue from date of issue.

For example, if an invoice has a date of Nov. 1, 2023, it cannot be reported after Nov. 30, 2023.

This validation will come into effect from 1st Nov, 2023.

Great 👍

Thanks

AATO of 100 Crores for which Years Last Three Years or Five Years

from the beginning of GST