The Central Board of Direct Taxation has framed new rules for company-provided rent-free homes. It has lowered the tax for employees staying in such accommodations, effective 1 September 2023.

Employees who are given unfurnished rent-free accommodation from non-government sources will get a reduction in the valuation of such houses i.e., their taxable base will come down.

Rent-free accommodation is a perquisite given to an employee by the employer where an employee gets a place to live without paying much or anything at all. It’s a work-related benefit that’s part of the employee’s income and is taxed under ‘Salaries’.

The new rules have reduced the taxable value of rent-free accommodation, which means employees will pay less tax. This implies that it will increase their take-home salary.

As per the new rules, the rates at which such perquisites could be valued have been reduced. With this reduction, while the total salary value will seem reduced resulting in lower TDS, however, the in-hand salary or the cash component of the salary to the employees may seem higher vis-a-vis the TDS, subject to other perquisites and deductions.

Shashank Agarwal, Advocate, Delhi HC simplifies this:

For example, under previous rules, if X is offered a salary of Rs 1000 and the value of accommodation at 15% comes to be Rs 150, then the total salary (salary and perquisites) will be Rs 1,150/-. On this salary, say 10% TDS is applicable, then the net salary receivable in hand Rs 885 (1000 – 115), subject to other perquisites and deductions.

Under new rules, assuming the same salary and that the same accommodation is now valued at 10% comes to be Rs100, then the total salary (salary and perquisites) will be Rs.1,100/-. On this salary, assuming 10% TDS is applicable, then the net salary receivable in hand is Rs.890 (1000 – 110), subject to other perquisites and deductions.

Nuances

The rules provide for a more nuanced approach to taxation, after considering factors like the type of accommodation, location, and whether it’s furnished or unfurnished.

“Employees are required to pay close attention to these changes, as they may substantially impact take-home pay and tax liabilities. Moreover, introducing an inflation-linked cap for accommodations occupied for over a year adds another layer of complexity to the calculation process,” said Vipul Jai, Partner, PSL Advocates & Solicitors.

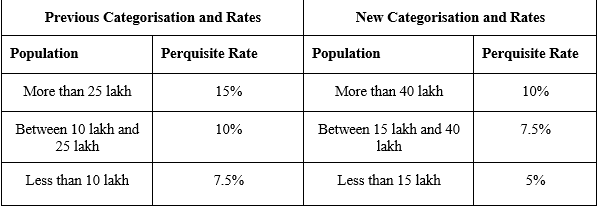

Further, the categorisation and the limits of cities and population have now been based on the 2011 census as against the 2001 census.

According to Jai, if an employee is working in a city with a population of 40 lakh and his/her salary is Rs 10 lakh, then the value of the accommodation perquisite will be Rs 1 lakh (10% of Rs 10 lakh).

The value of rent-free provided to an employee by the employer is taxable as a prerequisite.

Also, the value of the perquisite will be capped to inflation. This means that the value of the perquisite cannot increase by more than the inflation rate in any year. For example, if the inflation rate in a particular year is 5%, then the value of the accommodation perquisite cannot increase by more than 5% in that year.

The new rules also provide for a few exceptions, explains Jai. For example, the value of the accommodation perquisite will be nil if the accommodation is:

•Used wholly and exclusively for the performance of official duties by the employee.

•Provided to the employee on payment of a rent which is equal to or more than the fair market rent of the accommodation.