In India most of the people running small businesses, it is not possible for them to comply with monthly compliances of GST, in order to give them relief a scheme under GST is announced which is know as composition scheme.

The Composition Levy is an alternative method of levy of tax designed for small taxpayers whose turnover is up to prescribed limit. The objective of Composition Levy scheme is to bring simplicity, ease the compliance burden and reduce cost of compliance for the small taxpayers. The scheme is optional. It essentially provides for a turnover tax regime for such taxpayers, with facility for filing of return on annual basis along with quarterly payment of tax

Here are the key features of the Composition Scheme:

Eligibility & Threshold Limit:

Small taxpayers with an aggregate turnover of up to a specified threshold can opt for the composition scheme. The threshold limit may vary for different categories of states, such as regular states and special category states (e.g., northeastern states).

Threshold Limit: The threshold limit for the composition scheme is Rs. 1.5 crore for regular states and Rs. 75 lakhs for special category states.

Refer Sec 10(1) of CGST ACT 2017:

If aggregate turnover of registered person does not exceed 1.5 crore (NN 14/2019) in the preceding financial year He may opt for composition levy in the current year

For Special states (Arunachal Pradesh, Nagaland, Manipur, Sikkim, Meghalaya, Tripura, Mijoram, Utttrakhand) limit is Rs.75lakhs

Download NN 14/2019: https://taxinformation.cbic.gov.in/view-pdf/1000701/ENG/Notifications

Persons who are not eligible for the scheme:

Barring few exceptions, all registered taxable persons whose Aggregate Annual Turnover has not exceeded the eligibility limit (as mentioned above) in the previous financial year are eligible to opt for this scheme.

List of taxable persons who are not eligible for the scheme is as below:

(a) A casual taxable person i.e. a person who occasionally undertakes supplies in a State or Union Territory where he has no fixed place of business;

(b) A Non-Resident Taxable Person i.e. a person who occasionally undertakes supplies but has no fixed place of business or residence in India;

(c) A person engaged in providing inter-state supply of goods and services or both;

(d) A person engaged in supply of non-taxable goods i.e. goods which are not taxable under GST law;

(e) A person engaged in supply of goods through an Electronic Commerce Operator (ECO) who is required to collect Tax at source under Section 52 of the CGST Act;

(f) A person engaged in manufacturing of goods notified under Section 10 (2) (e) of the CGST Act 2017.

Below Manufactures cannot opt for composition scheme

| 1 | Ice cream and other edible ice, whether or not containing cocoa |

| 2 | Pan masala. |

| 3 | All goods, i.e. Tobacco and manufactured tobacco substitutes |

| 4 | Fly ash bricks or fly ash aggregate with 90 per cent. or more fly ash content; Fly ash blocks |

| 5 | Bricks of fossil meals or similar siliceous earths |

| 6 | Building bricks |

| 7 | Earthen or roofing tiles |

- From S.No. 4 these categories are added in restriction list from 1st April 2022

- In case of multiple business places under same PAN, composition scheme if opted shall be opted on PAN India basis

Registration and Intimation under the scheme:

(a) Registration under GST law is compulsory for opting for this scheme.

(b) A person who was not registered under existing law but applies for fresh registration may opt for the scheme by providing necessary information under Part-B of FORM GST REG-01.

(c) Any registered person who wants to opt for Composition Levy has to file an electronic intimation in the FORM GST CMP-02 prior to the commencement of financial year for which the option to pay tax under Composition Levy is exercised and also has to a furnish a statement in FORM GST ITC-03 in accordance with the Rule 44(4) of CGST Rules, 2017, within 60 days from the commencement of the relevant financial year.

(d) There is no need to file intimation in FORM GST CMP-02 every year. The intimation once filed would remain valid, as long as the taxpayer is eligible for Composition Levy scheme under GST.

Limited Tax Liability:

Businesses under the composition scheme are required to pay GST at a fixed rate on their turnover. They are not required to maintain detailed invoices or records as required for regular taxpayers.

Rate of Tax:

The GST rates applicable under the composition scheme are generally lower than the regular GST rates. The rates may vary for different types of businesses, such as manufacturers, traders, and restaurants.

The applicable composition scheme GST rate are divided in SGST/UGST + CGST split

i.e. 1% GST = 0.5% CGST + 0.5% SGST/UGST,

6% GST = 3% SGST/UGST + 3% CGST.

The composition levy rates under GST are as follows:

| Particulars | Particulars | On ATO | Total Rate |

| Supplier of Goods | Traders | ATO | 1% |

| Supplier of Goods | Manufacturer | ATO | 1% |

| Supplier of Services | Supplier of food & drinks (Restaurant business) | ATO | 5% |

| Supplier of Services | Goods & Services (deemed as composite supply) | ATO | 1% |

| Other** | Goods or services or both (deemed as mixed supplies, other than restaurant business) This is applicable from 1st April 2019 onwards. | ATO | 6% |

*ATO: Annual Aggregate Turnover for determining eligibility and Tax liability

Method to calculate Aggregate Annual Turnover:

Aggregate Annual Turnover is computed on All India basis for a person having same Permanent Account Number (PAN).

It is sum of value of all outward supplies falling in the following four categories:

(a) Taxable supplies;

(b) Exempt supplies;

(c) Exports of goods/services;

(d) Inter-state supplies;

but excludes:

(e) the value of inward supplies on which tax is payable by a person on reverse charge basis;

(f) taxes including cess paid under GST law;

(g) the value of exempt supply of services provided by way of extending deposits, loans or advances in so far as the consideration is represented by way of interest or discount.

Uniform rate of tax @ 1% under composition scheme for manufacturers and traders (for traders, turnover will be counted only for supply of taxable goods).

**

| New Composition Scheme for services/Concessional-NN CT(R) -2/2019 Conditions: 1.Aggregate turnover in preceding FY does not exceed Rs.50lakhs 2.Not eligible under original composition scheme (Sec10) 3.Pay total tax @ 6% on first supplies of Rs.50lakhs during the Financial Year 4.Service providers or service component more than10% Supply of Services (other than restaurant & catering) allowed to composite taxpayers upto –10% of turnover in preceding FY or –Rs.5,00,000 whichever is higher |

New GST Rate for Brick Manufacturing Sector

The Central Board of Indirect Taxes and Customs (CBIC) has recently made significant revisions to the GST rates for the brick manufacturing sector, effective from April 1, 2022. These changes, outlined in notifications dated March 31, 2022, entail an increase in GST rates for various brick products, alongside alterations in Input Tax Credit (ITC) norms. Let’s delve into the details of these modifications and their implications for the brick manufacturing industry.

Revised GST Rates:

The new GST rates for brick manufacturing have been revised as follows:

- Increased Rates: The GST rates for fly ash bricks, blocks, building bricks, and roofing tiles have been raised from 5% to 12% with Input Tax Credit (ITC), and 6% without ITC.

- Composition Scheme: Brick manufacturers now have the option to opt for a composition scheme, allowing them to pay a reduced GST rate of 6% without ITC, as opposed to the previous rate of 5%.

Applicability of Revised GST Rates:

The revised GST rates are applicable to all brick manufacturers with turnovers exceeding Rs. 20 lakhs, down from the earlier threshold of Rs. 40 lakhs. This means that all brick manufacturers falling under this category must register and pay GST at the specified rates.

Products Covered:

The new tax structure applies to the following products:

- Fly ash bricks and blocks

- Bricks of fossil meals or similar siliceous earth

- Building bricks

- Earthen or roofing tiles

Comparison with Previous Structure:

Before April 1, 2022, brick manufacturers had the option to choose between the composition scheme (1% GST without ITC) or the normal scheme (5% GST with ITC) to discharge their GST liability. However, under the new GST rate structure, the composition scheme has been discontinued, and manufacturers must now opt for either 12% GST with ITC or 6% GST without ITC.

Implications of the Changes:

The increase in GST rates may pose challenges for brick manufacturers, as it could impact their overall tax liability and pricing strategies. Additionally, the reduction in the threshold limit for registration means that more manufacturers will now fall under the purview of GST compliance, necessitating careful tax planning and adherence to regulatory requirements.

Conditions & Restrictions under the Composition scheme:

A person opting for the scheme has to adhere to the following conditions:

(a) Issue bill of supply in the prescribed manner;

(b) pay all taxes on purchases including taxes to be paid on reverse charge basis, if any;

(c) don’t claim Input Tax Credit of purchases;

(d) mention the words “Composition Taxable Person” on every notice board or signboard displayed at the prominent place at his every place of business;

(e) withdraw from the scheme if not eligible.

Inter-State Sales:

Businesses under the composition scheme are not allowed to make inter-state sales. They can only sell goods and services within the state where they are registered.

No Input Tax Credit:

Unlike regular taxpayers, businesses under the composition scheme are not eligible to claim input tax credit on their purchases.

Invoice and Tax Collection:

Composition scheme businesses cannot charge GST separately on their invoices. They are required to mention “Composition Taxable Person” on their bills, Sign Board and can issue Bill of Supply

Mainly Businesses/individuals registered under the composition scheme are not allowed to issue tax invoices as they cannot charge GST on outward supplies of goods/services.

Thus, a composition dealer has to issue a Bill of Supply in case of outward supply of goods/services. This bill of supply is mandatorily required to feature the words – “Composition Taxable Person, Not Eligible to Collect Tax on Supplies” on it. It must have:

- Supplier name, GST Identification Number (GSTIN) and Address

- Unique serial number termed as bill of supply number

- Date of issue of bill of supply

- Recipient details such as name, address and GSTIN (if registered)

- HSN code of goods being supplied

- Description/quantity of Goods/services (as applicable)

- Total value of supplies (adjusted for applicable discounts)

- Signature/digital signature of the supplier

Quarterly Returns:

Businesses under the composition scheme need to file quarterly GST returns (CMP-08) and a Annual Return (GSTR-4) instead of monthly returns, which reduces the compliance burden.

Very important question Asked for composition scheme is : if any taxpayer cancelled its registration under composition scheme do he required to file GSTR-10 (Final Return) :

Answer is No, Composite dealers are not required to file GSTR-10

Composition Scheme Forms under GST

| Form Number/Name | Purpose of Form |

| GST CMP-01 | Intimation for tax payment under composition scheme (for provisionally registered business entity/individual) |

| GST CMP-02 | To opt for composition scheme (unregistered entity/persons) |

| GST CMP-03 | To provide details of stock/inward supply from unregistered business/person |

| GST CMP-04 | To withdraw from GST composition scheme |

| GST CMP-05 | Show cause notice issued by appropriate tax official on contravention of GST Act rules |

| GST CMP-06 | Reply to show cause notice issued in Form GST CMP-05 |

| GST CMP-07 | Order indicating acceptance/rejection of show cause notice reply provided in Form GST CMP-06 |

| GST REG-01 | To register under composition scheme |

| GST ITC-01 | Details of inputs available with the composition registered supplier in the form of raw materials, semi-finished and finished goods |

GST Payments by Composition Registered Business/Individual

Businesses registered under the GST composition scheme are not allowed to claim input tax credit, hence such suppliers have to make GST payments on supplies by filing CMP-08 (Quarterly). Also GST payments need to be made by composition scheme registered dealers include:

- Tax payments on goods & Services received, that means purchases covered under Reverse Charge mechanism, it means Composition dealers must pay tax under the reverse-charge mechanism wherever it is applicable. The rate for the supplies produced will be the rate at which the dealer has to pay the GST. Hence, the rate under the scheme cannot be used to pay taxes under the reverse-charge mechanism.

- Tax incurred for import of services

Hence the total GST payable = tax on supplies + Tax on purchases under reverse charge + tax on import of services.

Due date under GST composition scheme

The due date for filing Form CMP-08 is the 18th of the month succeeding the quarter or as extended by the Government from time to time.

For example, for the quarter of April to June 2024, the Due Date is 18th July 2024. Even in case of a nil return, CMP-08 is required to be filed. However,

An annual return GSTR-4 is also required to be filed on or before 30th April after the end of financial year.

Late fees for not filing the CMP-08 within the due date

If a taxpayer does not file his/her return within the due dates mentioned above, he/she shall have to pay a late fee of Rs. 50/day i.e. Rs.25 per day in each CGST and SGST (in case of any tax liability) and Rs. 20/day i.e. Rs.10/- day in each CGST and SGST (in case of Nil tax liability) subject to a maximum of Rs.5000/-, from the due date to the date when the returns are actually filed.

Action for wrongly opting the scheme or for contravention of any provision of the scheme:

(a) In the scenario, when the proper officer has reason to believe that the registered person has wrongly opted for the scheme or he has contravened the provisions of the scheme, then he will seek a reply by issuing a show cause notice to such person in the FORM GST CMP-05. This notice is to be replied within 15 days of receipt of the same. Thereafter within 30 days of receipt of reply, officer has to issue an order in FORM GST CMP-07, either accepting the reply or denying the option to pay tax under the scheme.

(b) Subsequently the registered person who has been denied the option to pay tax under the scheme has to forward a statement in FORM GST ITC-01 containing details of the stock of the inputs and inputs contained in semi-finished or finished goods held in stock by him on the date on which the option is denied. The said statement has to be submitted on the common portal within 30 days from the date of denial order passed in the FORM GST CMP-07.

(c) The delinquent taxpayer will be liable to pay the due tax and penalty. However, no adverse action will be taken without following the principles of natural justice.

Benefits of GST Composition Scheme Registration

- Reduced compliance requirements, hence suitable for small businesses with limited resources

- Limited liability in terms of tax payable in lieu of composition levy

- Higher liquidity for small businesses as tax rates are lower

Limitations of the GST Composition Scheme Registration

- Limited area of operation as composition dealer cannot engage in inter-state sales transactions (outward supplies)

- Unavailability of input tax credit mechanism to offset GST payments

- Composition registered businesses cannot supply goods through an e-commerce portal

How to switch from Normal To compositions Scheme

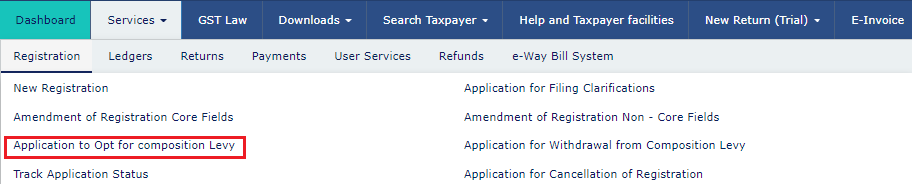

To opt for the Composition Levy on the GST Portal as an existing taxpayer, perform following steps:

1. Access the https://www.gst.gov.in/ URL. The GST Home page is displayed. Login to the GST Portal by entering your login credentials.

2. Select ‘Application to Opt for composition Levy’ from the Registration Menu.

3. Application to Opt for Composition Levy page is displayed.

Note: If a normal taxpayer had entered HSN of any Goods or Service which is not eligible for Composition Levy while registering for GST and now wants to opt for the composition scheme, below warning message will pop-up. He/She will not be able to proceed further unless the commodity has been removed from the list of commodities.

4. Your GSTIN, Legal Name of Business, Trade Name (if any), Address of Principal Place of Business and Jurisdiction are auto-populated. Select the Category of Registered Person.

Note: For Manufacturers, other than manufacturers of such goods as may be notified by the Government for which option is not available certain goods will not be allowed under Composition Opt-In. Following Error message will be displayed on the screen on entering such restricted goods.

5. Select the Composition and Verification Declaration.

6. Select the Authorized Signatory from the drop-down list and enter the Place from where the form is filled.

7. Click SAVE.

8. A confirmation message is displayed that Application has been saved.

9. Click the SUBMIT WITH DSC or SUBMIT WITH EVC button.

10.1. SUBMIT WITH DSC:

a. Click YES.

b. Select the certificate and click the SIGN button.

10.2. SUBMIT WITH EVC:

a. Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VALIDATE OTP button.

11. The success message is displayed. You will receive the acknowledgement in next 15 minutes on your registered e-mail address and mobile phone number.

FAQ – To Opt Composition Scheme (Explained under GST)

1. How to opt for the Composition Scheme in GST?

You can opt for the Composition Levy under GST if you are a regular taxpayer with an aggregate annual domestic PAN-based turnover as specified from time to time.

However, you cannot opt for the Composition Levy if you are/you make:

– any supply of goods which are not liable to be taxed under this Act

– inter-state outward supplies of goods

– supplies through electronic commerce operators who are required to collect tax under section 52.

– a manufacturer of notified goods

– a casual dealer

– a Non-Resident Foreign Taxpayer

– a person registered as Input Service Distributor (ISD)

– a person registered as TDS Deductor/Tax Collector

2. How do I apply for Composition Scheme if I am already registered as a regular taxpayer?

To opt for the Composition Levy, perform the following steps on the GST portal:

- Log in to the Taxpayers’ Interface

- Go to Services > Registration > Application to Opt for Composition Levy

- Fill the form as per the form specification rules and submit

3. How do I convert from regular to composition scheme in GST?

Any taxpayer who is registered as normal tax payer under GST needs to file an application to opt for Composition Levy in Form GST-CMP-02 at GST Portal prior to the commencement of financial year for which the option to pay tax under the aforesaid section is exercised.

4. When can I opt for the Composition Levy?

In order to avail this scheme, you need to file an online application to Opt for Composition Levy with the tax authorities. Taxpayers who can opt for this scheme can be categorized as below:

- New Taxpayers: Any person who becomes liable to register under GST Act, after the appointed day, needs to file his option to pay composition amount in the Application for New Registration in Form GST REG-01.

- Existing Taxpayers: Any taxpayer who is registered as normal tax payer under GST needs to file an application to opt for Composition Levy in Form GST-CMP-02 at GST Portal prior to the commencement of financial year for which the option to pay tax under the aforesaid section is exercised.

5. I am a registered taxpayer availing the composition scheme under GST Portal. Do I need to file fresh application to opt for composition scheme?

For those taxpayers, who are already availing the composition scheme, there is no requirement to file fresh application opting for composition scheme, subject to compliance of relevant conditions/restrictions in this regard.

6. Is it mandatory to file a Stock Intimation? How do I file a Stock Intimation?

Yes, it is mandatory to file a Stock Intimation.

In addition to filing the application to opt for Composition Levy, you would also require to file a Stock Intimation to furnish the details of stock including inward supply of goods from unregistered persons, held by you on the day preceding the date from which you opt to pay the composition amount. You are required to file Stock Intimation details within 30 days of the date from which Composition Levy is sought.

The application to opt for Composition Levy is not subject to approval by the tax authorities. On filing of the application, you are marked as a composition taxpayer in the system and consequential changes are made in the system. However, in case it is found that you were not eligible for the Composition Levy or have not filed Stock Intimation, you would be compulsorily pushed out of the Composition Levy by initiating appropriate proceedings.

Stock Intimation filed by you is not subject to processing by State & Centre Tax Authorities. However, in case it is found out by the tax authorities that the particulars of stock and ITC reversal furnished in the Stock Intimation are incorrect, the tax authorities can initiate appropriate demand proceedings from back office against you.

7. Can I save the Application to Opt for Composition Levy?

Yes, the application can be saved for up to 15 days from the date of initiation after which it will be purged by the system.

Saved applications can be accessed using the My Saved Applications functionality available in the Taxpayers’ Interface.

8. Can I opt for Composition Levy, if I have dealt in services?

Yes, you can opt for Composition Levy, even if you have dealt in services, from FY 2019-20 onwards.

9. I have dealt in services from 1st April 2019 to 31st July 2019 and have filed application to Opt for Composition Levy. My application has been rejected. Why?

If you have filed Form GSTR-1 or Form GSTR-3B for April/ May/ June 2019 against any GSTIN registered on your PAN across India for FY 2019-20, your application to Opt for Composition Levy will be rejected.

10. What are the returns to be filed by a Composition taxpayer?

Composition taxpayer needs to pay tax and furnish a statement, every quarter or part thereof, as the case may be, in FORM GST CMP-08.

And further he has to furnish a return for every financial year or part thereof, as the case may be, in FORM GSTR-4.

NOTE: For current applicable timelines, refer to Important Dates section on https://www.gst.gov.in/

Compulsory Withdrawal From Composition Levy FAQs

1. What is meant by Compulsory Withdrawal from Composition Levy?

A taxpayer can opt out of Composition levy in any of the two ways:

- Voluntarily opt out of Composition levy by filing Form GST CMP-04 on the GST Portal or

- Compulsorily removed out of Composition levy by the Tax Official at any time during the financial year.

In case, the taxpayer does not opt out of the Composition levy within 7 days of disqualifying event, proceedings for compulsory withdrawal from Composition levy can be initiated by the Tax Official.

2. What are the pre-conditions for Compulsory Withdrawal from Composition Levy?

Listed below are the pre-conditions for Compulsory Withdrawal from Composition Levy:

- Taxpayer has a valid and active GSTIN.

- Composition Taxpayer has successfully submitted “Application to Opt for Composition levy” for the subsequent financial year Or Applicant is flagged as Composition taxpayer as on the current date.

3. By when can a taxpayer reply to SCN issued by Tax Official?

On issue of SCN to taxpayer for Compulsory withdrawal from the Composition levy, taxpayer needs to file a reply within 15 days from date of issue of such notice.

4. How can I view the notice and order issued for Compulsory Withdrawal from Composition Levy?

Navigate to Services > User Services > View Notices and Orders option to view the notice and order issued by Tax Official for Compulsory Withdrawal from Composition Levy.

Click here to know more about it.

5. How can I reply to the notice issued by Tax Official for Compulsory Withdrawal from Composition Levy?

Navigate to Services > Registration > Application for Filing Clarifications option to reply to the notice issued by Tax Official for Compulsory Withdrawal from Composition Levy.

Click here to know more about it.

6. Can a Tax Official Compulsory Withdraw a taxpayer from Composition Levy without issuing SCN?

Compulsory withdrawal from Composition levy cannot be initiated without issuing SCN by the Tax Official. Taxpayer will always be given an opportunity of being heard before withdrawal from the Composition levy.

7. What a Tax Official can do in case taxpayer has not replied to SCN issued by Tax Official?

The Tax Official will have 30 calendar days’ time from the date of receipt of clarification from taxpayer on SCN or 15 days if no reply is received from taxpayer on SCN issued, whichever is earlier, to take any of following action on the work item:

- Drop proceedings

- Withdraw Composition levy of the taxpayer.

In case, taxpayer doesn’t submit clarifications within 15 days from date of issue of SCN, Tax Official can only “Withdraw Composition”.

8. Tax Official has initiated Compulsory Withdrawal from Composition Levy. What will happen in case, I have applied for new registration with same PAN?

If any new registration application is filed mapped to the same PAN and is pending for processing with the Tax officer, which is not approved or rejected, the decision of the approval/ rejection of proceeding for Compulsory withdrawal from Composition levy will also apply to the new GSTIN as applicable.

After issue of “Order for Compulsory Withdrawal from Composition levy”, any new Registration (GSTIN) granted over the same PAN (having effective date of Registration earlier than withdrawal date), will be treated as “Composition” till the date of withdrawal of composition and deemed to be flagged as “Normal” from the date of withdrawal of composition.

For example: If the effective date of Registration is 2nd Jan 2019 and withdrawal from composition date is 11th Jan 2019. In such case, the GSTIN will be treated as Composition till 11th Jan 2019 and Normal from 12th Jan 2019.

9. What will happen if a Tax Official Compulsory Withdraw a taxpayer from Composition Levy?

Once a Tax Official Compulsory Withdrawal a taxpayer from Composition Levy:

- GST Portal will generate an order for compulsory withdrawal from composition levy.

- Taxpayer as well as all GSTINs mapped to the same PAN will be intimated about compulsory withdrawal via e- mail and SMS.

- GST Portal will remove the ‘Composition’ flag, against all the GSTINs mapped to the same PAN.

- Information about compulsory withdrawal will be passed on to the concerned State/Centre Tax Authorities of such GSTINs.

10. What will happen if a Tax Official drops the proceedings for Compulsory Withdrawal of a taxpayer from Composition Levy?

Once a Tax Official drops the proceedings for Compulsory Withdrawal of a taxpayer from Composition Levy:

- GST Portal will generate an order for dropping of proceedings.

- Taxpayer will be intimated about dropping of proceedings via e- mail and SMS.

- Information about dropping the proceedings will be passed on to the concerned State/Centre Tax Authorities of such GSTINs.

11. What are the various statuses for Compulsory Withdrawal of a taxpayer from Composition Levy?

Various statuses for Compulsory Withdrawal of a taxpayer from Composition Levy are:

- Pending for Clarification: On issuance of SCN and pending reply by taxpayer

- Pending for Order: On receipt of reply to SCN and pending order by Tax Official

- Order Issued: On passing of Order for Withdrawal by Tax Official

- Proceeding Dropped: On passing of Order by Tax Official for dropping of SCN

Intimation Of Stock Details On GST Portal CMP 03 FAQs

1. What is meant by Intimation of Stock Details by Migrated Taxpayers Opting for Composition Levy?

In addition to filing the application to opt for Composition Levy, the Migrated taxpayers are also required to file a form for Stock Intimation to furnish the details of stock including inward supply of goods from unregistered persons, held by them on the day preceding the date from which they opt to pay the composition levy. Such taxpayers are required to file Stock Intimation details within 90 days from the appointed date or as extended.

2. Who all need to file the FORM CMP-03, Stock Intimation for Opting Composition Levy? OR I am unable to view the option to file – Stock Intimation for Opting Composition Levy. Why?

Only Migrated taxpayers, with effective date of composition as 1st July 2017, can file FORM CMP-03. The form is only visible if all of the following conditions are met:

- Taxpayer is a migrated taxpayer andi

- Effective date of composition is 1st July 2017 and

- Taxpayer has opted for composition levy by filling CMP-01 form.

3. Is the application to opt for Composition Levy or form for Intimation of Stock Details subject to approval by the Tax Authorities?

No, the application to opt for Composition Levy is not subject to approval by the tax authorities.

4. What happens if I don’t file the Intimation of Stock Details form within 120 days or extended period?

Tax official will get an alert post 90 days (or at end of such extended period) in case taxpayer does not file the intimation of stock details of all the GSTIN attached to the PAN within 90 days from the appointed date.

5. How can I intimate my stock details on the GST Portal?

Navigate to Services > Registration > Stock Intimation for opting Composition Levy.

6. How can I download the Intimation of Stock Details form?

It will be available on your post-login Dashboard under the Services > Registration section.

7. Can I submit the Intimation of Stock Details form and make the due payment at a later date?

No, intimation cannot be submitted without due payment of tax except when the tax liability is Nil.

8. Do I need to file intimation of Stock details for all the GSTINs mapped to PAN Separately?

Yes.

Practical Course at: www.cagurujiclasses.com