In a significant development, the Centralized Processing Cell (TDS) has reprocessed the TDS returns for the fiscal year 2023-24. The reprocessing has resulted in the removal of short deduction demands from the returns affected by higher TDS/TCS rates due to the non-linkage of PAN with Aadhaar, in accordance with the relaxation provided by Circular 6/2024.

Overview of Circular 6/2024

Circular 6/2024 was issued to provide relief to taxpayers who faced higher TDS/TCS rates due to the non-linkage of their PAN with Aadhaar. According to the circular, transactions up to March 31, 2024, were eligible for this relaxation provided the PAN was linked with Aadhaar by May 31, 2024. This measure aimed to alleviate the undue burden on taxpayers and streamline the compliance process.

Action Taken by CPC (TDS)

The CPC (TDS) has promptly acted on the provisions of the circular by reprocessing the affected TDS returns for FY 2023-24. This reprocessing has resulted in the removal of short deduction demands that arose due to the higher TDS/TCS rates enforced on non-linked PANs.

The reprocessing and subsequent removal of demands were completed in the first week of June 2024, as promised by the Income Tax Department. This swift action has provided much-needed relief to taxpayers who had faced discrepancies in their TDS returns due to the PAN-Aadhaar linkage issue.

Impact on Tax Professionals and Taxpayers

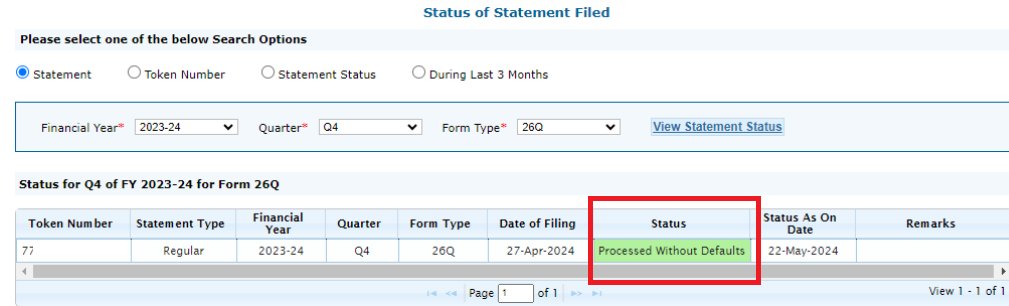

Tax professionals and taxpayers are advised to check the reprocessed TDS returns to ensure that the short deduction demands have been cleared. This step is crucial to confirm that the reprocessed returns reflect the correct TDS amounts and comply with the relaxation provided by Circular 6/2024.

How to Verify the Updated TDS Returns

Tax professionals and taxpayers can follow these steps to verify the updated TDS returns:

1. Log in to the TRACES Portal: Visit the TRACES (TDS Reconciliation Analysis and Correction Enabling System) portal and log in using your credentials.

2. Access the TDS Statement: Navigate to the relevant TDS statement for FY 2023-24.

3. Check for Updates: Review the statement to ensure that the short deduction demands have been removed.

4. Cross-verify with Circular 6/2024: Ensure that the adjustments made are in line with the provisions of Circular 6/2024.

The removal of short deduction demands from TDS returns for FY 2023-24, due to the relaxation provided by Circular 6/2024, is a welcome relief for taxpayers. The prompt action by the CPC (TDS) and the Income Tax Department underscores their commitment to resolving taxpayer issues efficiently.

Tax professionals and taxpayers should take immediate steps to verify their TDS returns to ensure accuracy and compliance. For any further clarifications or assistance, they may contact the Income Tax Department or their tax advisors.

Visit www.cagurujiclasses.com for practical courses