Many Taxpayers were getting Notice from department that your GSTR 3B is reset of a particular period and your E cash ledger and E Credit Ledgers are reset, take necessary action

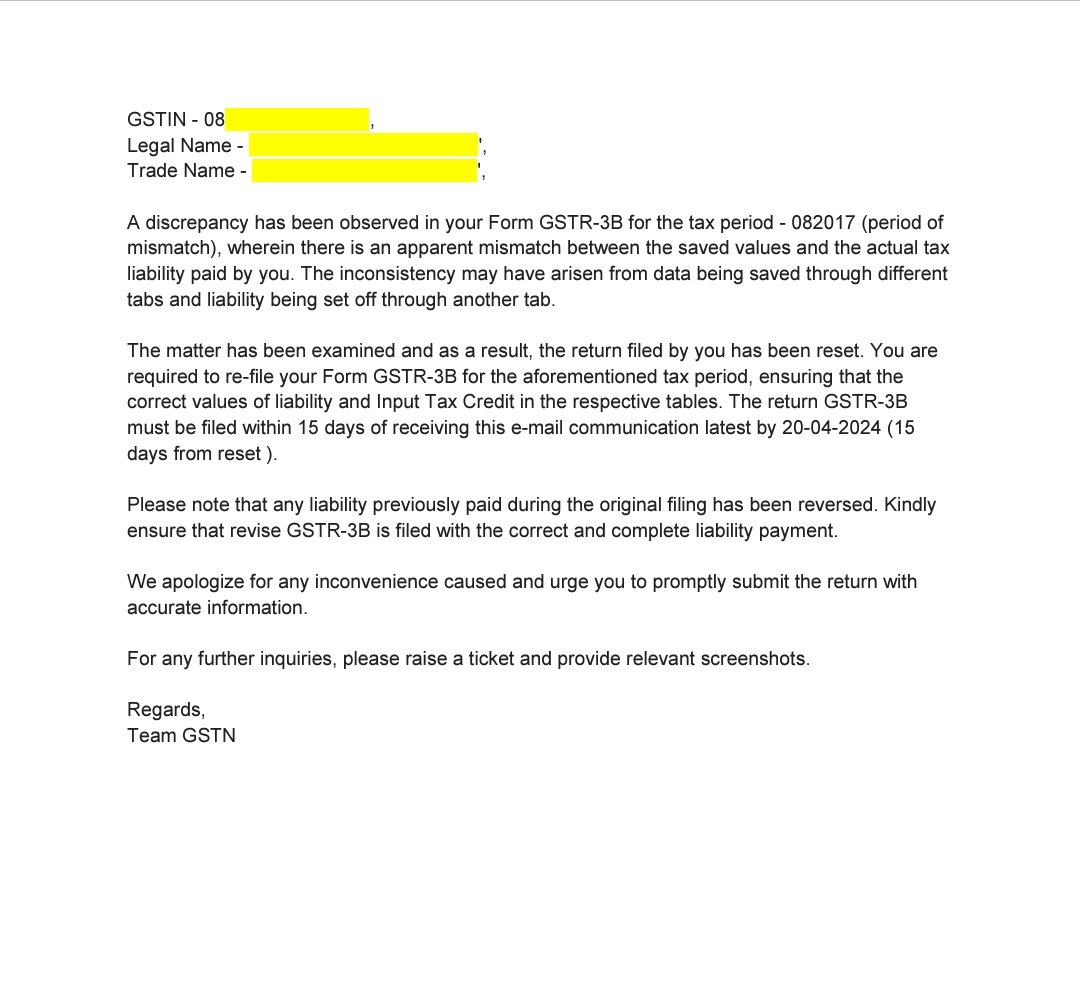

Below is notice which many taxpayers were getting:

Below is advisory

Dear Taxpayers,

We wish to address the facility for re-filing of GSTR-3B for certain taxpayers. Upon examination, discrepancies were noted between the saved data in the GST system and the data actually filed, particularly in the areas of ITC availment and payment of tax liabilities. The Grievance Redressal Committee of the GST Council deliberated on this matter and decided to reset these returns, providing affected taxpayers with an opportunity to rectify the discrepancies.

As per this decision, affected taxpayers have been individually communicated via their registered email IDs. The affected returns are now visible on their respective dashboards, enabling them to re-file with the correct data. We kindly request taxpayers who have received such communication to visit their dashboard and re-file their GSTR-3B within 15 days of receipt.

Should you encounter any difficulties during the re-filing process, please reach out to your jurisdictional tax officer or utilize the GST grievance redressal portal to raise a ticket.

We deeply regret any inconveniences caused to taxpayers.

Visit www.cagurujiclasses.com for practical courses

Muje new GST Lena he