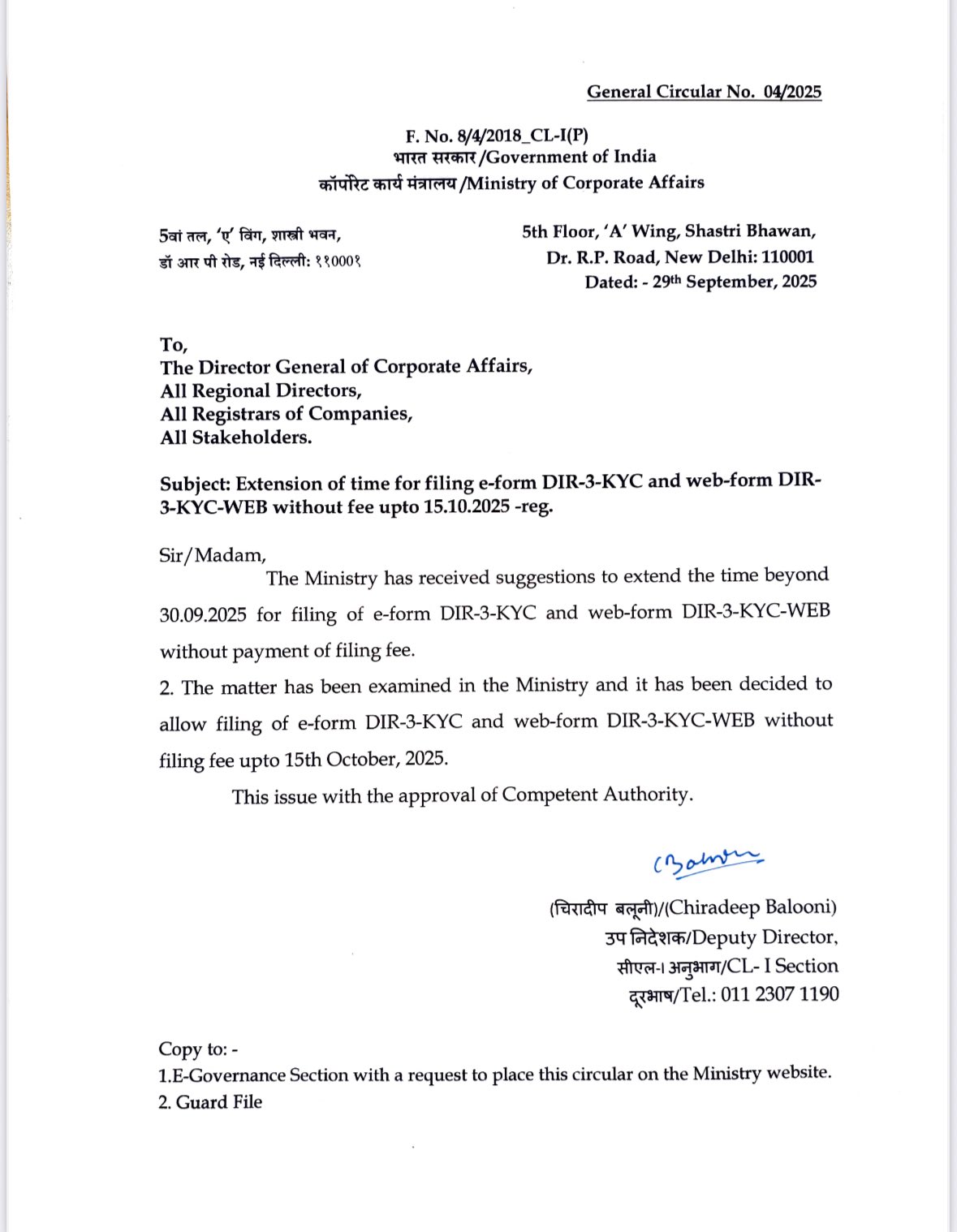

The Ministry of Corporate Affairs (MCA) has provided a major relief to company directors by extending the deadline for filing e-form DIR-3 KYC and web-form DIR-3 KYC-WEB without payment of fees.

Earlier, the last date for filing was 30th September 2025. Considering multiple representations and requests from stakeholders, the Ministry has now decided to extend the due date till 15th October 2025.

What is DIR-3 KYC?

The DIR-3 KYC (Know Your Customer) is a mandatory annual compliance requirement for all directors holding a Director Identification Number (DIN). It ensures that the details of directors such as mobile number, email ID, and personal information remain updated in MCA records.

There are two types of filings under this compliance:

- e-form DIR-3 KYC – to be filed by directors who have not filed DIR-3 KYC previously or need to update details.

- web-form DIR-3 KYC-WEB – to be filed by directors who have already filed the form in previous years and whose details remain unchanged.

Revised Deadline and Fee Implication

- Previous Due Date: 30th September 2025

- Extended Due Date: 15th October 2025

- Filing Fee Till 15th October 2025: Nil (No late fees)

- After 15th October 2025: A late filing fee of ₹5,000 per DIN will be applicable.

This extension gives directors additional time to complete their compliance without any financial burden.

Why is DIR-3 KYC Important?

Failure to file DIR-3 KYC can have serious implications:

- DIN of the director gets deactivated with the remark “Deactivated due to non-filing of DIR-3 KYC”.

- Director cannot file any forms on the MCA portal using the deactivated DIN.

- To reactivate, the director has to file the form with an additional penalty of ₹5,000.

Thus, timely filing ensures uninterrupted functioning of directors in company matters.

Key Takeaways from the MCA Extension

- Relief provided to directors and companies who were unable to file before 30th September.

- Smooth functioning of compliance due to additional time.

- Avoidance of penalty burden if filed before 15th October 2025.

Actionable Steps for Directors

- Check DIN Status on the MCA portal.

- File DIR-3 KYC (e-form or web-form) before the extended due date.

- Keep mobile number, email ID, PAN, and Aadhaar ready for OTP verification.

- Complete filing at the earliest to avoid last-minute rush and server issues.

The MCA’s extension till 15th October 2025 offers a welcome relief for directors across India. All directors with an active DIN must utilize this opportunity and ensure timely compliance. Delaying beyond this extended timeline will lead to penalties and unnecessary hassles.

👉 Stay compliant, stay penalty-free!

Visit www.cagurujiclasses.com for practical courses