The GSTN has issued GSTR-3A notices for non-filing of Form GSTR-4, creating confusion among many composition taxpayers—especially those who have already filed the return or whose registration was cancelled.

📌 What’s the Issue?

Several composition taxpayers have received GSTR-3A notices for non-filing of GSTR-4 for FY 2024–25, even though:

- ✅ They have already duly filed the relevant GSTR-4 return, OR

- ❌ Their GST registrations were cancelled before the beginning of FY 2024–25.

✅ What Should You Do?

As per the official GSTN advisory, no action is required in the following cases:

- You have already filed GSTR-4 for FY 2024–25 correctly, or

- Your GST registration was cancelled before FY 2024–25 began.

In these cases, you can safely ignore the notice.

However, if you haven’t yet filed GSTR-4 and your registration is active, you should take immediate action to avoid penalties.

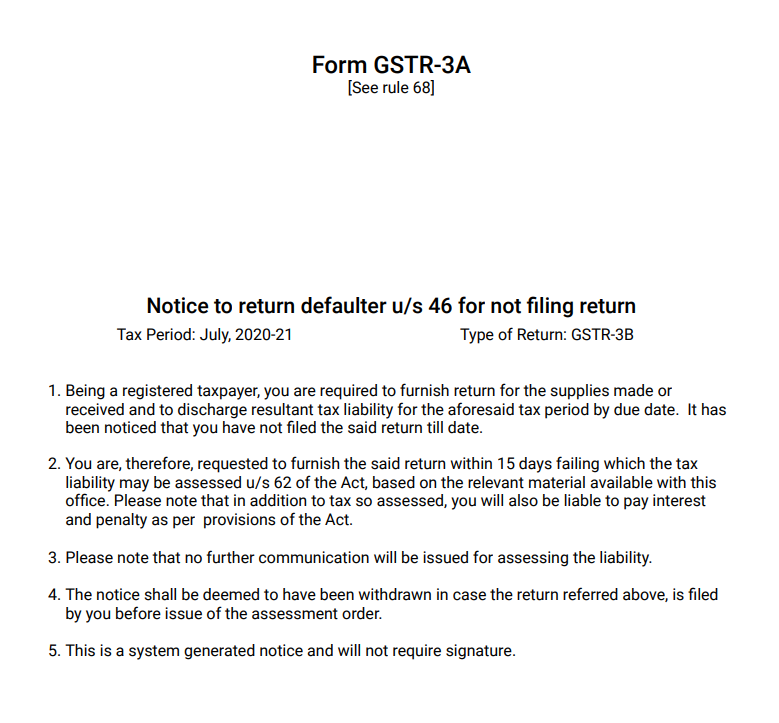

ℹ️ About GSTR-3A

- GSTR-3A is a notice issued under Rule 68 of CGST Rules when a registered taxpayer fails to file returns (like GSTR-4) on time.

- It gives an opportunity to file the pending return before further action like penalty or cancellation is taken.

📣 Conclusion

If you’re a composition taxpayer who’s received a GSTR-3A notice despite having either:

- Already filed GSTR-4, or

- Cancelled your registration prior to FY 2024–25,

then you don’t need to worry. The advisory clearly states no further steps are required in such cases.

👉 Click here to read the official GSTN advisory

Advisory: Regarding GSTR-3A Notices issued for non-filing of form GSTR 4 to cancelled Composition Taxpayers

Jul 20th, 2025

As per the provisions of Section 39(2) of the Central Goods and Services Tax (CGST) Act, 2017, read with Rule 68 of the CGST Rules, 2017, notices in Form GSTR-3A are required to be issued in cases of non-filing of Form GSTR-4. However, it has come to notice that, due to a system-related glitch, such notices have been inadvertently issued in certain cases where they were not applicable — including instances involving taxpayers whose registrations had been cancelled prior to the Financial Year 2024–25.

2. The issue is currently under active examination, and the technical team is implementing appropriate corrective measures to ensure that such instances do not recur. In the meantime, taxpayers who have either duly filed the relevant return or whose registrations were cancelled prior to the Financial Year 2024–25 are advised to ignore these notices, as no further action is required on their part in such cases.

3. For any other issues or concerns, taxpayers are advised to raise a grievance through the Self-Service Portal available on the GST Portal, along with all relevant details, to facilitate prompt and effective resolution.Regards,

Team GSTN

Visit www.cagurujiclasses.com for practical courses