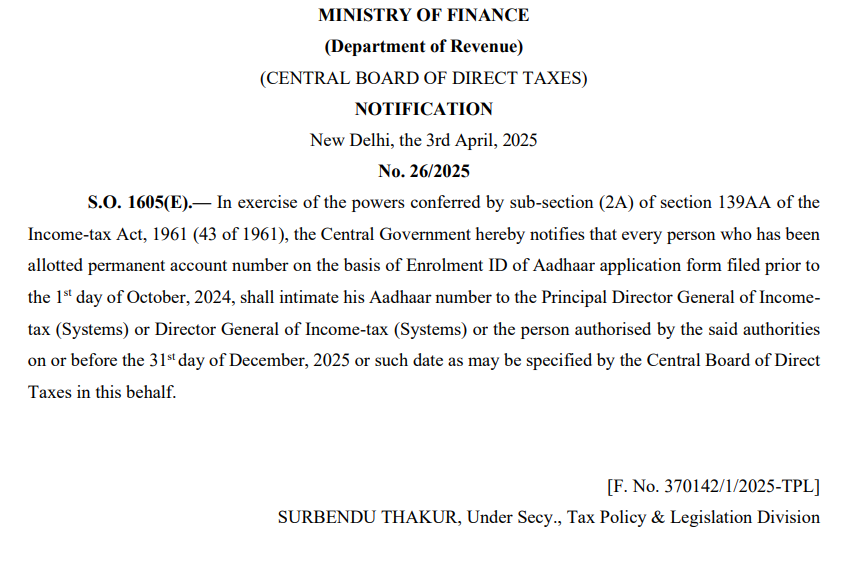

In a significant announcement, the Ministry of Finance, through the Central Board of Direct Taxes (CBDT), has provided relief to a specific group of taxpayers regarding the mandatory PAN-Aadhaar linking. As per the official notification No. 26/2025 dated April 3, 2025, individuals who were allotted a PAN based on an Aadhaar Enrolment ID submitted before October 1, 2024, can link their Aadhaar with PAN free of cost — but only if completed on or before December 31, 2025.

🔎 What the Notification Says

As per notification S.O. 1605(E), under powers granted by sub-section (2A) of section 139AA of the Income-tax Act, 1961, every person issued a PAN based on the Aadhaar Enrolment ID (from forms filed before October 1, 2024) must:

“…intimate his Aadhaar number to the Principal Director General of Income-tax (Systems) or Director General of Income-tax (Systems)…on or before the 31st day of December, 2025 or such date as may be specified by the Central Board of Direct Taxes…”

This essentially allows such individuals to complete the PAN-Aadhaar linking without the mandatory ₹1,000 late fee, as long as it is done within the prescribed deadline.

⏰ Who Can Link Aadhaar with PAN for Free?

This relaxation is only applicable to:

- Individuals who received their PAN using the Aadhaar Enrolment ID

- Aadhaar application form must have been filed before October 1, 2024

Everyone else — especially those who were issued PAN using a valid Aadhaar number or after the cutoff — must pay the prescribed ₹1,000 penalty if they haven’t already linked the two.

🛑 What Happens if You Don’t Link?

- Your PAN may become inoperative, leading to issues in:

- Filing Income Tax Returns (ITR)

- Opening bank accounts

- Conducting high-value financial transactions

- You may have to pay a late fee of ₹1,000 after the deadline, and additional delays can attract further penalties.

✅ Step-by-Step Guide to Link PAN with Aadhaar

Here’s how you can link PAN with Aadhaar:

- Visit the e-Filing Portal

- Go to https://www.incometax.gov.in

- Click on ‘Link Aadhaar’ under the “Quick Links” section.

- Enter PAN & Aadhaar

- Input both your PAN and Aadhaar numbers.

- Click Continue.

- Validate with OTP

- Provide a mobile number to receive an OTP (One-Time Password).

- Enter the OTP to proceed.

- Payment (if applicable)

- If you’re not eligible for the free linking, pay ₹1,000 using:

- e-Pay Tax option

- Select AY 2025–26 and choose “Other Receipts (500)” as the payment head

- If you’re not eligible for the free linking, pay ₹1,000 using:

- Submit Request

- Once payment (if needed) is successful, return to the ‘Link Aadhaar’ page.

- Submit your request and wait for confirmation.

📝 Final Words

The government is pushing for tighter integration of identity and financial records. This Aadhaar-PAN linking is a critical part of that process. Taxpayers who fall under the exempted category should act quickly and complete the linking before December 31, 2025 to avoid any charges or disruptions.

If unsure about your status or for help with the linking process, consult a tax expert or reach out to the Income Tax helpdesk through their official website.

Visit www.cagurujiclasses.com for practical courses

Maina spna pan card se aadhaar link karwa liya jiske liye mujhe ₹-1000/=JURMaNA bhi jama kar diya tha lekin is se pehle mere a/c se ₹-9101 /= deduct kar liye the jo ki mujhe abhi tak mere a/c me mere paise wapis mere a/c me abhi tak nahi aaye

Jabki mujhe axis bank se message aa gaya ki aapka pan aadhaar link hi gaya hai

How about the cases in which IT dept.has issued two PAN cards on the same name/Aadhaar and blinking now to correct. Any punishment for the person/system for this ?

How about the cases in which IT dept.has issued two PAN cards on the same name/Aadhaar and blinking now to correct. Any punishment for the person/system for this ? Now you are also silently watching giving free advice !