Digital payments platform PhonePe has inked a pact with PayMate, a leading digital B2B payments and service provider, to allow user to pay their income tax returns on the PhonePe app.

Income Tax Payment’ feature allows taxpayers, both individuals and businesses to pay self-assessment and advance tax directly from within the PhonePe app. This eliminates the need to log in to the tax portal, creating a seamless experience for taxpayers, PhonePe said in a statement.

Users can use their credit card or Unified Payments Interface (UPI) for this.

With credit card payments, users also get a 45-day interest-free period and earn reward points on their tax payments, depending on their bank, PhonePe said.

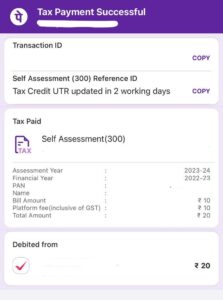

Once the payment has been made, taxpayers will receive a Unique Transaction Reference (UTR) number as an acknowledgement within one working day. The challan for the tax payment will be available within two working days.

All this will be possible without the need to log in to the income tax portal. Amid complaints of technical snags on the website, this feature will not only provide an alternative of tax filing but also reduce load on the website.

How to pay taxes with the help of PhonePe

- Download and install PhonePe app.

2. Open the PhonePe app homepage and tap on the ‘Income Tax’ icon.

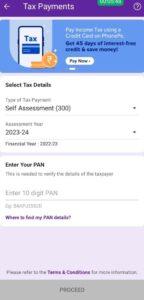

3. Choose the type of tax you want to pay, the assessment year.

4. Enter your PAN Card details.

5. Enter the total tax amount and pay using the payment mode of your choice.

6. After the successful payment, the amount will be credited to the tax portal within two working days.

Currently, the income tax return deadline is July 31 for the assessment year 2023-24.

According to the latest data on the income tax department’s website, 4 crore ITRs for AY 2023-24 have been filed so far. Out of these, 3.62 crore ITRs have been verified, and 2.13 crore verified ITRs have been processed.

- There are a total of 11.39 crore individual registered users.

Practical Course at: