Every taxpayer has to furnish the details of his income to the Income-tax Department. These details are to be furnished by filing up his return of income.

Once the return of income is filed up by the taxpayer, the next step is the processing of the return of income by the Income Tax Department. The Income Tax Department examines the return of income for its correctness.

The process of examining the return of income by the Income- Tax department is called as “Assessment”. Assessment also includes re-assessment and best judgment assessment under section 144. Under the Income-tax Law, there are four major assessments given below:

- Summary assessment without calling the assessee u/s 143(1)

- Scrutiny assessment: Assessment u/s 143(3): Know In Detail https://taxupdates.cagurujiclasses.com/scrutiny-assessment-u-s-1433/#more-2062

- Best judgment assessment u/s 144

- Income escaping assessment u/s 147

Here in this article we will discuss Section 143(1)

Assessment under section 143(1)

This is a preliminary assessment and is referred to as summary assessment without calling the assessee (i.e., taxpayer).

Section 143(1) of the Income Tax Act, 1961 is a provision that empowers the Income Tax Department to conduct a preliminary assessment of the taxpayer’s income tax return filed for a particular financial year. This provision allows the tax department to verify the correctness and completeness of the information provided by the taxpayer in the return.

Under Section 143(1), after the taxpayer has filed their income tax return, the tax department will perform a preliminary assessment known as a “scrutiny assessment” or “preliminary assessment.” The purpose of this assessment is to verify the arithmetical accuracy of the return and to cross-check the figures and information furnished with the details available with the department.

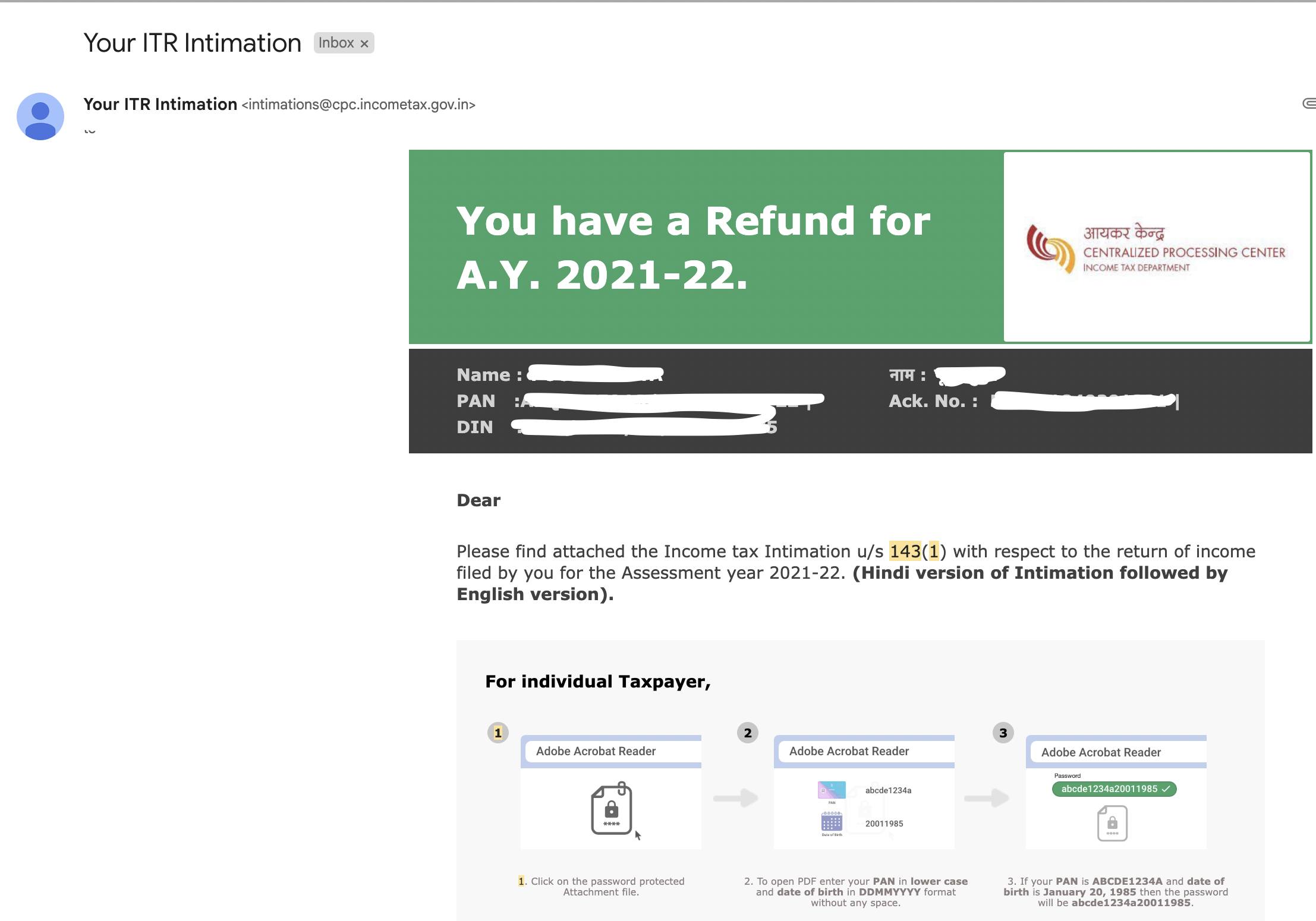

Below is mail type which you received for Assesssment u/s 143(1), This mail contains PDF file having password. password of intimation u/s 143(1) is combination of pan and date of birth in lower case.

On Top it shows, you have Refund, or liability or no refund no liability etc.

Scope of assessment under section 143(1):

Assessment under section 143(1) is like preliminary checking of the return of income. At this stage no detailed scrutiny of the return of income is carried out.

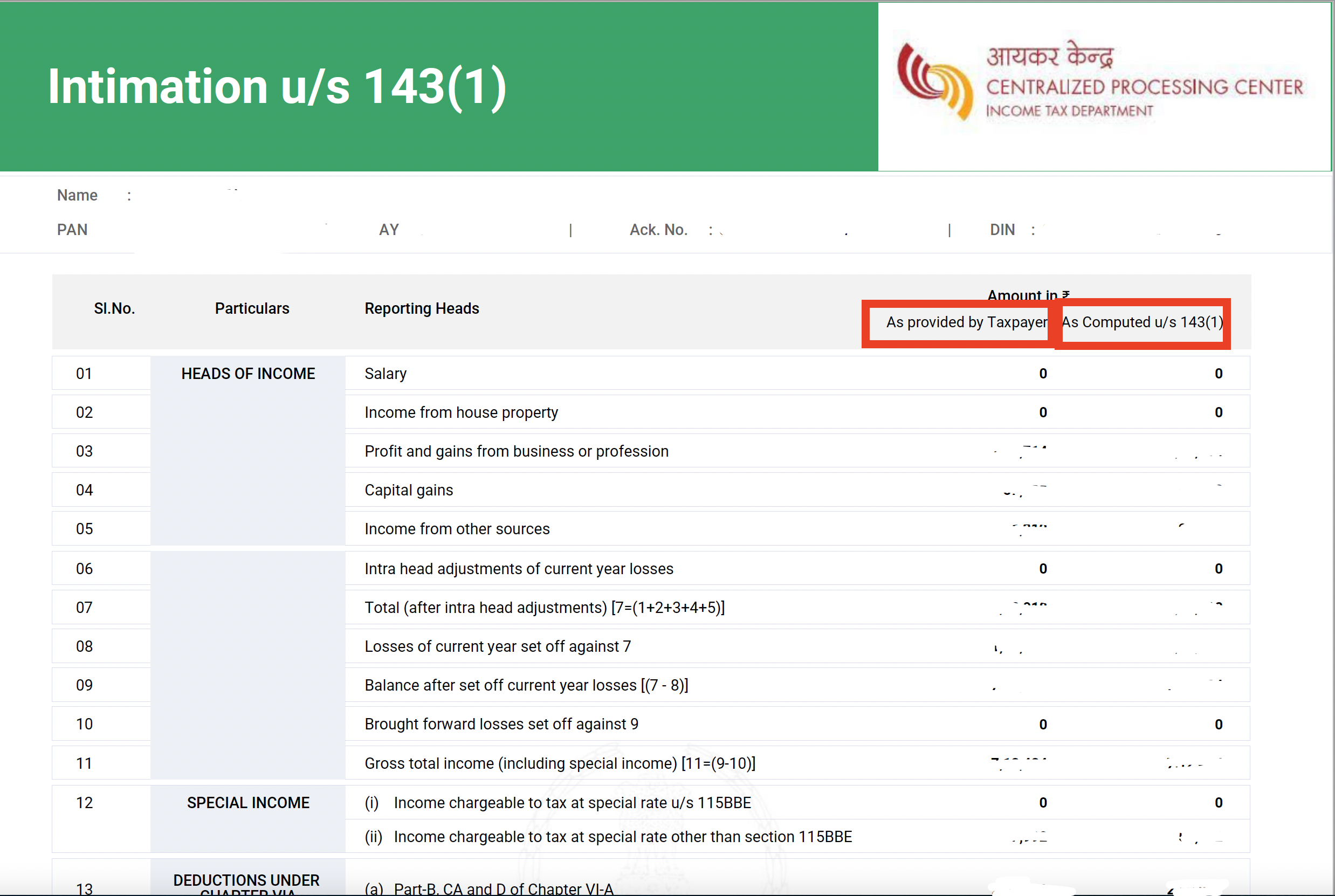

At this stage, the total income or loss is computed after making the following adjustments (if any), namely:-

(i) any arithmetical error in the return; or

(ii) an incorrect claim (*), if such incorrect claim is apparent from any information in the return;

(iii) disallowance of loss claimed, if return of the previous year for which set-off of loss is claimed was furnished beyond the due date specified under section 139(1); or

(iv) disallowance of expenditure indicated in the audit report but not taken into account in computing the total income in the return; or

(v) disallowance of deduction claimed u/s 10AA, 80IA to 80-IE, if the return is furnished beyond the due date specified under section 139(1); or

(vi) addition of income appearing in Form 26AS or Form 16A or Form 16 which has not been included in computing the total income in the return. However, no such adjustment shall be made in relation to a return furnished for the assessment year 2018-19 and thereafter.

However, no such adjustment shall be made unless an intimation is given to the assessee of such adjustment either in writing or in electronic mode.

Further, the response received from the assessee, if any, shall be considered before making any adjustment, and in case where no response is received within 30 days of the issue of such intimation, such adjustments shall be made.

Meaning of an incorrect claim apparent from any information in the return

For the above purpose “an incorrect claim apparent from any information in the return” means a claim on the basis of an entry in the return :

(i) of an item which is inconsistent with another entry of the same or some other item in such return;

(ii) in respect of which the information is required to be furnished under the Act to substantiate such entry and has not been so furnished; or

(iii) in respect of a deduction, where such deduction exceeds specified statutory limit which may have been expressed as monetary amount or percentage or ratio or fraction;

Procedure of assessment under section 143(1):

After correcting arithmetical error or incorrect claim (if any) as discussed above, the tax and interest and fee*, if any, shall be computed on the basis of the adjusted income.

- Any sum payable by or refund due to the taxpayer shall be intimated to him.

- An intimation shall be prepared or generated and sent to the taxpayer specifying the sum determined to be payable by, or the amount of refund due to the taxpayer.

- An intimation shall also be sent to the taxpayer in a case where the loss declared in the return of income by the taxpayer is adjusted but no tax or interest is payable by or no refund is due to him.

- The acknowledgement of the return of income shall be deemed to be the intimation in a case where no sum is payable by or refundable to the assessee or where no adjustment is made to the returned income.

*As per section 234F, a fee shall be levied where the return of income is not filed within the due dates prescribed under section 139(1). Fee for default in furnishing return of income shall be Rs. 5,000 if return has been furnished after the due date prescribed under section 139(1). However, it shall be Rs. 1,000 if the total income of an assessee does not exceed Rs. 5 lakh.

Time-limit:

Assessment under section 143(1) can be made within a period of 9 months from the end of the financial year in which the return of income is filed.

It means if you filled return of FY 2023-24 on 15 July 2024 than intimation can be send till 31st March 2025

It is important for taxpayers to carefully review the intimation received under Section 143(1) and take appropriate action if any discrepancies or issues are identified. In case of disagreement with the assessment, taxpayers can file a request for rectification under Section 154 or initiate the process of filing an appeal, as per the provisions of the Income Tax Act.

Practical Courses at: