What is PAN?

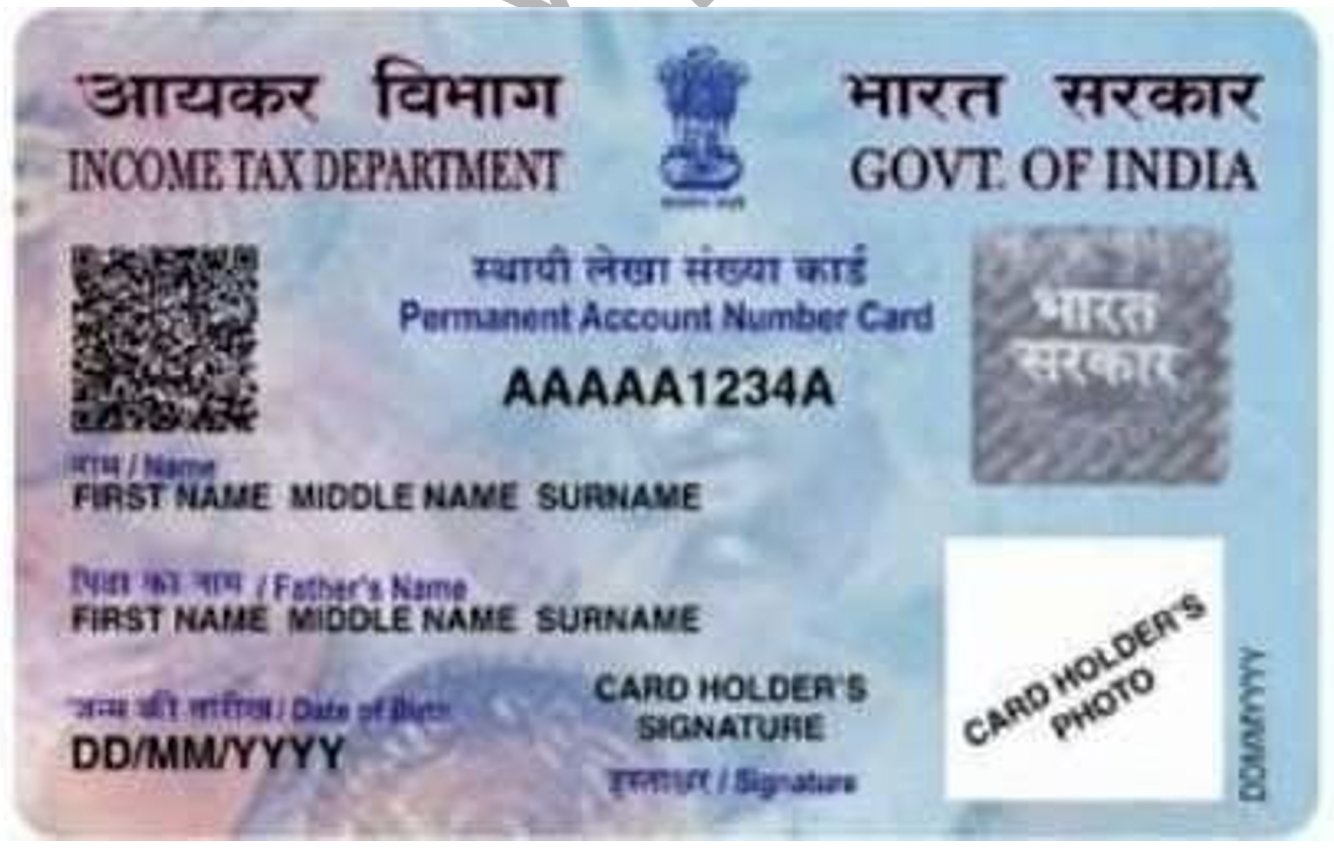

PAN is a ten-digit unique alphanumeric number issued by the Income Tax Department. PAN is issued in the form of a laminated plastic card as given below (commonly known as PAN card):

Permanent Account Number (PAN) Various aspects of PAN to be covered

Now we shall discuss on the structure of the ten characters of PAN.

Assume PAN number of Ashok Kumar is AAAPK1111A

Out of the first five characters, the first three characters represent the alphabetic series running from AAA to ZZZ.

The fourth character of PAN represents the status of the PAN holder

“P” stands for Individual

“C” stands for Company

“H” stands for Hindu Undivided Family (HUF)

“A” stands for Association of Persons (AOP)

“B” stands for Body of Individuals (BOI)

“G” stands for Government Agency

“J” stands for Artificial Juridical Person

“L” stands for Local Authority

“F” stands for Firm/ Limited Liability Partnership

“T” stands for Trust

Fifth character of PAN represents the first character of the PAN holder’s last name/surname in case of an individual. In case of non-individual PAN holders fifth character represents the first character of PAN holder’s name.

Next four characters are sequential numbers running from 0001 to 9999.

Last character, i.e., the tenth character is an alphabetic check digit.

PAN enables the department to identify/ link all transactions of the PAN holder with the department. These transactions include tax payments, TDS/TCS credits, returns of income, specified transactions, correspondence etc, and so on.

It facilitates easy retrieval of information of PAN holder and matching of various investments, borrowings and other business activities of PAN holder.

Who has to obtain PAN?

PAN is to be obtained by :

• Every person if his total income or the total income of any other person in respect of which he is assessable during the year exceeds the maximum amount which is not chargeable to tax.

• A charitable trust who is required to furnish return under Section 139(4A)

• Every person who is carrying on any business or profession whose total sale, turnover, or gross receipts are or is likely to exceed five lakh rupees in any year

• Every person who intends to enter into specified financial transactions in which quoting of PAN is mandatory.

Every non-individual resident persons and persons associated with them shall apply for PAN if the financial transaction entered into by them during the financial year exceeds Rs. 2,50,000.

Transactions in which quoting of PAN is mandatory

Following are the transactions in which quoting of PAN is mandatory by every person except the Central Government, the State Governments and the Consular Offices:

1) Sale or purchase of a motor vehicle or vehicle other than two wheeled vehicles.

2) Opening an account [other than a time-deposit referred at point No. 12 and a Basic Savings Bank Deposit Account] with a banking company or a co-operative bank

3) Making an application for issue of a credit or debit card.

4) Opening of a demat account with a depository, participant, custodian of securities or any other person with SEBI

5) Payment in cash of an amount exceeding Rs. 50,000 to a hotel or restaurant against bill at any one time.

6) Payment in cash of an amount exceeding Rs. 50,000 in connection with travel to any foreign country or payment for purchase of any foreign currency at any one time.

7) Payment of an amount exceeding Rs. 50,000 to a Mutual Fund for purchase of its units

8) Payment of an amount exceeding Rs. 50,000 to a company or an institution for acquiring debentures or bonds issued by it.

9) Payment of an amount exceeding Rs. 50,000 to the Reserve Bank of India for acquiring bonds issued by it.

10) Deposits of cash exceeding Rs. 50,000 during any one day with a banking company or a co- operative bank.

10A) Deposits of cash aggregating to more than Rs. 2,50,000 during the period of 09th November 2016 to 30th December 2016 with a banking company, cooperative bank or post office.

11) Payment in cash for an amount exceeding Rs. 50,000 during any one day for purchase of bank drafts or pay orders or banker’s cheques from a banking company or a co-operative bank.

12) A time deposit of amount exceeding Rs. 50,000 or aggregating to more than Rs. 5 lakh during a financial year with – (i) a banking company or a co-operative bank (ii) a Post Office; (iii) a Nidhi referred to in section 406 of the Companies Act, 2013 or (iv) a non-banking financial company

13) Payment in cash or by way of a bank draft or pay order or banker’s cheque of an amount aggregating to more than Rs. 50,000 in a financial year for one or more pre-paid payment instruments, as defined in the policy guidelines for issuance and operation of pre-paid payment instruments issued by Reserve Bank of India under section 18 of the Payment and Settlement Systems Act, 2007 to a banking company or a co-operative bank or to any other company or institution.

14) Payment of an amount aggregating to more than Rs. 50,000 in a financial year as life insurance premium to an insurer

15) A contract for sale or purchase of securities (other than shares) for amount exceeding Rs. 1 lakh per transaction

16) Sale or purchase, by any person, of shares of a company not listed in a recognised stock exchange for amount exceeding Rs. 1 lakh per transaction.

17) Sale or purchase of any immovable property for an amount exceeding Rs. 10 lakh or valued by stamp valuation authority referred to in section 50C of the Act at an amount exceeding ten lakh rupees.

18) Sale or purchase of goods or services of any nature other than those specified above for an amount exceeding Rs. 2 lakh per transaction.

NOTE:

1) Minor person can quote PAN of his father or mother or guardian provided he does not have any income chargeable to income-tax.

2) Any person, who does not have PAN and enters into any of above transaction, can make a declaration in Form No.60.

3) Quoting of PAN is not required by a non-resident in a transaction referred at point No. 3 or 5 or 6 or 9 or 11 or 13 or 18.

4) Any person who has an account (other than a time deposit referred at point no. 12 and a Basic Saving Bank Deposit Account) maintained with a banking company or a co-operative bank. He will be required to furnish his PAN or Form No.60 on or before 30-06-2017 if he has not quoted his PAN or furnished Form No. 60 at the time of opening of such account or subsequently.

How to apply for PAN?

Income Tax Department has authorised UTI Infrastructure Technology and Services Limited (UTIITSL) and National Securities Depository Limited (NSDL) [now protean] to set-up and manage PAN Service Centers. UTIITSL and NSDL [now protean] have established PAN Service Centers and TIN Facilitation Centers at various places in major cities of India (hereinafter referred to as PAN application centers of UTIITSL/Protean).

Thus, a person wishing to obtain PAN can apply for PAN by submitting the PAN application form (Form 49A/49AA) along with the related documents and prescribed fees at the PAN application center of UTIITSL or Protean. An online application can also be made from the website of UTIITSL or Protean.

As per Section 139AA, every person who is eligible to obtain Aadhaar is required to quote his Aadhaar number in the PAN application form with effect from 1st day of July, 2017. If any person does not possess the Aadhaar Number but he had applied for the Aadhaar card then he can quote Enrolment ID of Aadhaar application Form.

However, the provisions of section 139AA shall not apply to an individual who does not possess the Aadhaar number or the Enrolment ID and is:-

i) residing in any of these States-Assam, Jammu and Kashmir and Meghalaya;

ii) a non-resident as per the Income-tax Act, 1961;

iii) of the age of 80 years or more at any time during the previous year, i.e., super-senior citizen;

iv) not a citizen of India.

Hence, it will not be mandatory for an individual (as notified above) to quote his/her Aadhaar Number in the PAN application form.

In case of an applicant, being a company which has not been registered under the Companies Act, 2013, the application for allotment of a Permanent Account Number may be made in Spice- INC-32 specified under sub-section (1) of section 7 of the said Act for incorporation of the company.

A resident person shall apply for PAN in form 49A and a non-resident person including a foreign company shall apply for allotment of PAN in form 49AA.

Individual applicants will have to affix two recent, coloured photograph (Stamp size 3.5 cms x 2.5. cms) on PAN application form.

Prescribed document must be furnished as a proof of ‘Identity’ ‘Address’ and ‘Date of Birth’. Designation and Code of concerned Assessing Office of Income Tax Department will have to be mentioned in PAN application form.

The address, phone numbers, etc., of PAN application centers of UTIITSL or Protean at which PAN application can be submitted can be obtained from :

• Website of Income Tax Department : www.incometaxindia.gov.in

• Website of UTIITSL : www.utiitsl.com Website of Protean : https://www.protean-tinpan.com/

Instant PAN

Income-tax Dept. has launched a new functionality on the e-filing portal which allots a PAN to the assessee on basis of his Aadhaar Number.

This facility can be used by an assessee only if the following conditions are fulfilled:

a) He has never been allotted a PAN;

b) His mobile number is linked with his Aadhaar number;

c) His complete date of birth is available on the Aadhaar card; and

d) He should not be a minor on the date of application for PAN

How to get instant PAN using this functionality?

How to correct any mistake in PAN card or intimate any change in data pertaining to PAN?

- Request for reissue of lost PAN card or for change/correction in PAN data is to be filed in “Request for New PAN Card Or/ And Changes Or Correction in PAN Data”.

- For Changes or Correction in PAN data, fill all mandatory fields of the Form and select the corresponding box on left margin of appropriate field where correction is required.

- If the application is for re-issuance of a PAN card without any changes in PAN related data of the applicant, fill all fields in the Form but do not select any box on left margin.

- In case of either a request for Change or Correction in PAN or request for re-issuance of a PAN Card without any changes in PAN data, the address for communication will be updated in the ITD database using address for communication provided in the application.

- For Cancellation of PAN, fill all mandatory fields in the Form, enter PAN to be cancelled in appropriate column of the Form and select the check box on left margin.

- PAN to be cancelled should not be same as PAN (the one currently used) mentioned at the top of the Form.

Holding of more than one PAN not allowed

A person cannot hold more than one PAN. A penalty of Rs. 10,000/- is liable to be imposed under section 272B of the Income-tax Act, 1961 for having more than one PAN. If a person has been allotted more than one PAN then he should immediately surrender the additional PAN card(s).

Linking of PAN with Aadhaar Number

The Finance Act, 2017 had inserted a new section 139AA in the Income-tax Act, 1961, requiring every person who is eligible to obtain Aadhaar to quote his Aadhaar number while applying for PAN or furnishing return of income with effect from July 1, 2017. If any person does not possess the Aadhaar Number but he had applied for the Aadhaar card then he can quote Enrolment ID of Aadhaar application Form in the ITR.

Section 139AA further provides that every person who has been allotted PAN as on the 1st day of July, 2017, and who is eligible to obtain Aadhaar number shall intimate his Aadhaar number on or before 31-03-20221 to the Income-tax Department.

In case of failure to intimate the Aadhaar number, PAN allotted to the person shall be made inoperative after the date so notified. The CBDT has notified that all the consequences provided under the Income-tax Act for not furnishing, intimating or quoting PAN shall come into effect from 01-07-2023 if PAN becomes inoperative due to non-linking of it with Aadhaar. However, the taxpayer is liable to pay fee if PAN is linked with Aadhaar from 01-04-2022

Consequences for not linking PAN with Aadhaar Number

The Central Board of Direct Taxes has notified Rule 114AAA prescribing the manner and consequences if PAN becomes inoperative.

The Rule 114AAA(3) provides that if PAN of a person become inoperative, then he shall be liable for the following consequences:

I. Refund of any amount of tax or part thereof, due under the provisions of the Act shall not be made;

II. Interest shall not be payable on such refund for the period, beginning with the date when PAN become inoperative and ending with the date on which it becomes operative;

III. Where tax is deductible under Chapter XVIIB in case of such person, such tax shall be deducted at higher rate, in accordance with provisions of section 206AA;

IV. Where tax is collectible at source under Chapter XVII-BB in case of such person, such tax shall be collected at higher rate, in accordance with provisions of section 206CC.

However, the person can reactivate his PAN by subsequently intimating his Aadhaar to the Department.

Fee for default relating to intimation of Aadhaar number

The Finance Act, 2021 has inserted a new Section 234H to levy a fee for default in intimating the Aadhaar Number. If a person is required to intimate his Aadhaar under Section 139AA and such person fails to do so, he shall be liable to pay a fee, as may be prescribed, not exceeding Rs. 1,000 at the time of making such intimation.

The CBDT vide notification No. 17/2022, dated 29-03-2022 has amended Rule 114 to prescribe the fees to be levied if Aadhaar is not linked with PAN. As per Rule 114(5A), if a person intimates his Aadhaar number after the due date, then he shall be liable to pay a fee of:

a) Rs. 500, if such intimation is made between 01-04-2022 and 30-06-2022; and

b) Rs. 1,000, in all other cases.

PAN and AADHAR are interchangeable for Income -tax purpose

Section 139A of the Income-tax Act, 1961, prescribes various conditions under which an assessee is required to obtain PAN. He needs to mention his PAN in all communications with the Income-tax Dept. and while entering into specified financial transactions. However, there can be situations where a person entering into high-value transactions, such as purchase of foreign currency or huge withdrawal from the banks, does not possess a PAN. Thus, the Finance (No. 2) Act, 2019, has provide for interchangeability of PAN with Aadhar. It has been provided that every person who is required to furnish or intimate or quote his PAN under the Income-tax Act, and who,- a) has not been allotted a PAN but possesses the Aadhaar number, may furnish or intimate or quote his Aadhaar in lieu of PAN. Further, Income-tax department shall allot PAN to such person in prescribed manner. b) has been allotted a PAN, and who has linked his Aadhaar number with PAN as per section 139AA, may furnish his Aadhaar number in lieu of a PAN for all the transactions where quoting of PAN is mandatory as per Income-tax Act.

Penalty for not complying with provisions relating to PAN or Aadhar

Section 272B provides for penalty in case of default in complying with the provisions relating to PAN, i.e., failure to obtain, quote, or authenticate PAN. The amount of penalty shall be Rs. 10000 for each default. As the Finance (No. 2) Act, 2019 as provided for interchangeability of Aadhar with PAN, Consequential amendments have been made in the penal provisions of Section 272B so as to levy a penalty of Rs. 10,000 for each default in the following cases:

a) If assessee fails to quote or intimate his PAN or Aadhaar or quotes or intimates invalid PAN or Aadhaar.

b) If assessee fails to quote or authenticate his PAN or Aadhaar in specified transactions.

c) If receiver (i.e., banks, financial institution, etc.) of documents in respect of specified transactions fails to ensure that the PAN or Aadhaar are duly quoted and authenticated