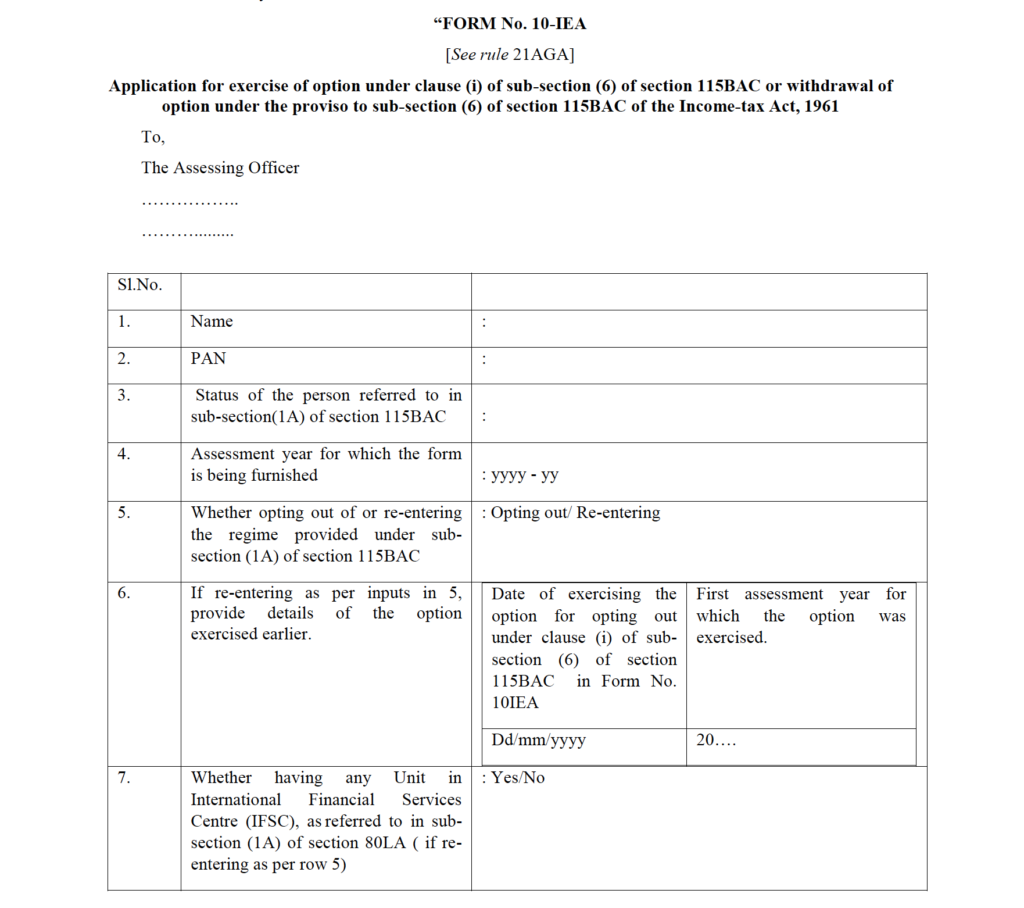

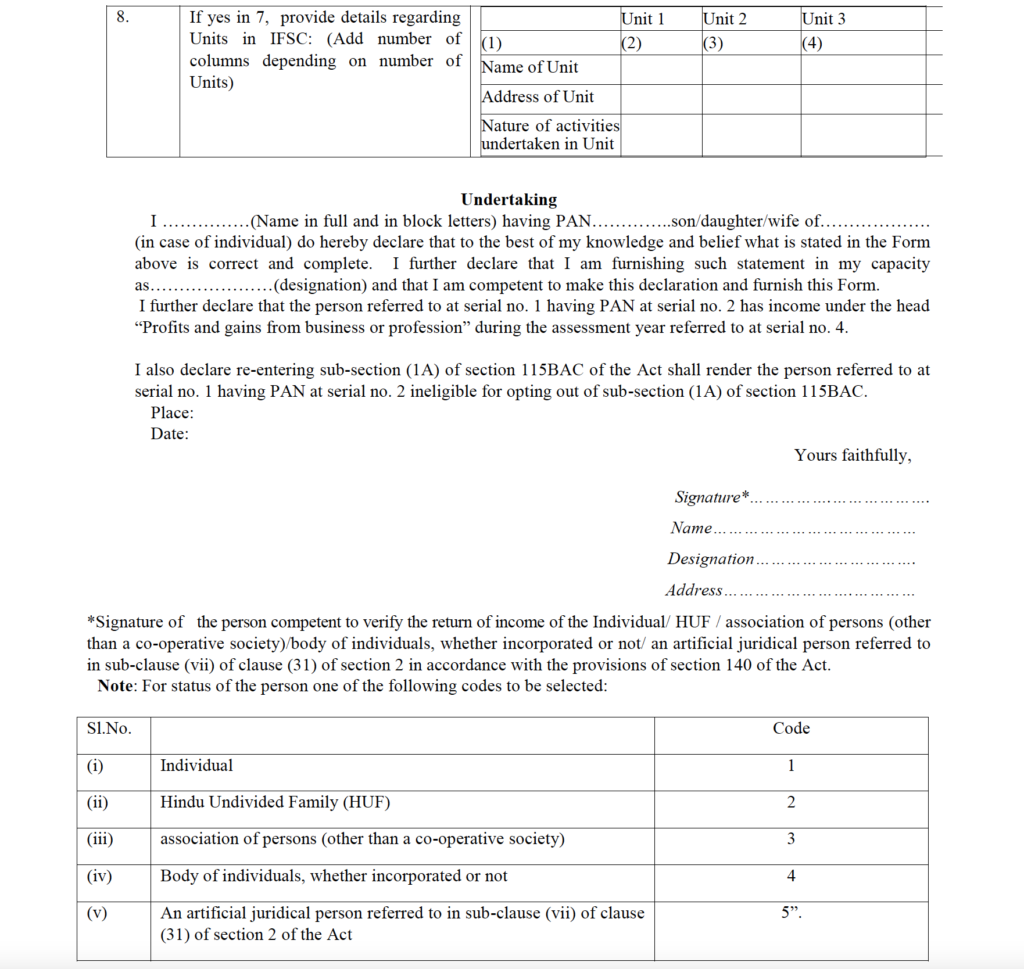

Notification No. 43/2023 Dated 21st June 2023 notified new form 10IEA for optin and opt out old slab rate from FY 2023-24 onwards

for this Changes in section 115BAC and Rule 2BB are made

What is the change in new slab rate for FY 2023-24 or AY 2024-25 let’s understand:

From April 1, 2023:

1. The new income tax regime will be your default tax regime. If you want to opt old tax regime, you have to separately choose it at the beginning of the financial year. Other than Businessman and professionals taxpayers can switch to any regime any year.

2. New Tax Regime is also available for Individual, HUF, AOP, BOI, AJP (other than cooperative societies), earlier it was available only for Individual & HUF

3. Basic exemption limit is increased from Rs.2.50 lakh to Rs.3.00 lakh (under the new tax regime)

4. Rebate under section 87A is increased from Rs.5 lakh to Rs.7 lakh (under the new tax regime)

New Income Tax Slab Rate till FY 2022-23 (Sec 115BAC(1)) & from FY 2023-24 (Sec. 115BAC(1A))

| Total Income (Rs) | Till FY 2022-23 | Total Income (Rs) | From FY 2023-24 |

| Up to 2,50,000 | Nil | Up to 3,00,000 | Nil |

| From 2,50,001 to 5,00,000 | 5% | From 3,00,001 to 6,00,000 | 5% |

| From 5,00,001 to 7,50,000 | 10% | From 6,00,001 to 9,00,000 | 10% |

| From 7,50,001 to 10,00,000 | 15% | From 9,00,001 to 12,00,000 | 15% |

| From 10,00,001 to 12,50,000 | 20% | From 12,00,001 to 15,00,000 | 20% |

| From 12,50,001 to 15,00,000 | 25% | ||

| Above 15,00,000 | 30% | Above 15,00,000 | 30% |

Note: The option to pay tax at lower rates shall be available only if the total income of assessee is computed without claiming specified exemptions or deductions. as provided under

clause (ia) of section 16 of the Act, deduction in respect of income in the nature of family pension as provided under clause (iia) of section 57 of the Act and deduction in respect of the amount paid or deposited in the Agni veer Corpus Fund as proposed to be provided under subsection (2) section 80CCH of the Act, shall be allowed for the purposes of computing the income chargeable to tax under sub-section (1A) of section 115BAC.

Following new deductions are now allowed in new Tax Regime:

Standard Deduction of Rs.50,000 to salaried individual,

Family pension Deduction u/s 57 ( Rs.15,000 or 1/3 of Pension, whichever is lower)

New Deduction u/s 80CCH (2) amount paid or deposited in the Agni veer Corpus Fund.

Earlier one more deduction was allowed under new regime, which is still continued is section 80 CCD (2)

In new tax regime, the highest rate of surcharge of 37% on income above Rs.5 crores is reduced to 25%.

Now because of above changes and New Slab Rate is now default regime, so to opt in or opt out old regime a new form 10IEA is notified as below:

Join our Practical GST Course:

with lifetime validity: https://cagurujiclasses.com/courses/gst-course-2022/

With limited validity: https://studywudy.com/courses/gst/

Join our Practical Income Tax, ITR & TDS Course:

with lifetime validity: https://cagurujiclasses.com/courses/practical-course-income-tax-itr-tds/

With limited validity: https://studywudy.com/courses/incometax/