CBDT releases new functionality in AIS to increase transparency and issued Press Release Dated 13 May 2024

Highlights

- In AIS, taxpayer has been provided with a functionality to furnish feedback on every transaction displayed therein. This feedback helps the taxpayer to comment on the accuracy of the information provided by the Source of such information.

- In case of wrong reporting, the same is taken up with the Source for their confirmation, in an automated manner.

- A new functionality has been rolled out in AIS to display the status of information confirmation process.

- This will display, whether the feedback of the taxpayer has been acted upon by the Source, by either, partially or fully accepting or rejecting the same.

- This is an initiative towards ease of compliance and enhanced taxpayer services.

Taxpayers can now check whether their feedback is acted upon by the Source/Reporting Entities

Posted On: 13 MAY 2024 7:42PM by PIB Delhi

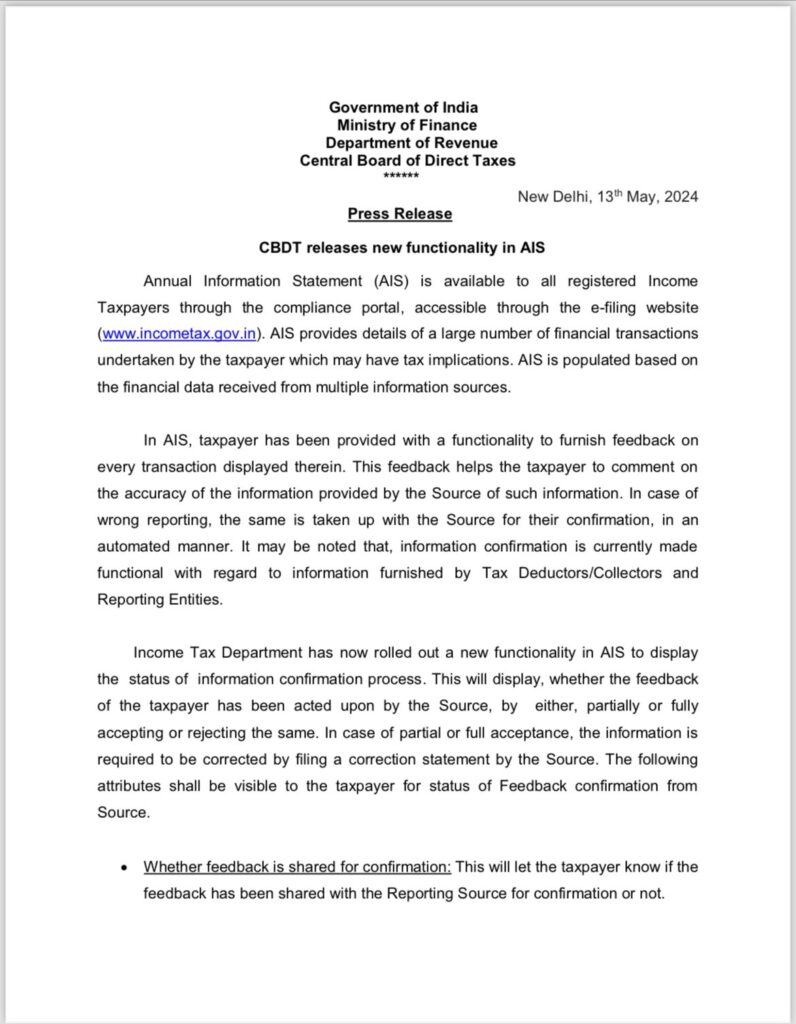

The Annual Information Statement (AIS) is available to all registered Income Taxpayers through the compliance portal, accessible through the e-filing website (www.incometax.gov.in). AIS provides details of a large number of financial transactions undertaken by the taxpayer which may have tax implications. AIS is populated based on the financial data received from multiple information sources.

In AIS, taxpayer has been provided with a functionality to furnish feedback on every transaction displayed therein. This feedback helps the taxpayer to comment on the accuracy of the information provided by the Source of such information.

In case of wrong reporting, the same is taken up with the Source for their confirmation, in an automated manner. It may be noted that, information confirmation is currently made functional with regard to information furnished by Tax Deductors/Collectors and Reporting Entities.

The Central Board of Direct Taxes (CBDT) has now rolled out a new functionality in AIS to display the status of information confirmation process. This will display, whether the feedback of the taxpayer has been acted upon by the Source, by either, partially or fully accepting or rejecting the same.

In case of partial or full acceptance, the information is required to be corrected by filing a correction statement by the Source.

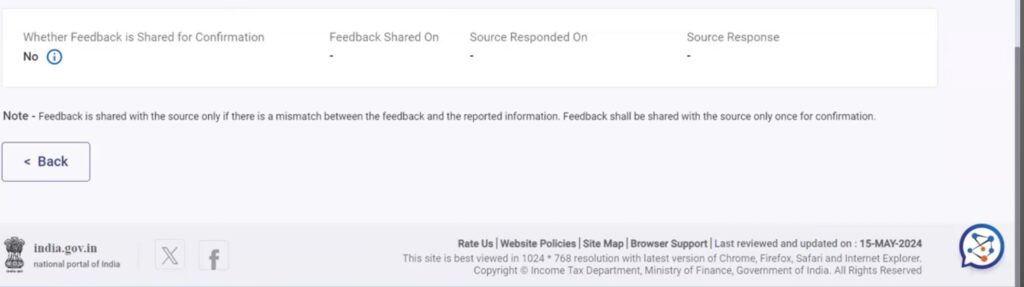

The following attributes shall be visible to the taxpayer for status of Feedback confirmation from Source.

- Whether feedback is shared for confirmation: This will let the taxpayer know if the feedback has been shared with the Reporting Source for confirmation or not.

- Feedback Shared On: This will let the taxpayer know the date on which the feedback has been shared with the Reporting Source for confirmation.

- Source Responded On: This will let the taxpayer know the date on which the Reporting Source has responded on the feedback shared with it for confirmation.

- Source Response: This will let the taxpayer know the response provided by the Source on the taxpayer’s feedback (if any correction is required or not).

This new functionality is expected to increase transparency by displaying such information in AIS to the taxpayer. This is another initiative of the Income Tax Department towards ease of compliance and enhanced taxpayer services.

Press Release Dated 13 May 2024:

Form 26AS

Just like AIS form 26AS is also important to file ITR, watch below video to know in detail:

Visit www.cagurujiclasses.com for practical courses

So, the tax payers have to do the income tax deptt. works.

What happens in case of death of someone. How to accept the transaction. For example if a person dies on 1.1 2024 so transaction till 31.12.2023 will be treated as his income. For the period 1.1.2024 to 31.03.2024 income reported under his pan. How to treat the same.