Introducing Electronic Credit Reversal and Reclaimed statement

Vide Notification No. 14/2022 – Central Tax dated 05th July, 2022 (read with circular 170/02/2022-GST, Dated 6th July,2022), the Government introduced certain changes in Table 4 of Form GSTR-3B so as to enable the taxpayers in reporting correct information regarding ITC availed, ITC reversal, ITC re-claimed and ineligible ITC. The re-claimable ITC earlier reversed in Table 4(B)2 may be subsequently claimed in Table 4(A)5 on fulfilment of necessary conditions. Such reclaimed ITC in Table 4(A)5 also needs to be explicitly reported in Table 4D(1)

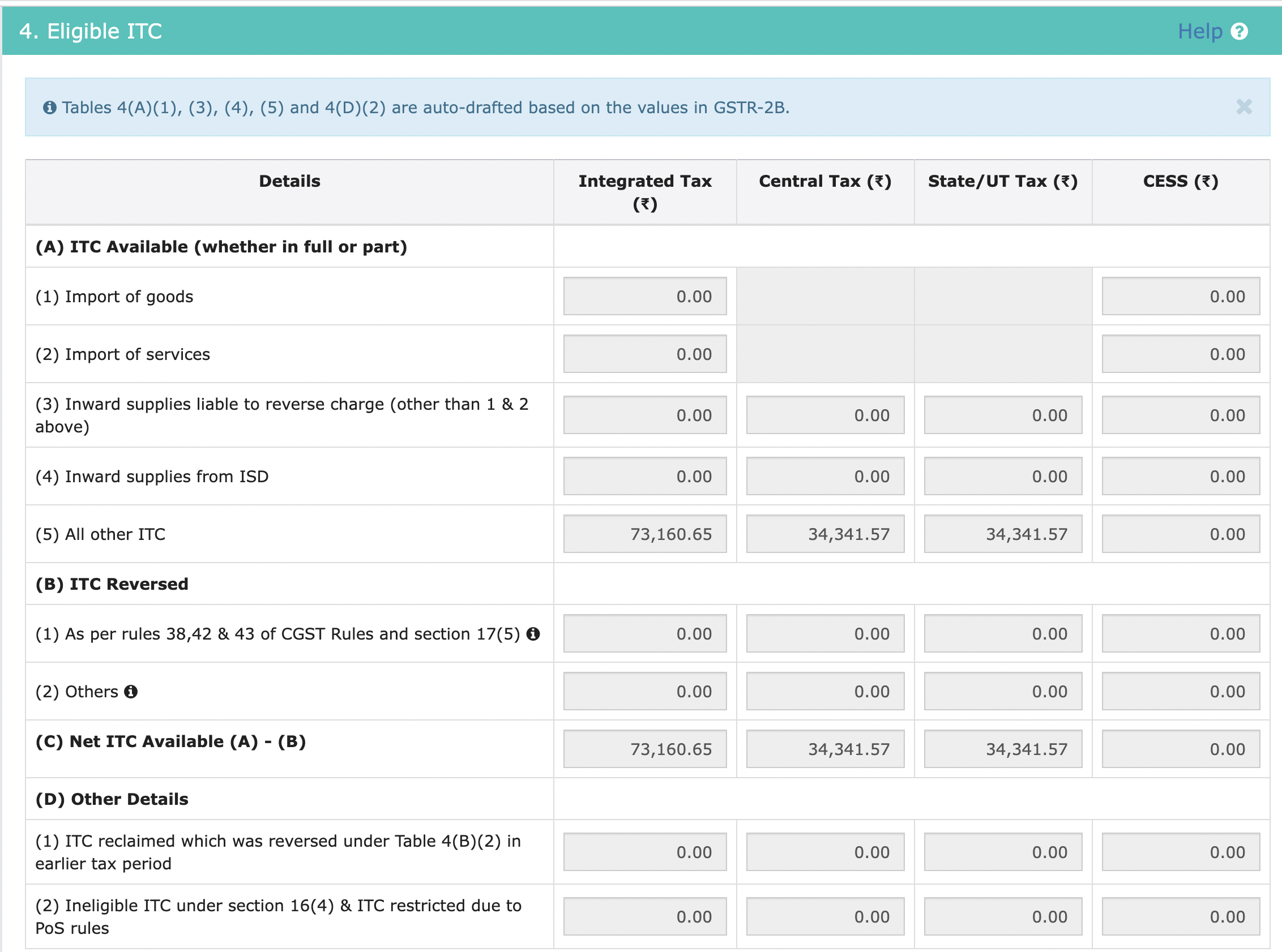

Below is Table 4 of GSTR-3B:

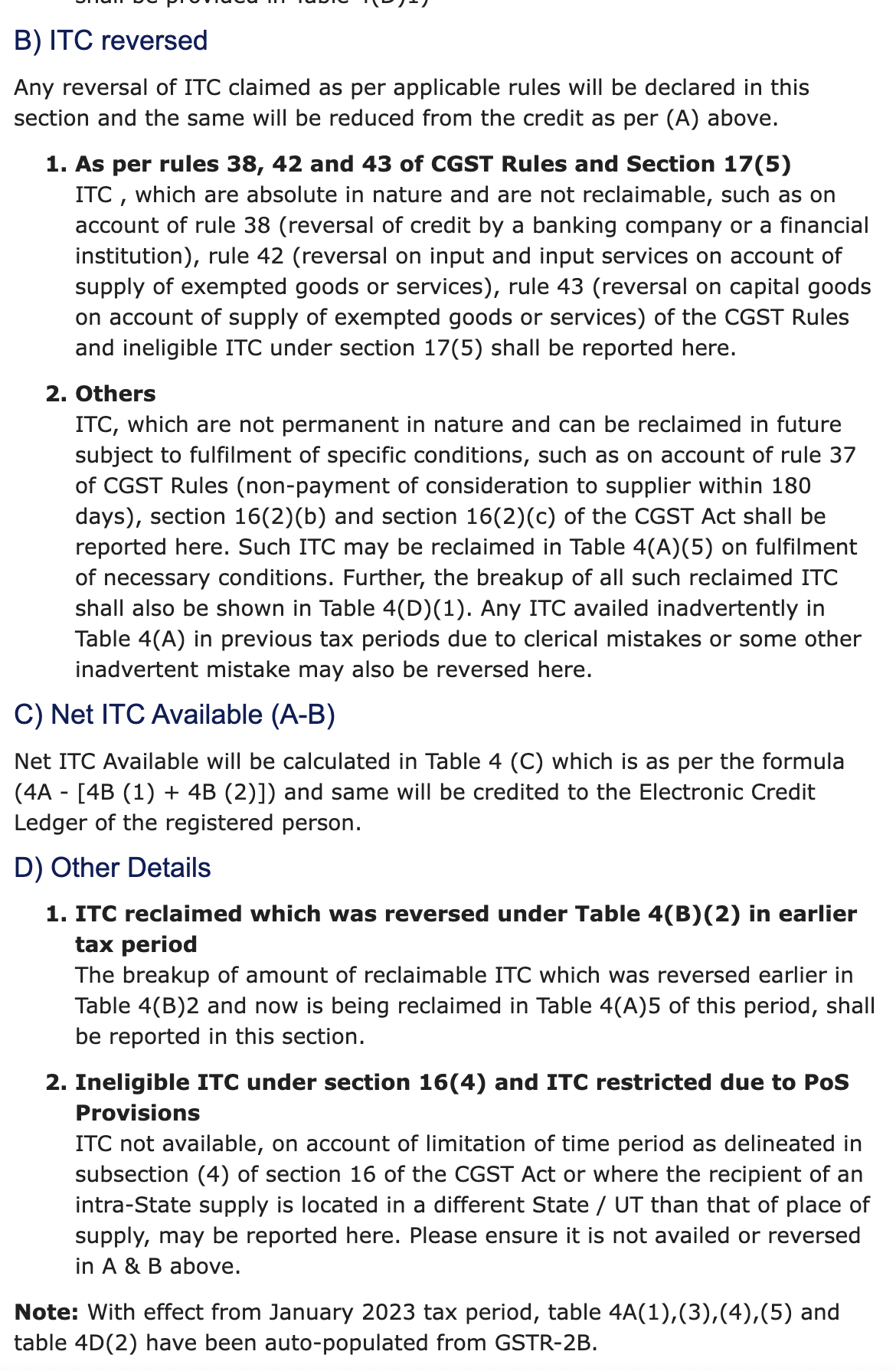

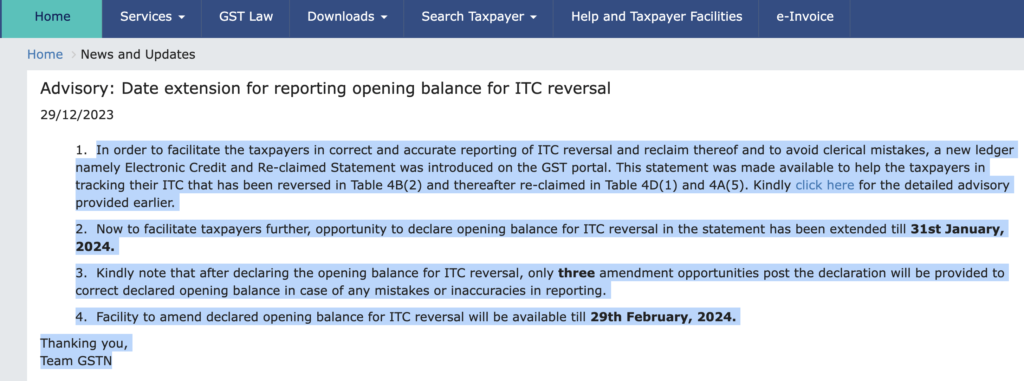

Below is advisory of Table 4 ITC Reversal:

In order to facilitate the taxpayers in correct and accurate reporting of ITC reversal and reclaim thereof and to avoid clerical mistakes, a new ledger namely Electronic Credit and Re-claimed Statement is being introduced on the GST portal. This statement will help the taxpayers in tracking of their ITC that has been reversed in Table 4B(2) and thereafter re-claimed in Table 4D(1) and 4A(5) for each return period, starting from August return period. For a detailed advisory please click here

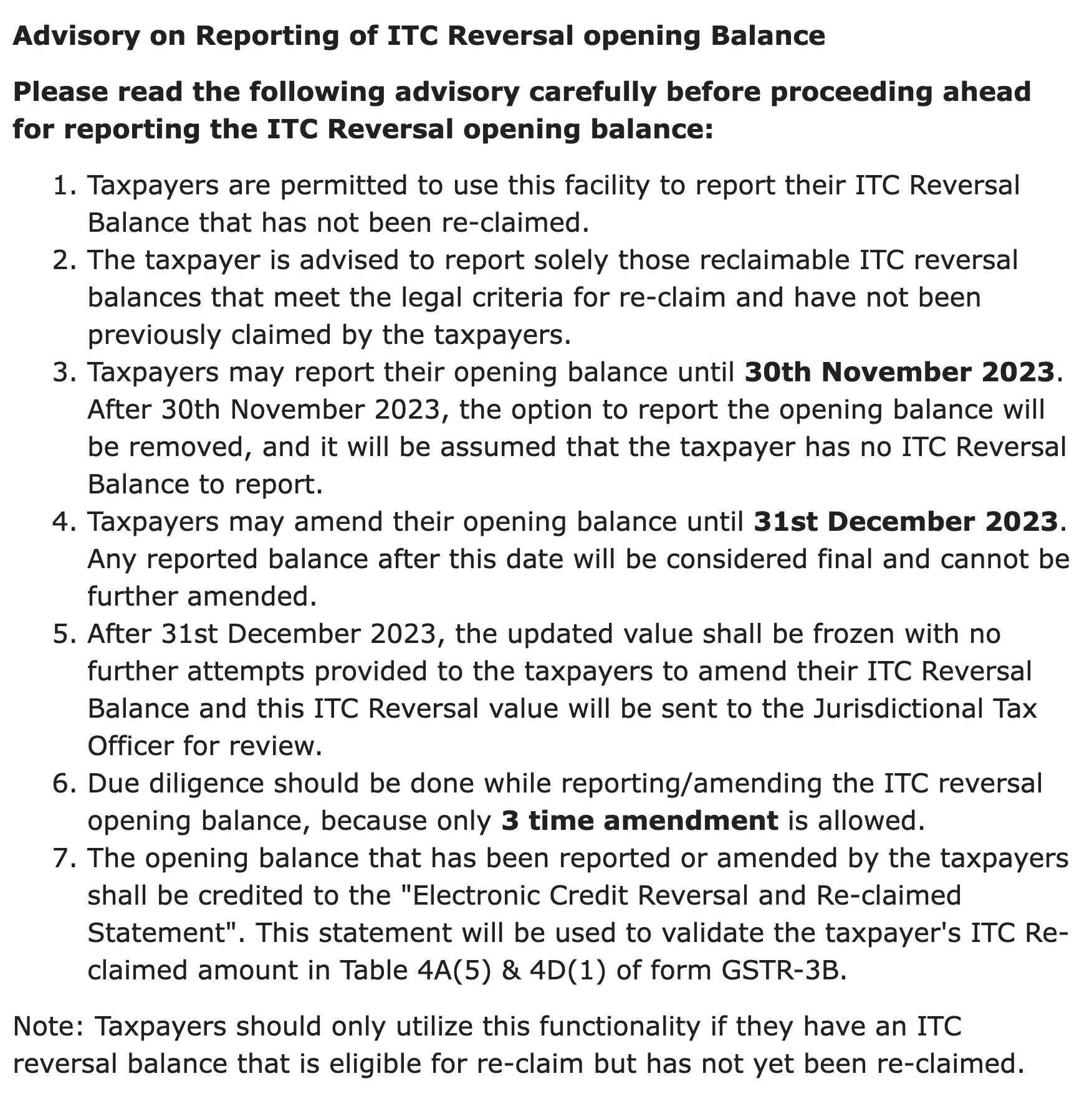

- Taxpayers are permitted to use this facility to report their ITC Reversal Balance that has not been re-claimed.

- The taxpayer is advised to report solely those reclaimable ITC reversal balances that meet the legal criteria for re-claim and have not been previously claimed by the taxpayers.

- Taxpayers may report their opening balance until 30th November 2023 (Extended Date 31 January 2024) After 30th November 2023, the option to report the opening balance will be removed, and it will be assumed that the taxpayer has no ITC Reversal Balance to report.

- Taxpayers may amend their opening balance until 31st December 2023 (Extended Date 29 February 2024) Any reported balance after this date will be considered final and cannot be further amended.

- After 31st December 2023, the updated value shall be frozen with no further attempts provided to the taxpayers to amend their ITC Reversal Balance and this ITC Reversal value will be sent to the Jurisdictional Tax Officer for review.

- Due diligence should be done while reporting/amending the ITC reversal opening balance, because only 3 time amendment is allowed.

- The opening balance that has been reported or amended by the taxpayers shall be credited to the “Electronic Credit Reversal and Re-claimed Statement”. This statement will be used to validate the taxpayer’s ITC Re-claimed amount in Table 4A(5) & 4D(1) of form GSTR-3B.

Note: Taxpayers should only utilize this functionality if they have an ITC reversal balance that is eligible for re-claim but has not yet been re-claimed.

The Government has notified certain changes in Table 4 of Form GSTR-3B to enable taxpayers in reporting correct information regarding ITC availed, ITC reversal, ITC re-claimed and ineligible ITC vide Notification No. 14/2022 – Central Tax dated 05th July, 2022 (read with circular 170/02/2022-GST, Dated 6th July,2022).

Accordingly, the reclaimable ITC earlier reversed in Table 4(B)2 may be subsequently claimed in Table 4(A)5 on fulfilment of necessary conditions. Such reclaimed ITC in Table 4(A)5 also needs to be explicitly reported in Table 4D(1).

1) In order to facilitate the taxpayers in correct and accurate reporting of ITC reversal and reclaim thereof and to avoid clerical mistakes, a new ledger namely Electronic Credit and Re-claimed Statement is being introduced on the GST portal.

This statement will help the taxpayers in tracking of their ITC that has been reversed in Table 4B(2) and thereafter re-claimed in Table 4D(1) and 4A(5) for each return period, starting from August return period.

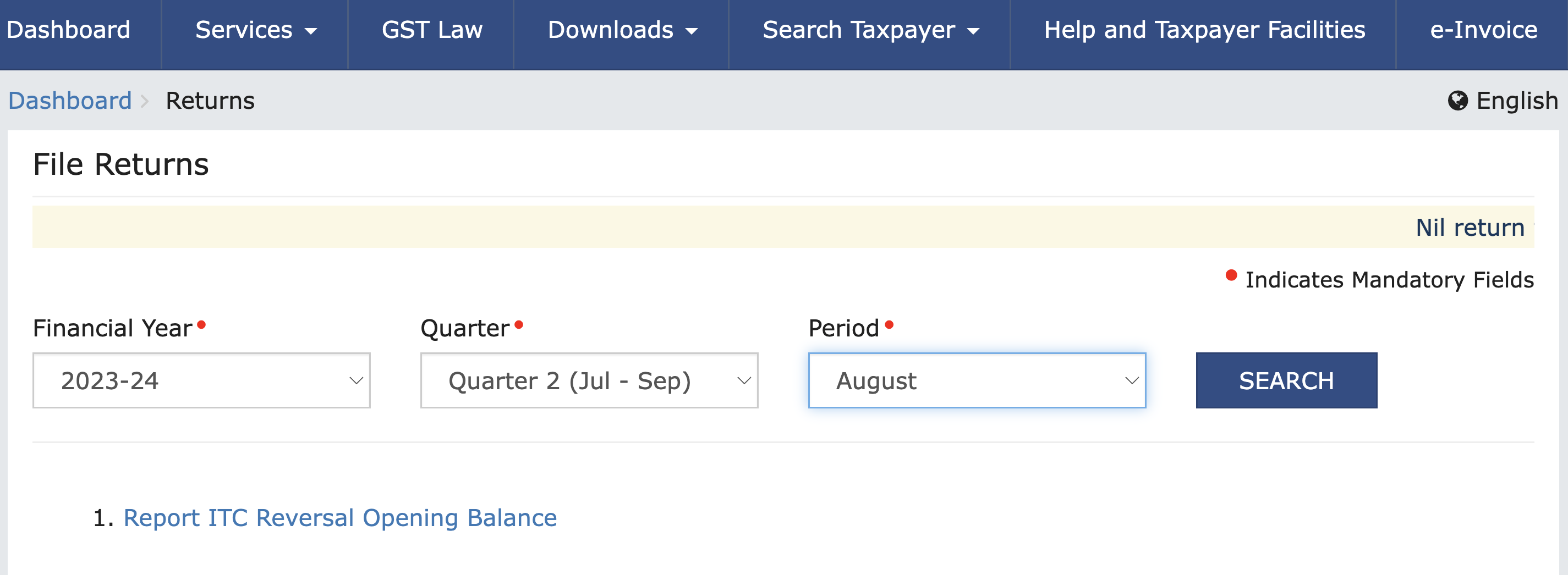

2) This statement shall facilitate that while re-claiming ITC in GSTR-3B, the amount aligns appropriately with the corresponding reversed ITC. This aims to improve the overall consistency and correctness of ITC reversal and re-claims related transactions. For Monthly taxpayers, the specified return period pertains to August 2023. For those filing quarterly returns, the specified return period corresponds to Q2 of the financial year 2023-24, encompassing the months of JulySeptember 2023.

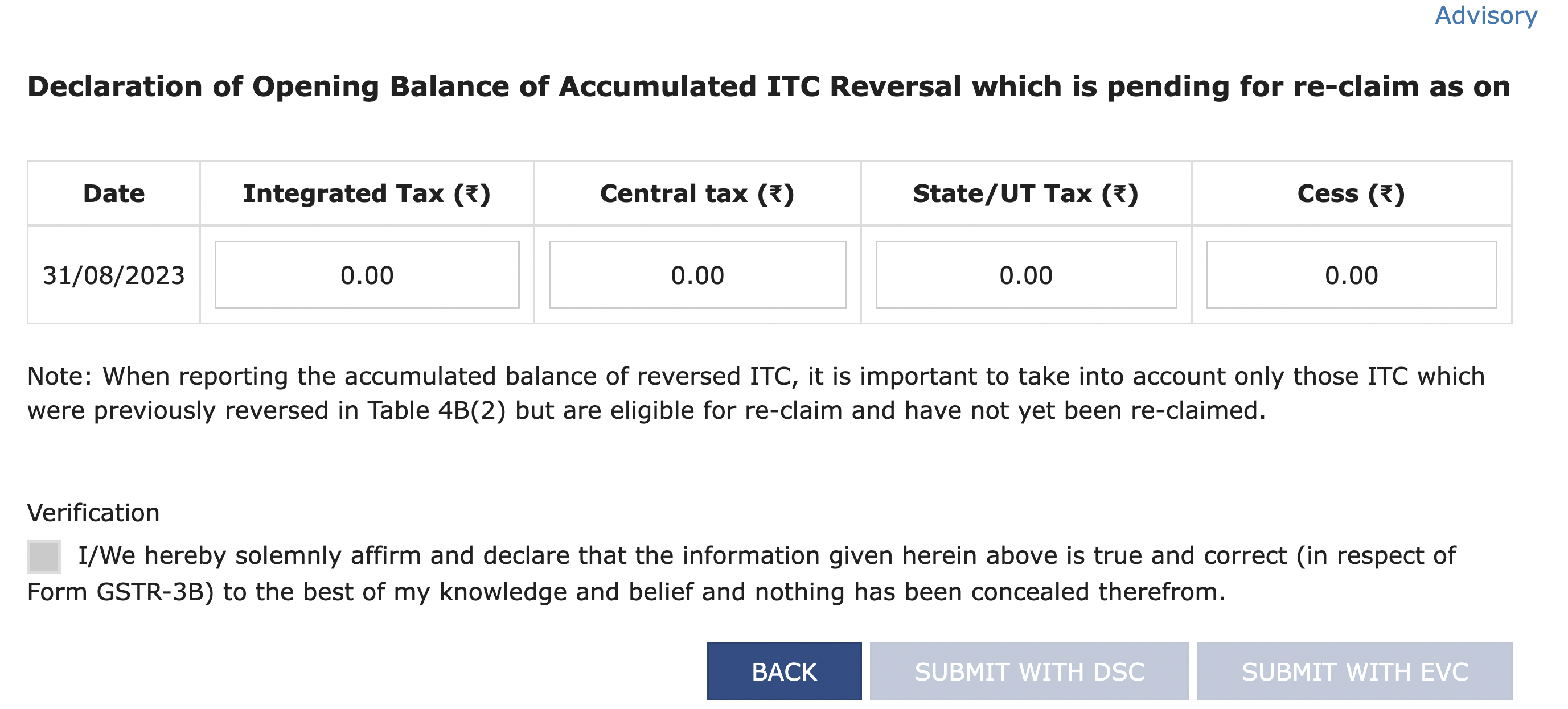

3) Taxpayers are being provided a facility to report their cumulative ITC reversal (ITC that has been reversed earlier and has not yet been reclaimed) as opening balance for “Electronic Credit Reversal and Re-claimed Statement”, if any.

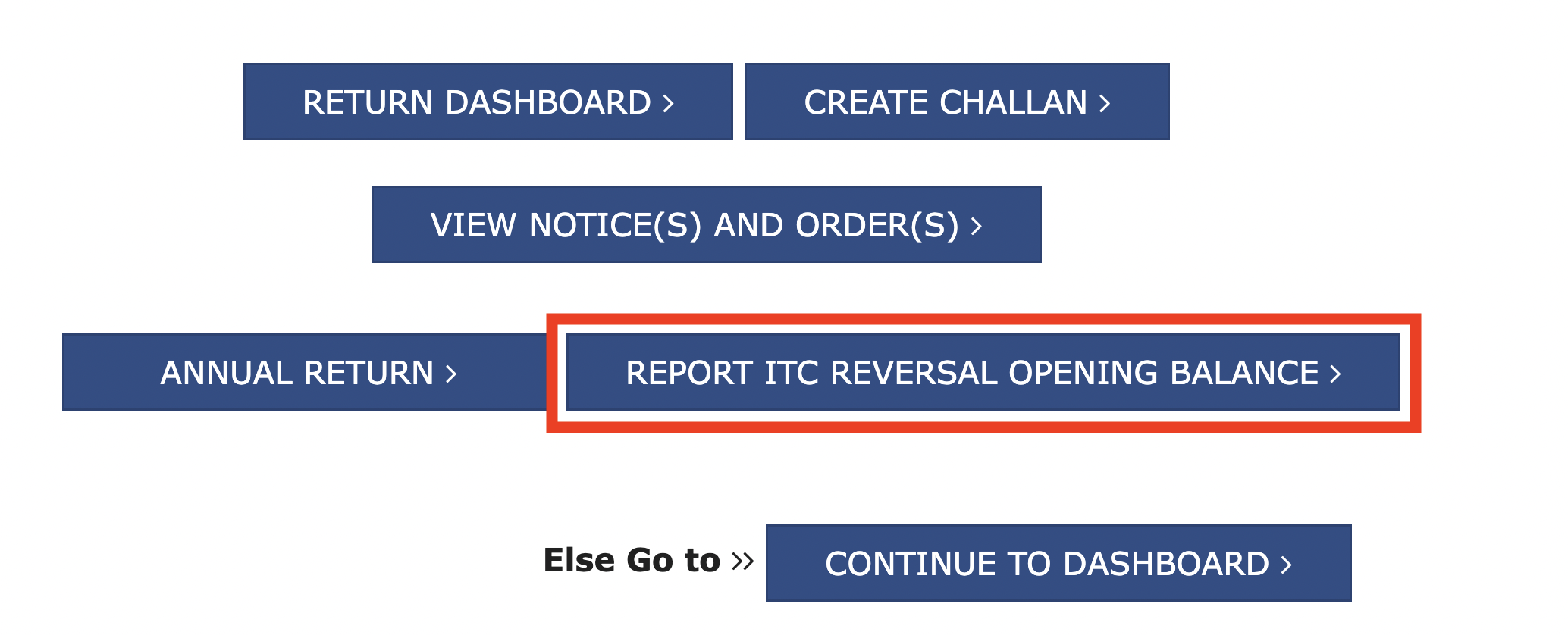

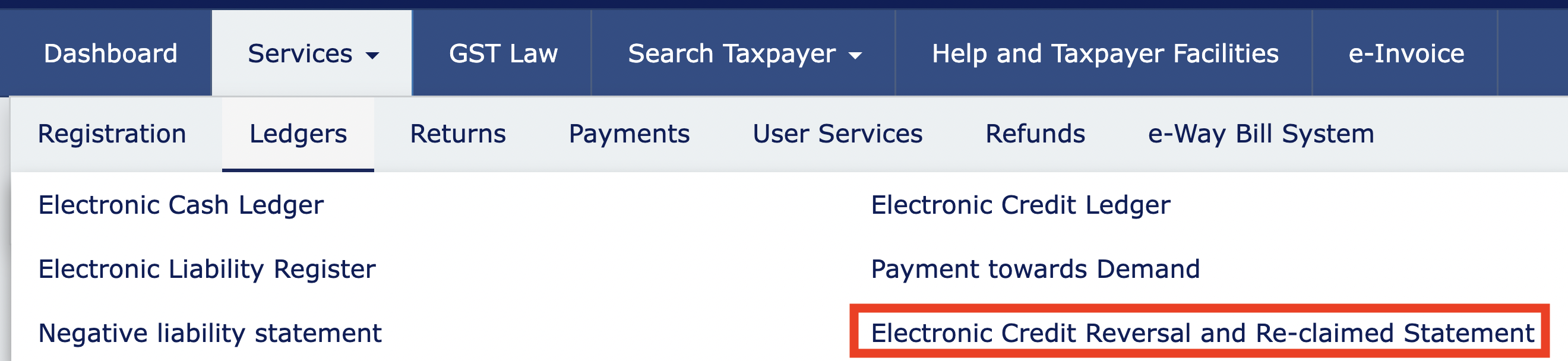

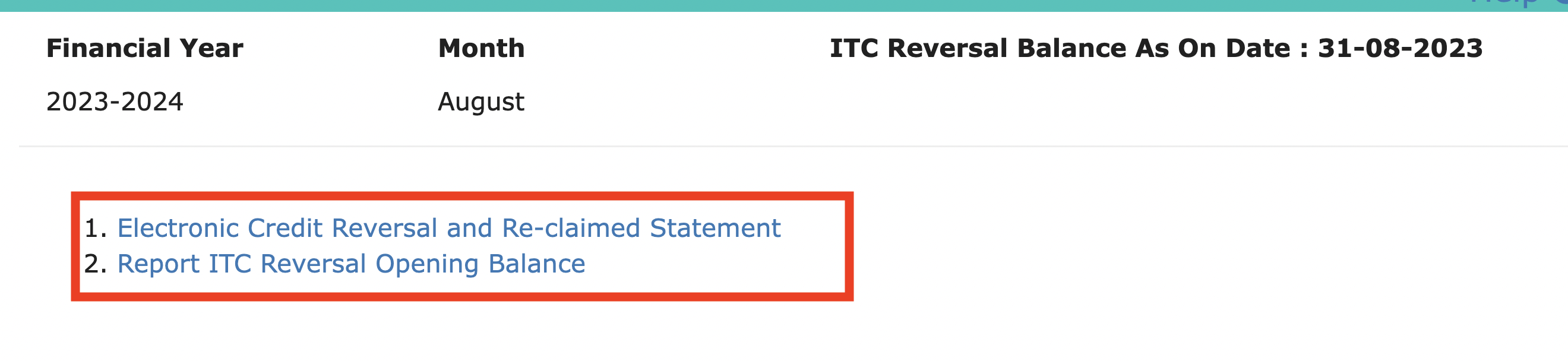

The navigation to report ITC reversal balance: Login >> Report ITC Reversal Opening Balance. or Services >> Ledger >> Electronic Credit Reversal and Re-claimed Statement >> Report ITC Reversal Opening Balance

a. Taxpayers having monthly filing frequency are required to report their opening balance considering the ITC reversal done till the return period of July 2023.

b. In contrast, quarterly taxpayers shall report their opening balance up to Q1 of the financial year 2023-24, considering the ITC reversal made till the April-June 2023 return period.

c. The taxpayers have the opportunity to declare their opening balance for ITC reversal Until 30th November 2023.

d. The taxpayers shall also be provided 3 (three) amendment opportunities to correct their opening balance in case of any mistakes or inaccuracies in reporting. Importantly, until 30th November 2023, both reporting and amendment facilities are accessible.

e. However, after 30th November till 31st December 2023, only amendments will be permitted and the option for fresh reporting will not be available.

This amendment facility shall be discontinued after 31st December 2023.

4) With the provision for taxpayers to report their accumulated ITC reversal balance, the portal will subsequently maintain a record of reversal and re-claimed amounts on a return period basis in statement.

Hence, a validation mechanism is incorporated into the GSTR-3B form. This validation will trigger a warning message if a taxpayer attempts to re-claim excess ITC in table 4D(1) than the available ITC reversal balance in the statement along with ITC reversal made in current return period in Table 4B(2). This warning message would facilitate accurate reporting but the taxpayers will still have the option to proceed with filing. However, the taxpayers are advised not to reclaim ITC exceeding the closing balance of “Electronic Credit Reversal and Re-claimed Statement” and may report their pending reversed ITC, if any, as ITC reversal opening balance.

5) For monthly taxpayers, the warning message will commence appearing from the GSTR-3B filing for the August 2023 return period. Similarly, for quarterly taxpayers this warning message would start from the filing period covering July to September 2023.

Ma’am you explained excellent .

Ma’am you explained good