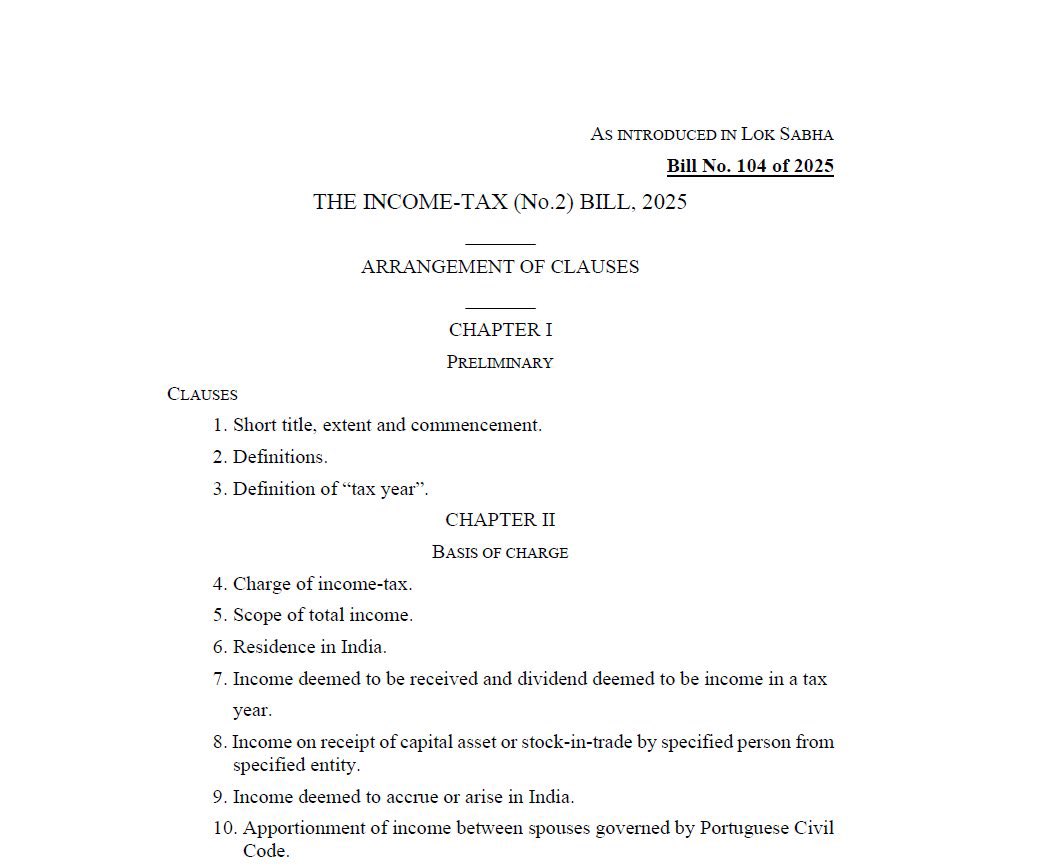

Recently CBDT issued Circular No. 6 Dated 23 April 2024 to give Relief for TDS/TCS Deductors on higher Deduction of TDS and Default Notices in case of Deductees who’s PAN is not linked with Aadhaar and Given time limit to till 31st May 2024 to link PAN Aadhaar in these cases and if PAN become operative till 31st May 2024 then TDS to be deducted at Normal Rate.

Also Read Date extended till 31.05.2024 – Relief for TDS/TCS Deductors on PAN-Aadhaar Linkage

Watch below video to Know about the full Change:

But beside this circular TDS deductors are still getting default notices, are previous Default notices also not Cleared, so an Twitter user tweeted to Income Tax India about this issue and Got below reply from Income Tax Department:

“Implementation of Changes in processing as per Circular no 6/2024 completed, The CPC (TDS) will start reprocessing of affected statements in the first first week of June 2024”

Read Below Tweet

Visit www.cagurujiclasses.com for practical courses