Big News in GST Returns!

📊 The introduction of GSTR-1A on the GSTN portal will allow taxpayers to revise their GSTR-1 returns within the month before filing GSTR-3B. Updated values will auto-populate into GSTR-3B for seamless compliance. Taxpayers are advised to wait for the final announcement by the GST Council. If GSTR-1A is implemented, the GST portal will need time to be updated for this new functionality. Stay tuned for more updates from the 53rd GST Council meeting on June 22, 2024!

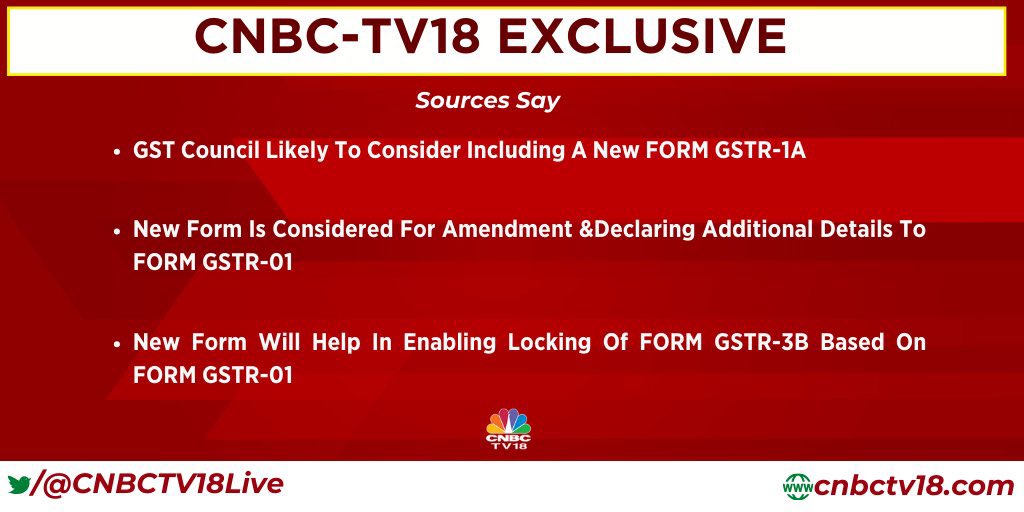

The GST Council is set to hold its 53rd meeting on June 22, 2024, in New Delhi. This meeting, coming after a nine-month gap, has generated considerable anticipation among taxpayers and industry stakeholders. One of the major topics expected to be discussed is the potential introduction of a new GST return form, GSTR-1A.

What is GSTR-1A?

As per recent news reports, the GST Council might launch the new return form, GSTR-1A, which aims to provide more flexibility for taxpayers in amending their filed returns. This form is designed to allow taxpayers to amend or add records within the same month/period after filing GSTR-1 and before filing GSTR-3B. Currently, taxpayers are unable to modify GSTR-1 in the same period once it has been filed; any amendments or missed records must be reported in the GSTR-1 of the subsequent return period.

Key Features of GSTR-1A

1. Same Period Amendment:

- GSTR-1A will enable taxpayers to amend their filed GSTR-1 within the same return period.

- This means that any corrections or additions can be made in the same month before filing GSTR-3B.

2. Seamless Compliance:

- The amended liability will automatically populate into GSTR-3B, ensuring that the correct liability is discharged.

- This feature promotes efficient and accurate reporting, reducing the chances of errors and the need for subsequent adjustments.

3. Efficient Reporting:

- By allowing amendments within the same period, GSTR-1A aims to streamline the compliance process for taxpayers.

- This reduces the administrative burden and enhances the accuracy of tax reporting.

Implications for Taxpayers

The introduction of GSTR-1A is expected to bring significant benefits to taxpayers by simplifying the amendment process and ensuring timely corrections. However, taxpayers are advised to await the final announcement from the GST Council regarding the implementation of GSTR-1A. If the new form is approved, the GST portal will require updates to accommodate this functionality, which may take some time.

Upcoming GST Council Meeting

The GST Council’s 53rd meeting will be closely watched as it marks the first meeting under the new government. Apart from the potential introduction of GSTR-1A, taxpayers and industry bodies are expecting other crucial decisions that could impact the GST framework and compliance requirements.

Conclusion

The proposed GSTR-1A form represents a significant step towards enhancing the flexibility and efficiency of GST compliance. Taxpayers should stay informed about the outcomes of the upcoming GST Council meeting on June 22, 2024, and prepare for any changes that may be announced. The potential introduction of GSTR-1A highlights the Council’s ongoing efforts to streamline GST processes and support taxpayer needs.

Visit www.cagurujiclasses.com for practical courses