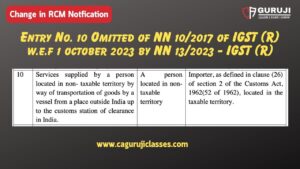

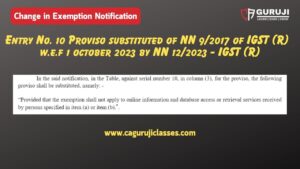

The government has exempted payments made for goods imported through ocean freight from 5% integrated GST with effect from October 1.

The Finance Ministry has notified changes to the IGST Act with regard to payment of integrated GST on ‘ocean freight’ on imported goods with effect from October 1.

Currently, importers are required to pay 5 per cent GST under the Reverse Charge Mechanism.

Let’s understand the concept first

What is Ocean Freight:

Ocean freight is a method of transport by which goods and cargo is transported by ships via shipping lines. Over 90% of all the world’s trade is carried by sea – and even more in some countries

GST Implications till 30 September 2023

The CGST Act requires the importers to pay IGST at 5% on ocean freight under the Reverse Charge Mechanism (RCM).

Section 5(3) of the IGST Act:-This section notifies the supplies which are taxable to GST under the reverse charge mechanism.

Under the reverse charge mechanism, a recipient of goods/service is liable to pay GST instead of the supplier.

Under Section 2(93) of CGST Act Recipient of supply of goods and/or services means

(a) Where a consideration is payable for the supply of goods or services or both, the person who is liable to pay that consideration,

(b) Where no consideration is payable for the supply of goods, the person to whom the goods are delivered or made available, or to whom possession or use of the goods is given or made available, and

(c) Where no consideration is payable for the supply of a service, the person to whom the service is rendered, and any reference to a person to whom a supply is made shall be construed as a reference to the recipient of the supply and shall include an agent acting as such on behalf of the recipient in relation to the goods or services or both supplied.

Notification No. 10/2017 –Integrated tax (Rate) dated 28th June 2017.

This notification stated the categories of supplies that are liable to GST under the reverse charge mechanism.

The Government has included the term importer in this category.

The freight expense in case of import of goods can be categorised into two types based on transaction value:

1) Based on CIF (Cash, Insurance and Freight) value: While importing goods, if no separate transportation charges are imposed on the importer by the supplier for bringing goods into India, then the value charged on the goods is called CIF value. In the case of a CIF transaction, the importer is not the recipient of the service of transportation of goods as per section 2(93) of the CGST Act. The supplier has contacted the shipping line and made the payment as well, and thus the supplier is the recipient of service. Thus, the importer is not liable to tax.

2) Based on FOB (Free on board) value: Now, the other situation is where the importer has hired the ocean freight service provider, and he makes the payment for the import of goods. So, here the importer can be clearly defined as a recipient as per section 2(93) above.

Also, as per the above notification, the importer is included in the category of supplies liable to the reverse charge mechanism.

Thus, if the shipping line is located in a non-taxable territory, then GST is payable by the importer, i.e. the recipient of service. If the shipping line is located in India, then the shipping line itself will have to pay GST on a forward charge.

However, in the case of imports, customs duty is applicable on assessable value, and the assessable value includes freight amount. IGST is payable on the freight element by including it in the assessable value of goods. So, the applicability of GST on an RCM basis will lead to double taxation.

With reference to the above it was observed that audit authority has levied tax to an assesses on ocean freight on CIF value in so many cases. If you go through the erstwhile service tax honorable Supreme Court and high court said levying service tax on CIF value is unconstitutional. This is because already the assesse used to discharge the custom duty on valuation including freight charges, insurance etc. The concept of service and nature of business is not changed even in GST law.

The GST law specifically provides that the importers are required to discharge IGST at 5% on ocean freight charges under the reverse charge mechanism. However, at the same time, customs duty on the CIF value (which includes the freight component as well) of the goods imported into India is also paid by the importer. As a result, there is double taxation on the ocean freight under GST law, which is an impediment and has bloated the cost of imports.

landmark ruling, the Gujarat High Court in the case of Mohit Minerals Pvt. Ltd. & Ors. Vs. Union of India & Ors. [TS-29-HC-2020(GUJ)-NT]

has held that no tax is leviable on the ocean freight for services provided by a person located in non-taxable territory by way of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India.

In this case, the taxpayer was engaged in the business of importing coal from various countries. It discharges the customs duty at the time of import on the assessable value as determined under Section 14 of the Customs Act, 1962.

The value also includes ocean freight. In addition to the levy of customs duty and IGST at the time of import, the taxpayer (as an importer) was also required to pay IGST on ocean freight, leading to double taxation on the ocean freight amount.

The taxpayers, being aggrieved by the fact that ocean freight is being taxed twice, had filed various writ petitions before the Gujarat High Court seeking quashing of the notifications mentioned above, by declaring that the same is ultra-vires the IGST Act, 2017. The taxpayers challenged the levy before the Gujarat High Court by inter-alia arguing that there was:

The provisions contained in the IGST Act apply only for supplies made within the taxable territory. In the case of ocean freight, since both the service providers (i.e., shipping company and exporter) are located outside India, IGST cannot be levied.

Since IGST was paid at the time of import on total assessable value (which includes ocean freight), the notifications requiring the importer to once again pay IGST on the same component tantamount to double taxation and thus it is unconstitutional.

Under Section 5(3) of the IGST Act, the liability to pay tax can be shifted from the provider of supply to the recipient on a reverse charge basis.

However, as per Entry 10 of Notification No. 10 / 2017, the liability has been shifted on the importer and not on the recipient, and thus entry is ultra-vires to Section 5(3). After considering the various provisions/rule of GST law, the High Court observed as under:

Section 5(3) by the IGST Act, which deals with the discharge of tax by the recipient under reverse charge on supplies, does not include a person who is not the recipient of the supply. The taxpayer (as the importer), when not being the recipient of ocean freight services, cannot be made liable to pay tax under the IGST Act.

Ocean freight services provided by a person in nontaxable territory to another person in a non-taxable territory are neither an inter-state supply nor an intra-state supply.

Such service is not covered under the scope of the IGST Act, and therefore, cannot be taxed without the authority of law. A supply where both suppliers and recipients are outside India can be made leviable to tax only under Section 7(5) (c) of the IGST Act provided that the supply is in the taxable territory. The entire supply has taken place outside the taxable territory, i.e., outside India, as both the service provider and service recipient are located outside India.

The IGST Act does not sanction extraterritorial jurisdiction, and the mere fact that the transportation of goods terminates in India does not mean that the supply has taken place in India. IGST cannot be imposed on the same freight amount by treating it as a supply of service since freight also suffers IGST as a part of the assessable value of imported goods. This is necessary to avoid the vice of double taxation.

The notifications mentioned above, being subordinate legislation, which acts as to deem the importer to be liable to pay tax under reverse charge, are ultra-vires the provisions of the IGST Act. Consequently, the imposition of IGST on ocean freight and deeming the importer as the person liable to pay tax are unconstitutional, given that there is no statutory sanction for levy and collection of such tax. Based on the above, the High Court held that no tax is leviable under the IGST Act on ocean freight for the services provided by a person located in non-taxable territory by way of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India.

Moreover, the notifications mentioned above are declared ultra-vires the IGST Act, as they lack legislative competency. Hence, both the notifications are hereby declared to be unconstitutional.

Finally as on 19/05/2022 supreme court upheld the decision of the Gujarat High Court in the case of Mohit Minerals Pvt. Ltd. & Ors. Vs. Union of India & Ors. [TS-29-HC-2020(GUJ)-NT]

Thus, having paid the IGST on the amount of freight which is included in the value of the imported goods, the impugned notifications levying tax again as a supply of service, without any express sanction by the statute, are illegal and liable to be struck down.” We are in agreement with the High Court to the extent that a tax on the supply of a service, which has already been included by the legislation as a tax on the composite supply of goods, cannot be allowed.

In Tune with above Now This is amendment applicable from 1 October 2023