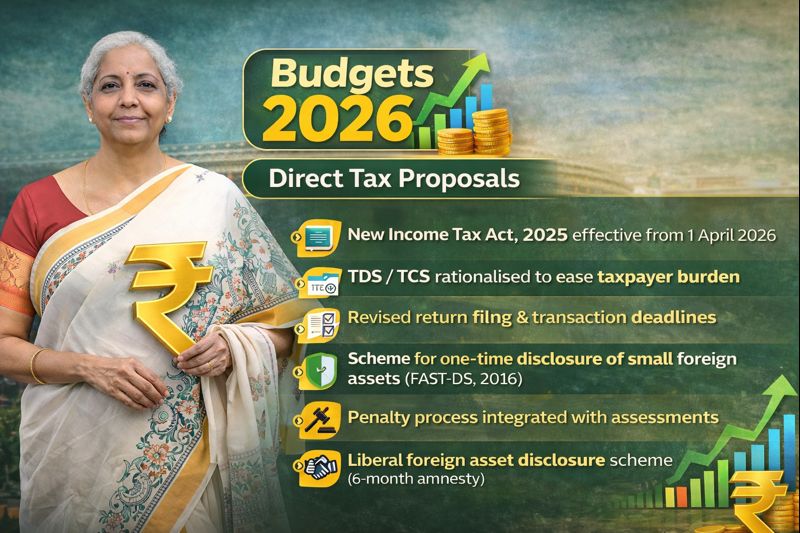

Direct Tax Proposals in Budget 2026

In Budget 2026, the Government has unveiled a comprehensive and forward-looking set of Direct Tax reforms, aimed at simplifying tax laws, reducing litigation, easing compliance, and strengthening India’s attractiveness as a global investment destination. The proposals reflect a clear shift from a punitive, process-heavy tax framework to a trust-based, technology-driven, and taxpayer-friendly system, aligned with the national vision of Viksit Bharat.

1. New Income Tax Act – A Structural Reset

A landmark reform announced in Budget 2026 is the replacement of the Income-tax Act, 1961 with the Income-tax Act, 2025, which will come into force from 1 April 2026.

The new law is designed to be:

- Significantly simpler and more concise, with substantially fewer chapters and provisions

- Written in clear and direct language, reducing interpretational disputes

- Easier for both taxpayers and tax administrators to understand and apply

Simplified Income-tax Rules and Forms will be notified shortly, and return forms have been redesigned so that ordinary citizens can comply without professional difficulty.

2. Ease of Living – Key Relief Measures for Taxpayers

Several proposals directly address long-standing pain points faced by individuals:

Exemption for MACT Interest

- Any interest awarded by the Motor Accident Claims Tribunal (MACT) to a natural person will be fully exempt from income tax.

- No TDS will be applicable on such interest, irrespective of the amount.

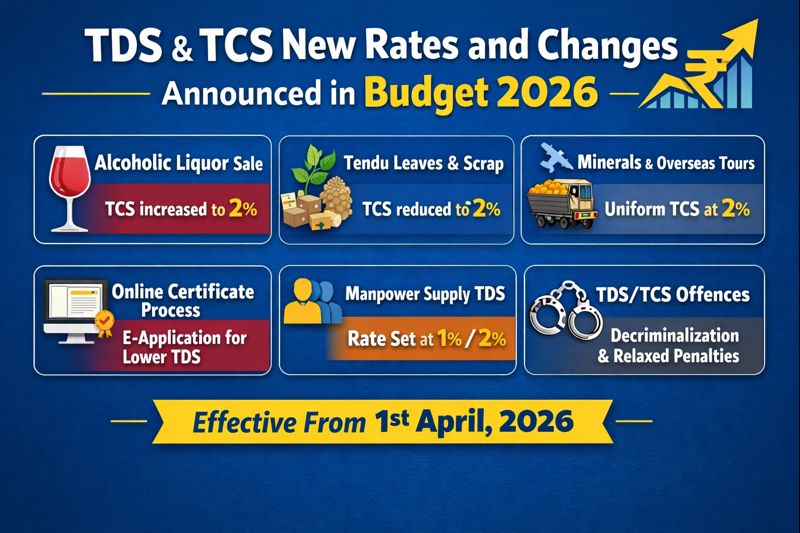

Rationalisation of TCS under LRS and Overseas Spending

- TCS on overseas tour packages reduced to 2%, replacing the earlier 5% / 20% structure, with no minimum amount condition.

- TCS for education and medical remittances under LRS reduced from 5% to 2%.

Clarity on TDS for Manpower Supply

- Supply of manpower services is explicitly classified as payment to contractors.

- Applicable TDS rate restricted to 1% or 2%, eliminating ambiguity and litigation.

Automated Lower / Nil TDS Certificates

- Small taxpayers will be able to obtain lower or nil TDS certificates through a rule-based automated system, without approaching the Assessing Officer.

Simplification of Form 15G / 15H

- Depositories will be empowered to accept Form 15G / 15H centrally and transmit it to multiple companies, avoiding repetitive filings by investors.

3. Rationalisation of Return Filing Timelines

To reduce last-minute compliance stress:

- Revised / belated returns can now be filed up to 31st March (instead of 31st December), on payment of a nominal fee.

- Staggered ITR due dates introduced:

- ITR-1 and ITR-2 (individuals): 31st July

- Non-audit business cases and trusts: 31st August

4. Relief in Property Transactions with NRIs

In a major compliance relief:

- For purchase of immovable property from a non-resident, the resident buyer is no longer required to obtain TAN.

- TDS will be deposited using a PAN-based challan, similar to resident-to-resident transactions.

5. One-Time Foreign Asset Disclosure Scheme (FAST-DS, 2026)

To address genuine hardship faced by small taxpayers such as students, young professionals, tech employees, relocated NRIs, etc., a one-time 6-month disclosure scheme has been introduced.

Category A

- Undisclosed overseas income / asset up to ₹1 crore

- Payment required:

- 30% tax

- 30% additional tax (in lieu of penalty)

- Immunity from prosecution granted

Category B

- Asset value up to ₹5 crore

- Payment of ₹1 lakh fee only

- Complete immunity from penalty and prosecution

Additionally, immunity from prosecution is retrospectively extended for non-immovable foreign assets below ₹20 lakh.

6. Rationalisation of Penalty and Prosecution Framework

To reduce litigation and harassment:

- Assessment and penalty proceedings will be consolidated into a single common order.

- No interest on penalty amount during pendency of first appeal.

- Pre-deposit reduced from 20% to 10%, computed only on core tax demand.

Updated Returns Even After Reassessment

- Taxpayers can file updated returns even after reassessment has begun, by paying additional 10% tax, and such updated return will form the basis of proceedings.

Penalty to Fee Conversion

- Certain technical penalties (audit default, TP report, SFT non-filing) will be converted into fee-based defaults, reducing criminal exposure.

Decriminalisation & Proportional Punishment

- Minor offences attract fine only.

- Most prosecutions converted to simple imprisonment, with maximum term reduced to two years.

- Punishment graded based on quantum of tax evasion.

7. Cooperatives – Targeted Tax Relief

Key benefits for cooperative societies include:

- Extension of deduction to supply of cattle feed and cotton seed by primary cooperatives.

- Inter-cooperative dividend income allowed as deduction under the new tax regime, to prevent double taxation.

- Three-year dividend exemption for notified national cooperative federations, subject to onward distribution.

8. Boost to IT Sector & Transfer Pricing Certainty

Recognising IT services as India’s growth engine:

- All IT and IT-enabled services clubbed under “Information Technology Services”.

- Uniform safe harbour margin of 15.5%.

- Threshold raised from ₹300 crore to ₹2,000 crore.

- Safe harbour approvals to be fully automated and valid for 5 years.

- Fast-track unilateral APA for IT services with targeted 2-year completion.

9. Attracting Global Business & Talent

Major proposals include:

- Tax holiday till 2047 for foreign companies providing global cloud services using Indian data centres.

- Safe harbour of 15% cost margin for related data-centre service entities.

- 5-year tax exemption for non-residents providing capital goods to toll manufacturers in bonded zones.

- Exemption of global (non-India sourced) income of foreign experts staying in India up to 5 years.

- MAT exemption for all non-residents taxed on a presumptive basis.

10. Tax Administration Reforms

- ICDS to be merged into Ind-AS, eliminating separate tax accounting from FY 2027-28.

- Definition of “accountant” rationalised to support Indian advisory firms going global.

11. Other Significant Tax Measures

- Buyback taxation shifted to capital gains for all shareholders, with additional tax for promoters to curb arbitrage.

- TCS on liquor, scrap, minerals reduced to 2%; tendu leaves from 5% to 2%.

- STT increased on futures and options.

- MAT made a final tax from 1 April 2026, rate reduced to 14%, with limited set-off of past MAT credit.

The Direct Tax proposals in Budget 2026 represent a decisive move towards simplicity, certainty, and trust-based taxation. With a new Income-tax Act, far-reaching compliance relief, rationalised penalties, and strong incentives for investment and global integration, the reforms aim to balance revenue needs with taxpayer confidence and economic growth.

Read all Budget Documents from here

Visit www.cagurujiclasses.com for practical courses