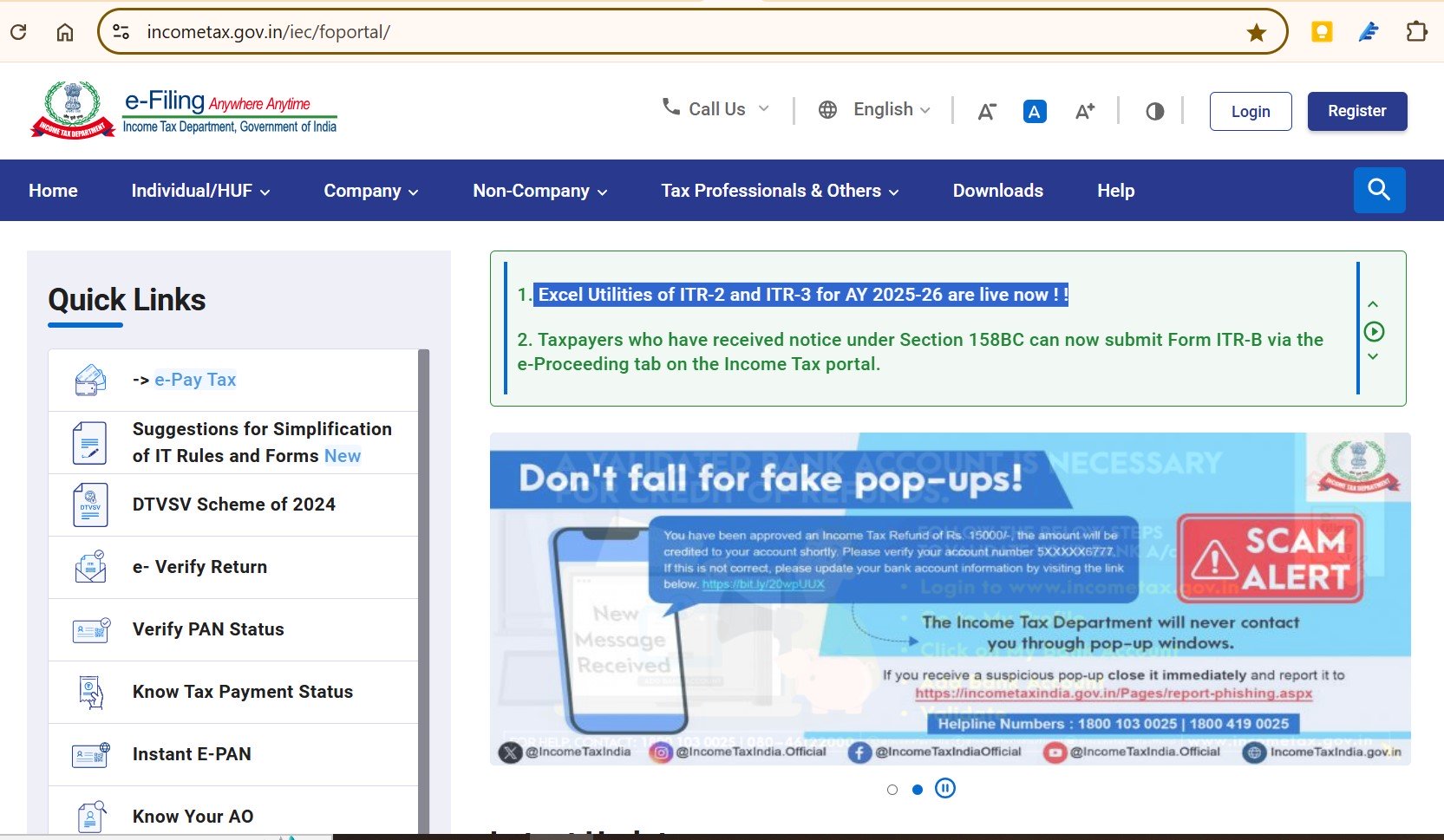

The Income Tax Department of India has officially released the Excel utilities for ITR-1 and ITR-4 for the Assessment Year 2025-26, marking the beginning of this year’s return filing season. The utilities are designed to help taxpayers prepare and file their income tax returns efficiently.

✅ Key Updates from Income Tax Portal

- Availability Announcement:

- Excel Utilities for ITR-1 and ITR-4 are now live and available for download from the official income tax portal: https://www.incometax.gov.in.

- Deadline Extended:

- The due date for filing ITRs (original returns) for AY 2025–26 (normally 31st July 2025) has been extended to 15th September 2025.

- Users are warned against suspicious pop-ups and advised to report phishing attempts via the official reporting page.

📄 What is ITR-1 (Sahaj)?

ITR-1 is applicable to resident individuals having:

- Income from salary/pension

- Income from one house property

- Income from other sources (excluding lottery winnings and income from racehorses)

- Total income not exceeding ₹50 lakh

Not applicable for:

- Directors in a company

- Individuals holding unlisted equity shares

- Agricultural income > ₹5,000

- Foreign assets or income

📘 Features of the Excel Utility for ITR-1 (AY 2025–26)

This year’s utility continues to provide a user-friendly, form-based interface with macro-enabled features. Below is a summary of the important sheets in the .xlsm utility:

1. Income Details

Captures:

- General Information (Name, PAN, Aadhaar, Date of Birth, etc.)

- Filing Status (original/revised)

- Income breakdown (salary, house property, other sources)

- Deductions under Chapter VI-A

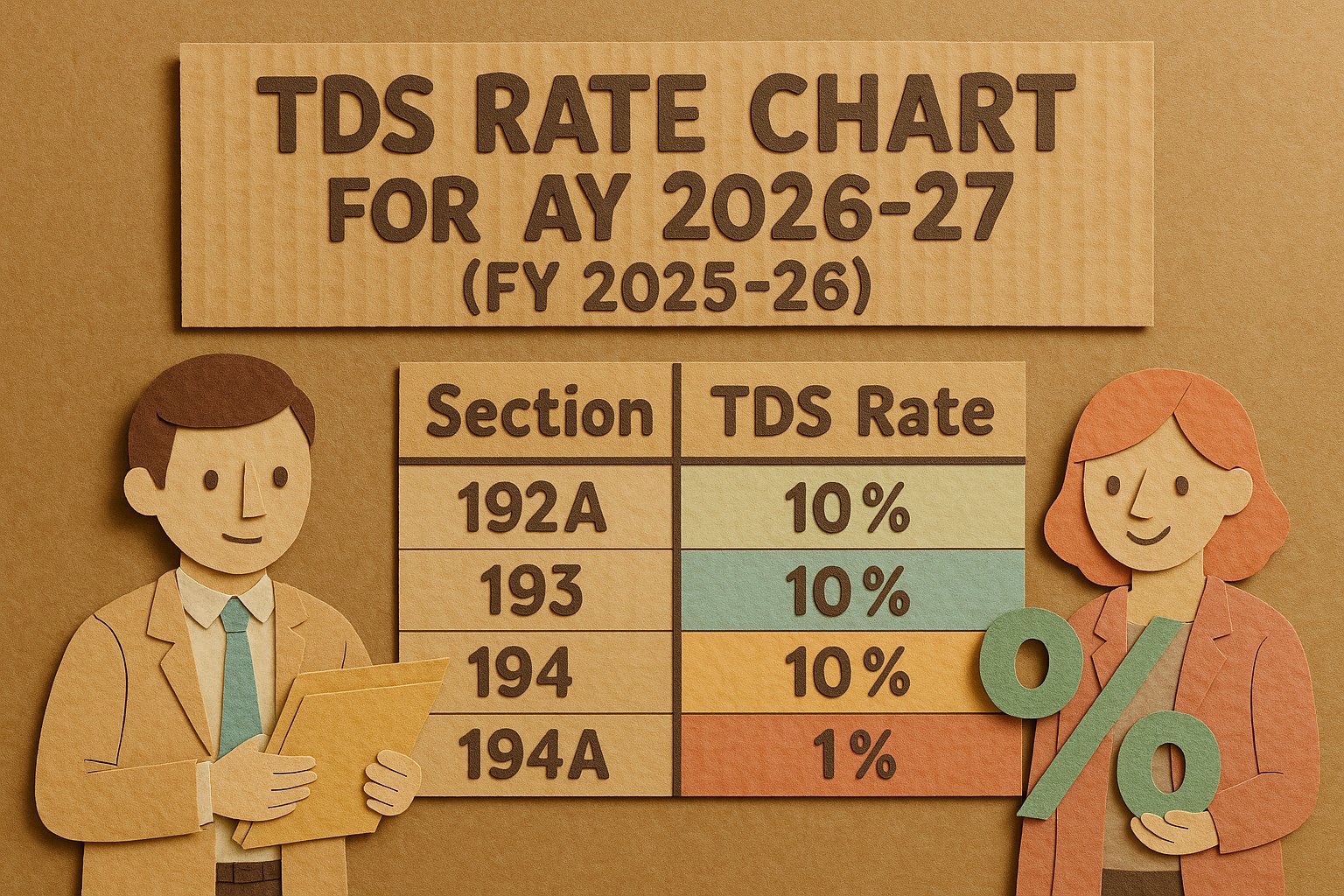

2. TDS (Tax Deducted at Source)

Details:

- TDS from Salary (Form 16 – TAN, Name of Deductor, Amount)

- TDS from other income (Form 16A)

- Pre-filled values can be verified and edited

3. Taxes Paid and Verification

Consolidates:

- Advance Tax

- Self-Assessment Tax

- TDS and TCS claimed

- Refund calculation

- Tax payable

4. Schedule 80C to 80U

Includes individual tabs like:

- 80C (LIC, PPF, Tuition Fees)

- 80D (Health Insurance)

- 80G (Donations)

- 80E, 80EEA, 80EEB (Loans and Interest)

- 80U (Disability), 80DD (Dependents)

5. Summary and Verification

Provides a clear summary of tax computation and allows for final verification, including selection of declaration method:

- Aadhaar OTP

- Net Banking

- EVC via bank account or Demat

📥 How to Use the Excel Utility

- Download the ITR-1 Excel Utility from the Income Tax Portal.

- Enable Macros upon opening the file in MS Excel.

- Fill in all required sheets with accurate details.

- Validate using the “Validate” buttons available within sheets.

- Generate JSON using the “Generate JSON” button.

- Upload JSON to the income tax portal through your login.

📝 Tips for Smooth Filing

- Always double-check pre-filled data from AIS/TIS (Annual Information Statement).

- Keep documents like Form 16, interest certificates, and investment proofs handy.

- Use the latest version of the utility and make sure Excel security settings allow macro execution.

- File early to avoid last-minute server issues.

You can contact team of Tax Experts to file Your ITR at 9150010300 or visit www.legalsahayak.com

The Excel-based ITR filing remains a reliable and accessible method for salaried individuals, especially those who prefer offline preparation. With the due date extension to 15th September 2025, taxpayers have more time this year, but early filing is always advised.

Visit www.cagurujiclasses.com for practical courses