1. Agricultural Income [Section 10(1)]

As per section 10(1), agricultural income earned by the taxpayer in India is exempt from tax.

Agricultural income is defined under section 2(1A) of the Income-tax Act.

As per section 2(1A), agricultural income generally means:

(a) Any rent or revenue derived from land which is situated in India and is used for agricultural purposes.

(b) Any income derived from such land by agriculture operations including processing of agricultural produce so as to render it fit for the market or sale of such produce.

(c) Any income attributable to a farm house subject to satisfaction of certain conditions specified in this regard in section 2(1A).

(d) Any income derived from saplings or seedlings grown in a nursery shall be deemed to be agricultural income.

2. Amount received by a member of the HUF from the income of the HUF, or in case of impartible estate out of income of family estate [Section 10(2)]

As per section 10(2), amount received out of family income, or in case of impartible estate, amount received out of income of family estate by any member of such HUF is exempt from tax.

3. Share of profit received by a partner from the firm [Section 10(2A)]

As per section 10(2A), share of profit received by a partner from a firm is exempt from tax in the hands of the partner.

Further, share of profit received by a partner of LLP from the LLP will be exempt from tax in the hands of such partner.

This exemption is limited only to share of profit and does not apply to interest on capital and remuneration received by the partner from the firm/LLP.

4. Leave travel concession [Section 10(5)]

An employee can claim exemption under section 10(5) in respect of Leave Travel Concession. Exemption under section 10(5) is available to all employees (i.e. Indian as well as foreign citizens).

Exemption is available in respect of value of any travel concession or assistance received or due to the employee from his employer (including former employer) for himself and his family members in connection with his proceeding on leave to any place in India.

Important points:

Where journey is performed by air: Amount of exemption will be lower of amount of economy class air fare of the National Carrier by the shortest route or actual amount spent.

Where journey is performed by rail: Amount of exemption will be lower of amount of air-conditioned first class rail fare by the shortest route or actual amount spent.

The same rule will apply where journey is performed by any other mode and the place of origin of journey and destination are connected by rail.

Where the place of origin and destination are not connected by rail and journey is performed by any mode of transport other than by air:

The exemption will be as follows:

(a) If recognised public transport exists: Exemption will be lower of first class or deluxe class fare by the shortest route or actual amount spent.

(b) If no recognised public transport exists: Exemption will be lower of amount of air- conditioned first class rail fare by the shortest route (considering as if journey is performed by rail) or actual amount spent.

Block: Exemption is available for 2 journeys in a block of 4 years. The block applicable for current period is calendar year 2022-25. The previous block was of calendar year 2018-2021.

Carry over: If an employee has not availed of travel concession or assistance in respect of one or two permitted journeys in a particular block of 4 years, then he is entitled to carry over one journey to the next block. In this situation, exemption will be available for 3 journeys in the next block.

However, to avail of this benefit, exemption in respect of journey should be utilised in the first calendar year of the next block. In other words, in case of carry over, exemption is available in respect of 3 journeys in a block, provided exemption in respect of at least 1 journey is claimed in the first year of the next block.

Exemption is in respect of actual expenditure on fare, hence, if no journey is performed, then no exemption is available.

Family: Family will include spouse and children of the individual, whether dependent or not and parents, brothers, sisters of the individual or any of them who are wholly or mainly dependent on him

Exemption is restricted to only 2 surviving children born after October 1, 1998 (multiple births after first single child will be considered as one child only), however, such restriction is not applicable to children born before October 1, 1998.

5. Amount paid on life insurance policy [Section 10(10D)]

As per section 10(10D), any amount received under a life insurance policy, including bonus is exempt from tax.

Following points should be noted in this regard:

- Exemption is available only in respect of amount received from life insurance policy. Exemption under section 10(10D) is unconditionally available in respect of sum received for a policy which is issued on or before March 31, 2003.

- However, in respect of policies issued on or after April 1st, 2003, the exemption is available only if the amount of premium paid on such policy in any financial year does not exceed 20% (10% in respect of policy taken on or after 1st April, 2012) of the actual capital sum assured. With effect from 1-4- 2013, in respect of policy taken in the name of a person suffering from diseases specified under section 80DDB or in the name of a person suffering from disability specified under section 80U, the limit will be increased to 15% of capital sum assured.

- Value of premium agreed to be returned or of any benefit by way of bonus (or otherwise), over and above the sum actually assured, which is received under the policy by any person, shall not be taken into account while calculating the actual capital sum assured.

- Amount received on death of the person will continue to be exempt without any condition.

Note 1: No exemption would be available in case of any sum received under section 80DD(3) or under Keyman insurance policy.

Note 2: w.e.f. Assessment Year 2021-22, any sum received from Unit Linked Insurance Plan (ULIP) is not entitled for exemption if such ULIP is issued on or after the 01-02-2021 and the amount of premium payable for any of the previous year during the term of such policy exceeds 2,50,000. Further, if premium is payable by a person for more than one ULIP, issued on or after 0102- 2021, the exemption under Section 10(10D) shall be available in respect to those ULIPs, where the aggregate amount of premium does not exceed Rs. 2,50,000 in any of the previous year during the term of any of those policies.

Note 3: w.e.f. Assessment Year 2024-25, no exemption shall be available in respect of life insurance policies (excluding ULIP) issued on or after 01-04-2023 if the premium payable for any year during the term of policy exceeds Rs. 5 lakhs. Further, if the premium is payable by a person for more than one life insurance policy, the exemption shall be available only for those life insurance policies (other than ULIPs), where the aggregate amount of premium does not exceed Rs. 5 lakhs in any of the previous years during the term of any of those policies.

Note 4: The above shall not apply where the sum is received on the death of a person.

6. Exemption in respect of amount received from public provident fund/statutory provident fund/ recognised provident fund/ un-recognised provident fund [Section 10(11)/(12)]

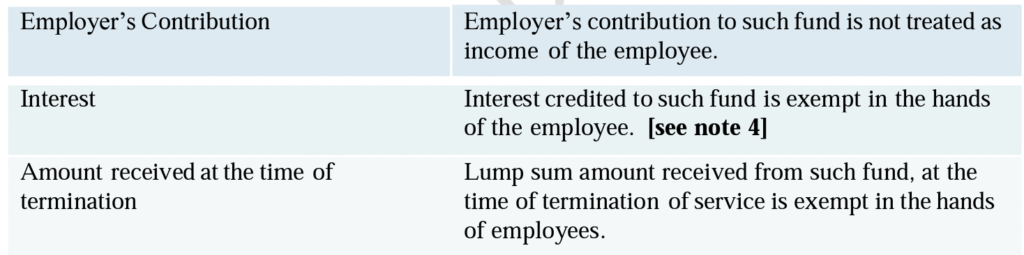

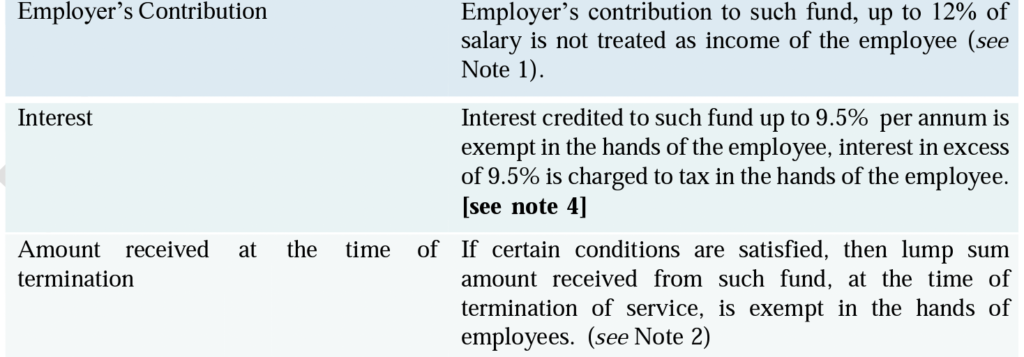

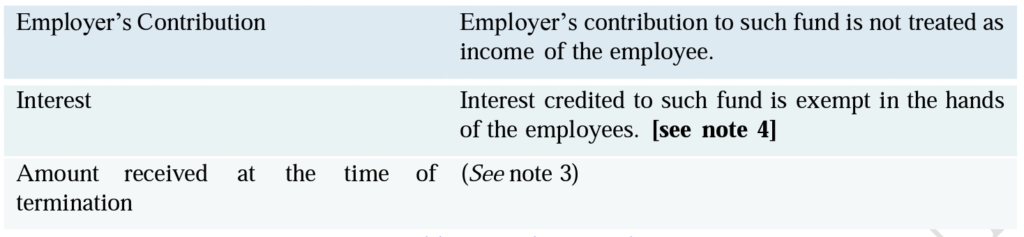

Statutory Provident Fund

Recognised Provident Fund

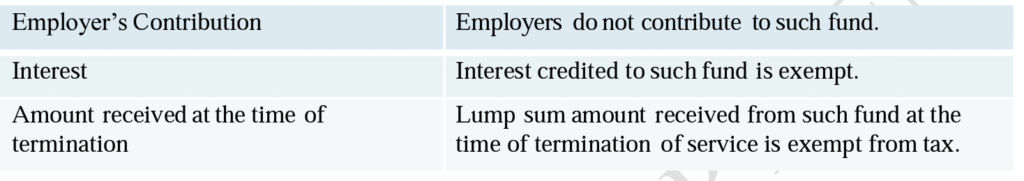

Un-recognised Provident Fund

Public Provident Fund

Notes:

1. Salary for this purpose will include basic salary, dearness allowance, if the terms of service so provide and commission based on fixed percentage of turnover achieved by the employee.

2. Accumulated balance paid from a recognised provident fund will be exempt from tax in following cases:

a) If the employee has rendered a continuous service of 5 years or more. If the accumulated balance includes amount transferred from other recognised provident fund maintained by previous employer, then the period for which the employee rendered service to such previous employer shall also be included in computing the aforesaid period of 5 years.

b) If the service of employee is terminated before the period of 5 years, due to his ill health or discontinuation of business of the employer or other reason beyond his control.

c) If on retirement, the employee takes employment with any other employer and the balance due and payable to him is transferred to his individual account in any recognised fund maintained by such other employer, then the amount so transferred will not be charged to tax. Except above situations, payment from a recognised provident fund will be charged to tax considering such fund as un-recognised from the beginning (See note 3 given below for tax treatment of un-recognised provident fund).

3. Treatment of payment (at the time of termination) from un-recognised provident fund: Payment on termination will include 4 things, viz., employee’s contribution and interest thereto and employer’s contribution and interest thereto, the tax treatment of such payment is as follows:

Employee’s contribution is not chargeable to tax; interest on employee contribution is taxed under the head “Income from other sources”.

Employer’s contribution and interest thereon are taxed as salary income, however, an employee can claim relief under section 89 in respect of such payment.

4. No exemption shall be available for the interest income accrued during the previous year in the recognized and statutory provident fund to the extent it relates to the contribution made by the employees over Rs. 2,50,000 in the previous year. However, if an employee is contributing to the fund but there is no contribution to such fund by the employer, then the interest income accrued during the previous year shall be taxable to the extent it relates to the contribution made by the employee to that fund in excess of Rs. 5,00,000 in a financial year.

7. Payment from account opened in accordance with the Sukanya Samriddhi Account Rules, 2014 [Section 10(11A)]

As per section 10(11A), any payment from an account opened in accordance with the Sukanya Samriddhi Account Rules, 2014 made under the Government Savings Bank Act, 1873 is exempt from tax. In other words, interest and withdrawals from such account will be exempt from tax under section 10(11A).

8. Payment from the National Pension System Trust to an employee [Section 10(12A)]

Any payment from the National Pension System Trust to an assessee on closure of account or his opting out of the pension scheme referred to in section 80CCD, to the extent it does not exceed 40 % of the total amount payable to him at the time of closure or his opting out of the scheme, is exempt from tax.

With effect from April 01, 2020, 60 % of the amount payable shall be exempt from tax.

9. Partial withdrawal from NPS [Section 10(12B)]

To provide relief to an employee withdrawing partial amount from National Pension System (NPS) Trust. A new clause (12B) is inserted under section 10 with effect from assessment year 2018-19 to provide that the withdrawal from NPS will not be chargeable to tax if the following conditions are satisfied:-

1. Amount of withdrawal should not exceed 25% of total contribution made by an employee in NPS.

2. Partial withdrawal should be made in accordance with the terms and conditions specified under the Pension Fund Regulatory and Development Authority Act, 2013 and the regulations made thereunder.

10. Income of minor [Section 10(32)]

Under section 64(1A) income of a minor child is clubbed along with the income of his/her parent, subject to certain conditions.

If the income of an individual includes any income of his/her minor child, then such individual can claim exemption (in respect of each minor child) of lower of following amount:

(a) Rs. 1,500 per minor child; or

(b) Amount of income of each minor child (which is clubbed).

11. Capital gains in case of compulsory acquisition of urban agricultural land [Section 10(37)]

An individual or Hindu Undivided Family (HUF) can claim exemption in respect of capital gain arising on transfer by way of compulsory acquisition of agricultural land situated in an urban area provided compensation is received on or after April 1, 2004.

This exemption is available if the land was used by the taxpayer (or by his parents in the case of an individual) for agricultural purpose for a period of 2 years immediately preceding the date of its transfer.

12. Long-term capital gains on transfer of equity shares or units of an equity oriented mutual fund or a unit of a business trust covered by securities transaction tax [Section 10(38)]

Long-term capital gains arising on transfer of securities are not chargeable to tax in the hands of any person, if following conditions are satisfied:

The asset transferred should be equity shares of a company or units of an equity oriented mutual fund or a unit of a business trust.

1. The transaction should be liable to securities transaction tax, at the time of transfer.

2. Such asset should be a long-term capital asset.

3. Transfer should have taken place on or after October 1, 2004. Equity oriented mutual fund means a mutual fund specified under section 10(23D) and 65% of its investible funds, out of total proceeds are invested in equity shares of a domestic company.

Note:

(1) With effect from 1-4-2016, exemption from capital gains under Section 10(38) shall be available even in respect of long-term capital gains arising from transfer of units of a business trust which were acquired in lieu of shares of special purpose vehicle as referred to in section 47(xvii) and on which securities transaction tax has been paid.

(2) Exemption from long term capital gains under section 10(38) shall be available w.e.f April1, 2017 even where STT is not paid, provided that – – transaction is undertaken on a recognised stock exchange located in any International Financial Service Centre, and

(3) With effect from the assessment year 2018-19, exemption under section 10(38) will not be available even if STT is paid at the time of transfer if the following conditions are satisfied- a. Long-term capital gain is arise from transfer of equity shares in a company. b. The shares were acquired on or after 1/10/2004. c. At the time of acquisition of shares, the transaction was not chargeable to security transaction tax. d. The transaction of acquisition shouldn’t be a notified transaction. The Central Government will notify certain transaction to protect the exemption in genuine cases.

4) No exemption under section 10(38) is available with effect from Assessment Year 2019-20. The long-term capital gains arising from sale of listed securities in excess of Rs. 1 lakh is taxable at the rate of 10% under Section 112A (subject to certain conditions).

13. Educational scholarship [Section 10(16)]

Any amount received as educational scholarship (i.e., scholarship to meet the cost of education is exempt from tax in the hands of recipient).

14. Awards [Section 10(17A)]

Any payment received in pursuance of following (whether paid in cash or in kind) is exempt from tax:

- Any award instituted in the public interest by the Central Government or State Government or by any other body approved by the Central Government in this behalf.

- Any reward by the Central Government or any State Government for such purpose as may be approved by the Central Government in this behalf in the public interest.

15. Pension to gallantry award winner [Section 10(18)]

- Pension received by an individual who was employee of the Central Government or State Government and who has been awarded Param Vir Chakra or Maha Vir Chakra or Vir Chakra or any other notified gallantry award is exempt from tax.

- Family pension received by any member of such individual is also exempt.

16. Family pension received by the family members of armed forces [Section 10(19)]

From the assessment year 2005-06, family pension received by the widow or children or nominated heirs, of a member of armed forces (including paramilitary forces) of the Union, is exempt from tax in the hands of such family members, if the death of such member of armed forces has occurred in the course of operational duty in prescribed circumstances and subject to such conditions as may be prescribed (see rule 2BBA for prescribed circumstances and conditions).

17. Annual value of one palace [Section 10(19A)]

Annual value of any one palace in the occupation of a former ruler is exempt from tax under section 10(19A).

Read our other articles on exempt incomes, exempt allowance and perquisites from articles tab

Join our Practical GST Course:

with lifetime validity: https://cagurujiclasses.com/courses/gst-course-2022/

With limited validity: https://studywudy.com/courses/gst/

Join our Practical Income Tax, ITR & TDS Course:

with lifetime validity: https://cagurujiclasses.com/courses/practical-course-income-tax-itr-tds/

With limited validity: https://studywudy.com/courses/incometax/