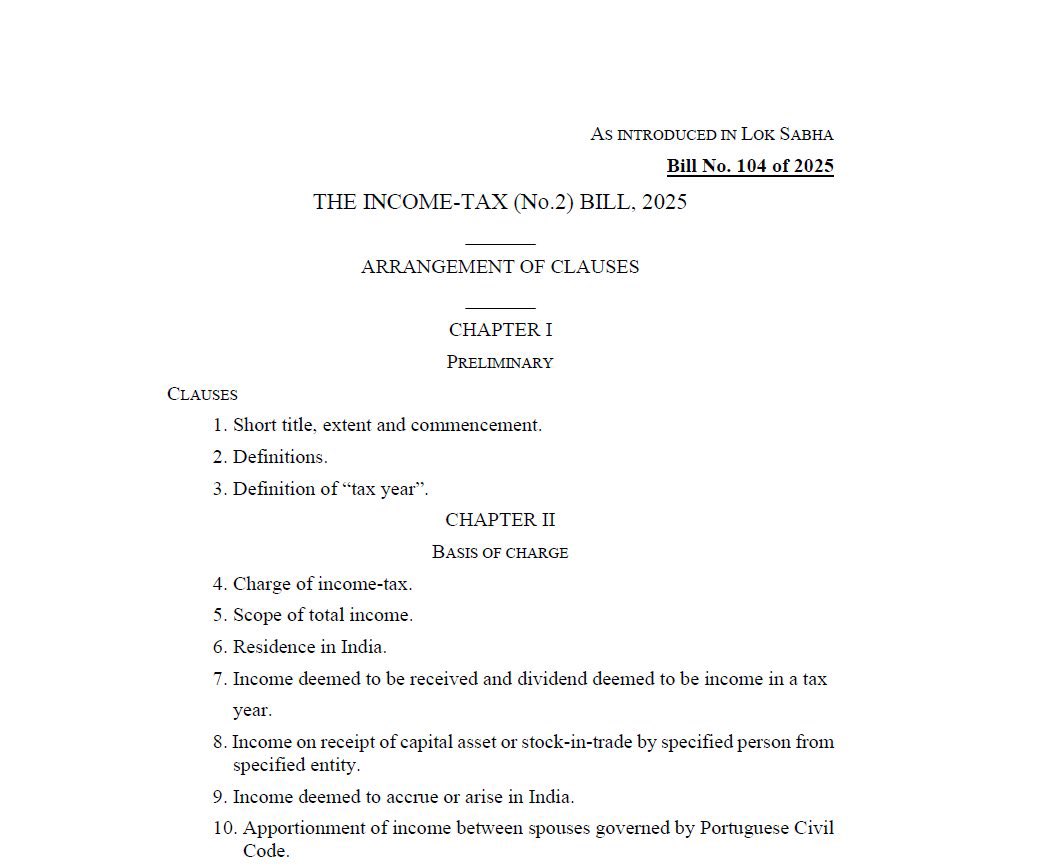

CBDT issued Circular No. 20/2023 Dated 28 December 2023 to issue Guidelines for Removal of difficulties and clarity has been provided on issues in applicability on section 194-O

Section 194-O : According to Section 194O of income tax act, an E-commerce operator is responsible for deducting TDS at the rate of 1% of the gross amount credited to the seller’s account or at the time of making payment, whichever is earlier. This applies to any transaction the e-commerce platform facilitates involving goods and services which includes professional and technical services.

Below is Press Release:

Link to download Circular No. 20 of 2023

Below is Circular:

Visit www.cagurujiclasses.com for practical courses