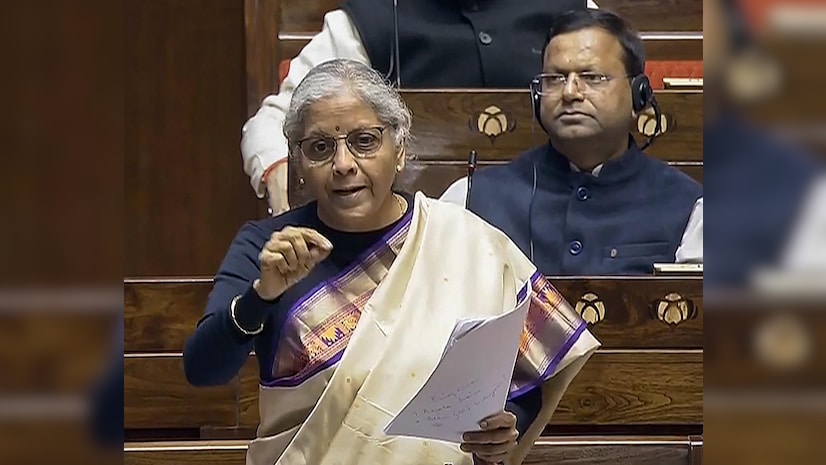

Union Finance Minister Nirmala Sitharaman speaks in the Rajya Sabha during the Budget session of Parliament (Photo: PTI)

Finance Minister Nirmala Sitharaman on Monday asked the goods and services tax (GST) officials to bring about clarity on classification-related issues at the earliest through appropriate channels.

Inaugurating the National Conference of Enforcement Chiefs of the State and the Central GST Formations here, Sitharaman exhorted the officials to engage with stakeholders to understand their concerns, enhance compliance, streamline processes, and work collaboratively towards making the tax system more transparent and efficient.

GST rates are based on classification of goods and services on the basis of harmonised system of nomenclature (HSN) codes and often this leads to various disputes and litigation. The issue is then addressed by various judicial and quasi-judicial fora, including GST commissioners, authority for advance rulings (AARs), courts.

The Central Board of Indirect Taxes and Customs (CBIC) brings about various circulars and frequently asked questions (FAQs) to clear the air over various classification issues based on the recommendations of the GST Council.

Sitharaman urged the officials to leverage technology to plug the loopholes and provide better taxpayer services.

Highlighting the importance of innovation, she advocated for sharing of emerging best practices, emphasising the need for seamless coordination across the states. Various presentations were made during the conference. According to data presented by GST Council Secretariat, the nationwide crackdown on fake registrations and bogus billing from May 2023 alone has resulted in detection of input tax credit tax evasion of Rs 49,623 crore involving 31,512 bogus firms.

The CBIC gave a presentation that it has detected fake input tax credit claim of Rs 1.14 trillion from the year 2020 till date.

I-T asks taxpayers to file updated ITRs for AY 2021-22 by March 31

Income-tax assessee can file updated returns for the assessment year 2021-22 till the end of this month, making use of the annual information statement (AIS) since the department has the information of mismatch between filing in the returns and the data shown by third parties.

In some cases, a ‘mismatch’ has been identified between the information filed in the returns for 2021-22 vis-à-vis information of specified financial transactions, as available with the department, the Central Board of Direct Taxes (CBDT) said in a statement.

Accordingly, as part of the e-Verification Scheme-2021, the income tax department is in the process of sending communications to the taxpayers for this mismatch.

Non-filers can also submit updated returns, the CBDT said.

Below is tweet

As part of the e-Verification Scheme-2021, Income Tax Department (ITD) is in the process of sending communication to taxpayers pertaining to ‘mismatch’ between the information filed in the Income Tax Return (ITR) vis-à-vis information of specified financial transactions, as… pic.twitter.com/Vrfz3pZMRz

— Income Tax India (@IncomeTaxIndia) March 4, 2024

Visit www.cagurujiclasses.com for practical courses