The e-Way Bill System under the Goods and Services Tax (GST) is designed to facilitate the movement of goods throughout the country by introducing a single e-Way Bill for all states. The system aims to ensure compliance, prevent tax evasion, and promote hassle-free trade across India. Here are some key points about the e-Way Bill System:

- Purpose: The e-Way Bill is a document that needs to be generated by every registered person prior to the commencement of the movement of goods. It contains details such as the GSTIN of the recipient, place of delivery, invoice number, invoice date, value of goods, HSN code, etc.

- Unique e-Way Bill Number (EBN): Once the e-Way Bill is generated on the common portal, a unique e-Way Bill number (EBN) is made available to the supplier, recipient, and transporter. This number serves as a valid document accompanying the truck during the transportation of goods.

- Compliance and Verification: The e-Way Bill details are made available to the recipient, who can accept or reject the consignment covered by the e-Way Bill. Authorized officers can intercept any conveyance to verify the e-Way Bill or the e-Way Bill number. Inspections are recorded online, and in case of detention exceeding thirty minutes, the transporter can upload the information on the common portal.

- Objectives: The e-Way Bill system aims to achieve several objectives, including the implementation of a single e-Way Bill for nationwide movement of goods, prevention of tax evasion, hassle-free movement of goods, easy tracking with e-Way Bill numbers, and easier verification for officers.

- Stakeholders: The e-Way Bill system involves four key stakeholders: suppliers, recipients, transporters, and department officers. Suppliers and recipients generate and verify e-Way Bills, while transporters generate consolidated e-Way Bills and update vehicle numbers. Department officers are responsible for verifying the e-Way Bills and the corresponding consignments.

- Benefits: The e-Way Bill system offers several benefits, including eliminating the need for physical visits to tax offices, reducing waiting times at mobile squads, enabling self-policing by traders, reducing paper usage, automating GSTR-1 returns, and relieving officials from manual way bill matching.

- Enhancements: The e-Way Bill system has undergone enhancements, such as auto-calculation of distance based on PIN codes, blocking multiple e-Way Bills on one invoice/document, extension of e-Way Bills in transit, alerts for expiring e-Way Bills, and registration of transporters through a common enrollment process.

- Features: The e-Way Bill system offers user-friendly operations, various methods for e-Way Bill generation, checks and balances to eliminate errors, support for multiple modes of generation, provision for creating customized masters, management of sub-users, monitoring of e-Way Bills generated against a person, integration with GSTR-1 returns, consolidated e-Way Bills, enrollment for unregistered transporters, common enrollment for GST-registered transporters, alerts and notifications, QR code integration, and integration with RFID for tracking.

Overall, the e-Way Bill System aims to simplify compliance, ensure efficient verification, and promote smooth movement of goods under the GST regime.

FAQs – E-Way Bill

• What is an e-way bill?

e-way bill is a document required to be carried by a person in charge of the conveyance carrying any consignment of goods of value exceeding Rs.50000 as mandated by the Government in terms of Section 68 of the Goods and Services Tax Act read with Rule 138 of the rules framed thereunder. It is generated from the GST Common Portal for eWay bill system by the registered persons or transporters who cause movement of goods of consignment before commencement of such movement.

Why is the e-way bill required?

Section 68 of the Act mandates that the Government may require the person in charge of a conveyance carrying any consignment of goods of value exceeding such amount as may be specified to carry with him such documents and such devices as may be prescribed. Rule 138 of CGST Rules, 2017 prescribes e-way bill as the document to be carried for the consignment of goods in certain prescribed cases. Hence e-way bill generated from the common portal is required.

Who all can generate the e-way bill?

The consignor or consignee, as a registered person or a transporter of the goods can generate the e-way bill.

The unregistered transporter can enroll on the common portal and generate the e-way bill for movement of goods for his clients.

Any person can also enroll and generate the e-way bill for movement of goods for his/her own use.

What are pre-requisites to generate the e-way bill?

The pre-requisite for generation of eway bill is that the person who generates eway bill should be a registered person on GST portal and he should register in the eway bill portal. If the transporter is not registered person under GST it is mandatory for him to get enrolled on e-waybill portal (https://ewaybillgst.gov.in) before generation of the e-way bill. The documents such as tax invoice or bill of sale or delivery challan and Transporter’s Id, who is transporting the goods with transporter document number or the vehicle number in which the goods are transported, must be available with the person who is generating the e-way bill.

If there is a mistake or wrong entry in the e-way bill, what has to be done?

If there is a mistake, incorrect or wrong entry in the e-way bill, then it cannot be edited or corrected. Only option is cancellation of eway bill and generate a new one with correct details.

Whether e-way bill is required for all the goods that are being transported?

The e-way bill is required to transport all the goods except exempted under the notifications or rules. Movement of handicraft goods or goods for job-work purposes under specified circumstances also requires e-way bill even if the value of consignment is less than 50,000 rupees. Kindly refer to the e-way bill rules for other exemptions.

Is there any validity period for e-way bill?

Yes. Validity of the e-way bill depends upon the distance the goods have to be transported. In case of regular vehicle or transportation modes, for every 100 KMs or part of its movement, one day validity has been provided. And in case of Over Dimensional Cargo vehicles, for every 20 KMs or part of its movement, one day validity is provided. And this validity expires on the midnight of last day.

While calculating time validity for e-way bill, how is a day determined?

This can be explained by following examples –

(i) Suppose an e-way bill is generated at 00:04 hrs. on 14th March. Then first day would end on 12:00 midnight of 15 -16 March. Second day will end on 12:00 midnight of 16 -17 March and so on.

(ii) Suppose an e-way bill is generated at 23:58 hrs. on 14th March. Then first day would end on 12:00 midnight of 15 -16 March. Second day will end on 12:00 midnight of 16 -17 March and so on.

Which types of transactions that need the e-way bill?

For transportation of goods in relation to all types of transactions such as outward supply whether within the State or interstate, inward supply whether from within the State or from interstate including from an unregistered persons or for reasons other than supply also e-way bill is mandatory. Please refer relevant notifications/rules for details.

What is the Part-A Slip?

Part-A Slip is a temporary number generated after entering all the details in PART-A. This can be shared or used by transporter or yourself later to enter the PARTB and generate the E-way Bill. This will be useful, when you have prepared invoice relating to your business transaction, but don’t have the transportation details. Thus you can enter invoice details in Part A of eway bill and keep it ready for entering details of mode of transportation in Part B of eway bill.

When I enter the details in e-way bill form, the system is not generating e-way bill, but showing Part-A Slip?

If you don’t enter the vehicle number for transportation by road or transport document number for other cases, the system will show you the PART-A slip. It indicates that you have not completed the e-way bill generation process. Only when you enter the Part-B details, e-way bill will be generated.

How to generate e-way bill from Part-A Slip?

Part-A Slip is entry made by user to temporarily store the document details on the e-way bill system. Once the goods are ready for movement from the business premises and transportation details are known, the user can enter the Part-B details and generate the e-way bill for movement of goods. Hence, Part-B details convert the Part-A slip into e-way bill.

What are the documents that need to be carried along with the goods being transported?

The person in charge of a conveyance shall carry the invoice or bill of supply or delivery challan, bill of entry as the case may be and a copy of the e-way bill number generated from the common portal. Please refer relevant rules for details.

How to generate the e-way bill from different registered place of business?

The registered person can generate the e-way bill from his account from any registered place of business. However, he/she needs to enter the address accordingly in the e-way bill. He/she can also create sub-users for a particular 8 business place and assigned the role for generating the e-way bill to that sub user for that particular business place.

How does taxpayer enter Part-A details and generate e-way bill, when he is transporting goods himself?

Sometimes, taxpayer wants to move the goods himself. E-way bill Portal expects the user to enter transporter ID or vehicle number. So if he wants to move the goods himself, he can enter his GSTIN in the transporter Id field and generate PartA Slip. This indicates to the system that he is a transporter and he can enter details in Part-B later when transportation details are available.

What has to be entered in GSTIN column, if consignor or consignee is not having GSTIN?

If the consignor or consignee is unregistered taxpayer and not having GSTIN, then user has to enter ‘URP’ [Unregistered Person] in corresponding GSTIN column.

When does the validity of the e-way bill start?

The validity of the e-way bill starts when first entry is made in Part-B i.e. vehicle entry is made first time in case of road transportation or first transport document number entry in case of rail/air/ship transportation, whichever is the first entry. It may be noted that validity is not re-calculated for subsequent entries in Part-B.

How is the validity of the e-way bill calculated?

The validity period of the EWB is calculated based on the ‘approx. distance’ entered while generating the EWB. For every 100 Kms one day is a validity period for EWB as per rule and for part of 100 KM one more day is added. For ex. If approx. distance is 310 Kms then validity period is 3+1 days. For movement of Over Dimensional Cargo (ODC), the validity is one day for every 20 KM (instead of 100 KM) and for every 20KM or part thereof one more day is added. Please refer relevant rules for details.

How the distance has to be calculated, if the consignments are imported from or exported to other country?

The approximate distance for movement of consignment from the source to destination has to be considered based on the distance within the country. That is, in case of export, the consignor place to the place from where the consignment is leaving the country, after customs clearance and in case of import, the place where the consignment is reached the country to the destination place and cleared by Customs.

Whether e-way bill is required, if the goods are being purchased and moved by the consumer to his destination himself?

Yes. As per the e-way bill rules, e-way bill is required to be carried along with the goods at the time of transportation, if the value is more than Rs. 50,000/-. Under this circumstance, the consumer can get the e-way bill generated from the taxpayer or supplier, based on the bill or invoice issued by him. The consumer can also enroll as citizen and generate the e-way bill himself.

Can the e-way bill be modified or edited?

The e-way bill once generated cannot be edited or modified. Only Part-B can be updated. However, if e-way bill is generated with wrong information, it can be cancelled and generated afresh. The cancellation is required to be done within twenty four hours from the time of generation.

Before submission, the system is not allowing to edit the details. What is the reason?

The system allows editing the details of e-way bill entries before submission. However, if the products/commodities details are entered, it will not allow editing some fields as the tax rates will change. To enable this, please delete the products and edit the required fields and enter the products again.

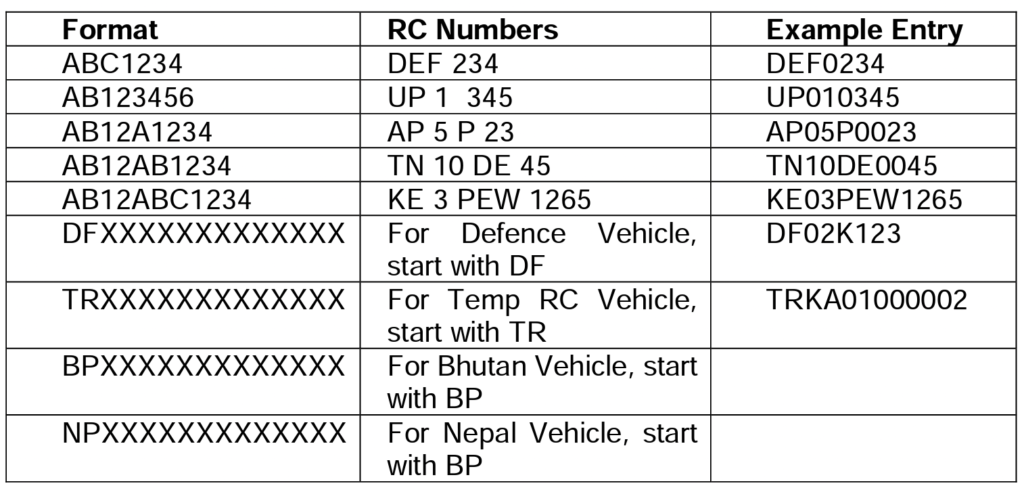

The system shows the ‘Invalid Format’ when we are trying to enter the vehicle number. What is the reason?

The system expects you to enter the vehicle number details in proper format. Please see the format details in the help with the vehicle entry field.

What are the formats of vehicle number entry?

To enable proper entry of the vehicle number, the following formats have been provided for the vehicle numbers

How to enter the vehicle number DL1AB123 as there is no format available for this in e-way bill system?

If the RC book has vehicle number like DL1A123, then you enter as DL01A0123. The vehicle entered in the e-way bill system is only for information and GST officer will accept this variation.

How can anyone verify the authenticity or the correctness of e-way bill?

Any person can verify the authenticity or the correctness of e-way bill by entering EWB No, EWB Date, Generator ID and Doc No in the search option of EWB Portal.

How to generate e-way bill for multiple invoices belonging to same consignor and consignee?

If multiple invoices are issued by the supplier to recipient, that is, for movement of goods of more than one invoice of same consignor and consignee, multiple EWBs have to be generated. That is, for each invoice, one EWB has to be generated, irrespective of the fact whether same or different consignors or consignees are involved. Multiple invoices cannot be clubbed to generate one EWB. However after generating all these EWBs, one Consolidated EWB can be prepared for transportation purpose, if goods are going in one vehicle.

What has to be done by the transporter if consignee refuses to take goods or rejects the goods for any reason?

There is a chance that consignee or recipient may reject to take the delivery of consignment due to various reasons. Under such circumstances, the transporter can get one more e-way bill generated with the help of supplier or recipient by indicating supply as ‘Sales Return’ with relevant documents, return the goods to the supplier as per his agreement with him.

What has to be done, if the validity of the e-way bill expires?

If validity of the e-way bill expires, the goods are not supposed to be moved. However, under circumstance of ‘exceptional nature and trans-shipment’, the transporter may extend the validity period after updating reason for the extension and the details in PART-B of FORM GST EWB-01.

Can I extend the validity of the e-way bill?

Yes, one can extend the validity of the e-way bill, if the consignment is not being reached the destination within the validity period due to exceptional circumstance like natural calamity, law and order issues, trans-shipment delay, accident of conveyance, etc. The transporter needs to explain this reason in details while extending the validity period.

How to extend the validity period of e-way bill?

There is an option under e-way bill to extend the validity period. This option is available for extension of e-way bill before 4 hours and after 4 hours of expiry of the validity. Here, transporter will enter the e-way bill number and enter the reason for the requesting the extension, from place (current place), approximate distance to travel and Part-B details. It may be noted that he cannot change the details of Part-A. He will get the extended validity based on the remaining distance to travel.

Who can extend the validity of the e-way bill?

The transporter, who is carrying the consignment as per the e-way bill system at the time of expiry of validity period, can extend the validity period.

How to handle “Bill to” – “Ship to” invoice in e-way bill system?

Sometimes, the tax payer raises the bill to somebody and sends the consignment to somebody else as per the business requirements. There is a provision in the eway bill system to handle this situation, called as ‘Bill to’ and ‘Ship to’.

In the e-way bill form, there are two portions under ‘TO’ section. In the left hand side – ‘Billing To’ GSTIN and trade name is entered and in the right hand side – ‘Ship to’ address of the destination of the movement is entered. The other details are entered as per the invoice. In case ship to state is different from Bill to State, the tax components are entered as per the billing state party. That is, if the Bill to location is inter-state for the supplier, IGST is entered and if the Bill to Party location is intra-state for the supplier, the SGST and CGST are entered irrespective of movement of goods whether movement happened within state or outside the state.

How to handle “Bill from” – “Dispatch from” invoice in e-way bill system?

Sometimes, the supplier prepares the bill from his business premises to consignee, but moves the consignment from some others’ premises to the consignee as per the business requirements. This is known as ‘Billing From’ and ‘Dispatching From’. E-way bill system has provision for this. In the e-way bill form, there are two portions under ‘FROM’ section. In the left hand side – ‘Bill From’ supplier’s GSTIN and trade name are entered and in the right hand side – ‘Dispatch From’, address of the dispatching place is entered. The other details are entered as per the invoice. In case Bill From location State is different from the State of Dispatch the Tax components are entered as per the State (Bill From). That is, if the billing party is inter-state for the supplier, IGST is entered and if the billing party is intra-state for the supplier, the SGST and CGST are entered irrespective of movement of goods whether movement happened within state or outside the state.

How the transporter is identified or assigned the e-way bill by the taxpayer for transportation?

While generating e-way bill the taxpayer has a provision to enter the transporter id in the transportation details section. If he enters 15 digits transporter id provided by his transporter, the e-way bill will be assigned to that transporter. Subsequently, the transporter can log in and update further transportation details in Part B of eway bill.

How to generate e-way bill, if the goods of one invoice is being moved in multiple vehicles simultaneously?

Where the goods are being transported in a semi knocked down or completely knocked down condition or being bulk cargo or being transported through multimodal means of transport, the EWB shall be generated for each of such vehicles based on the delivery challans issued for that portion of the consignment as per CGST Rule 55 which provides as under.

(a) Supplier shall issue the complete invoice before dispatch of the first consignment

(b) Supplier shall issue a delivery challan for each of the subsequent consignments, giving reference of the invoice

(c) each consignment shall be accompanied by copies of the corresponding delivery challan along with a duly certified copy of the invoice; and

(d) Original copy of the invoice shall be sent along with the last consignment

Please note that multiple EWBs are required to be generated in this situation. That is, the EWB has to be generated for each consignment based on the delivery challan details along with the corresponding vehicle number.

The sub-rule (1) of rule 138A of CGST Rules, 2017 states that person in charge of a conveyance may carry ‘e-way bill number in electronic form. Does the phrase ‘electronic form’ means that he needs to carry e-way bill in softcopy in his mobile etc.?

No. He can merely quote the e-way bill number to the proper tax officer. Tax officer based on that number will do all the requisite verifications.

Join our Practical GST Course:

with lifetime validity: https://cagurujiclasses.com/courses/gst-course-2022/

With limited validity: https://studywudy.com/courses/gst/