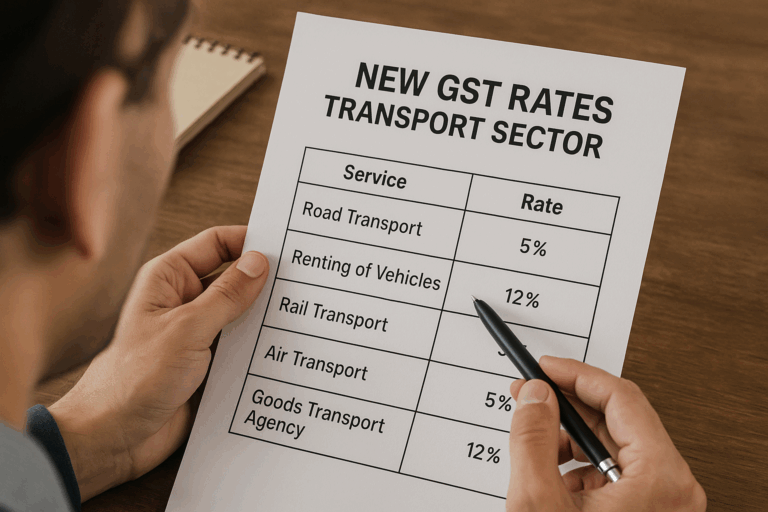

GST Rate Changes on Services – works contracts, passenger and goods transport, hotel, local delivery, job work, beauty & wellness, entertainment, insurance etc.

The 56th GST Council meeting has brought a series of important changes in the services sector, covering works contracts, passenger and …