Big Relief in Budget 2026: No More Heavy Penalty on Tax Audit Delay | Big Change in Tax Audit Rules from April 2026

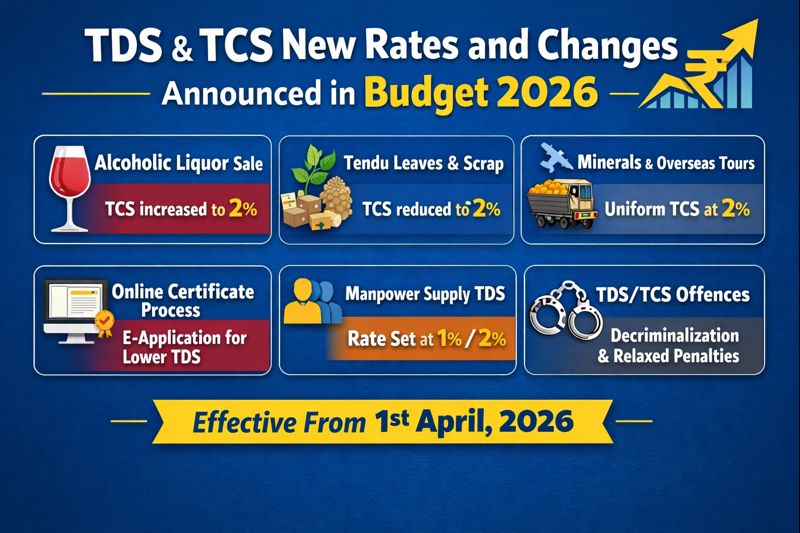

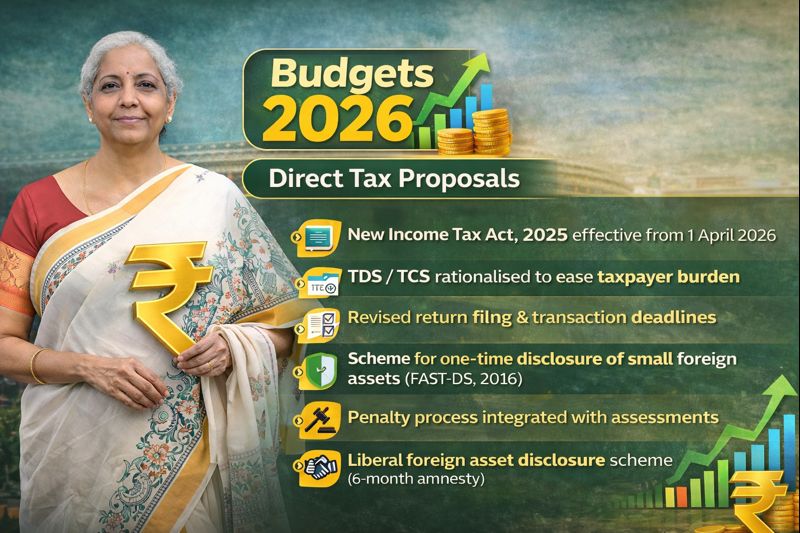

One of the important compliance-friendly measures introduced in Budget 2026 is the rationalisation of penalties into mandatory fees for certain procedural and technical defaults …