Small savings schemes are government-backed investment options that offer guaranteed returns. There is a variety of such schemes, offering varying benefits, which you can explore and apply for through post offices and banks.

In terms of liquidity, small savings schemes are generally less liquid than FDs. This is because small savings schemes usually come with a lock-in period and premature withdrawal restrictions, which make it more challenging for you to access your funds in an emergency. Fixed deposits usually offer greater flexibility in comparison, though at a penalty, when it comes to accessing funds.

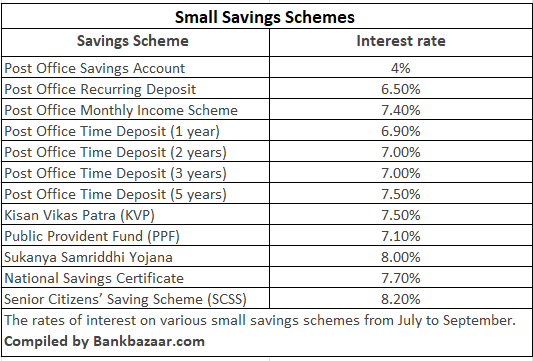

Here is a list of interest rates being offered on small saving schemes

For example, the Senior Citizens’ Saving Scheme (SCSS), which is a government-backed retirement benefits programme, is currently offering an 8.20 per cent interest. Senior citizens resident in India can invest a lump sum in the scheme, individually or jointly, and get access to regular income along with tax benefits. It is a Post Office savings scheme.

At 8.2% p.a. interest rate and an investment amount of R.30 lakh, the monthly income is stated to be R.20,500 per month for each investor. This interest rate is also better than the fixed deposit interest rates offered by most of the top banks currently.

They will receive a quarterly interest against their deposited amount. Interest payment will be credited to an individual’s account on the first date of April, July, October, and January.

The maturity period of SCSS is 5 years. However, individuals can extend the maturity period for 3 more years by submitting an application. The application for extension of maturity should be given in the 4th year.

The minimum investment amount is Rs 10,000 and maximum is Rs 30,00,000.

Individuals can withdraw the amount after one year of opening the account. There is no charge for premature closure of the account within one year of opening it. However, a 1.5% charge will be deducted from the principal amount if the account is closed after one year but within two years of opening it. A 1% charge will be deducted from the principal amount if the account is closed after two years but within five years of opening it.

You get an income tax deduction of up to Rs.1.5 lakh under Section 80C of the Indian Tax Act, 1961, and the 5-year tenure of the account can be extended for another 3 years.

In the case the interest amount is more than Rs.50,000 p.a., TDS will be deducted.

If you are looking for stable investment for your daughter, you can opt for the Sukanya Samriddhi Yojana, a government-backed small savings scheme for the benefit of a girl child. It is a part of the Beti Bachao, Beti Padhao Yojana and can be opened by the parents of a girl child below the age of 10. SSY accounts can be opened at designated banks or post offices. The Sukanya Samriddhi Yojana Account has a tenure of 21 years or until the girl child marries after the age of 18. The SSY scheme comes with an interest rate of 8 per cent along with several tax benefits.

As per the latest notification issued by the Finance Ministry, it is mandatory to provide your Aadhaar number and PAN to open a new SSY account. If you have not been assigned an Aadhaar yet, you need to provide proof of application of enrollment for an Aadhaar or enrollment ID at the time of opening the account and furnish the Aadhaar number to the accounts office within 6 months from the date of account opening. SSY provides tax deduction benefits under Section 80C up to Rs. 1.5 Lakh annually.

One can make a minimum deposit of Rs. 250 in a year and a maximum deposit of Rs. 1.5 Lakh in a year. This ensures people with different financial standing can invest in the SSY scheme.

The scheme is a great long-term investment scheme as it provides the benefit of annual compounding. So, even small investments will give higher returns over the long term.

Withdrawal can also be made from the account up to 50% of the balance available at the end of the previous F.Y. once the girl is above 18 years of age or has passed 10th standard to meet expenses relating to higher education such as fees or other such charges. Maximum one withdrawal can be made in a year, in lump sum or in instalments, for a maximum of 5 years, subject to the ceiling specified and to the actual requirement of fee/other charges.

Premature closure can only be done by a girl child on attaining the age of 18 years for the purpose of marriage expenses. However, there are some special cases under which the account can be closed and the respective amount can be withdrawn.

From a taxation perspective, SSY investments are designated as EEE (Exempt, Exempt, Exempt) investments. This means that the principal invested, the interest earned as well and the maturity amount are tax-free. Under existing taxation rules of Sukanya Samriddhi Yojana, the tax deduction benefit on the principal amount invested is up to Rs 1.5 Lakh per annum under Section 80C of the Income Tax Act, 1961.

“The overall returns offered by small savings schemes and FDs can vary depending on the prevailing interest rates offered and investment tenure. It is important that you compare both these options based on the returns they may offer when making your decision. If you are investing for specific long-term goals, such as your children’s education or marriage, small savings schemes may be the ideal option. Fixed deposits are better suited for short-term goals, such as opening a small business, funding your foreign trip, or purchasing a vehicle,” said Adhil Shetty, CEO of Bankbazaar.