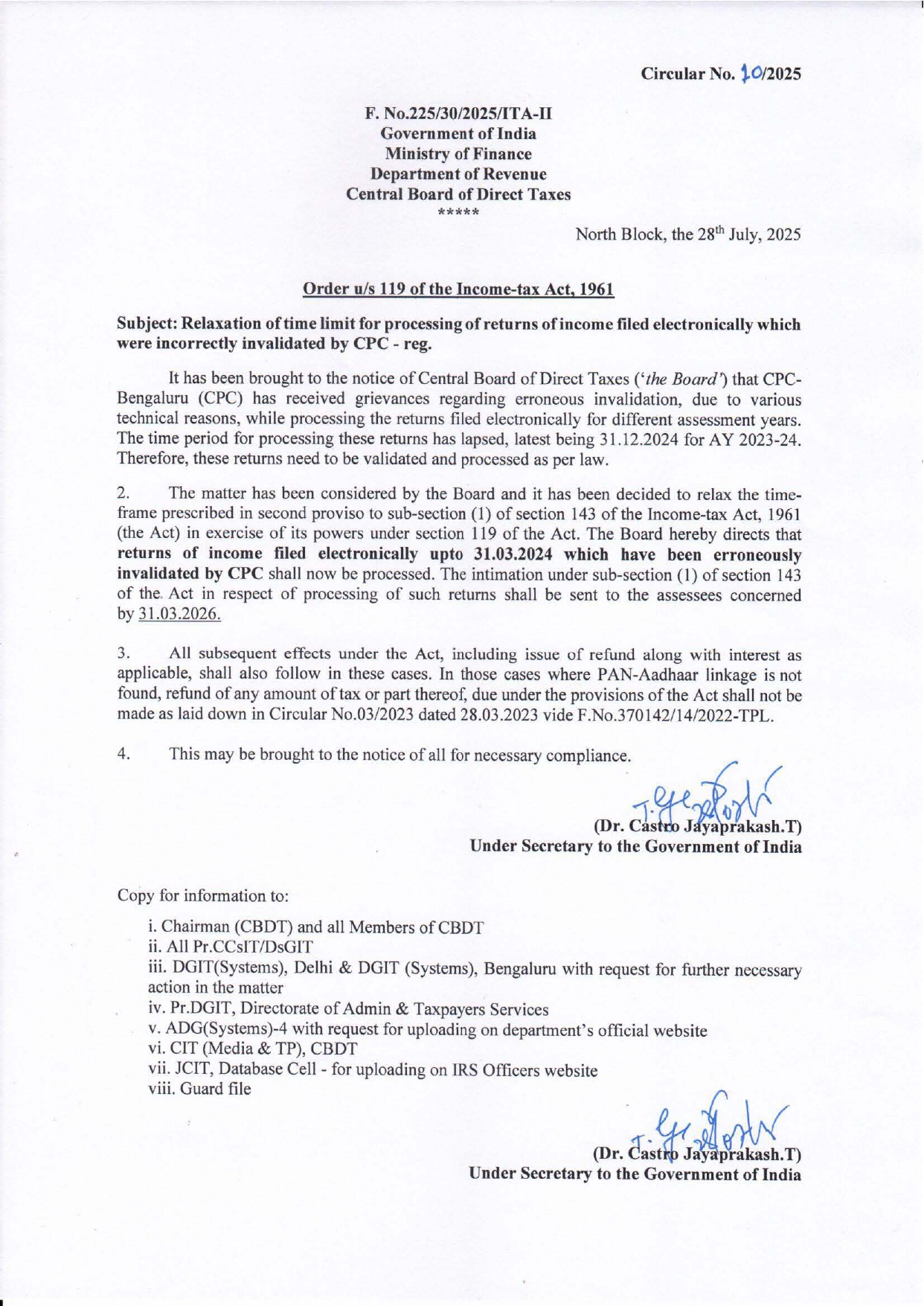

📅 Date of Circular: 28th July 2025

📄 Circular No.: 10/2025

🏛️ Issued By: Central Board of Direct Taxes (CBDT), Ministry of Finance, Government of India

🧾 Relevant Law: Section 119 of the Income-tax Act, 1961

🔍 What’s the Issue?

Many taxpayers had filed their Income Tax Returns (ITRs) electronically up to 31st March 2024, but due to technical errors or system issues at the Centralized Processing Centre (CPC) Bengaluru, their ITRs were erroneously invalidatedand not processed.

Normally, the deadline for processing such returns is one year from the end of the financial year (i.e. 31st December 2024for AY 2023-24), after which CPC refuses to process them. This caused delays in refunds and other benefits due to taxpayers.

✅ What CBDT Has Now Decided?

CBDT, exercising powers under Section 119 of the Income-tax Act, has decided to relax the time limit and allow processing of such erroneously invalidated ITRs.

📌 Key Highlights of Circular 10/2025:

- Returns Covered: All ITRs filed electronically up to 31.03.2024, which were invalidated due to CPC error.

- New Deadline: These returns can now be processed till 31.03.2026.

- Processing As Per Law: Such returns will now be validated and processed under section 143(1) of the Income-tax Act.

- Refunds & Intimations:

- If refund is due, it will be issued along with interest, as per law.

- Intimations under section 143(1) will be sent to taxpayers.

- However, if PAN-Aadhaar not linked, no refund will be processed (as per earlier Circular No. 03/2023 dated 28.03.2023).

🎯 Who Will Benefit?

- Taxpayers whose ITRs were filed correctly but rejected due to backend/system errors.

- Individuals and businesses awaiting pending refunds for AY 2023-24 and earlier.

- Professionals and traders who had genuine compliance but were penalized due to technical glitches.

📝 What Taxpayers Should Do Now?

- Check your ITR status on the Income Tax e-filing portal.

- If your return was marked as invalid, it may now get processed.

- Ensure PAN-Aadhaar linking is done to receive any refund.

- No need to re-file the return if it was already filed but rejected due to CPC error.

📥 Read the Official Circular:

This circular brings much-needed relief to honest taxpayers who were impacted by system issues. If your refund was stuck or your ITR was rejected despite timely filing, this is your chance to get it resolved.

For regular updates on Income Tax and GST, stay connected with CA Guruji.

Visit www.cagurujiclasses.com for practical courses