New Rule 88C was inserted in 26th December 2022 under CGST Rules 2017:

Rule 88 C. Manner of dealing with difference in liability reported in statement of outward supplies and that reported in return.

(1) Where the tax payable by a registered person, in accordance with GSTR-1/IFF, exceeds the amount of tax payable by such person GSTR-3B for that period furnished by him, by such amount and such percentage, as may be recommended by the Council, the said registered person shall be intimated of such difference in Part A of FORM GST DRC-01B, electronically on the common portal, and a copy of such intimation shall also be sent to his e-mail address provided at the time of registration or as amended from time to time, highlighting the said difference and directing him to—

(a) pay the differential tax liability, along with interest under section 50, through FORM GST DRC-03; or

(b) explain the aforesaid difference in tax payable on the common portal,

within a period of 7 days.

(2) The registered person referred to sub-rule (1) shall, upon receipt of the intimation referred to in that sub-rule, either,-

(a) pay the amount of the differential tax liability, as specified in Part A of FORM GST DRC-01B, fully or partially, along with interest under section 50, through FORM GST DRC-03 and furnish the details thereof in Part B of FORM GST DRC-01B electronically on the common portal; or

(b) furnish a reply electronically on the common portal, incorporating reasons in respect of that part of the differential tax liability that has remained unpaid, if any, in Part B of FORM GST DRC-01B,

within the period specified in the said sub-rule.

Now you read the Rule, so you can easily understand this new form DRC-01B

GSTN has developed a functionality to enable the taxpayer to explain the difference in GSTR-1 & 3B return online as directed by the GST Council. This feature is now live on the GST portal.

The functionality compares the liability declared in GSTR-1/IFF with the liability paid in GSTR-3B/3BQ for each return period. If the declared liability exceeds the paid liability by a predefined limit or the percentage difference exceeds the configurable threshold, taxpayer will receive an intimation in the form of DRC-01B.

Upon receiving an intimation, taxpayer must file a reply in Form DRC-01B Part B, providing clarification through reason in automated dropdown and details regarding the discrepancy.

It is mandatory to submit a reply of DRC-01B otherwise GSTR-1 will be blocked for next filing period and unblock only when DRC-01B reply will be submitted

To file the Form DRC-01B Part B, please follow the steps below:

1. Access the GST portal by visiting www.gst.gov.in. The GST home page will be displayed.

2. Login to the GST Portal using your valid credentials.

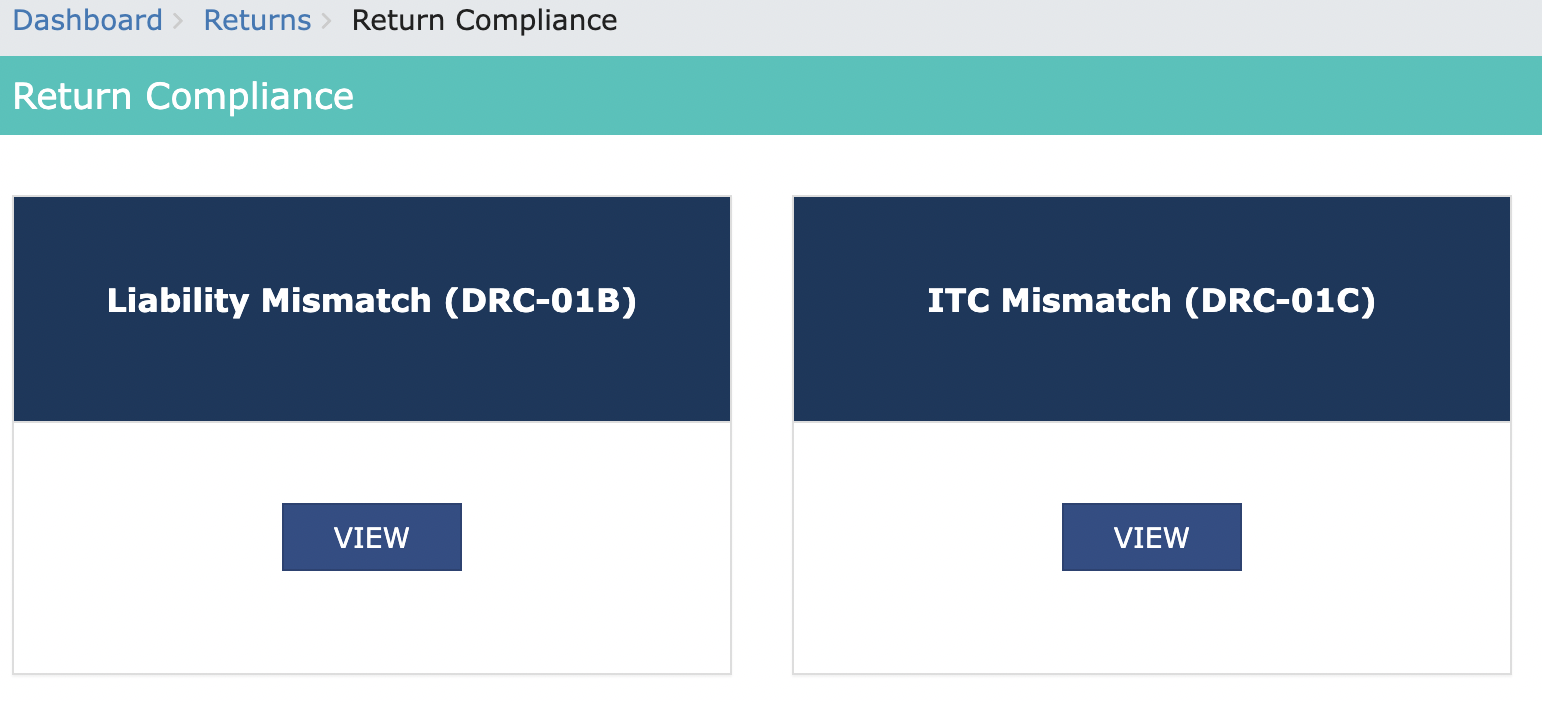

3. Navigate to Services > Returns > Return Compliance option. Alternatively, you can directly click on the Return Compliance link available on the dashboard.

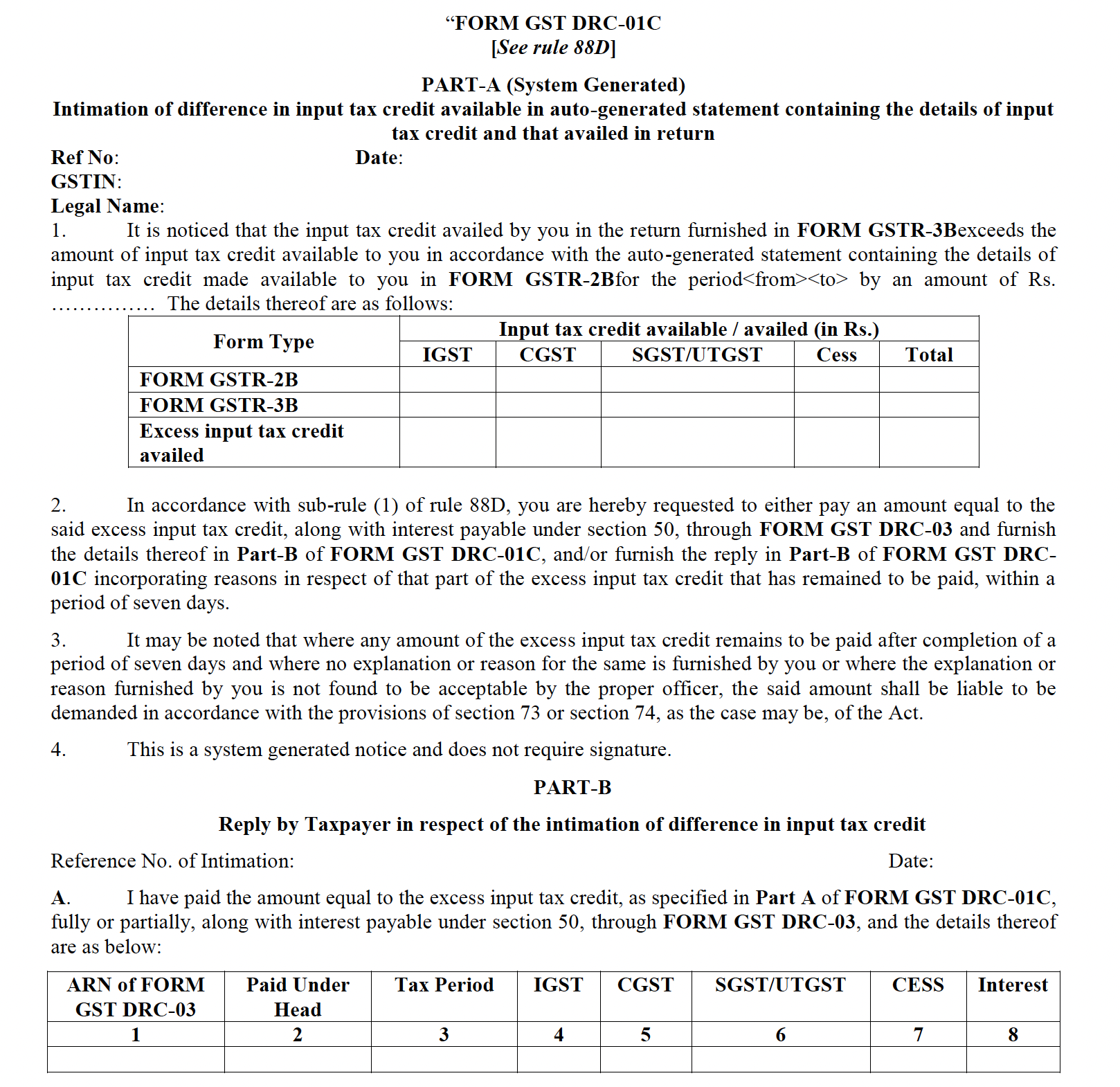

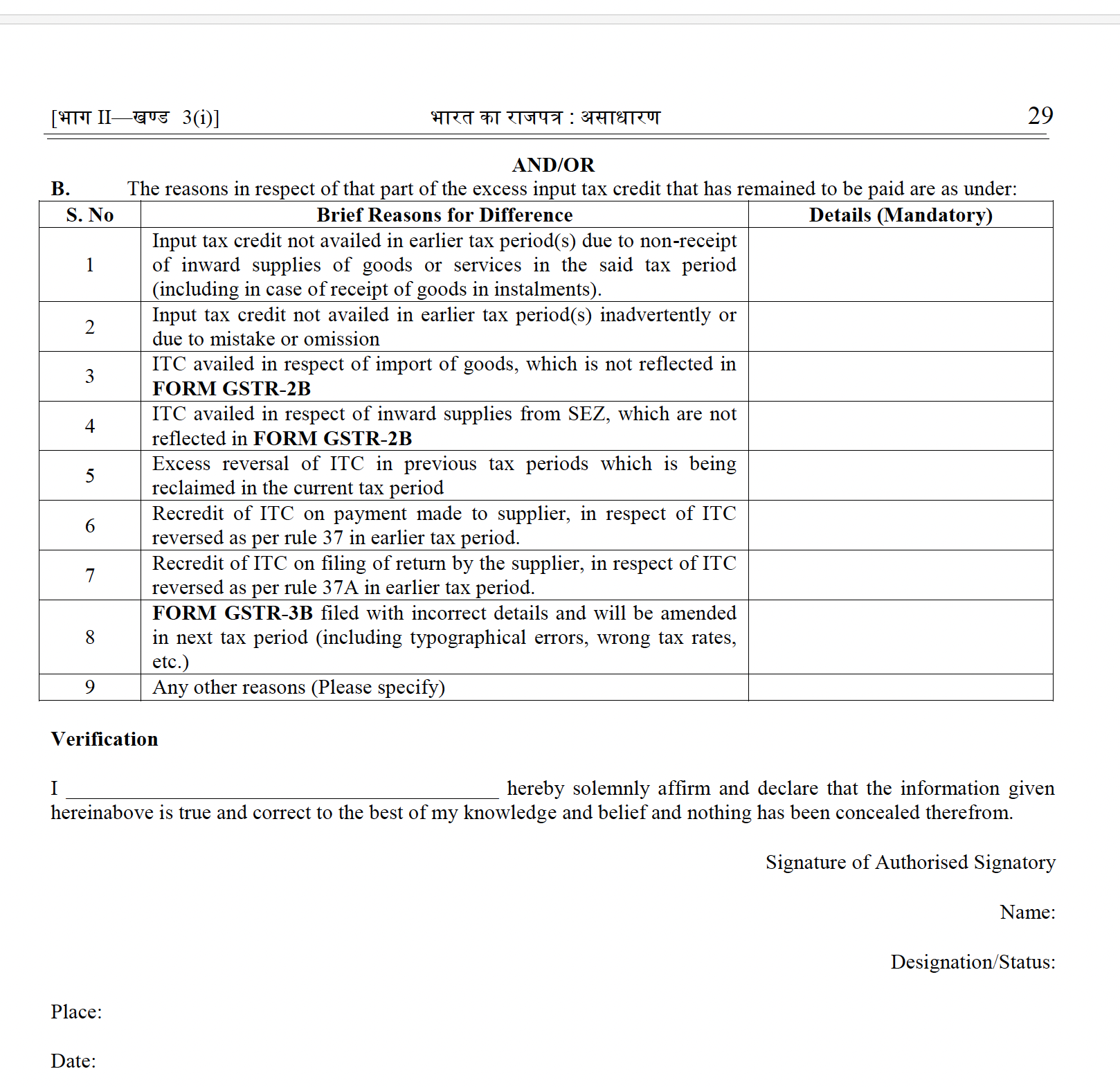

Mechanism to deal with differences in ITC between FORM GSTR-2B & GSTR-3B: The Council has recommended a mechanism for system-based intimation to the taxpayers in respect of the excess availment of ITC in FORM GSTR-3B vis a vis that made available in FORM GSTR-2B above a certain threshold, along with the procedure of auto-compliance on the part of the taxpayers, to explain the reasons for the said difference or take remedial action in respect of such difference. For this purpose, rule 88D and FORM DRC-01C to be inserted in CGST Rules, 2017, along with an amendment in rule 59(6) of CGST Rules, 2017. This will help in reducing ITC mismatches and misuse of ITC facility in GST.

Insertion of New Rule 88D w.e.f 4 August 2023

“88D. Manner of dealing with difference in input tax credit available in auto-generated statement containing the details of input tax credit and that availed in return.-

(1) Where the amount of input tax credit availed by a registered person in the return for a tax period or periods furnished by him in FORM GSTR-3B exceeds the input tax credit available to such person in accordance with the auto-generated statement containing the details of input tax credit in FORM GSTR-2B in respect of the said tax period or periods, as the case may be, by such amount and such percentage, as may be recommended by the Council,

the said registered person shall be intimated of such difference in Part A of FORM GST DRC- 01C, electronically on the common portal, and a copy of such intimation shall also be sent to his e-mail address provided at the time of registration or as amended from time to time, highlighting the said difference and directing him to—

(a) pay an amount equal to the excess input tax credit availed in the said FORM GSTR-3B, along with interest payable under section 50, through FORM GST DRC-03, or

(b) explain the reasons for the aforesaid difference in input tax credit on the common portal, within a period of seven days.

(2) The registered person referred to sub-rule (1) shall, upon receipt of the intimation referred to in the said sub-rule, either,

(a) pay an amount equal to the excess input tax credit, as specified in Part A of FORM GST DRC- 01C, fully or partially, along with interest payable under section 50, through FORM GST DRC-03 and furnish the details thereof in Part B of FORM GST DRC-01C, electronically on the common portal, or

(b) furnish a reply, electronically on the common portal, incorporating reasons in respect of the

amount of excess input tax credit that has still remained to be paid, if any, in Part B of FORM GST

DRC-01C, within the period specified in the said sub-rule.

(3) Where any amount specified in the intimation referred to in sub-rule (1) remains to be paid within the period specified in the said sub-rule and where no explanation or reason is furnished by the registered person in default or where the explanation or reason furnished by such person is not found to be acceptable by the proper officer, the said amount shall be liable to be demanded in accordance with the provisions of section 73 or section 74, as the case may be.”

Change in Rule 59(6): Blocking of GSTR-1/IFF of subsequent Period in case of non compliance of Rule 88D

In the said rules, in rule 59, in sub-rule (6), after clause (d), the following clauses shall be inserted, namely:-

“(e) a registered person, to whom an intimation has been issued on the common portal under the provisions of sub-rule (1) of rule 88D in respect of a tax period or periods, shall not be allowed to furnish the details of outward supplies of goods or services or both under section 37 in FORM GSTR-1 or using the invoice furnishing facility for a subsequent tax period, unless he has either paid the amount equal to the excess input tax credit as specified in the said intimation or has furnished a reply explaining the reasons in respect of the amount of excess input tax credit that still remains to be paid, as required under the provisions of sub-rule (2) of rule 88D;

Now you read the Rule, so you can easily understand this new form DRC-01C

DRC-01C available on www.gst.gov.in

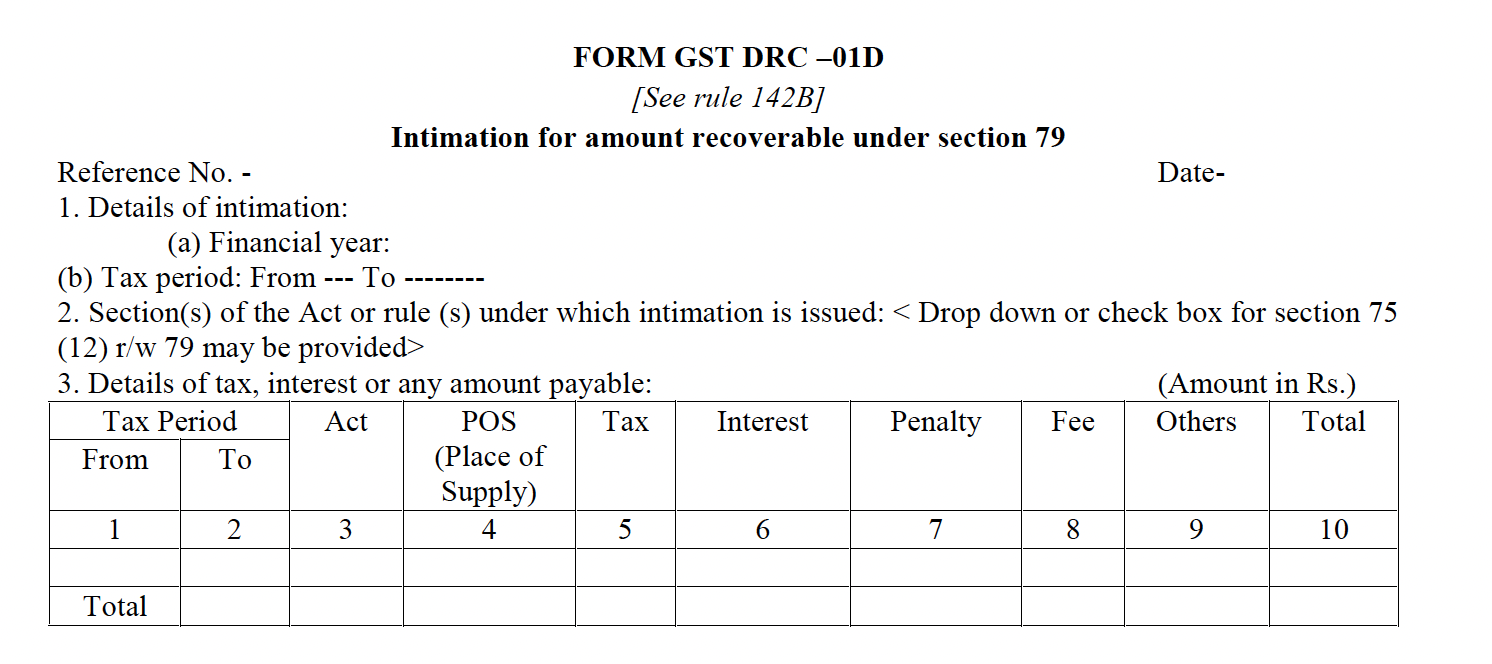

New Rule 142B inserted w.e.f 4 August 2023:

Procedure for Recovery of Tax and Interest in terms of Rule 88C(3): On the recommendations of the GST Council in its 48th meeting held on 17.12.2022, rule 88C was inserted in the CGST Rules, 2017 with effect from 26.12.2022 for system based intimation to the registered person in cases where the output tax liability in terms of FORM GSTR-1 of a registered person for any particular month exceeds the output tax liability disclosed by the said person in the return in FORM GSTR-3B for the said month by a specified threshold. The Council has now recommended insertion of Rule 142B in the CGST Rules, 2017 and insertion of a FORM GST DRC-01D to provide for manner of recovery of the tax and interest in respect of the amount intimated under rule 88C which has not been paid and for which no satisfactory explanation has been furnished by the registered person.

Insertion of Rule 142B: in the said rules, after rule 142A, the following rule shall be inserted, namely:-

“142B. Intimation of certain amounts liable to be recovered under section 79 of the Act.-

(1) Where, in accordance with section 75 (General provisions relating to determination of tax) read with rule 88C, or otherwise, any amount of tax or interest has become recoverable under section 79 (Recovery of Tax) and the same has remained unpaid, the proper officer shall intimate, electronically on the common portal, the details of the said amount in FORM GST DRC-01D, directing the person in default to pay the said amount, along with applicable interest, or, as the case may the amount of interest, within seven days of the date of the said intimation and the said amount shall be posted in Part-II of Electronic Liability Register in FORM GST PMT-01.

(2) The intimation referred to in sub-rule (1) shall be treated as the notice for recovery.

(3) Where any amount of tax or interest specified in the intimation referred to in sub-rule (1) remains unpaid on the expiry of the period specified in the said intimation, the proper officer shall proceed to recover the amount that remains unpaid in accordance with the provisions of rule 143 or rule 144 or rule 145 or rule 146 or rule 147 or rule 155 or rule 156 or rule 157 or rule 160.”.

Rule 145. Recovery from a third person

Rule 146. Recovery through execution of a decree, etc

Rule 147. Recovery by sale of movable or immovable property

Rule 155. Recovery through land revenue authority

Rule 156. Recovery through court

Rule 157. Recovery from surety

Rule 160. Recovery from company in liquidation

Now you read the Rule, so you can easily understand this new form DRC-01D

Soon below form will be available on www.gst.gov.in