- The GST Appellate Tribunal, established based on Council recommendations.

- Effectiveness from August 1, 2023.

Constitution of Appellate Tribunal – Section 109

Section 109(1): Establishment of Appellate Tribunal

- Government notification establishes the Goods and Services Tax Appellate Tribunal.

- Hears appeals against Appellate Authority and Revisional Authority orders.

The Government shall, on the recommendations of the Council, by notification, establish with effect from such date as may be specified therein, an Appellate Tribunal known as the Goods and Services Tax Appellate Tribunal for hearing appeals against the orders passed by the Appellate Authority or the Revisional Authority.

Section 109(2): Jurisdiction and Benches

- The Appellate Tribunal exercises its powers through Principal Bench and State Benches.

The jurisdiction, powers and authority conferred on the Appellate Tribunal shall be exercised by the Principal Bench and the State Benches constituted under sub-section (3) and sub-section (4).

Section 109(3): Principal Bench at New Delhi

- The Principal Bench consists of the President, a Judicial Member, a Technical Member (Centre), and a Technical Member (State).

The Government shall, by notification, constitute a Principal Bench of the Appellate Tribunal at New Delhi which shall consist of the President, a Judicial Member, a Technical Member (Centre) and a Technical Member (State).

Section 109(4): State Benches

- State Benches established based on State requests and Council recommendations.

- Comprise two Judicial Members, a Technical Member (Centre), and a Technical Member (State).

On the request of the State, the Government may, by notification, constitute such number of State Benches at such places and with such jurisdiction as may be recommended by the Council, which shall consist of two Judical Members, a Technial Member (Centre) and a Technical Member (State).

Section 109(5): Appeals

- Principal Bench and State Benches handle appeals.

- Principal Bench deals with cases involving place of supply issues.

The Principal Bench and the State Bench shall hear appeals against the orders passed by the Appellate Authority or the Revisional Authority:

Provided that the cases in which any one of the issues involved relates to the place of supply, shall be heard only by the Principal Bench.

Section 109(6): Distribution of Cases

- The President allocates cases among the Benches and transfers cases as necessary.

The President shall, from time to time, by a general or special order, distribute the business of the Appellate Tribunal among the Benches and may transfer cases from one Bench to another.

Section 109(7): Vice-President

- Senior-most Judicial Member within State Benches acts as Vice-President, with powers prescribed.

The senior-most Judicial Member within the State Benches, as may be notified, shall act as the Vice-President for such State Benches and shall exercise such powers of the President as may be prescribed, but for all other purposes be considered as a Member.

Section 109(8): Handling Appeals

- Appeals under fifty lakh rupees and no legal questions may be heard by a single Member with President’s approval.

- All other cases heard by one Judicial Member and one Technical Member.

Appeals, where the tax or input tax credit involved or the amount of fine, fee or penalty determined in any order appealed against, does not exceed fifty lakh rupees and which does not involve any question of law may, with the approval of the President, and subject to such conditions as may be prescribed on the recommendations of the Council, be heard by a single Member, and in all other cases, shall be heard together by one Judicial Member and one Technical Member.

Section 109(9): Difference of Opinion

- If Members disagree, points of disagreement noted.

- The President refers the case for majority decision, including original Members.

If, after hearing the case, the Members differ in their opinion on any point or points, such Member shall state the point or points on which they differ, and the President shall refer such case for hearing,—

| (a) | where the appeal was originally heard by Members of a State Bench, to another Member of a State Bench within the State or, where no such other State Bench is available within the State, to a Member of a State Bench in another State; | |

| (b) | where the appeal was originally heard by Members of the Principal Bench, to another Member from the Principal Bench or, where no such other Member is available, to a Member of any State Bench, |

and such point or points shall be decided according to the majority opinion including the opinion of the Members who first heard the case.

Section 109(10): Administrative Efficiency

- Members may be transferred between Benches for administrative efficiency.

The Government may, in consultation with the President, for the administrative efficiency, transfer Members from one Bench to another Bench:

Provided that a Technical Member (State) of a State Bench may be transferred to a State Bench only of the same State in which he was originally appointed, in consultation with the State Government.

Section 109(11): Validity

- No invalidity based on vacancy or defect in the Appellate Tribunal’s constitution.

No act or proceedings of the Appellate Tribunal shall be questioned or shall be invalid merely on the ground of the existence of any vacancy or defect in the constitution of the Appellate Tribunal.”

Conclusion:

- The GST Appellate Tribunal, effective from August 1, 2023, is structured to efficiently handle appeals, ensuring a fair and impartial process.

Qualification, Appointment, and Conditions of Service for GST Appellate Tribunal – Section 110

- This section outlines the qualifications, appointment, and conditions of service for the President and Members of the Goods and Services Tax Appellate Tribunal.

- It specifies eligibility criteria, appointment processes, and conditions that govern their tenure.

Key Provisions:

Section 110(1): Qualification for Appointment

- Eligibility criteria for the President, Judicial Member, Technical Member (Centre), and Technical Member (State).

1) A person shall not be qualified for appointment as—

| (a) | the President, unless he has been a Judge of the Supreme Court or is or has been the Chief Justice of a High Court; | |

| (b) | a Judicial Member, unless he— |

| (i) | has been a Judge of the High Court; or | |

| (ii) | has, for a combined period of ten years, been a District Judge or an Additional District Judge; |

| (c) | a Technical Member (Centre), unless he is or has been a member of the Indian Revenue (Customs and Indirect Taxes) Service, Group A, or of the All India Service with at least three years of experience in the administration of an existing law or goods and services tax in the Central Government, and has completed at least twenty-five years of service in Group A; | |

| (d) | a Technical Member (State), unless he is or has been an officer of the State Government or an officer of All India Service, not below the rank of Additional Commissioner of Value Added Tax or the State goods and services tax or such rank, not lower than that of the First Appellate Authority, as may be notified by the concerned State Government, on the recommendations of the Council and has completed twenty-five years of service in Group A, or equivalent, with at least three years of experience in the administration of an existing law or the goods and services tax or in the field of finance and taxation in the State Government: |

Provided that the State Government may, on the recommendations of the Council, by notification, relax the requirement of completion of twenty-five years of service in Group A, or equivalent, in respect of officers of such State where no person has completed twenty-five years of service in Group A, or equivalent, but has completed twenty-five years of service in the Government, subject to such conditions, and till such period, as may be specified in the notification.

Section 110(2): Appointment and Re-appointment

- Appointment processes, including the Search-cum-Selection Committee.

- Acting President’s role in case of a vacancy.

- Functions of Vice-President when the President is unable to discharge duties.

(2) The President, Judicial Member, Technical Member (Centre) and Technical Member (State) shall be appointed or re-appointed by the Government on the recommendations of a Search-cum-Selection Committee constituted under sub-section (4):

Provided that in the event of the occurrence of any vacancy in the office of the President by reason of his death, resignation or otherwise, the Judicial Member or, in his absence, the senior-most Technical Member of the PrincipaI Bench shall act as the President until the date on which a new President, appointed in accordance with the provisions of this Act to fill such vacancy, enters upon his office:

Provided further that where the President is unable to discharge his functions owing to absence, illness or any other cause, the Judicial Member or, in his absence, the senior-most Technical Member of the Principal Bench, shall discharge the functions of the President until the date on which the President resumes his duties.

Section 110(3): State Bench Preference

- Preference for officers with State Government experience in selecting Technical Members for State Benches.

While making selection for Technical Member (State) of a State Bench, first preference shall be given to officers who have worked in the State Government of the State to which the jurisdiction of the Bench extends.

Section 110(4): Composition of Search-cum-Selection Committee

- Composition of the Committee for Technical Member (State) and other appointments.

- Duties and roles of Committee members.

(4) (a) The Search-cum-Selection Committee for Technical Member (State) of a State Bench shall consist of the following members, namely:—

| (i) the Chief Justice of the High Court in whose jurisdiction the State Bench is located, to be the Chairperson of the Committee;(ii) the senior-most JudiciaI Member in the State, and where no JudiciaI Member is available, a retired Judge of the High Court in whose jurisdiction the State Bench is located, as may be nominated by the Chief Justice of such High Court;(iii) Chief Secretary of the State in which the State Bench is located;(iv) one Additional Chief Secretary or Principal Secretary or Secretary of the State in which the State Bench is located, as may be nominated by such State Government, not in-charge of the Department responsible for administration of State tax; and(v) Additional Chief Secretary or Principal Secretary or Secretary of the Department responsible for administration of State tax, of the State in which the State Bench is located — Member Secretary; and |

(b) the Search-cum-Selection Committee for all other cases shall consist of the following members, namely:—

| (i) the Chief Justice of India or a Judge of Supreme Court nominated by him, to be the Chairperson of the Committee;(ii) Secretary of the Central Government nominated by the Cabinet Secretary — Member;(iii) Chief Secretary of a State to be nominated by the Council — Member;(iv) one Member, who(A) in case of appointment of a President of a Tribunal, shall be the outgoing President of the Tribunal; or(B) in case of appointment of a Member of a Tribunal, shall be the sitting President of the Tribunal; or(C) in case of the President of the Tribunal seeking re-appointment or where the outgoing President is unavailable or the removal of the President is being considered, shall be a retired Judge of the Supreme Court or a retired Chief Justice of a High Court nominated by the Chief Justice of India; and(v) Secretary of the Department of Revenue in the Ministry of Finance of the Central Government — Member Secretary. |

Section 110(5): Voting and Chairperson’s Role

- The Chairperson’s role and voting rights in the Committee.

The Chairperson shall have the casting vote and the Member Secretary shall not have a vote.

Section 110(6): Panel of Recommendations

- The Committee recommends a panel of two names for President or Member appointments.

Notwithstanding anything contained in any judgment, order, or decree of any court or any law for the time being in force, the Committee shall recommend a panel of two names for appointment or re-appointment to the post of the President or a Member, as the case may be.

Section 110(7): Validity

- Appointments are not invalidated due to vacancy or Committee defects.

No appointment or re-appointment of the Members of the Appellate Tribunal shall be invalid merely by reason of any vacancy or defect in the constitution of the Search-cum-Selection Committee.

Section 110(8): Salary and Terms of Service

- Salary, allowances, and terms of service as applicable to Central Government officers.

- Protection against adverse changes after appointment.

Notwithstanding anything contained in any judgment, order, or decree of any court or any law for the time being in force, the salary of the President and the Members of the Appellate Tribunal shall be such as may be prescribed and their allowances and other terms and conditions of service shall be the same as applicable to Central Government officers carrying the same pay

Provided that neither the salary and allowances nor other terms and conditions of service of the President of Members of the Appellate Tribunal shall be varied to their disadvantage after their appointment:

Provided further that, if the President or Member takes a house on rent, he may be reimbursed a house rent higher than the house rent allowance as are admissible to a Central Government officer holding the post carrying the same pay, subject to such limitations and conditions as may be prescribed.

Section 110(9) and (10): Term and Re-appointment

- President’s, Judicial Member’s, and Technical Member’s terms and re-appointment conditions.

Notwithstanding anything contained in any judgment, order, or decree of any court or any law for the time being in force, the President of the Appellate Tribunal shall hold office for a term of four years from the date on which he enters upon his office, or until he attains the age of 70 years, whichever is earlier and shall be eligible for re-appointment for a period not exceeding two years.

Notwithstanding anything contained in any judgment, order, or decree of any court or any law for the time being in force, the Judicial Member, Technical Member (Centre) or Technical Member (State) of the Appellate Tribunal shall hold office for a term of four years from the date on which he enters upon his office, or until he attains the age of 67 years, whichever is earlier and shall be eligible for re-appointment for a period not exceeding two years.

52nd GST Council recommends changes to CGST Act:

- Advocates with 10 years’ experience in tax law eligible as judicial members.

- Minimum age for President and Members set at 50.

- Maximum tenure: President 70 years, Members 67 years

Section 110(11): Resignation

- The process for President or Member resignation and its effect on office continuation.

The President or any Member may, by notice in writing under his hand addressed to the Government, resign from his office:

Provided that the President or Member shall continue to hold office until the expiry of three months from the date of receipt of such notice by the Government or until a person duly appointed as his successor enters upon his office or until the expiry of his term of office, whichever is the earliest.

Section 110(12): Removal

- Grounds and procedures for President or Member removal.

- Rights and opportunities for the President or Member in case of removal.

The Government may, on the recommendations of the Search-cum-Selection Committee, remove from the office President or a Member, who—

| (a) | has been adjudged an insolvent; or | |

| (b) | has been convicted of an offence which involves moral turpitude; or | |

| (c) | has become physically or mentally incapable of acting as such President or Member; or | |

| (d) | has acquired such financial or other interest as is likely to affect prejudicially his functions as such President or Member; or | |

| (e) | has so abused his position as to render his continuance in office prejudicial to the public interest: |

Provided that the President or the Member shall not be removed on any of the grounds specified in clauses (d) and (e), unless he

Section 110(13): Suspension

- Conditions and procedures for suspension in case of removal proceedings.

The Government, on the recommendations of the Search-cum-Selection Committee, may suspend from office, the President or a Judicial or Technical Member in respect of whom proceedings for removal have been initiated under sub-section (12).

Section 110(14): Post-tenure Restrictions

- Restrictions on post-tenure appearances or pleadings before the Tribunal.

Subject to the provisions of article 220 of the Constitution, the President or other Members, on ceasing to hold their office, shall not be eligible to appear, act or plead before the Principal Bench or the State Bench in which he was the President or, as the case may be, a Member.”

Conclusion:

- Section 110 defines the stringent criteria, appointment processes, and service conditions for the President and Members of the GST Appellate Tribunal, ensuring a fair and effective functioning of the tribunal in hearing appeals.

Procedure before the GST Appellate Tribunal – Section 111

- Section 111 of the GST Act outlines the procedures to be followed when appealing before the GST Appellate Tribunal.

- Unlike the Code of Civil Procedure, the Appellate Tribunal operates based on the principles of natural justice, guided by the GST Act and its rules, while having the authority to regulate its own procedure.

Section 111(1): Disposal Procedure

- The Appellate Tribunal is not bound by the procedures of the Code of Civil Procedure, 1908, while deciding appeals.

- It must follow the principles of natural justice and is empowered to regulate its own procedures, considering the GST Act and rules.

Section 111(2): Powers of the Appellate Tribunal

- The Appellate Tribunal possesses powers akin to a civil court under the Code of Civil Procedure, 1908, regarding various matters.

- These powers include summoning individuals, administering oaths, demanding document discovery, accepting evidence via affidavits, requisitioning public records, issuing witness or document examination commissions, and more.

Section 111(3): Enforcement of Orders

- The Appellate Tribunal’s orders can be enforced just like court decrees in pending suits.

- It can seek execution assistance from a court within the jurisdiction where the registered office of a company (in case of orders against a company) or where the concerned person resides, conducts business, or works

Appeals to the GST Appellate Tribunal – Section 112

- Section 112 of the GST Act outlines the procedures and conditions for making appeals to the GST Appellate Tribunal.

- Individuals or entities aggrieved by an order under Section 107 (Appeal to Appellate Authority), Section 108 (Appeal to Revisional authority) , or corresponding sections of the State or Union Territory GST Acts may file appeals.

Section 112(1): Appeal Period

- Appeals must be made within three months from the date of communication of the order being appealed against.

Section 112(2): Discretion of the Appellate Tribunal

- The Appellate Tribunal may choose not to admit appeals where the financial stakes involved (tax, input tax credit, fine, fee, or penalty) do not exceed fifty thousand rupees.

Section 112(3): Review by the Commissioner

- The Commissioner can review orders passed by the Appellate Authority or Revisional Authority.

- The Commissioner may direct an officer to apply to the Appellate Tribunal to determine specific points arising from the order.

Section 112(4): Treatment of Officer’s Application

- Applications arising from the Commissioner’s direction will be treated as appeals under Section 107 or Section 108.

- All provisions of the GST Act related to appeals apply to these applications.

Section 112(5): Cross-objections

- Parties against whom an appeal is filed can file a memorandum of cross-objections within forty-five days of receiving notice, even if they didn’t appeal.

- The Appellate Tribunal will handle cross-objections as if they were appeals.

Section 112(6): Time Extensions

- The Appellate Tribunal can admit appeals within three months after the initial three-month appeal period or permit cross-objections within forty-five days after the initial period, given sufficient cause.

Section 112(7): Appeal Requirements

- Appeals to the Appellate Tribunal must follow the prescribed form, verification process, and include the required fee.

Section 112(8): Pre-requisites for Filing Appeals

- Appeals cannot be filed under sub-section (1) unless the appellant has paid the admitted amount of tax, interest, fine, fee, and penalty.

- A sum equal to twenty percent of the remaining disputed tax amount, subject to a maximum of fifty crore rupees, must also be paid.

Section 112(9): Stay of Recovery Proceedings

- Payment of the prescribed amounts stays the recovery proceedings for the balance amount until the appeal is resolved.

Section 112(10): Application Fees

- All applications before the Appellate Tribunal, including those for rectification, restoration, or other purposes, must include the prescribed fees.

Conclusion:

- Section 112 of the GST Act defines the process for making appeals to the GST Appellate Tribunal. These provisions aim to ensure fair and well-regulated appeals in cases where taxpayers are aggrieved by orders related to tax, penalties, or other financial matters

Orders of the Appellate Tribunal – Section 113

- Section 113 of the GST Act outlines the authority and procedures for the Appellate Tribunal to pass orders on appeals.

Section 113(1): Appellate Tribunal’s Orders

- The Appellate Tribunal may, after hearing the parties to the appeal, pass orders as it deems appropriate. These orders can confirm, modify, or annul the decision or order under appeal.

- The Appellate Tribunal may also refer the case back to the Appellate Authority, Revisional Authority, or the original adjudicating authority with specific directions for a fresh adjudication or decision, including the gathering of additional evidence if required.

Section 113(2): Granting Adjournments

- The Appellate Tribunal, if satisfied with sufficient cause, may grant adjournments during the hearing of an appeal. However, no more than three adjournments may be granted to a party during the appeal hearing.

Section 113(3): Amending Orders

- The Appellate Tribunal has the authority to amend any order passed under sub-section (1) to rectify any apparent errors on the face of the record.

- Such amendments may be made at the Tribunal’s discretion, or if an error is brought to its notice by the Commissioner, Commissioner of State tax, the Commissioner of Union territory tax, or the other party to the appeal within three months from the date of the original order.

- The party potentially affected by an amendment must be given an opportunity to be heard, especially if the amendment might increase their liability.

Section 113(4): Timely Resolution

- The Appellate Tribunal is encouraged to hear and decide every appeal within one year from the date of filing.

Section 113(5): Notification

- The Appellate Tribunal must send copies of its orders to the Appellate Authority, Revisional Authority, original adjudicating authority, the appellant, and the relevant tax authorities.

Section 113(6): Finality of Orders

- Except for situations covered in Section 117 or Section 118, orders passed by the Appellate Tribunal on an appeal are considered final and binding on the involved parties.

Conclusion:

- Section 113 of the GST Act empowers the Appellate Tribunal to review, modify, or annul decisions or orders subject to appeal. The Tribunal aims to provide fair and efficient resolutions, with the authority to amend orders when necessary, and strives to conclude appeals within one year. Its orders hold significant legal weight, making them final and binding on the parties involved, except in certain specific circumstances outlined in other sections of the Act.

Financial and Administrative powers of President – section 114

The President shall exercise such financial and administrative powers over the Appellate Tribunal as may be prescribed.”

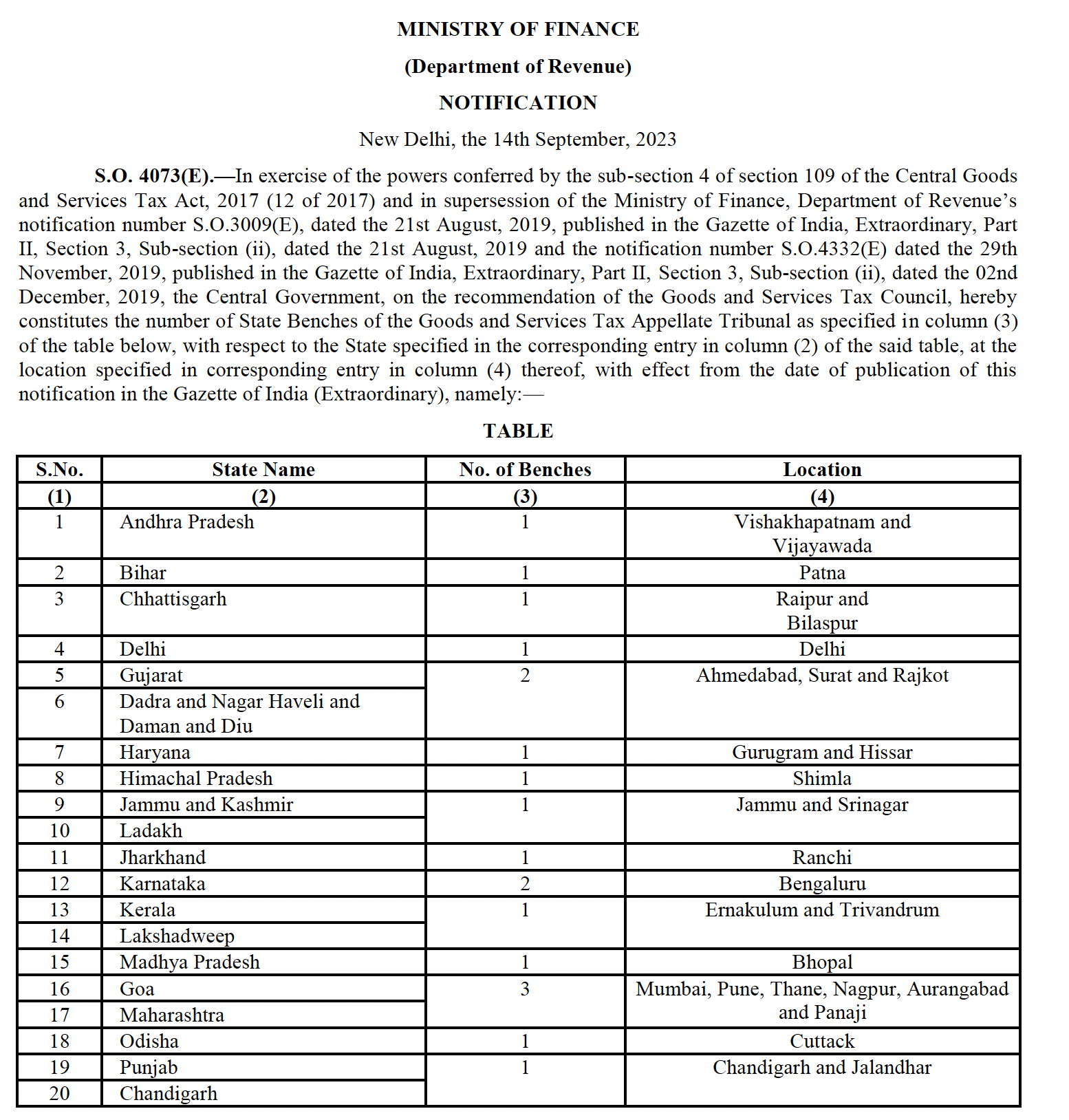

GST Appellate Tribunal- 31 state benches announced (GSTAT)

MINISTRY OF FINANCE (Department of Revenue) issued NOTIFICATION dated 14th September, 2023 the Central Government, on the recommendation of the Goods and Services Tax Council, hereby constitutes the number of State Benches of the Goods and Services Tax Appellate Tribunal.

Visit www.cagurujiclasses.com for practical courses