In the 53rd GST Council meeting, major recommendations for GST changes were issued, and 16 new GST circulars were released on June 26, 2024. These include clarifications on GST liability and ITC availability in cases involving warranty or extended warranty, following Circular No. 195/07/2023-GST dated July 17, 2023. Additional clarifications were provided regarding ITC on premiums for life insurance policies not included in the taxable value, the taxability of transactions involving loans by overseas or Indian affiliates to related persons, and the availability of ITC on ducts and manholes used in optical fiber cable networks per Section 17(5) of the CGST Act, 2017. The meeting also addressed mechanisms for providing evidence of compliance with Section 15(3)(b)(ii) of the CGST Act, the time of supply for construction and maintenance services of national highway projects under the Hybrid Annuity Model (HAM), the place of supply for custodial services provided by banks to foreign portfolio investors, and measures to reduce government litigation by setting monetary limits for appeals. Further clarifications covered the valuation of imported services by related persons eligible for full ITC, special procedures for manufacturing specified commodities, ITC entitlement for insurance companies, and the time limit under Section 16(4) of the CGST Act, 2017.

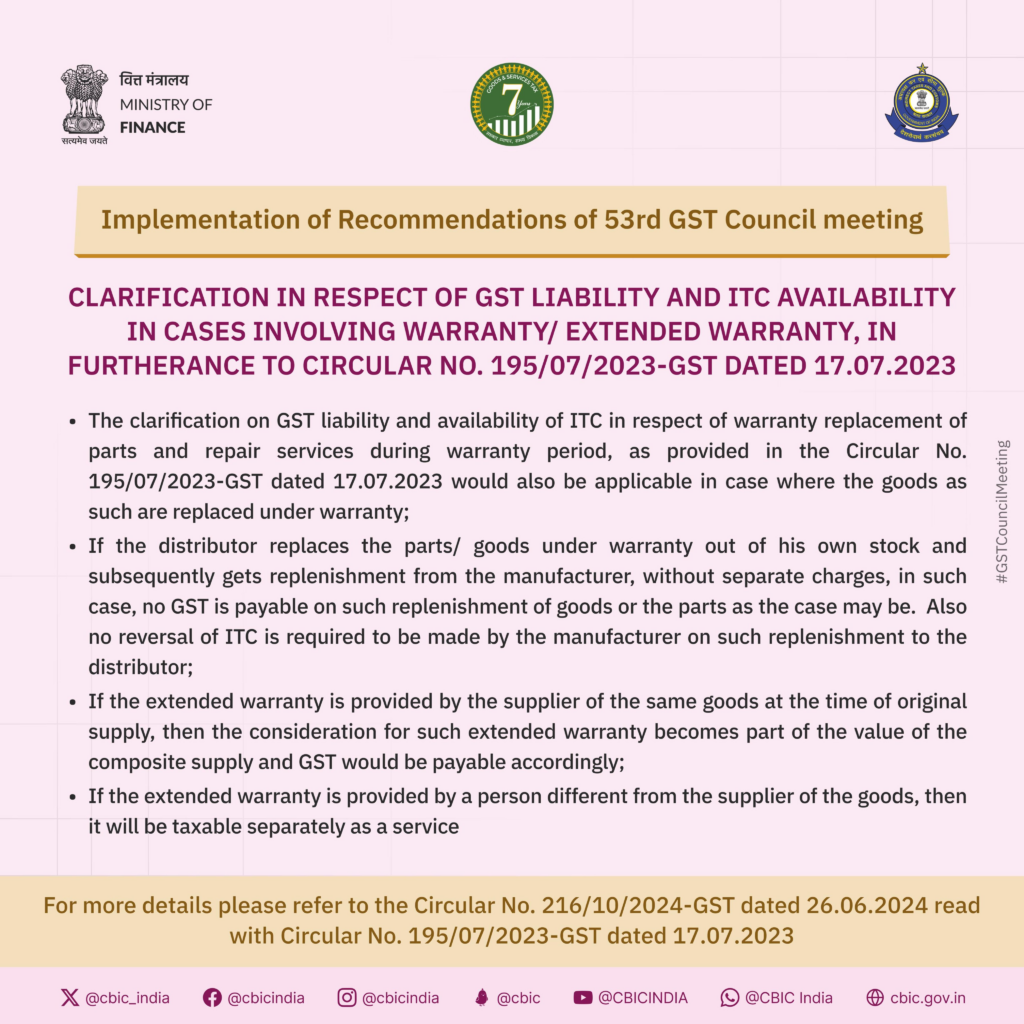

Clarification in respect of GST liability and ITC availability in cases involving warranty/extended warranty, in furtherance of Circular No. 195/07/2023-GST dated 17.07.2023

Watch this detailed video also

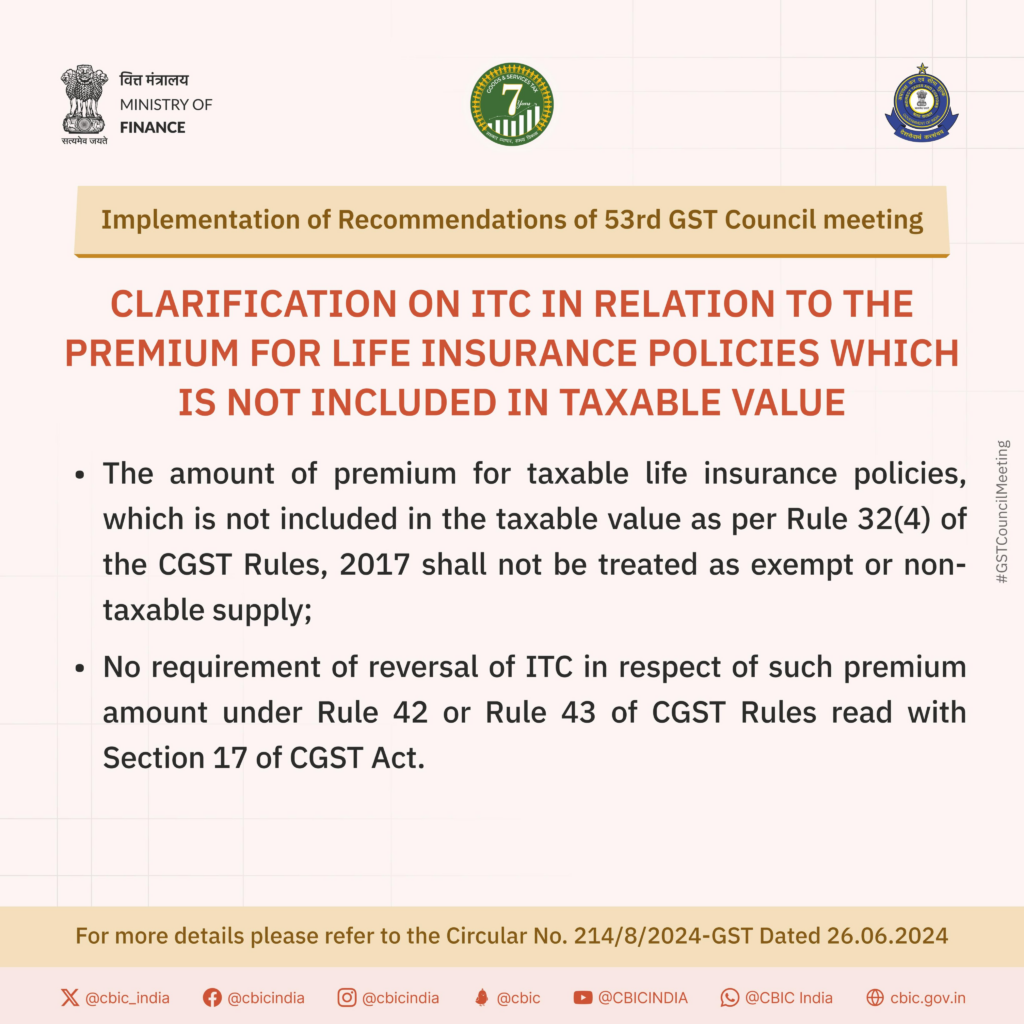

Clarification on ITC in relation to the Premium for Life Insurance Policies which is not included in taxable value

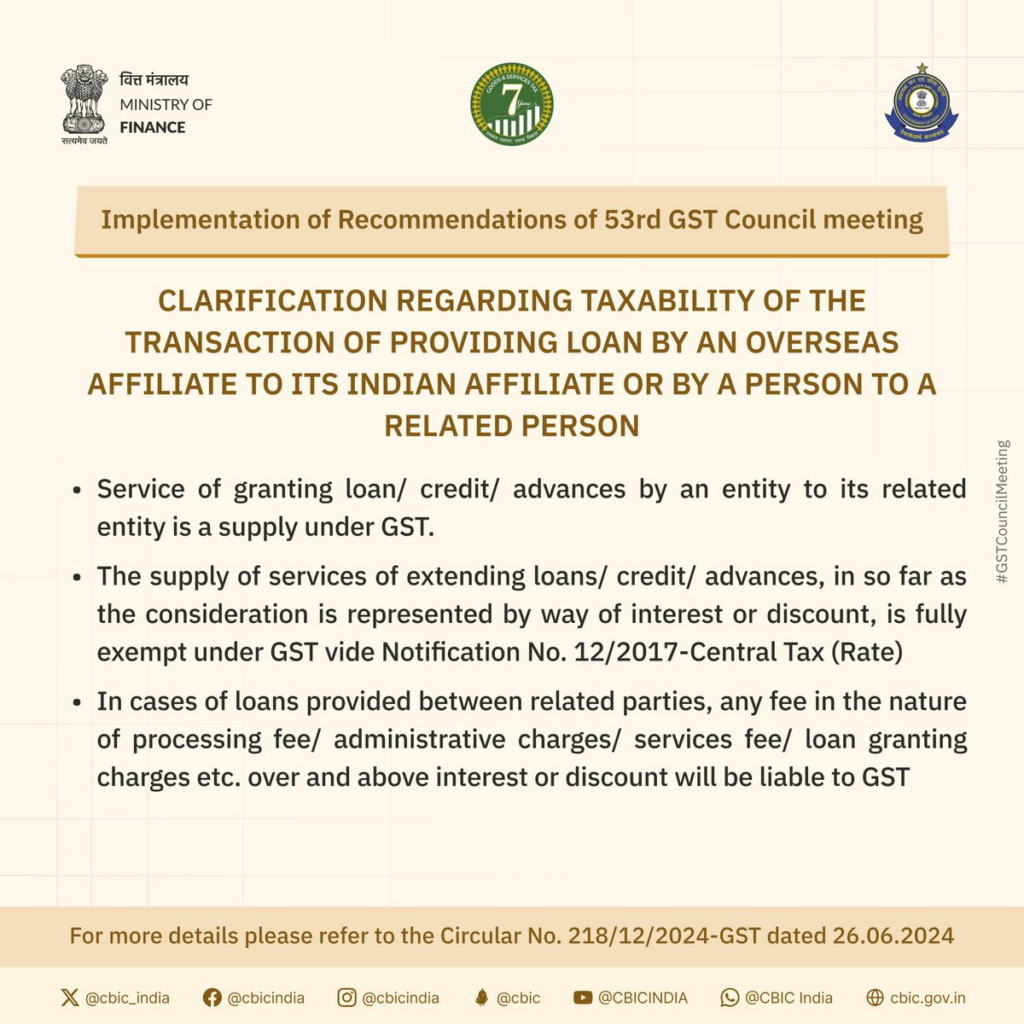

Clarification regarding taxability of the transaction of providing loan by an Overseas Affiliate or its Indian Affiliate or by a Person to a Related Person

Clarification on availability of Input Tax Credit (ITC) on ducts and manholes used in the network of Optical Fiber Cables (OFCs) in terms of Sec 17(5) of the CGST Act, 2017

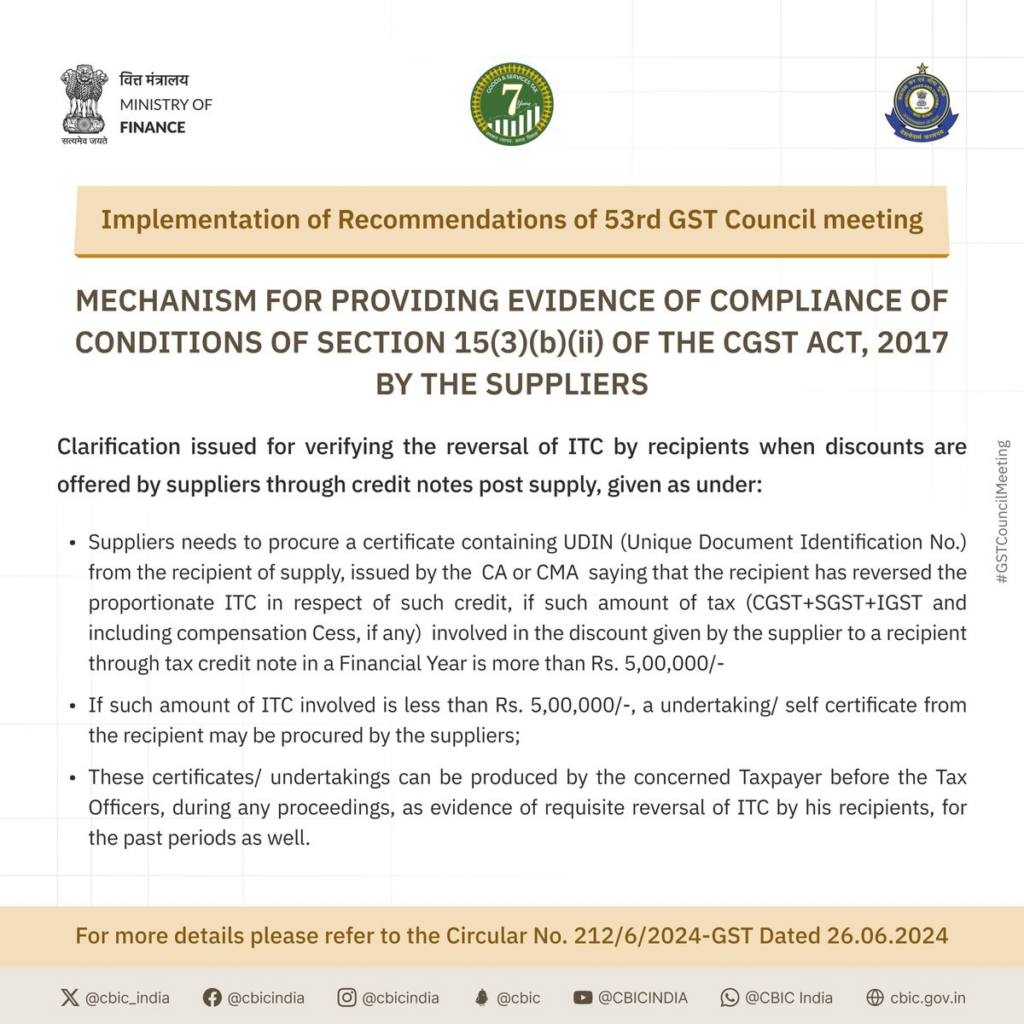

Mechanism for providing evidence of compliance of conditions of Section 15(3)(b)(ii) of the CGST Act, 2017 by the suppliers

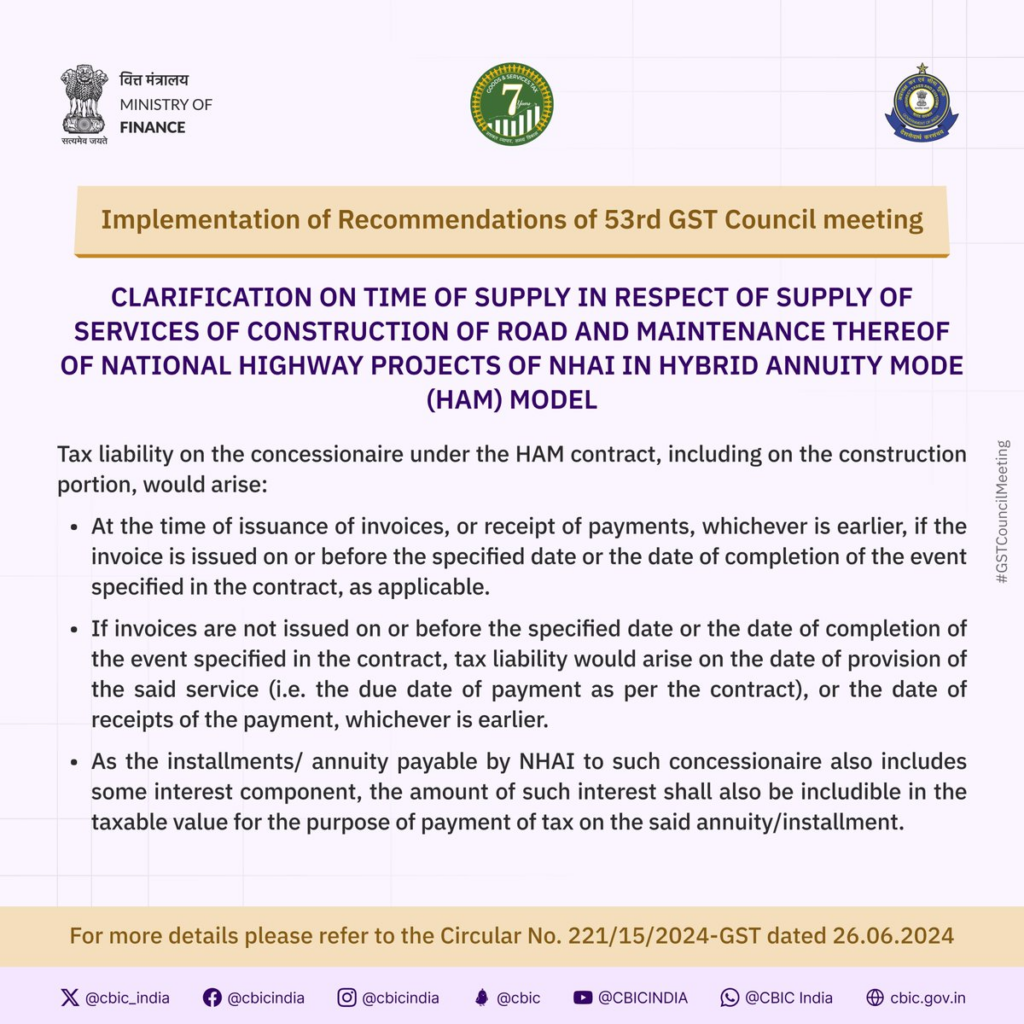

Clarification on time of supply in respect to supply of services of construction of road and maintenance thereof of National Highway projects of NHAI in Hybrid Annuity Mode (HAM) model

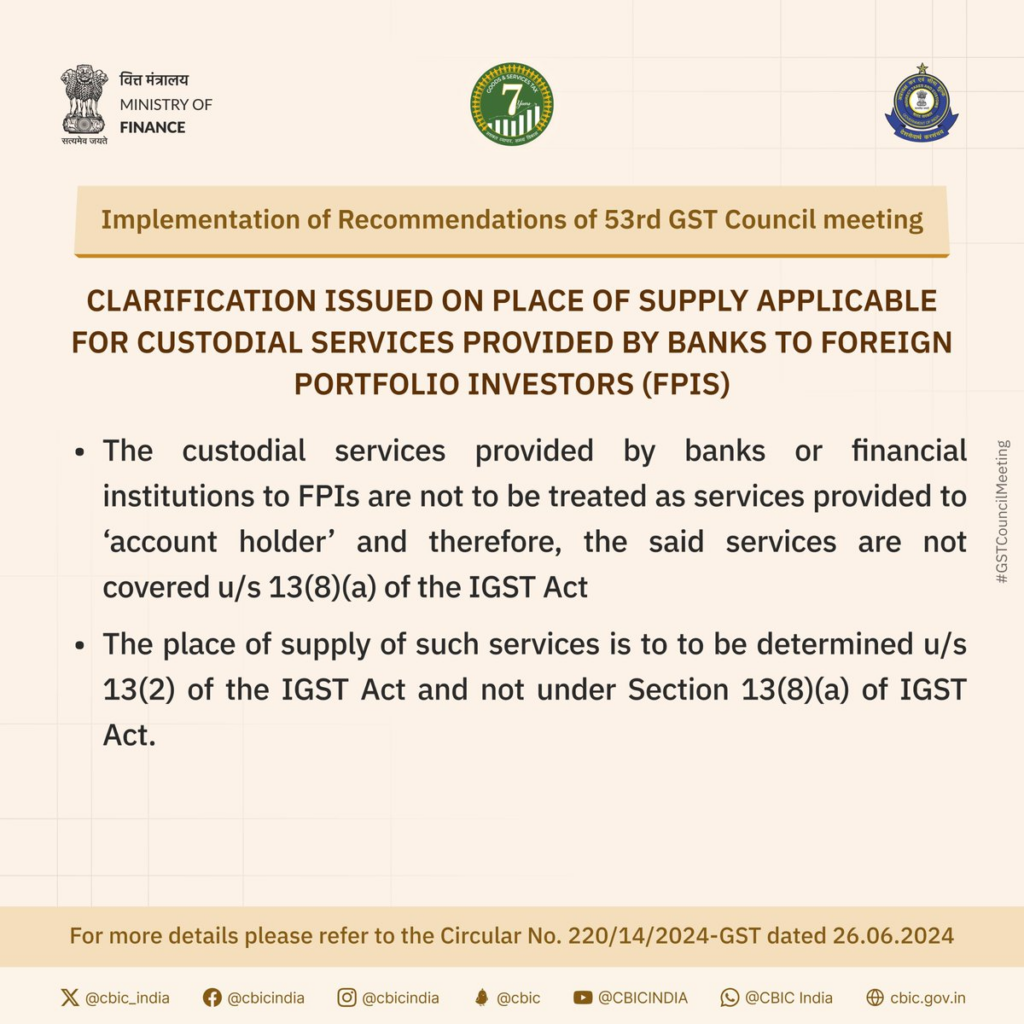

Clarification issued on Place of Supply applicable for custodial services provided by Banks to Foreign Portfolio Investors (FPIs)

Reduction of Government litigation, fixing monetary limit for filing appeals or application by the department before GSTAT, High Court and Supreme Court

Clarification on valuation of supply of import of services by a related person where the recipient is eligible for full ITC

Clarification on various issues pertaining to special procedure for the manufacture of the specified commodities

Clarification issued on entitlement of ITC by the Insurance Companies

Clarification on the time limit under Section 16(4) of the CGST Act, 2017

Clarification issued regarding place of supply of goods (particularly being supplied through e-commerce platform) to unregistered persons where the billing address is different from the address of delivery of goods

Clarification on the taxability of ESOP/ESPP/RSU provided by a company to its employees through its overseas holding company

Visit www.cagurujiclasses.com for practical courses